Tag Archive: Property

Costs of owning a home in Switzerland set to rise for some

Currently, home owners in Switzerland must pay tax on fictional rent, calculated based on a home’s size and location. At the same time home owners get to deduct mortgage interest and home maintenance costs from their taxable income.

Read More »

Read More »

No relief for Swiss renters

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 1 June 2017 when it fell to its lowest level since 2008.

Read More »

Read More »

House Prices Down in Verbier but Up in Some other Swiss resorts

A recent report published by UBS shows real estate price changes in european mountain resorts. Over the last year, Verbier (-3.2%) and Crans Montana (-3.0%) experienced the largest price declines, while Saas Fee (+14.3%) and St. Moritz (+7.4%) climbed the most.

Read More »

Read More »

Geneva’s mega apartment project now underway – 1,000 apartments and 2,500 jobs

Last week, work started on a project to construct 1,000 apartments in Geneva. The project known as the Quartier de l’Etang will unfold over an 11 hectare site in Vernier, not far from Geneva airport. The video above shows the commencement ceremony and a computer animation of the completed project.

Read More »

Read More »

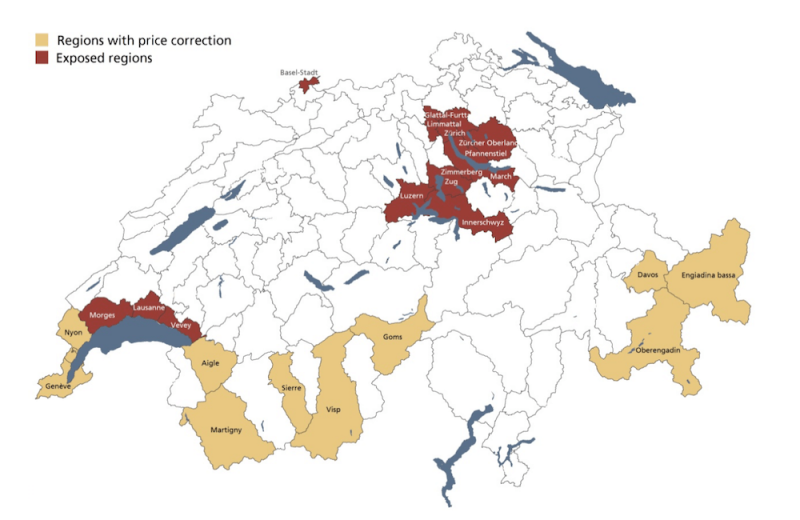

Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction.

Read More »

Read More »

Swiss fact: nearly half of Swiss rental properties owned by individuals

If you rent a home in Switzerland it is more likely to belong to an individual than a big real estate company or pension fund. In 2017, 49% of residential rental properties in Switzerland were owned by individuals, according to Statistics published by the Swiss Federal Statistical Office. The highest rate of rental home ownership by individuals was in the Italian-speaking canton of Ticino (71%). The lowest rate was in the Lake Geneva region (41%).

Read More »

Read More »

Swiss rents could fall 10%, says UBS

In a report published today entitled: rents losing altitude, UBS says asking rents for apartments will probably drop by up to 10% over the next three years. Competition in the rental market is getting even fiercer. By mid-2017, 2.4% of all rental apartments were vacant. This level was last exceeded in 1998, when 2.8% of rental apartments stood empty, says the bank.

Read More »

Read More »

Housing in Zurich and Geneva only moderately overvalued, says UBS

The UBS Global Real Estate Bubble Index 2017 describes housing in Zurich and Geneva as only moderately overvalued. The two Swiss cities rank 6th (Geneva) and 9th (Zurich) in a list of 20 selected global cities.

The top eight: Toronto, Stockholm, Munich, Vancouver, Sydney, London, Hong Kong and Amsterdam are all classified as bubble risk. Only Chicago is undervalued.

Read More »

Read More »

Geneva and Lausanne remain Switzerland’s toughest home markets

Home vacancy rates in Switzerland’s main cities have all risen over the last few years, bringing some hope to those looking for a place to live. The latest 2017 data confirm this trend. While these percentage shifts might appear big, very low vacancy rates underly them. On 1 June 2012, none of these cities had a vacancy rate above 1%. Zurich (0.29%), Bern (0.48%), Basel (0.13%), Lausanne (0.28%) and Geneva (0.21%) were all well below 1% vacancy...

