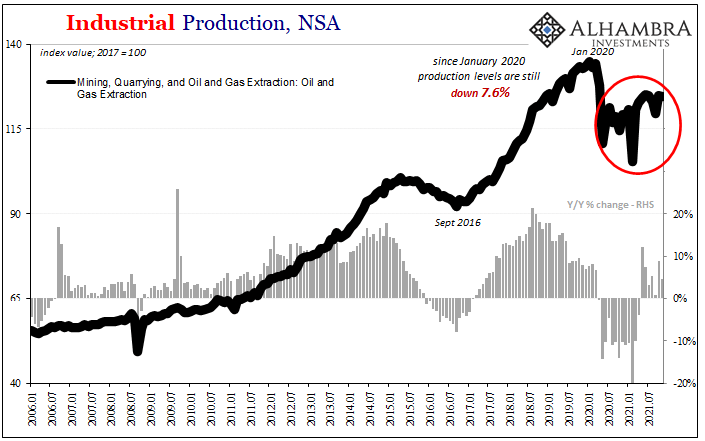

Have oil producers shot themselves in the foot, while at the same time stabbing the global economy in the back? It’d be quite a feat if it turns out to be the case, one of those historical oddities that when anyone might honestly look back on it from the future still hung in disbelief. Let’s start by reviewing just the facts.

Read More »

Tag Archive: inflation breakevens

Short Run TIPS, LT Flat, Basically Awful Real(ity)

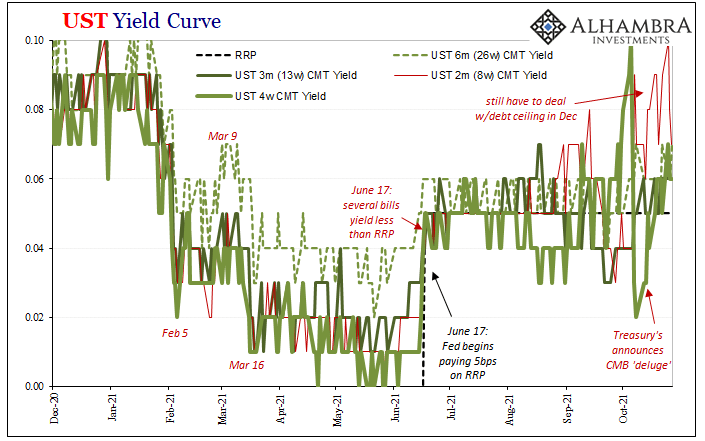

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

Rechecking On Bill And His Newfound Followers

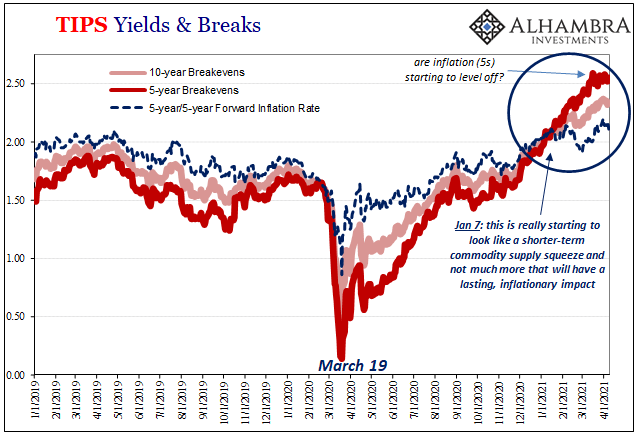

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard).

Read More »

Read More »

Three Things About Today’s UST Sell-off, Beginning With Fedwire

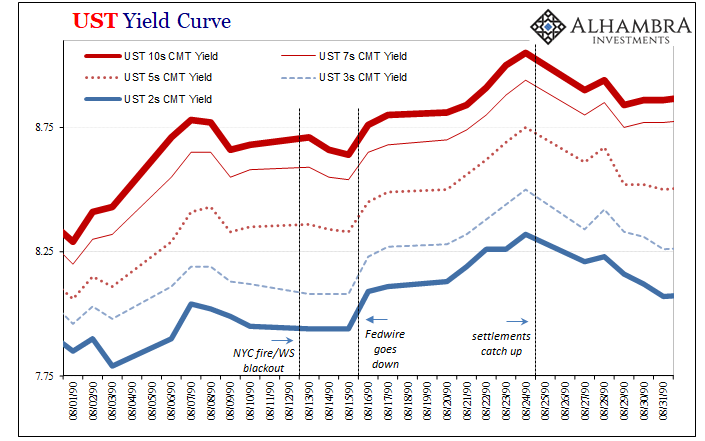

Three relatively quick observations surrounding today’s UST selloff.1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday.

Read More »

Read More »

Just Who Was The Intended Audience For The Rate Cut?

