Tag Archive: profits

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

S&P 500 – A Bullish And Bearish Analysis

The S&P 500 index is a critical benchmark for the U.S. equity market, and its performance often dictates investor sentiment and decision-making. Between November 1, 2022, and September 6, 2024, the S&P 500 experienced a significant rally but not without volatility. Currently, investors have very mixed views about where markets are heading next as concerns of a recession linger or what changes to monetary policy will cause.

However, as...

Read More »

Read More »

Technological Advances Make Things Better – Or Does It?

It certainly seems that technological advances make our lives better. Instead of writing a letter, stamping it, and mailing it (which was vastly more personal), we now send emails. Rather than driving to a local retailer or manufacturer, we order it online. Of course, we mustn’t dismiss the rise of social media, which connects us to everyone and everything more than ever.

Economists and experts have long argued that technological advances drive...

Read More »

Read More »

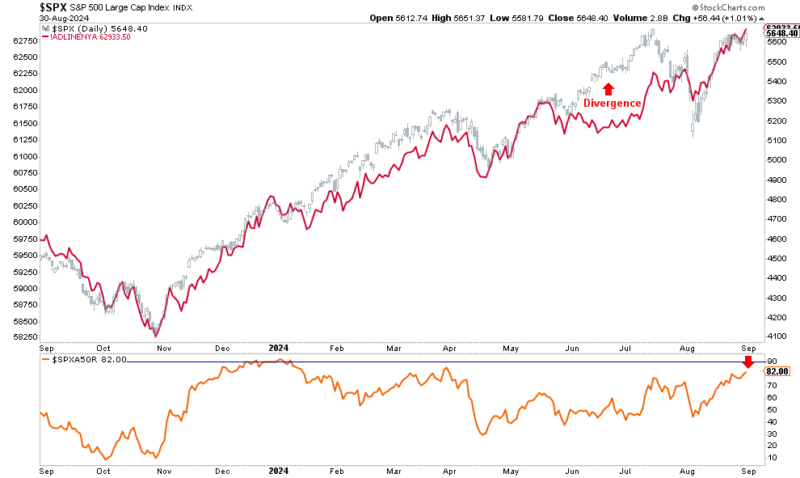

Risks Facing Bullish Investors As September Begins

Since the end of the “Yen Carry Trade” correction in August, bullish positioning has returned with a vengeance, yet two key risks face investors as September begins. While bullish positioning and optimism are ingredients for a rising market, there is more to this story.

Read More »

Read More »

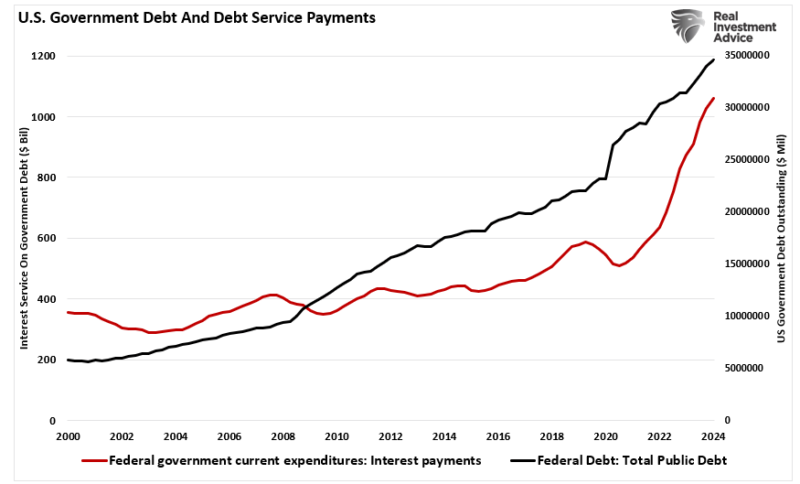

Japanese Style Policies And The Future Of America

In a recent discussion with Adam Taggart via Thoughtful Money, we quickly touched on the similarities between the U.S. and Japanese monetary policies around the 11-minute mark. However, that discussion warrants a deeper dive. As we will review, Japan has much to tell us about the future of the U.S. economically.

Let’s start with the deficit. Much angst exists over the rise in interest rates. The concern is whether the government can continue to...