Read More »

Read More »

Switzerland’s home ownership illusion

When 10-year mortgage interest rates fall to 1%, home ownership becomes a very attractive alternative to renting. A recent report on home ownership shows why home ownership remains out of reach of the average Swiss household despite very low interest rates.The report, by Credit Suisse, says that despite the strong desire for people to own their own home, fewer and fewer households are able to afford them as the years go by.

Read More »

Read More »

Switzerland’s most expensive apartments in Zurich, Maloja and Lavaux

According to data from comparis.ch, Switzerland’s most expensive apartments are found in Zurich, Maloja – home to Saint-Moritz, and Lavaux-Oron. One square metre will cost you CHF 12,250 (US$ 13,000) in Zurich, CHF 11,500 in Maloja and CHF 11,250 in Lavaux-Oron. Lavaux-Oron contains posh parts of Greater Lausanne, such as Lutry, and the UNESCO-listed wine terraces of Lavaux on the shore of Lake Geneva.

Read More »

Read More »

Finding a place to rent getting easier in Switzerland

A recent Credit Suisse report, entitled: Tenants Wanted, says capital continues to flow into Swiss real estate, boosting the supply of rental properties. Against a backdrop of negative interest rates at Switzerland’s central bank, investors continue to plough money into constructing new residential properties. At the same time, declining immigration has hit the demand for rental apartments.

Read More »

Read More »

A Swiss parliamentary commission wants to get rid of imputed rent

In Switzerland, home owners have to add a theoretical rent to their taxable income. This means home ownership can increase your annual tax bill, sometimes substantially.

Read More »

Read More »

Number of vacant homes rises again in Vaud

At 1 June 2017, 3,650 empty homes, of which 2,655 were for rent and 995 for sale, were on the market in Vaud. This brought the vacancy rate to 0.9%, a rise of 0.1% compared to the year before. This rise follows an increase of 0.1% in 2016 from a rate of 0.7% in 2015. The market is considered balanced when the vacancy rate reaches 1.5%. The last time it was above this mark in Vaud was in 1999.

Read More »

Read More »

Property prices fall in Swiss resorts but climb elsewhere, says UBS report

A real estate report by the bank UBS, which looks at 25 top resorts in Switzerland, Austria, France and Italy, shows vacation home price drops across Switzerland. These price falls contrast with price rises in resorts in Austria, France and Italy.

Read More »

Read More »

Mortgage reference rate falls opening way for Swiss rent cuts

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it dropped 0.25% to 1.50%. The interest rate used to set the reference rate was the average rate on Swiss mortgages at 31 March 2017 of 1.61% which rounds to 1.50% under the rounding rules, which round to the nearest quarter of a percent.

Read More »

Read More »

Poor not being pushed out of Swiss cities

It is widely believed that as the price of real estate climbs those on low incomes are forced out of city centres. A study by the University of Geneva, commissioned by the Swiss Federal Statistical Office focused on the period between 2010 and 2014, shows this is not true in Switzerland.

Read More »

Read More »

Swiss have never moved as much as they did in 2015

In Switzerland, more than a million people moved house in 2015, 12.1% of the population. The figure has never be higher, according to a report called Immo-Monitoring published by Wüest Partner. The home moving covered around 490,000 dwellings. Of those who moved, 344,000 stayed in the same commune (Gemeinde) while the other 659,000 changed municipality.

Read More »

Read More »

Fall in Swiss property prices accelerates

Over the year ending 31 March 2017, apartment prices across Switzerland dropped by 6.8%, according to a property price report published by the Zurich-based research and consulting firm Fahrländer Partner FPRE.

Read More »

Read More »

The Swiss municipalities with too many second homes – latest figures

On 11 March 2012, Swiss voted to accept a law restricting the construction of secondary residences, homes that are only used occasionally by owners living somewhere else. Under the law no more than 20% of a municipality’s housing can be second homes. Those with percentages above 20% run into building restrictions.

Read More »

Read More »