Tag Archive: newsletter

The Certifiers Rule, So Be Prepared

In a true free market economy, credentials would not matter, and certainly not to the extent that they matter today. Credentialism, unfortunately, is a product of government interventionism.

Read More »

Read More »

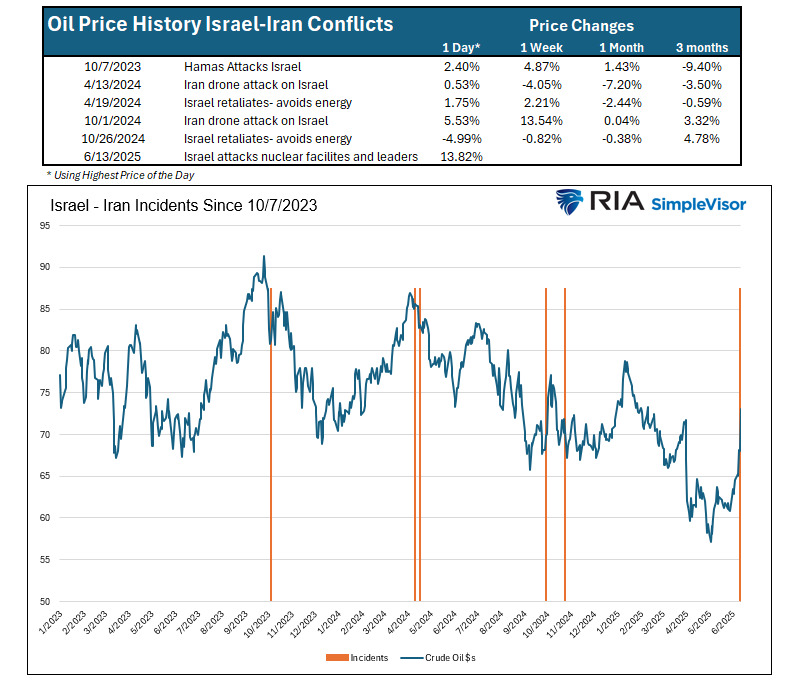

6-16-25 Market Effects of Iran-Israel Conflict

[NOTE: This is a "color-corrected" verson of our second show segment this morning, which unfortunately had audio issues.]

Lance Roberts breaks down the latest developments in the Iran-Israel conflict and what they mean for global markets: Be careful of headlines and re-allocating capital based on the "news of the day." By the time this show had aired, markets had already moved past the news of Israel's pre-emptive attacks on...

Read More »

Read More »

Hitzeschutz Wahninn: Glutwelle rast auf Deutschland zu!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Meine neuen Kursziele: Gold, Bitcoin und Aktien!

► Sichere Dir jetzt mein Spezial zu Uran-ETFs – 100% gratis → https://www.lars-erichsen.de/

► Hier kannst Du meinen Kanal abonnieren → https://www.youtube.com/erichsengeld?sub_confirmation=1

► Der ultimative ETF-Guide – und vieles vieles mehr – in der brandneuen „BuyTheDip+“-App → https://premium.buy-the-dip.de/checkout?code=FREELARS&code=LARSBTD1&code=LARSBTD2&selected=FREELARS

Vor 4 Wochen habe ich hier an dieser Stelle Kursziele...

Read More »

Read More »

The #1 Money Lie You Were Taught in School – Andy Tanner, Del Denney

🎯 Ready to take control of your financial future? Visit https://bit.ly/3JsRdmj for access to FREE investing tools, including Andy’s “Power of 6” ebook.

Most people wake up each day thinking about how to get to work on time, what to wear, and how to impress their boss. But what if the first question you asked each morning was, “What asset can I acquire today?” In this episode of Rich Dad’s StockCast, host Del Denney and Rich Dad expert Andy Tanner...

Read More »

Read More »

Tag 16

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

GUERRA TOTAL EN ORIENTE MEDIO: ISRAEL CONTRA IRÁN

Israel ataca a Irán para frenar su programa nuclear. La región entra en riesgo extremo y el petróleo vuelve a temblar.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a...

Read More »

Read More »

Wird Thomas bald zertifizierter Finfluencer? 🤓 #finfluencing

Muss Thomas bald zertifizierter Finfluencer werden? 🤓 #finfluencing

Marktgeflüster Podcast #152: BUND verbrennt 130 Millionen mit Corona 🔥

🎙️Marktgeflüster – Der Podcast: Zwei Ex-Investmentbanker, der eine Finanzprofessor, der andere Unternehmer, sprechen jede Woche über Finanzen, Börse, Wirtschaft und Karriere. Auf allen gängigen Plattformen.

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände...

Read More »

Read More »

Angriffe auf US-Basen im IRAK: Trump muss reagieren!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Dalio’s 3% 3 Part Solution to Decrease the Deficit

The US is approaching the end of the long-term debt cycle. There are 3 levers we can pull to bring the deficit down to ~3% of GDP and mitigate our debt burdens: 1) reducing spending, 2) increasing taxes, and 3) lowering interest rates.