Read More »

Read More »

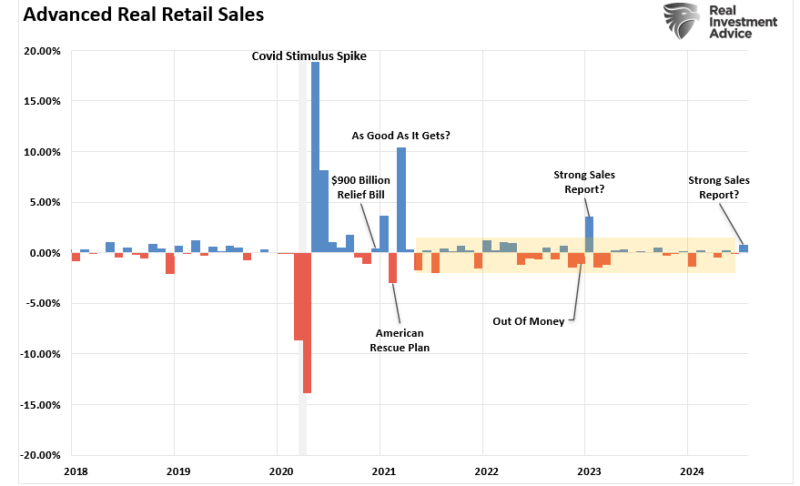

Red Flags In The Latest Retail Sales Report

The latest retail sales report seems to have given Wall Street something to cheer about. Headlines touting resilience in consumer spending increased hopes of a “soft landing” boosting the stock market. However, as is often the case, the devil is in the details. We uncover a more troubling picture when we peel back the layers of this seemingly positive data. Seasonal adjustments, downward revisions, and rising delinquency rates on credit cards and...

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

Consistent Trade War Inconsistency Hides The Consistent Trend

You can see the pattern, a weathervane of sorts in its own right. Not for how the economy is actually going, mind you, more along the lines of how it is being perceived from the high-level perspective. The green light for “trade wars” in the first place was what Janet Yellen and Jay Powell had said about the economy.

Read More »

Read More »

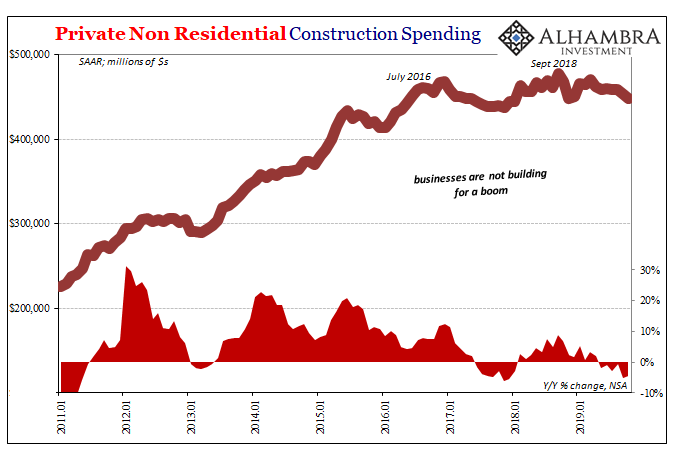

Now Capex?

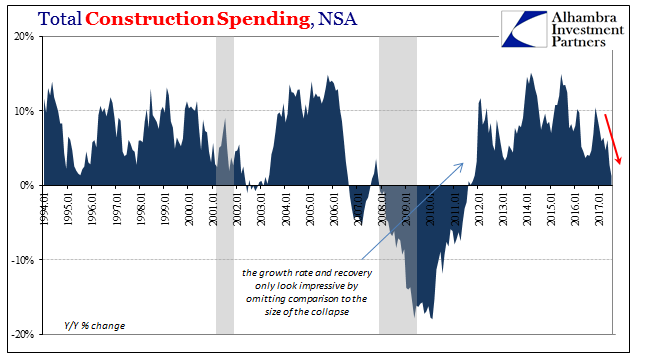

Of all the high frequency data the Personal Savings Rate is probably the least reliable. It is subject to both regular and benchmark revisions that can change the estimates drastically one way or the other. One step up from that statistic is the figures for Construction Spending. The initial monthly estimates don’t survive very long, and lately they have been quite weak in the first run only to be revised sharply higher over subsequent months.

Read More »

Read More »

Some Thoughts on Q3 US GDP

US Q3 was revised higher mostly due to consumption. Business investment was a drag. Profits rose to snap a five-quarter slide.

Read More »

Read More »

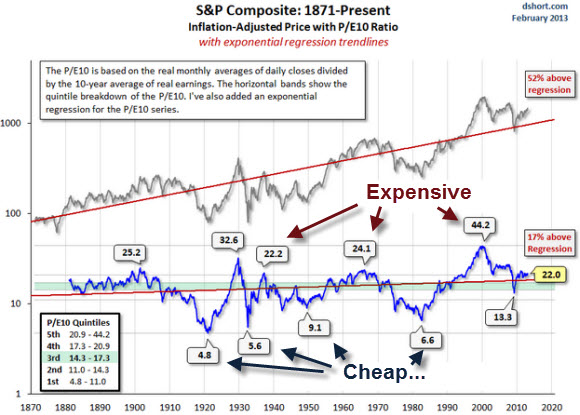

Rising Profits as Reason for the Stock Market Rally?

A list of relevant graphs for long-term price earnings ratios and the rising company profits in the last years.

Read More »

Read More »

Performance of global stock markets compared

A list of relevant graphs for the long-term price earnings rations and different stock market returns over the last 2 years. Moreover we show the return of the S&P 500 for each of the year.

Read More »

Read More »