Tag Archive: Lance Roberts

Market Sector Review: Extreme Market Bifurcation

Since the beginning of the year, we have discussed the "reflation trade" and its impact on specific market sectors. This past weekend's newsletter also showed some of these more extreme returns in various market sectors since the beginning of the year. To wit: "Despite what seemed like a rough week in the market, it really wasn’t as …

Read More »

Read More »

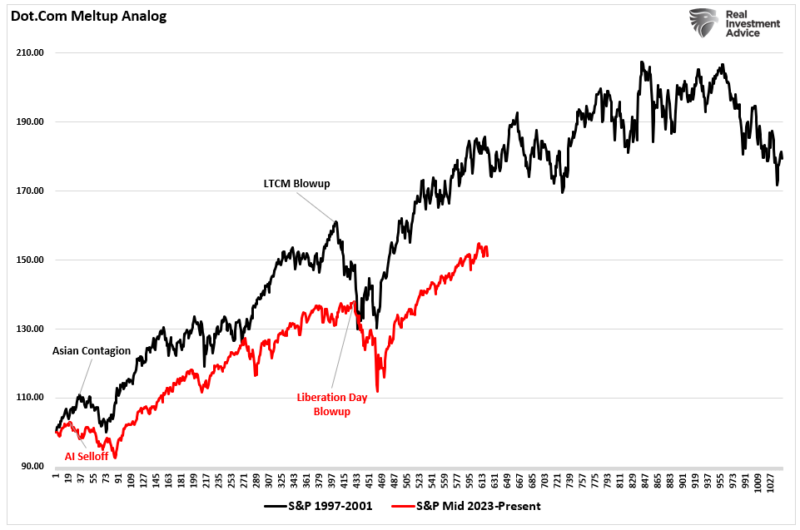

Speculative Narrative Unwinds

For nearly two years, markets were driven by the same speculative narrative that "this time is different.” Bitcoin, precious metals, and AI-linked equities rose not only because of robust fundamentals, but also because investors clung to powerful narratives about inflation, disruption, and monetary collapse. Those speculative narratives are not only seductive but also contribute to …

Read More »

Read More »

