Tag Archive: Monetary Policy

Weekly Market Pulse: Big Rate Cuts? Not Right Now

“I think we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September”. “If you look at any model” it suggests that “we should probably be 150, 175 basis points lower.”

Treasury Secretary Scott Bessent in a Bloomberg interview, 8/13/25

President Trump and others in his administration have been pushing for lower interest rates for months – one wonders what they’re worried about – and are doing and saying...

Read More »

Read More »

Weekly Market Pulse: The Turkey Leg

Note: I wrote most of this commentary prior to the US strike on Iran and I decided to go ahead with it anyway. I don’t know any more than you do about what is going on in the Middle East and trying to predict what will happen in the coming days and weeks is a fool’s errand. We have a strategic allocation to commodities in our portfolios exactly because we can’t predict things like this.

Read More »

Read More »

Weekly Market Pulse: Did The Fed Just Make A Mistake?

Well, they did it. The Fed cut the Fed Funds rate by 50 basis points last week and indicated that there is likely more to come. Stock investors liked it, bidding up small cap stocks (S&P 600) by 2.25%, large caps (S&P 500) by 1.4% and the NASDAQ by 1.5%.

Read More »

Read More »

Assessing the Hawkish Stance in Modern Monetary Policy: Implications and Outcomes

In the intricate world of economic management, the term "monetary policy" often surfaces in discussions among policymakers, economists, and financial analysts. As central banks navigate the delicate balance between fostering economic growth and curbing inflation, their stance on monetary policy becomes a focal point of analysis and debate.

Read More »

Read More »

Navigating Economic Waters: The Role and Impact of Monetary Policy

**The Role and Impact of Monetary Policy in Modern Economies**In the intricate web of modern economies, few instruments wield as much influence as monetary policy. At its core, monetary policy encompasses the actions undertaken by a nation's central bank to manage the money supply, interest rates, and inflation, with the overarching goal of fostering economic stability and growth.

Read More »

Read More »

Decoding Monetary Policy: How Central Banks Steer the Economy

Monetary policy stands as a cornerstone of modern economic management, wielded by central banks worldwide to influence the economic landscape. This dynamic toolset plays a pivotal role in steering economies through the ebbs and flows of growth, inflation, and employment.

Read More »

Read More »

Exploring the Impact of Monetary Policy on Aggregate Supply: A Comprehensive Analysis

In the intricate dance of economics, the relationship between monetary policy and aggregate supply often remains a nuanced and complex topic. While much attention is typically given to the immediate impacts of monetary policy on aggregate demand—such as changes in interest rates and their effect on consumer spending and investment—the potential repercussions on aggregate supply are equally significant, albeit less straightforward.

Read More »

Read More »

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

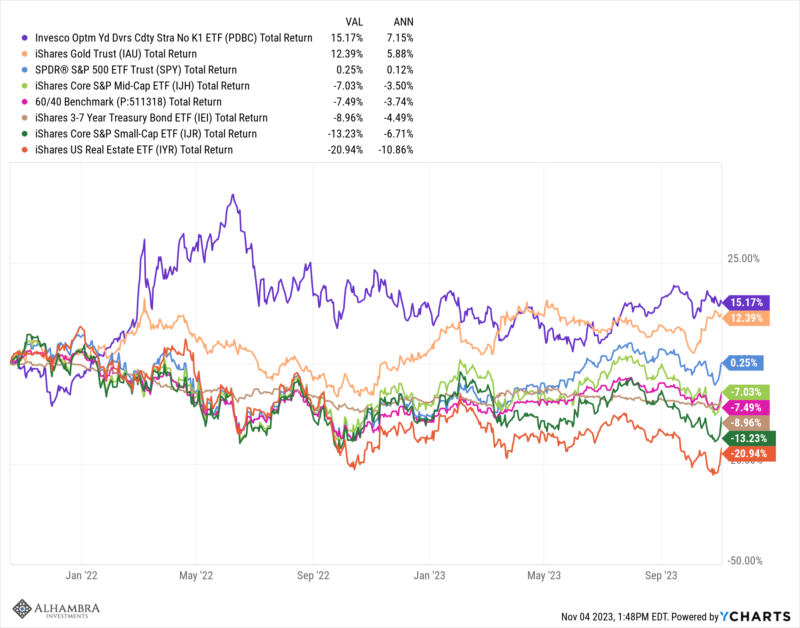

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

Risk Appetites Squashed by Weak Chinese Imports/Exports and Moody’s Downgrade of 10 US Banks

Overview: The combination

of falling Chinese imports and exports, Moody's downgrade of ten US small and

medium-sized banks is serving to squash risk appetites. Equities are weak, but

bond markets are strong despite the surprise tax on Italian banks announced

yesterday and the kick-off of the US $103 bln refunding today. Outside of Japan

and Australia, Asia Pacific equity markets were lower led by a 1.8% drop in the

Hang Seng and a nearly 2.2% loss...

