Tag Archive: Monetary

“The U.S. economy felt like a balloon in search of a needle” – Part I

As we move deeper and deeper into this covid crisis, more and more people understand that there’s a lot more to fear besides the disease itself. As the economic impact and the full scale of the damage caused by the lockdowns and the shutdowns become undeniable, there are too many questions lacking any sort of convincing answer and the future for so many employees, business owners, investors and ordinary savers seems bleak and uncertain.

Read More »

Read More »

You cannot print your way to prosperity – Part II

Looking at the damage inflicted upon supply chains, production facilities and global trade in particular, how quickly could these operations snap back even if all COVID-related restrictions were lifted tomorrow? Do you think we’ll eventually get back to business as usual, or have we now experienced a permanent shift to a “new normal”?

Read More »

Read More »

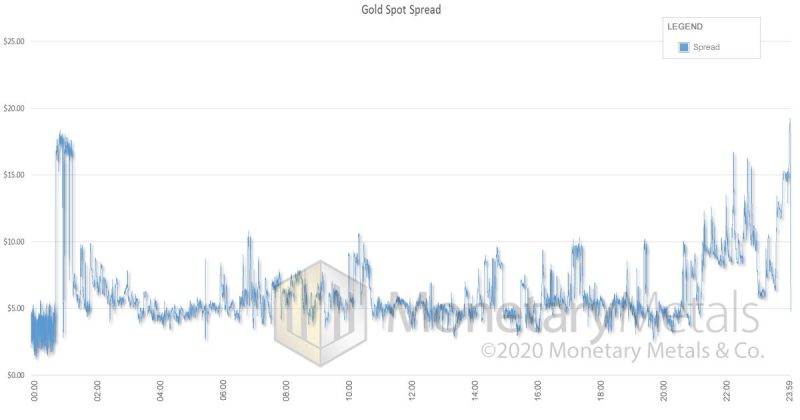

Gold doing what it does best – Part II

While the economic forces that drive this rush to precious metals are clearly understandable, there are other, deeper and less obvious factors that must also be taken into account. This “fear of uncertainty”, which pushes demand for gold higher as it has done so many times in the past, is different this time.

Read More »

Read More »

A blueprint for a European superstate

After intense negotiations, long days and nights of clashes and a distinctly sour note underlying the entire summit, European Union leaders finally agreed on an unprecedented 1.82 trillion-euro ($2.1 trillion) budget and COVID recovery package.

Read More »

Read More »

Is the West repeating India’s mistakes?

Following the publication of our last conversation with Jayant Bhandari, I received a lot of interesting feedback and remarks. The common denominator of all those comments was the astonishment of many Western readers at the real conditions and dynamics on the ground in India.

Read More »

Read More »

War on poverty, or just war on the poor?

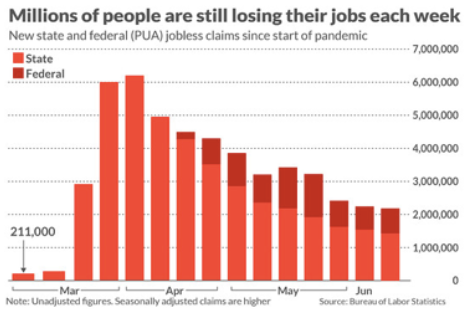

As the dust is now begging to settle, both from the heights of the COVID panic and from the riots that shook the western world, we are starting to get an idea about where we stand after this unprecedented and tumultuous time.

Read More »

Read More »

The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian...

Read More »

Read More »

Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek

Read More »

Read More »

An unexpected blow to the ECB

Since the beginning of the year, the corona crisis has come to monopolize the news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling out of the German Constitutional Court in early May, that challenged the actions and remit of the ECB.

Read More »

Read More »

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable.

Read More »

Read More »

Nothing Is What It Seems

My latest interview about Corona, Liberty, Private Property, Authoritarism, and a fear-mongering global media campaign, which I call borderline criminal

[embedded content]

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »

Modern Monetary Theory is an old Marxist Idea

Modern Monetary Theory, or “MMT”, has been getting a lot of attention lately, often celebrated as a revolutionary breakthrough. However, there is absolutely nothing new about it. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist, Michael Kalecki (1899 – 1970).

Read More »

Read More »

Gold is the 7th sense of financial markets

Claudio Grass (CG): Looking at the interest rate policy of the last years, it would seem that central banks are backed into a corner. They cannot hike borrowing costs without risking a domino effect, as both government and corporate debt have reached record highs, encouraged by the central banks’ own NIRP and ZIRP policies. In your view, is there a “safe” way out of this vicious circle?

Read More »

Read More »

Gold is the 7th sense of financial markets

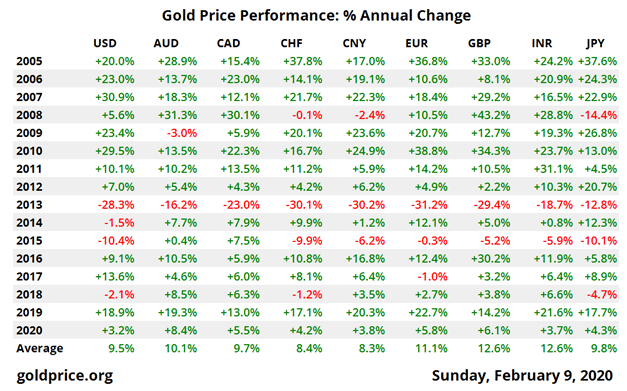

As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion.

Read More »

Read More »

What lies ahead for gold in 2020

Over the last few months, gold’s performance has been remarkable. Many market observers and mainstream analysts have pointed to various geopolitical developments in their efforts to explain away the bullishness as a reaction to whatever happens to be in the headlines at the time.

Read More »

Read More »

Investing in crypto the sound way!

I have long been fascinated by the far-reaching consequences and the great potential of the wave of new technologies and ideas that emerged with the crypto revolution. While most of us first came into contact with these concepts in 2017, this tectonic shift that is only just beginning has been in the making for nearly a decade. Now, we begin to see the basic ideas and tools take shape and give rise to endless exciting possibilities that can affect...

Read More »

Read More »