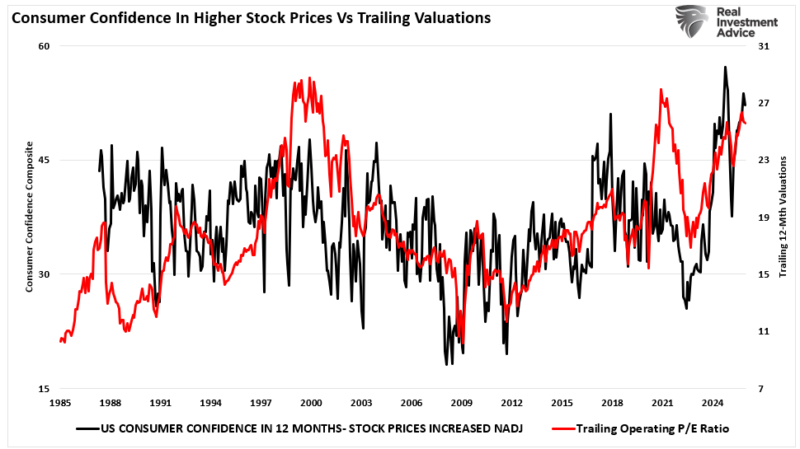

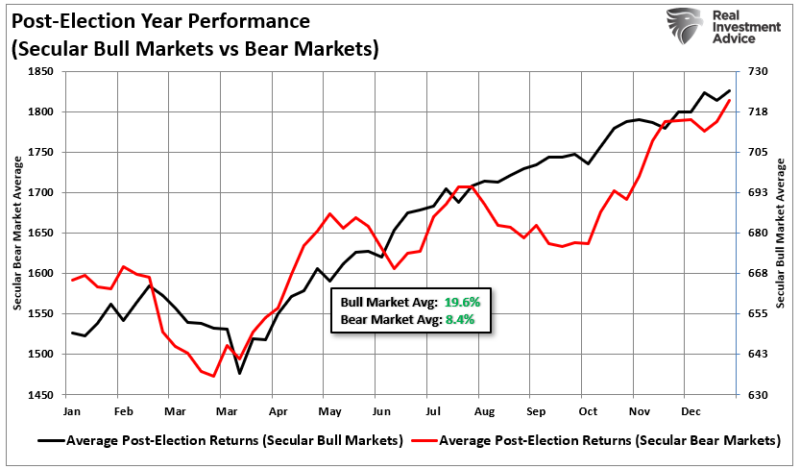

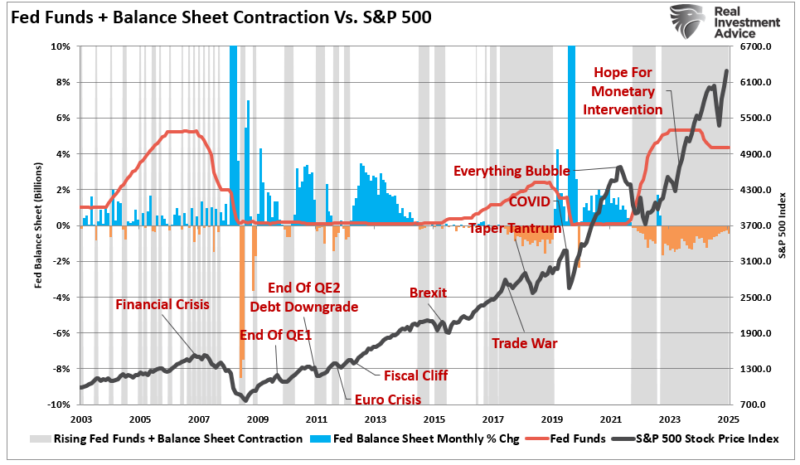

The Market Cycles Potentially Driving 2026 Returns

Market cycles are once again at the center of the investment narrative as we head into 2026. The optimism is familiar as earnings held up in 2025, the economy avoided recession, and big tech lifted the indexes. However, those victories are already reflected in the price. As we head into 2026, with valuations extended, the …

Read More »

Read More »

The South Park Market Of 2026

I have been a "South Park" fan for as long as I can remember, and while the show isn't a market guidebook, its brutal satire cuts through nonsense better than many Wall Street commentaries. Just like on the show, characters make absurd decisions and face absurd consequences, which is familiar to investors today. For example, … Continue...

Read More »

Read More »

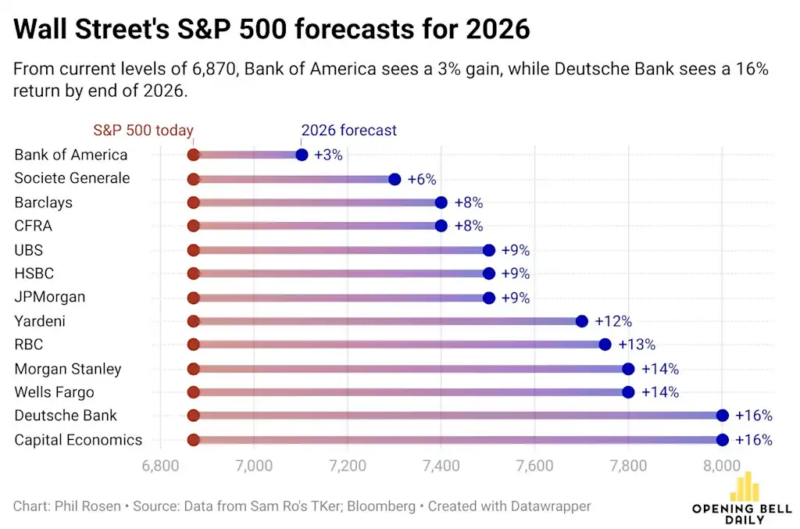

2026 Earnings Outlook: Another Year Of Optimism

The Wall Street consensus forecast for 2026 earnings growth is strong by historical standards. Analysts are giddy and projecting another year of double-digit growth in S&P 500 earnings per share (EPS). FactSet’s most recent data showed an expected 2026 earnings growth rate for the S&P 500 of about 15 percent. That is well above the …

Read More »

Read More »

New Year’s Resolutions For 2026 – Investor Version

Every January, it happens like clockwork: you drive by gym parking lots that look like a Taylor Swift concert. Go to the store, and the salad aisles are ransacked like there’s a lettuce shortage, and half of your coworkers suddenly start quoting Warren Buffett while buying stock in companies they can’t spell. You got it, …

Read More »

Read More »

Bull Market Genius Is A Dangerous Thing

During extended upward-trending markets that reward risk-takers and punish caution, everyone is a "bull market genius." That dynamic flips investor psychology and, over time, creates a false sense of control. As the market continues to climb, risk appears to vanish, and investors believe that nothing can go wrong, leading them to take on increasing levels …

Read More »

Read More »

The DPI Link To Margin Debt

A recent article by Simon White, via Bloomberg, discussed the rising cost of margin debt for investors. While his analysis below compares the cost of debt to GDP, we will also consider a more critical comparison to disposable personal income (DPI). Here is Simon's point. "Yet, where history does raise a red flag is if … Continue reading...

