Overview: The dollar is firm, and the market is challenging the JPY160 level, which it has traded above in Europe. Japanese officials say that they do not defend a specific level. The market is nervous though and some participants have professed intentions to sell dollars above there. The Australian dollar is the main exception to the greenback's strength today. A strong monthly inflation print boosts the chances of a rate hike. The Aussie, though,...

Read More »

Tag Archive: real rates

Short Run TIPS, LT Flat, Basically Awful Real(ity)

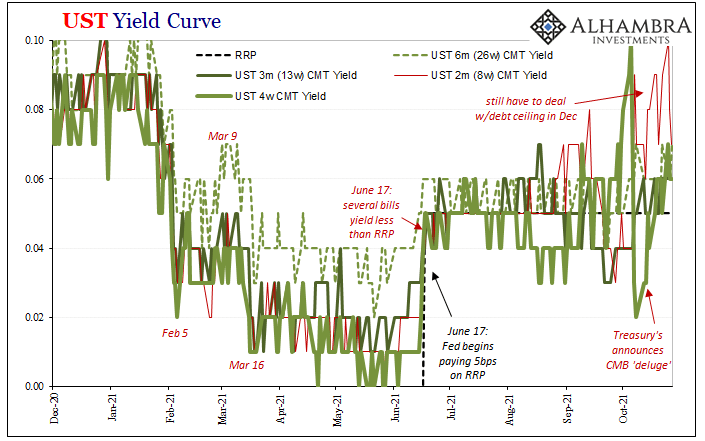

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

And Now Three Huge PPIs Which Still Don’t Matter One Bit In Bond Market

And just like that, snap of the fingers, it’s gone. Without a “bad” Treasury auction, there was no stopping the bond market today from retracing all of yesterday’s (modest) selloff and then some. This despite the huge CPI estimates released before the prior session’s trading, and now PPI figures that are equally if not more obscene.

Read More »

Read More »

Great Graphic: Fed Raising Rates, but Yields Still Negative

The yield on the 3-month US Treasury bill is pushing above 2% today for the first time since 2008. The yield had briefly dipped below zero as recently as late 2015. Although today's yield seems high, this Great Graphic shows the nominal generic three-month yield going back to 1990. Then the three-month bill yielded 8%. The peak in the last cycle (2006-2007) was a little above 5%.

Read More »

Read More »

The Dollar: Real or Nominal Rates?

Real interest rates are nominal rates adjusted for inflation expectations.Inflation expectations are tricky to measure. The Federal Reserve identifies two broad metrics. There are surveys, like the University of Michigan's consumer confidence survey, and the Fed conducts a regular survey of professional forecasters. There are also market-based measures, like the breakevens, which compare the conventional yield to the inflation-linked, or protected...

Read More »

Read More »

Great Graphic: Real Rates in US are Elevated

The US 10-year yield fell briefly below 1.32% last July. The yield slowly rose to reach 1.80% in mid-October. The day after the election, the yield initially slipped to almost 1.71%. This was a bit of a miscue, and the yield rose sharply to hit almost 2.64% the day after the FOMC hiked rates for the second time in the cycle on December 14. The yield backed off to hit 2.33% at the end of last week.

Read More »

Read More »