Tag Archive: RBA

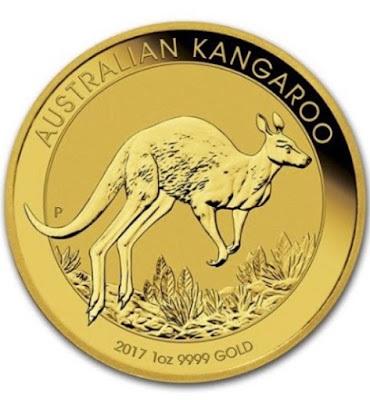

RBA Holds Fire, Sterling Reaches Best Level since last June, and the Dollar Struggles to Find Much Traction

Overview: The jump in oil prices is the newest shock and the May

WTI contract is holding above $80 a barrel as it consolidates yesterday's

surge. A week ago, it settled near $73.20. Australian and New Zealand bond

yields moved lower, partly in catch-up and partly after the RBA stood pat. South

Korean bonds also rallied on the back of softer inflation (4.2% vs. 4.8%). But

European and US benchmark yields is 2-4 bp higher. The large equity markets...

Read More »

Read More »

OPEC+ Surprises while Manufacturing Remains Challenged

Overview: News of OPEC+ unexpected output cuts saw May WTI gap

sharply higher and helped lift bond yields. May WTI settled near three-week

highs before the weekend near $75.65 and opened today near $80. It reached

almost $81.70 before stabilizing and is straddling the $80 area before the

North American session. The high for the year was set in the second half of

January around $83. Benchmark 10-year yields are up 2-5 bp points. The 10-year

US...

Read More »

Read More »

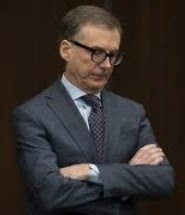

Powell Sends the Two-Year Yield above 5% and Ignites Powerful Dollar Rally

Overview: Federal Reserve Chair Powell's comments to

the Senate Banking Committee were seen as hawkish by the market, even though it

has been clear to most observers that the 5.10% median terminal rate that the

Fed projected in December would be increased. Also, it seemed well appreciated

a few Fed officials support a 50 bp hike at the February 1 FOMC meeting, two

days before a "hot" jobs report that showed over 500k jobs were

filled. It...

Read More »

Read More »

US Dollar is Better Bid Ahead of Powell, while Aussie Sells Off on Dovish Hike by the RBA

Overview: The US dollar is trading with a firmer bias against

nearly all the G10 currencies ahead of Federal Reserve Chairman Powell's

semi-annual testimony before Congress. Speaking for the Federal Reserve, the

Chair is likely to stay on message which is higher rates are necessary to cool

the overheating economy. This comes on the heels of the Reserve Bank of

Australia's 25 bp hike and indication that it is not pre-committing to an April

hike. The...

Read More »

Read More »

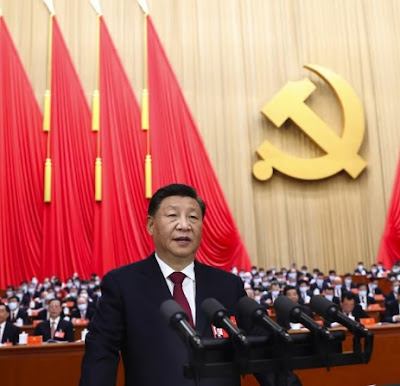

Yields Pull Back to Start the New Week

Overview: The modest economic goals announced as

China's National People's Congress starts was seen as a cautionary sign after

growth disappointed last year. It seemed to weigh on Chinese stocks, though

others large bourses in the region advanced, led by Japan's Nikkei and South

Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after

rising for the past two sessions. US index futures are slightly softer. Strong

gains were seen...

Read More »

Read More »

No Turn Around, but Consolidation Featured

Overview: After large moves yesterday, the capital

markets ae quieter today. Stocks are mostly firmer, and the 10-year US yield is

a little softer near 3.62%. Strong nominal wage increases in Japan and a

hawkish hike by the Reserve Bank of Australia helped their respectively

currencies recover, though remain within yesterday's ranges. The euro briefly

traded below $1.07, and sterling has been sold through $1.20. That said, a

consolidative tone is...

Read More »

Read More »

Week Ahead: RBA and BOC Meetings Featured and China’s Inflation and Trade

The week ahead

is more than an interlude before five G10 central banks meet on December

14-15. The data highlights

include the US ISM services and producer prices, Chinese trade and inflation

measures, Japanese wages, household consumption, and the current account.

Also, the Reserve Bank of Australia and the Bank of Canada hold policy

meetings. Central banks from India, Poland, Brazil, Peru, and Chile also meet.The dollar appreciated in Q1 and Q2...