Read More »

Read More »

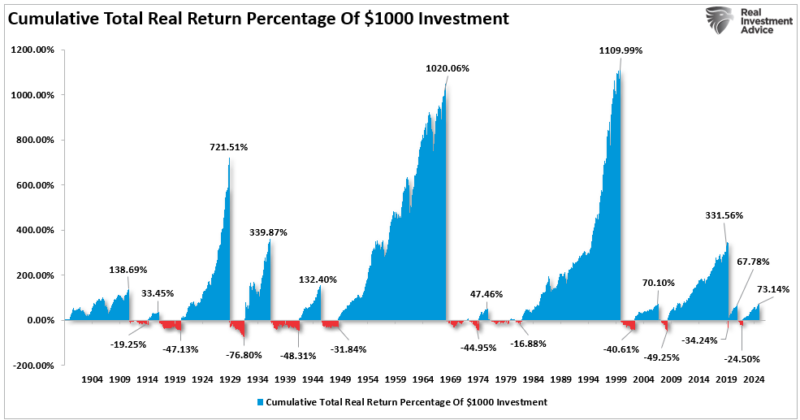

A Bear Market Is A Good Thing.

One of my favorite writers for the WSJ is Spencer Jakab, who recently penned an article explaining why a bear market is not necessarily a bad thing. He starts with a quote from "The Godfather." "“These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten … Continue reading »

Read More »

Read More »

