Tag Archive: gold bars

In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves

In one of the most profound developments in the central bank gold market for a long time, the Hungarian National Bank, Hungary’s central bank, has just announced a 10 fold jump in its monetary gold holdings. The central bank, known as Magyar Nemzeti Bank (MNB) in Hungarian, made the announcement in Budapest, Hungary’s capital.

Read More »

Read More »

LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

The first day of each month sees the reporting of a number of statistics about the London Gold Market by the bullion bank led London Bullion Market Association (LBMA). These statistics focus on clearing data and vault holdings data and are reported in a 1 month lag basis for clearing activity and a 3 month lag basis for vault holdings data.

Read More »

Read More »

As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran.

Read More »

Read More »

Gold’s Price Performance: Beyond the US Dollar

With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a drop of US $50.

Read More »

Read More »

Why the World’s Central Banks hold Gold – In their Own Words

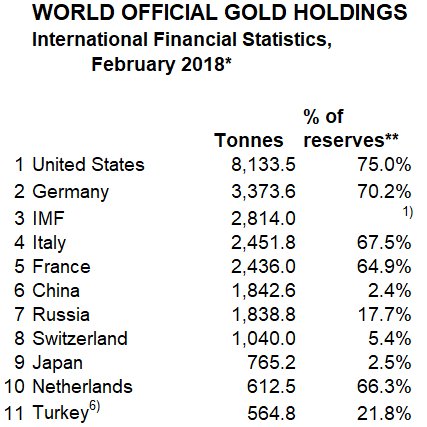

Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range.

Read More »

Read More »

US Gold Reserves, Of Immense Interest to Russia and China

Recently, Russian television network RT extensively quoted me in a series of articles about the US Government’s gold reserves. The RT articles, published on the RT.com website, were based on a series of questions RT put to me about various aspects of the official US gold reserves. These gold reserves are held by the US Treasury, mostly in the custody of the US Mint. The US Mint is a branch of the US Treasury.

Read More »

Read More »

The West lost at least another 1000 tonnes of large gold bars in 2015

Over the last number of years, one of the most interesting trends in the physical gold world is the ongoing conversion of large 400 ounce gold bars into smaller high purity 1 kilogram gold bars to meet the insatiable demand of Asian gold markets such as China and India.

Read More »

Read More »

Are the World’s Billionaire Investors Actually Buying Gold?

The 4 investors profiled in the infographic are: Jacob Rothschild (Lord), chairman of London-based investment trust RIT Capital Partners Plc, David Einhorn, president of Manhattan-based hedge fund firm Greenlight Capital, Ray Dalio, chairman and CIO of hedge fund firm Bridgewater Associates, Westport (Connecticut), Stanley Druckenmiller, chairman and CEO of Manthattan-based Duquesne Family Office (and formerly of Duquesne Capital Management).

Read More »

Read More »

An update on SGE Vault Withdrawals and SGE Price Premiums

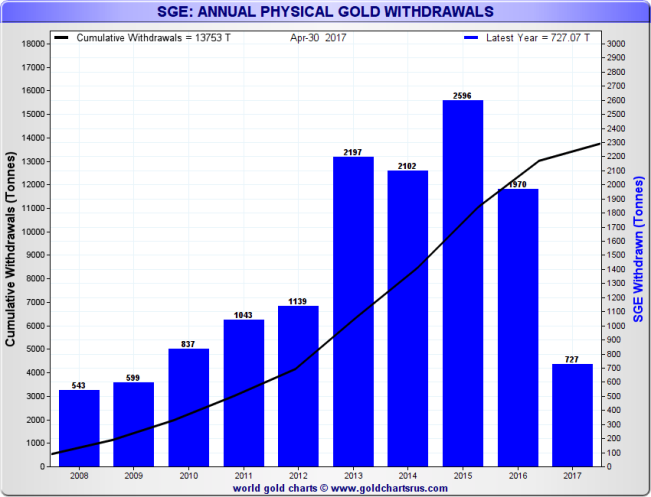

In 2016, withdrawals of gold from the Shanghai Gold Exchange totalled 1970 tonnes, the 4th highest annual total on record. This was 24% less than SGE gold withdrawals recorded in 2015, which reached a cumulative 2596 tonnes (See Koos Jansen’s 6 January 2017 blog at BullionStar “How The West Has Been Selling Gold Into A Black Hole” for more details of the 2016 withdrawals).

