Tag Archive: negative interest rates

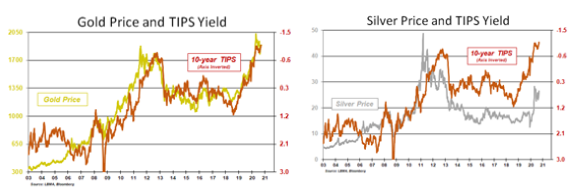

Gold to $2,300 and Silver to $35 by Year End – 2021, the Year the Barometer Explodes?

The US dollar set for further dramatic declines?Negative interest rate policy spreadingIncreased global liquidity in attempt to ignite a recoveryDemocrats’ win paves way for massive stimulus packagesGold and silver set to rally strongly in a perfect storm.

Read More »

Read More »

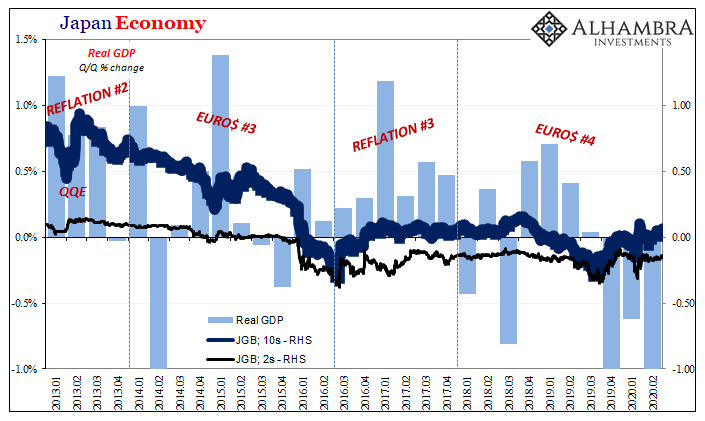

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself.

Read More »

Read More »

THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep stock markets afloat and the economic expansion alive.

Read More »

Read More »

THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates.

Read More »

Read More »

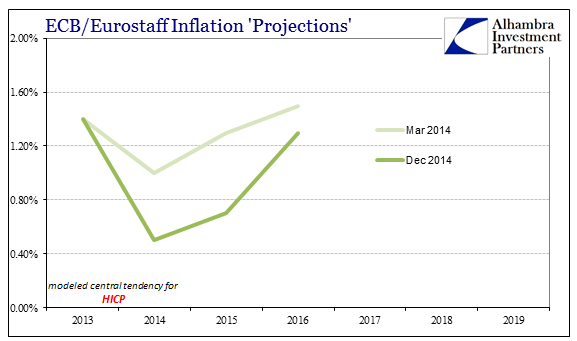

Consensus Inflation (Again)

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January 2014:

Read More »

Read More »

Canadian Bank Starts Charging Negative 0.75percent Rate On Most Foreign Cash Balances

Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada's most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most currencies, to match the deposit rate of Switzerland.

Read More »

Read More »

NIRP Has Failed: European Savings Rate Hits 5 Year High

One year ago, when it was still widely accepted conventional wisdom that NIRP would "work" to draw out money from savers who are loathe to collect nothing (or in some cases negative interest) from keeping their deposits at the bank, and would proceed to spend their savings, either boosting the stock market or the economy, we showed research from Bank of America demonstrating that far from promoting dis-saving, those European nations which had...

Read More »

Read More »