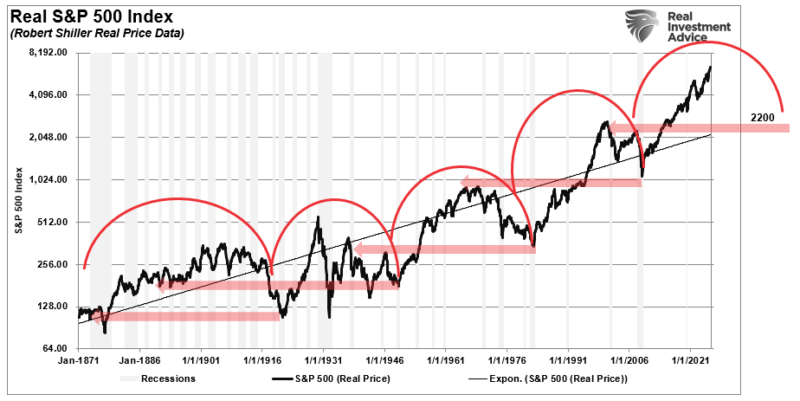

Market Bubbles: A Rational Guide To An Irrational Market

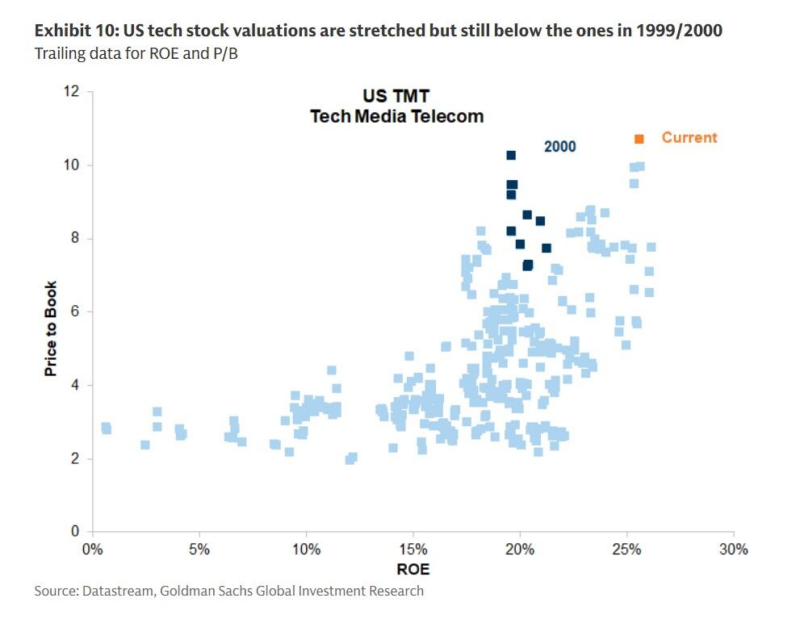

We’re hearing it everywhere: AI is in a bubble. The surge in capital, the parabolic stock charts, and the bold claims from CEOs all have a familiar rhythm. Nvidia’s valuation has soared, along with AI-related startups raising billions with little to no revenue. Investment in data centers, chips, and infrastructure is happening at a scale …

Read More »

Read More »

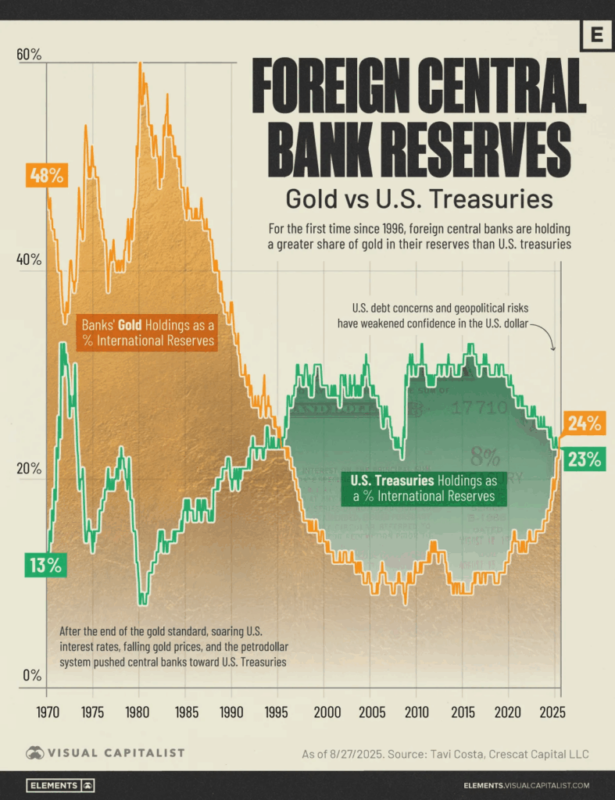

Gold Myths Luring Investors Into Risk

In case you haven't heard, precious metals, particularly gold, have risen sharply this year. Of course, whenever any asset class experiences a more speculative melt-up, investors are quick to rationalize why "this time is different." In stocks, it is about "artificial intelligence" and "data centers." The cryptocurrency community believes all fiat currencies will fail and …

Read More »

Read More »

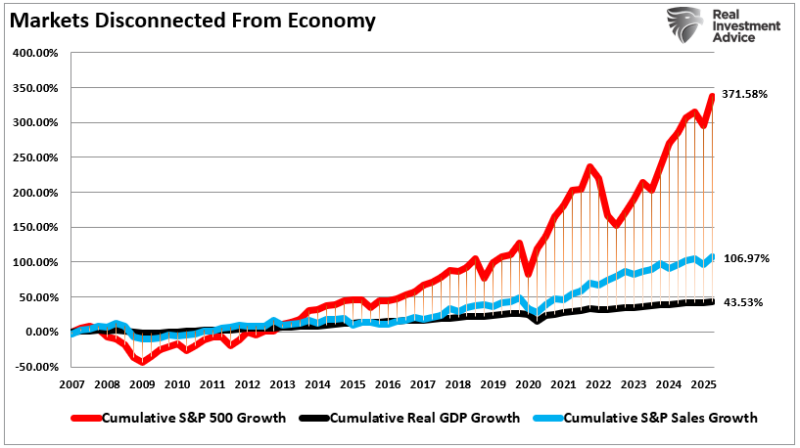

The Most Dangerous Era In History

We live in what Brett Arends claimed as "The Dumbest Stock Market In History," but I believe it is potentially the most dangerous era. That phrase is not hyperbole as it reflects structural distortion, extreme valuations, and an investor base intoxicated by momentum and narrative. The MarketWatch piece puts it bluntly: “At one level, there …

Read More »

Read More »