Read More »

Read More »

Bank of England releases new data on its gold vault holdings

An article in February on BullionStar’s website titled “A Chink of Light into London’s Gold Vaults?” discussed an upcoming development in the London Gold Market, namely that both the Bank of England (BoE) and the commercial gold vault providers in London planned to begin publishing regular data on the quantity of physical gold actually stored in their gold vaults.

Read More »

Read More »

German and Swiss Precious Metals Refiners join forces as Heraeus acquires Argor-Heraeus

German precious metals group Heraeus Precious Metals (HPM), part of the Heraeus industrial group, has just announced the full acquisition of Swiss precious metals refining group Argor-Heraeus. Heraeus is headquartered in Hanau, just outside Frankfurt. Argor-Heraeus is headquartered in Mendrisio in the Swiss Canton of Ticino, beside the Italian border.

Read More »

Read More »

Germany’s Gold remains a Mystery as Mainstream Media cheer leads

On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Eilmeldung: Massiver AOK Skandal in Baden-Württemberg! Versicherte AUGEPASST!

-

Coca-Cola Gold Bar (.9999) Limited to 5,000!

Coca-Cola Gold Bar (.9999) Limited to 5,000! -

2-24-26 Stop Chasing 2026 Returns

-

ACHTUNG: Gewerbesteuer bricht völlig zusammen! PANIK-Sitzung bei Klingbeil!

-

Our Take On Tariffs

-

Hör auf nach links und rechts zu schauen – dein Glück beginnt erst, wenn du deinen eigenen Weg gehst

Hör auf nach links und rechts zu schauen – dein Glück beginnt erst, wenn du deinen eigenen Weg gehst -

Wahnsinn! Nächste FAKE-News geht viral! Dieses Mal bei ARD!!

-

Switzerland leads Europe in technology found in Russia’s weapons

-

Gut verdient, mehr abgeben

Gut verdient, mehr abgeben -

Während alle über KI reden, liegt HIER der wahre Weg zum Reichtum

Während alle über KI reden, liegt HIER der wahre Weg zum Reichtum

More from this category

In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves

In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves18 Oct 2018

LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market

LBMA Clearing and Vaulting data reveal the absurdity of the London ‘Gold’ Market2 Oct 2018

As Emerging Market Currencies Collapse, Gold is being Mobilized

As Emerging Market Currencies Collapse, Gold is being Mobilized3 Sep 2018

Gold’s Price Performance: Beyond the US Dollar

Gold’s Price Performance: Beyond the US Dollar4 Jul 2018

Why the World’s Central Banks hold Gold – In their Own Words

Why the World’s Central Banks hold Gold – In their Own Words22 Mar 2018

US Gold Reserves, Of Immense Interest to Russia and China

US Gold Reserves, Of Immense Interest to Russia and China22 Jan 2018

The West lost at least another 1000 tonnes of large gold bars in 2015

The West lost at least another 1000 tonnes of large gold bars in 201514 Aug 2017

Are the World’s Billionaire Investors Actually Buying Gold?

Are the World’s Billionaire Investors Actually Buying Gold?24 Jun 2017

An update on SGE Vault Withdrawals and SGE Price Premiums

An update on SGE Vault Withdrawals and SGE Price Premiums20 May 2017

Bank of England releases new data on its gold vault holdings

Bank of England releases new data on its gold vault holdings4 May 2017

German and Swiss Precious Metals Refiners join forces as Heraeus acquires Argor-Heraeus

German and Swiss Precious Metals Refiners join forces as Heraeus acquires Argor-Heraeus4 Apr 2017

Germany’s Gold remains a Mystery as Mainstream Media cheer leads

Germany’s Gold remains a Mystery as Mainstream Media cheer leads6 Mar 2017