Tag Archive: PMI

Dollar Slump Halted as Stocks and Bonds Retreat

Overview: Hopes that the global tightening cycle is entering its last phase supplied the fodder for a continued dramatic rally in equities and bonds. The euro traded at par for the first time in two weeks, while sterling reached almost $1.1490, its highest since September 15.

Read More »

Read More »

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

The Week Ahead: Dollar Bulls Still in Charge

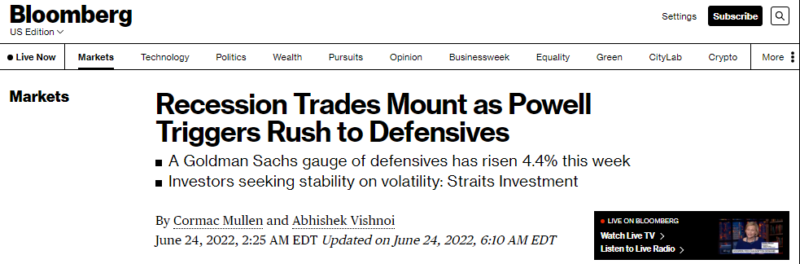

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk.

Read More »

Read More »

Surging Energy Prices Pushing Europe Closer to Recession

The poor eurozone PMI underscores likely recession and weighs on the single currency, which was sold to a new 20-year low. Rather than a "Turn Around Tuesday" a broadly consolidative session is unfolding. Asian and European equities are weaker, while US futures are positive but little changed. Benchmark 10-year bond yields are mostly firmer and the premium offered by Europe's periphery is edging higher. The US 10-year is little changed near...

Read More »

Read More »

Flash PMI, Jackson Hole, and the Price Action

For many, this will be the last week of the summer. However, in an unusual twist of the calendar, the US August employment report will be released on September 2, the end of the following week, rather than after the US Labor Day holiday (September 5).

Read More »

Read More »

Market Takes China’s Response in Stride, Risk Appetites Recover

Overview: The market is

judging China's response to Speaker Pelosi's visit in a mild way and risk

appetites returned. Equity markets are higher, even though Chinese shares

weakened. Europe's Stoxx 600 is edging higher after two days of small loses,

and US futures enjoy a firmer bias. The surge in US rates yesterday has calmed.

The US 10-year yield is firm near 2.76% and the 2-year yield is up a

couple of basis points near 3.07%. European yields are...

Read More »

Read More »

Yen Squeeze Continues

The US dollar begins the new month better offered. It is softer against all the major currencies. Short yen positions continue to get unwound, which is leading the move, followed by the Antipodeans, where the Reserve Bank of Australia is expected to hike rates tomorrow.

Read More »

Read More »

Macro and Prices

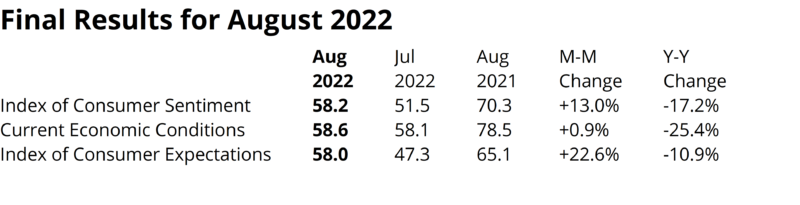

Next week, there are three big events: the US jobs report, the Reserve Bank of Australia meeting, and the Bank of England's meeting. That said, the final PMI readings may be more helpful this time than we often see because of how quickly it appears activity has stalled.

Read More »

Read More »

The Dollar Jumps and the Euro Slips under $1.03

Overview: The dollar is soaring today, and the euro is trading at new 22-year lows having traded below $1.03. Even a 50 bp hike by the Reserve Bank of Australia has failed to prevent a sharp drop in the Australian dollar.

Read More »

Read More »

Nasty Number Five, Not Hawk Hiking CBs

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide.

Read More »

Read More »

Johnson’s Ability to Lead Tories into Victory at Risk with Today’s By-Elections

Overview: Asia Pacific equities were mixed. Gains were recorded in China, Hong Kong, Australia, and India, among the large markets, while Japan was mostly flat and South Korea and Taiwan shares fell.

Read More »

Read More »

Moderating Labor Market is what the Fed Wants

Overview: For the large rally in US stocks yesterday and the sell-off in the dollar, US rates were surprisingly little changed. This set the tone for today's action, ahead of the US employment data. Asia Pacific equities moved higher and Europe’s Stoxx 600 has edged up to extend yesterday’s rise. The 10-year US Treasury yield is little changed, hovering around 2.91%. European benchmark yields are 1-3 bp higher.

Read More »

Read More »

European Currencies Continue to Bear the Brunt

Overview: Russia's invasion of Ukraine and the global response is a game-changer, as Fed Chair Powell told Congress yesterday. The UK-based research group NISER estimated that world output will be cut by 1% next year or $1 trillion, and global inflation will be boosted by three percentage points this year and two next.

Read More »

Read More »

Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are...

Read More »

Read More »

RBA Jettisons Yield Curve Control but Continues to Resist Market Pressure

Overview: The third record close of the S&P 500 failed to lift Asia Pacific and European shares today. In Asia, the large bourses fell, except South Korea, which rallied a little more than 1%. Europe's Stoxx 600 is threatening to snap a three-day advance, while US index futures are soft. The US 10-year yield is firm, around 1.56%. European bonds are rallying. Peripheral yields are off 8-9 bp, while core rates are 3-5 lower. The Reserve...

Read More »

Read More »

US-EU Rapprochement, Can France and UK Do the Same?

Overview: It is mostly a quiet start to the new month. Most of Europe is closed for the All -Saints holiday and the week's key events start tomorrow with the Reserve Bank of Australia meeting. News that the Liberal Democrats retained a majority in the lower chamber of the Diet helped lift Japanese indices by 2%. Most of the large regional markets gained, though China and Hong Kong markets fell. US index futures are trading with a higher bias...

Read More »

Read More »

Risk Appetites Return from Holiday

Overview: After an ugly week, market participants have returned with strong risk appetites. Equities are rebounding, and the greenback is paring recent gains. Bond yields are firm, as are commodities. Asia Pacific equities got the ball rolling with more than 1% gains in several large markets, including Japan, China, Hong Kong, and Taiwan.

Read More »

Read More »

FX Daily, July 01: The Greenback is Bid to Start the Second Half

Soft Asian manufacturing PMIs weighed on local shares after the S&P 500 set new record highs yesterday. European shares are recouping yesterday's month-end losses, while US futures indices are bid. The US 10-year yield is around 1.47%, and European yields are 1-2 bp higher.

Read More »

Read More »

FX Daily, June 23: Japan Retains Distinction of being the only G7 Country with Sub-50 PMI Composite

Federal Reserve officials, lead by Chair Powell, pushed gently against the more hawkish interpretations of last week's FOMC meeting. Tapering not a rate hike was the focus of discussions. Powell reiterated that price pressures would prove transitory and would ease after the re-opening disruptions settled down.

Read More »

Read More »

FX Daily, June 03: Don’t Believe Sino-American Thaw or Fed’s Corporate Bond Divestment is a Policy Signal

Market participants appear to be biding their time ahead of tomorrow's US jobs report as they digest recent developments. The dollar is firmer, equities are mixed, and benchmark bond yields are a little firmer. China and Hong Kong shares continue their recent underperformance, while most of the large markets in the Asia Pacific region edged higher.

Read More »

Read More »