Read More »

Read More »

Weekly Market Pulse: First, Kill All The Speculators

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome.

Read More »

Read More »

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

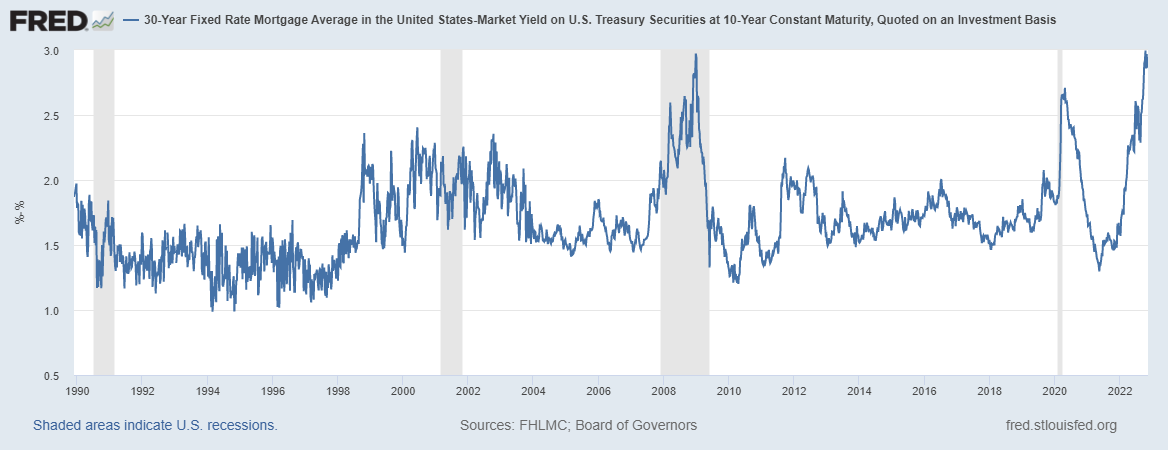

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Weekly Market Pulse: Peak Pessimism?

Goodbye and good riddance to the third quarter of 2022. That was one of the wildest 3 months I’ve experienced in my 40 years of trading and investing. The quarter started off great with the S&P 500 rising 14% from July 1 to August 16 but ended with a 17% swan dive into the end of the quarter. And we closed on the low of the year.

Read More »

Read More »

No One Wants a Recession, but Central Banks are willing to Take the Risk to Demonstrate Anti-Inflation Resolve

The

week ahead is busy. Three G7 central banks meet, the Federal

Reserve, the Bank of Japan, and the Bank of England. In addition, Japan and Canada

report their latest CPI readings, and the flash September PMI are

released. There

are three elements of the Fed's meeting that are worth previewing. First is the

interest rate decision itself and the accompanying statement. Ironically, this

seems to be the most straightforward. Even before the August...

Read More »

Read More »

Weekly Market Pulse: The Dog That Didn’t Bark

Gregory (Scotland Yard detective): “Is there any other point to which you would wish to draw my attention?”

Sherlock Holmes: “To the curious incident of the dog in the night-time.”

Gregory: “The dog did nothing in the night-time.”

Sherlock Holmes: “That was the curious incident.”

From Silver Blaze by Arthur Conan Doyle, 1892

Read More »

Read More »

The End Game Approaches

The pendulum of market sentiment swings dramatically. It has swung from nearly everyone and their sister complaining that the Federal Reserve was lagging behind the surge in prices to fear

of a recession.

Read More »

Read More »

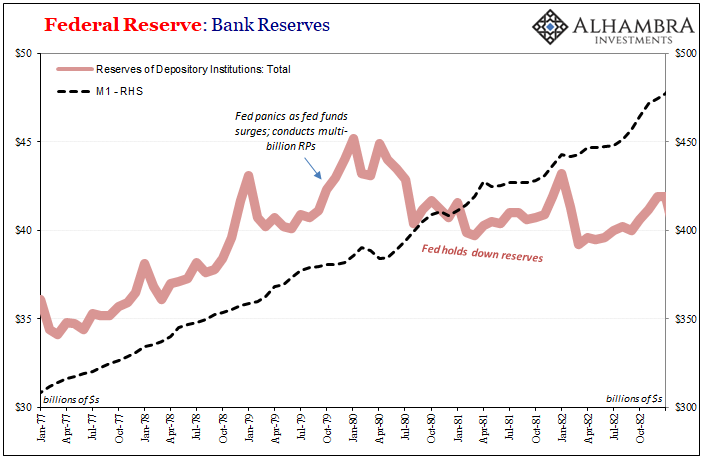

A Volcker Pan Recession

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money.

Read More »

Read More »

Central Banks…Why Bother?

Central banks…why bother? Inflation is here and it cannot be contained. US inflation is touching a 40-year high, the UK has hit the 40-year high, and the EU’s has already hit an all-time high.

Read More »

Read More »

Inflation is now out of the control of central banks

2022-07-01

by Stephen Flood

2022-07-01

Read More »