While we need to consider each of these levers, I recently discussed why reducing interest rates will ultimately have the greatest impact on the budget deficit with @the_IMF.

You can learn more about my proposed...

Read More »

Read More »

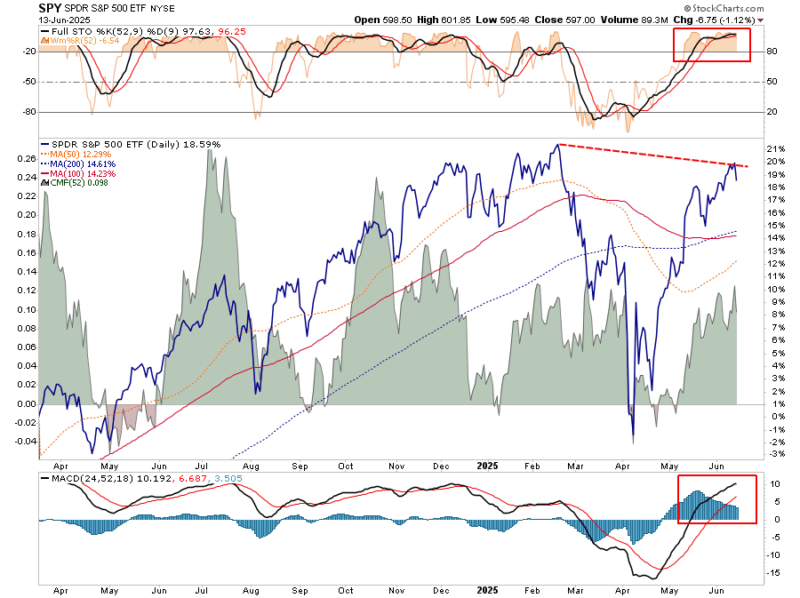

6-16-25 How the Iran-Israel Conflict Could Shock Global Markets

Lance Roberts breaks down the latest developments in the Iran-Israel conflict and what they mean for global markets, oil prices, and investor sentiment. With tensions rising in the Middle East, we explore how geopolitical risk is shaping the outlook for the S&P 500, energy stocks, safe-haven assets like gold and Treasuries. Lance touches on the impact of Middle East conflicts on the stock market, how oil prices typically respond to geopolitical...

Read More »

Read More »

Does the “Economy” Actually Exist?

We speak of the “economy” as though it produces goods. Yet, the term really is a fiction, as purposeful individuals working in cooperation with each other are the real producers.

Read More »

Read More »

Is Japan entering a recession?

Japan's economy contracted at a higher pace than expected in the first quarter of 2025, according to official data for the January to March period released on Friday.

Read More »

Read More »

Sachsen Anhalt: Zwischen AfD und CDU fliegen die Fetzen im Parlament!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenloser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Investors Take Israel-Iran Conflict in Stride: Gold, Oil, and the Dollar are Softer

Overview: After inflicting damage on Iran's proxies (Hamas and Hezbollah), Israel turned to Iran itself following the IAEA's finding that Tehran was in violation of its uranium-enrichment targets. The war continues. The US reportedly helped Israel shoot down missiles aimed at it, but so far Russia, which signed a defense pact with Iran earlier this …

Read More »

Read More »

Unternehmertum, Versicherungen, Gesellschafft: Buchempfehlungen von Thomas #lesen

Unternehmertum, Versicherungen, Gesellschafft: Buchempfehlungen von Thomas 📖 #lesen

🎥 5 Bücher, die du 2025 unbedingt lesen solltest!:

?si=JXONX7eWoeIWB1PW

🎯 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt....

Read More »

Read More »

Napolitano: Trump’s deploying Nat Guard and Marines is an assault on federalism.

The deployment of California National Guard troops and active-duty U.S. Marines onto the streets of Los Angeles without local approval is an assault on federalism.

Read More »

Read More »

Israel And Iran: Is This Time Different For Oil Prices?

Crude oil prices spiked by over $10 on the initial news that Israel was bombing Iran's nuclear facilities and targeting its key military leaders. The price surge should be expected, given that Iran accounts for slightly over 3% of global production and, more importantly, holds 12% of the world's proven crude oil reserves. For context, …

Read More »

Read More »

The Iran-Israel Conflict And The Likely Impact On The Market

The Iran-Israel conflict and equity markets are now in sharp focus. As direct strikes escalated in June 2025, global financial markets responded immediately. Israel’s airstrikes on Iranian nuclear and energy infrastructure triggered retaliatory missile and drone attacks from Iran. The Dow dropped nearly 2%, the S&P 500 lost over 1%, and oil prices surged by …

Read More »

Read More »