Tag Archive: newsletter

Why do we use slang?

Why are phrases like delulu, 67 and hanky panky popular? Lane Greene, our language correspondent, delves into why people love to use slang.

Read More »

Read More »

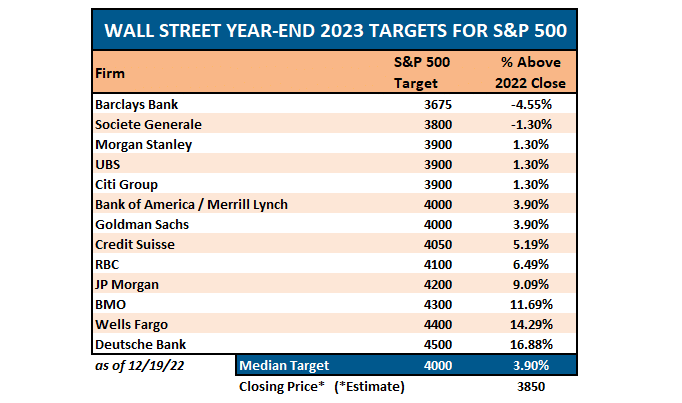

2026 Market Outlook Based On Valuations

It’s that time of year when Wall Street polishes up its crystal balls and begins predicting returns for 2026. Since Wall Street never predicts a down year, which would be unwise for fee-based product revenues, these forecasts are often inaccurate and sometimes significantly wrong. Let's review some previous years. For example, on December 7th, 2021, …

Read More »

Read More »

The Seen And The Unseen Of QE-RMP

In 1850, Economist Frederic Bastiat famously wrote an essay entitled "That which is seen, and that which is not seen.” The first chapter, "The Broken Window," argues that good economics requires considering not just the immediate, visible effects of an action but also the delayed, less obvious (unseen) consequences. Unfortunately, most commentators, when asked about …

Read More »

Read More »

How the Soviets Replaced Christmas with a Socialist Winter Holiday

Father Frost (the Soviet Santa Claus) asks: "To whom do we owe all the good things in our socialist society?,” to which, it is said, the children chorus the reply, "Stalin."

Read More »

Read More »

Is Switzerland losing its place in the world?

It was a remarkably blunt public warning from the top of Switzerland’s biggest bank. UBS chair Colm Kelleher declared last month that Switzerland was “losing its lustre” and had reached a “crossroads with major challenges”. As evidence, he cited fierce competition in wealth management, US tariffs that have hit pharmaceuticals and other export sectors, and …

Read More »

Read More »

Why Palantir is becoming a risky bet for Switzerland

Zurich serves as a hub for US tech company Palantir’s business relations. The Swiss foreign ministry now has the company in its sights, because of its controversial role in Gaza. Palantir is arguably the most controversial tech company in the world today. It expects over $4 billion (CHF3.2 billion) in revenue this year. Many people, …

Read More »

Read More »

Can I Get Some Coffee?

President Trump announced the tariffs aiming at two goals: protecting American producers and the relocation of foreign companies to the US. People have been “protected” by being disallowed peaceful, mutually-beneficial trades with others.

Read More »

Read More »

Wirst Du reich nur durch Dividenden?

Reich durch Dividenden? Klingt nice – ist aber unrealistisch.

📉 Wer 1.700 € brutto im Monat aus dem MSCI World kassieren will, hätte 2018 rund 1 Mio. Euro investieren müssen.

📉 Für 5.000 € monatlich? Sogar 3 Mio. Euro Startkapital nötig!

💡 Dividenden schwanken – Du kannst nicht mit fixen Einnahmen rechnen. Und: Wenn Du das Geld entnimmst, fehlt Dir langfristig der Zinseszinseffekt.

🧓 Für die Altersvorsorge besser: Ausschüttungen reinvestieren...

Read More »

Read More »

¿Viene una gran CRISIS en 2026? Análisis y claves

Señales preocupantes para 2026: deuda, inflación y bancos centrales marcando el ritmo.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes...

Read More »

Read More »

The Brutality of the US Empire Is on Display in Venezuela

What we cannot do, legitimately, is have the US government go abroad in search of the Venezuelan monster to destroy.

Read More »

Read More »

Unmasking Academia: The State’s Ministry of Opinion

Murray Rothbard properly noted that the predatory state needs its “court intellectuals” to legitimize its predations. American higher education is happy to provide them.

Read More »

Read More »

Deutschland 2025: Das ist keine Demokratie mehr

Roger Köppel zerlegt die deutsche Politik kompromisslos:

Erfolgs-Hybris, Brandmauer-Wahnsinn, Staatsquote über 50%, Parteiverbote und warum die Bürger längst schlauer sind als die Regierungseliten. Eine Analyse aus Schweizer Perspektive.

Rogers Kanal: https://www.youtube.com/@die.weltwoche

___________📅 Marc Lädt Ein 2026 ___________

✗ Erlebe den echten Austausch zu Finanzen, Politik und Gesellschaft. Zum vierten Mal lade ich ein zum "Marc...

Read More »

Read More »

1 Schritt, um dich vor der Inflation zu schützen!

Damit musst du heute beginnen, sonst brennt dir dein Geld am Konto weg!

1️⃣ Investiere in harte Vermögensklassen:

Gold, Immobilien, aber auch Aktien & Krypto.

Alles, was realen oder wachstumsstarken Wert hat, schützt dich, wenn dein Geld jeden Tag weniger wert wird.

2️⃣ Nutze das Schuldsystem, wie die Staaten es tun:

Wenn Geld an Wert verliert, verlieren auch Schulden an Wert.

Heißt: Mit klugem Fremdkapital baust du Vermögen auf, das steigt,...

Read More »

Read More »

12-21-25 Don’t Fall for the Hype: Safety Isn’t in Bitcoin Or MAG7

Bonds are being ditched at the exact moment investors need them most.

In this short video, Michael Lebowitz and I discuss why Treasuries $TLT remain the only true safety bucket and why replacing them with #Bitcoin $IBIT $BTCUSD or mega-cap tech $AAPL $AMZN $META $NFLX $NVDA $MSFT $GOOGL leaves portfolios exposed in a downturn.

Please ❤️like and 🔁retweet

📺Full episode:

Catch me daily on The Real Investment Show:...

Read More »

Read More »