Read More »

Read More »

US Dollar Offered Ahead of the Employment Report

Overview: Risk appetites have returned but may be

tested by the US jobs report. News of progress with US auditors in China helped

lift Hong Kong and Chinese equities. Most of the large bourses in the region

also rose. Europe’s Stoxx 600 is up a little more than 1% near midday after

shedding 1.3% over the past two sessions. US futures also are trading with an

upside bias. Benchmark 10-year yields are mostly a little softer today. The 10-year

US...

Read More »

Read More »

RBA Hikes by 25 bp, Chinese Stocks Surge, and the Greenback Trades Heavier

Overview: Risk appetites have returned today. Bonds

and stocks are advancing, while the dollar is better offered. Unsourced claims

that Beijing has formed a committee to assess how to exit the zero-Covid policy

sent Chinese shares sharply higher. An index of mainland companies list in Hong

Kong jumped nearly 7% and closed up almost 5.5%. The Hang Seng surged 5.2%,

while all the large markets in the region advanced. Europe’s Stoxx 600

recovered...

Read More »

Read More »

RBA, FOMC, BOE Meetings Featured while the Greenback’s Recovery can be Extended

The week ahead is important from a macro perspective. The data highlights include China's PMI, eurozone preliminary October CPI and Q3 GDP, and the US (and Canadian) employment reports. In

addition, the Federal Reserve meeting on November 2 is sandwiched between the Reserve Bank of Australia meeting and the Bank of England meeting.

Read More »

Read More »

Dollar Slump Stalls Ahead of ECB Meeting

The dollar’s recent losses have left it stretched on a near-term basis after today’s ECB meeting, the focus will shift to the Federal Reserve, next week’s meeting, and the employment report. The greenback is trading with a firmer bias against the G10 currencies, while the emerging market currencies are more mixed.

Read More »

Read More »

Stocks and Bonds Extend Rally

The big bond and stock market seen yesterday has continued today. The Reserve Bank of Australia’s reversion to a quarter-point hike stokes hope that the aggressive tightening cycle more broadly is set to slow.

Read More »

Read More »

Week Ahead: Macro and Prices

The market has much to digest. The Bank of England's new purchases of Gilts coincided with a reassessment of the trajectory of Fed policy. After the hawkish FOMC decision and forecasts, the market briefly thought the terminal rate could be 5.25-5.50% in the middle of next year. However, by the end of last week, it had returned to around 4.5% at the end of Q1 23.

Read More »

Read More »

Aussie Sells Off After RBA Hikes 50 bp while Sterling Bounces on UK New Initiative

Overview: A GBP130 bln initiative by the new UK government to protect households from the surge in power costs helped lift sterling from 2.5-year lows. The Reserve Bank of Australia delivered the expected 50 bp rate hike, but the prospect of smaller moves going forward saw the Australian dollar sold through yesterday’s lows.

Read More »

Read More »

What Happened Monday

The US and Canada may have been on holiday on September 5, but the world waits for no one and there were several significant developments. First, Gazprom's decision to indefinitely suspend gas shipments through the Nord Stream 1 pipeline announced before the weekend saw the European natgas benchmark soar 23.7.

Read More »

Read More »

RBA, BOC, and ECB Meetings and more in the Week Ahead

All

three major central banks that meet in the coming days will hike rates. The question is by how much. The Reserve Bank of Australia makes its

announcement early Tuesday, September 6. One of the challenges for policymakers and investors is

that Australia reports inflation quarterly. The Q2 estimate was released on July

27. It showed prices accelerating to 6.1% year-over-year from 5.1% in Q1. The

trimmed mean rose to 4.9% from 3.7%, and the...

Read More »

Read More »

Greenback Remains Firm

Overview: After retreating most of last week, the US

dollar has extended yesterday’s gains today. The Canadian dollar is the most resilient,

while the New Zealand dollar is leading the decline with a nearly 0.75% drop ahead

of the central bank decision first thing tomorrow. The RBNZ is expected to

deliver its fourth consecutive 50 bp hike. Most emerging market currencies are

lower as well, led by central Europe. Equities in Asia Pacific and Europe...

Read More »

Read More »

Aussie Hit with Profit-Taking after RBA Hikes 50 bp

Speaker Pelosi's visit to Taiwan has added to the risk-off mood of the capital markets today. Most of the large Asia Pacific equities sold off, with Australia and India being notable exceptions. Europe's Stoxx 600 is off for the second consecutive session, and by the most (~0.60%)

since mid-July. US futures are also weaker. Benchmark 10-year rates are lower.

Read More »

Read More »

Yen Squeeze Continues

The US dollar begins the new month better offered. It is softer against all the major currencies. Short yen positions continue to get unwound, which is leading the move, followed by the Antipodeans, where the Reserve Bank of Australia is expected to hike rates tomorrow.

Read More »

Read More »

Macro and Prices

Next week, there are three big events: the US jobs report, the Reserve Bank of Australia meeting, and the Bank of England's meeting. That said, the final PMI readings may be more helpful this time than we often see because of how quickly it appears activity has stalled.

Read More »

Read More »