Speculative Bull Runs And The Value Of A Bearish Tilt

The recent market crack certainly woke up the more complacent bullish investors. Of course, the complacency was warranted, given the recent market surge, conversations about “TINA” (There Is No Alternative), and how “this time is different.” But that is what a speculative bull run looks and feels like. However, deep inside, you know there are …

Read More »

Read More »

The Psychology Of Investing In A Zero-Risk Illusion

Every market cycle eventually changes investor psychology to believe risk has been conquered. The storylines may change, from “this time it’s different” to “the Fed has our back,” but the psychology does not. When markets rise steadily and volatility remains low, investors confuse stability with safety. That’s precisely the illusion forming in markets today. The …

Read More »

Read More »

ChatGPT Gives Financial Advice On Volatile Markets

Following Friday's selloff amid the resurgence of tariff threats on China, I asked ChatGPT a simple question: " How to Stay Calm In The Stock Market?" That simple question generated an engaging and humorous take on financial advice for navigating volatile markets. In this week's post, I thought it would be helpful to review ChatGPT's advice …

Read More »

Read More »

Bear Market Losses – A Dangerous Illusion

When bear market losses occur, headlines talk in percentages: “The market dropped 20 %.” Investors nod. A 20 % decline sounds manageable, historical, and expected. As Ben Carlson recently penned: "Bear markets have some symmetry to them, at least in the short-term. In the long term, bull markets versus bear markets are asymmetric. Things are not balanced. Look at …

Read More »

Read More »

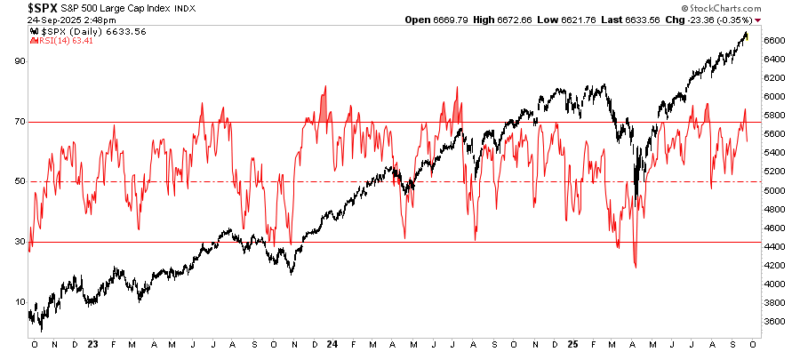

RSI (Relative Strength Index): Timing The Next Correction

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

Read More »

Read More »

Markets: Bullish Vs Bearish Case

Just recently, Scott Rubner of Citadel Securities wrote an excellent piece discussing the bull versus the bear case for the markets. You look at the markets today and see a tension between expectation and reality. On one hand, equities—especially tech and growth—are pushing to fresh highs. Optimism about rate cuts, AI and productivity gains, global …

Read More »

Read More »

Invest Or Index – Exploring 5-Different Strategies

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, …

Read More »

Read More »

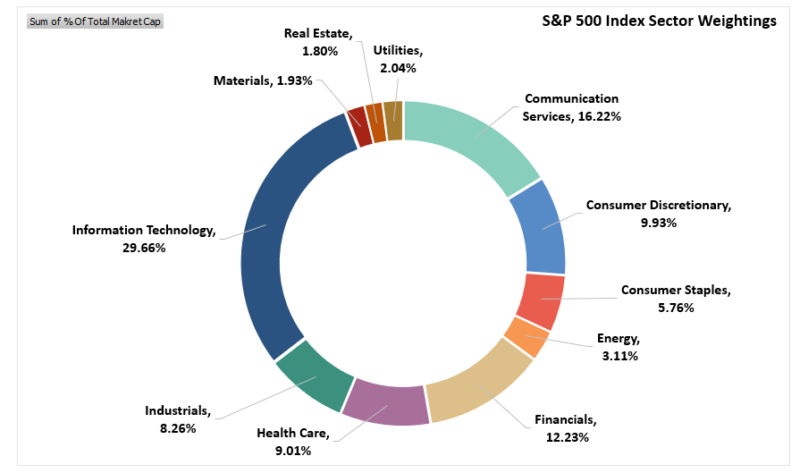

Why Diversification Is Failing In The Age Of Passive Investing

Diversification has been the backbone of "buy and hold" strategies for the last few decades. It was a boon to financial advisors who couldn't actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: "Buy a basket of assets, dollar cost …

Read More »

Read More »