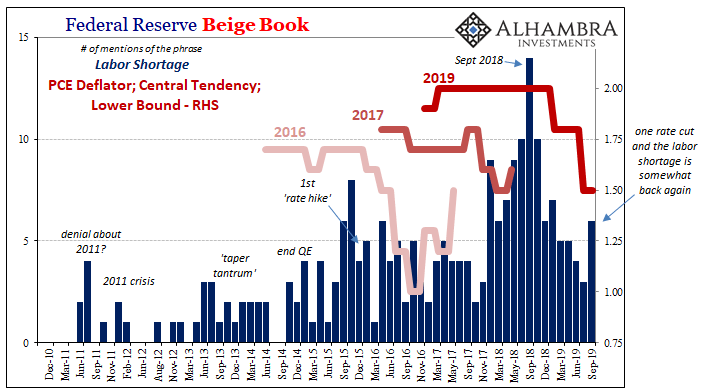

Federal Reserve policymakers appear to have grown more confident in their more optimistic assessment of the domestic situation. Since cutting the benchmark federal funds range by 25 bps on July 31, in speeches and in other ways Chairman Jay Powell and his group have taken on a more “hawkish” tilt. This isn’t all the way back to last year’s rate hikes, still a pronounced difference from a few months ago.

Read More »

Read More »

The Real End of the Bond Market

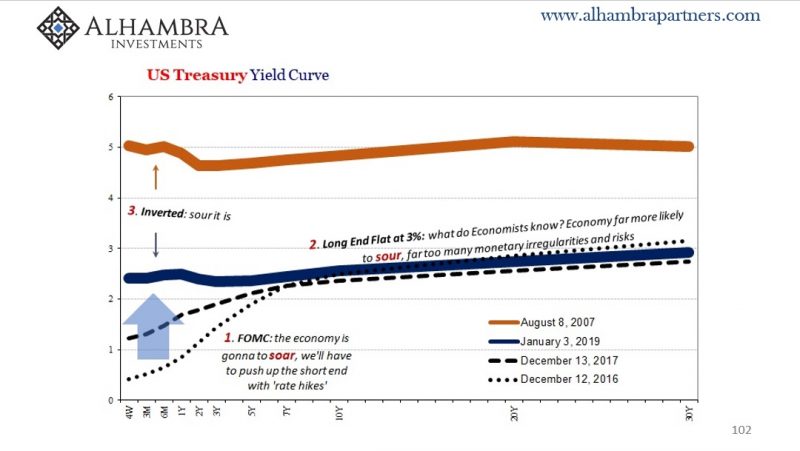

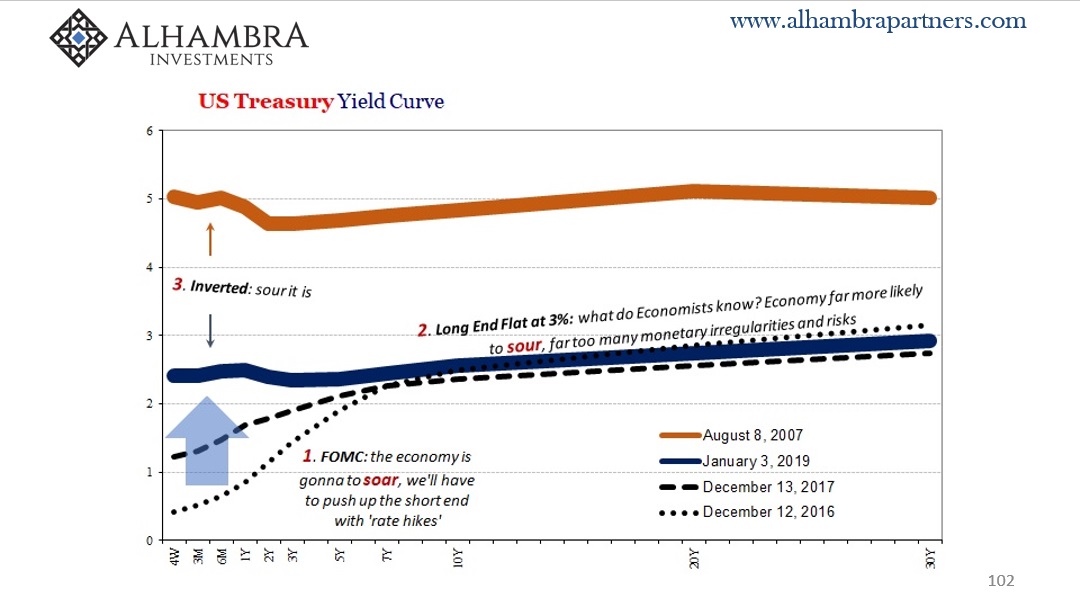

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke).

Read More »

Read More »

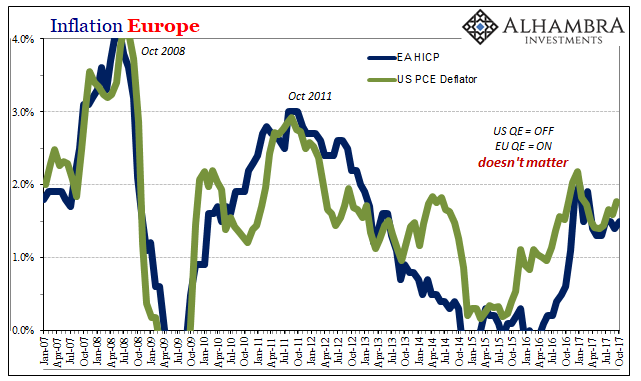

Globally Synchronized What?

In one of those rare turns, the term “globally synchronized growth” actually means what the words do. It is economic growth that for the first time in ten years has all the major economies of the world participating in it. It’s the kind of big idea that seems like a big thing we all should pay attention to. In The New York Times this weekend, we learn.

Read More »

Read More »