Tag Archive: Gold

Ron Paul: War Is Bipartisan

First Interview in the “World War III” Series Is Now Live

When it comes to opposing war and to raising objections even when it is extremely unpopular and even when one is the only sole voice speaking out against collective madness, there are very few individuals alive today that have repeatedly demonstrated the courage to do so. Even among these select few, arguable no-one has been as consistent, as tireless and as consistently sidelined and...

Read More »

Read More »

World War III: A film that challenges everything we have been told

Over the past decades, and especially in the last few years, war has been radically reframed in the public mind. It’s not raw and brutal bloodshed, senseless destruction and atrocious human pain and suffering. War is no longer seen as an abomination, as the absolute worst case scenario that we must all do our best to avoid. The mainstream media and political leadership of the western world is enthusiastically calling for war, with ominous...

Read More »

Read More »

Korruption & Machtmissbrauch – Die dunkle Seite der Politik!

In dieser Folge im Modelhof begrüßen wir Claudio Grass – Unternehmer, Edelmetall-Experte und überzeugter Verfechter individueller Freiheit und Selbstverantwortung. Seit Jahrzehnten beschäftigt er sich mit dem Geldsystem, der Geschichte des Goldes und den globalen Machtverhältnissen hinter der Finanzwelt.

Im Gespräch analysieren wir, wie korrumpiertes Geld ganze Gesellschaften verändert, warum Zentralbanken mehr Einfluss haben als viele...

Read More »

Read More »

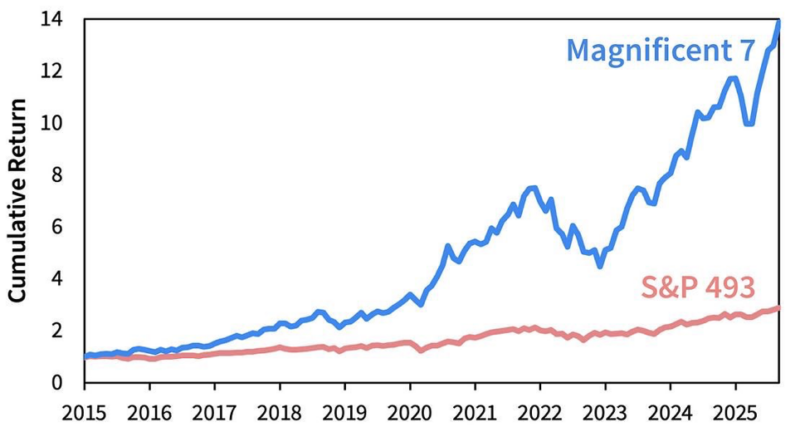

“Sometimes, the only winning move is not to play”

This was the conclusion of the assessment of legendary investor Michael Burry regarding the current market conditions. To be precise, his take as recently posted on X, in full, was “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” The insight behind these words is something that a lot of investors could use at this time. The unrestrained, unjustifiable and unrealistic...

Read More »

Read More »

Gold’s flashing warning: The end is nigh for fiat

Gold’s spectacular performance has drawn a lot of attention and invited endless analyses and commentaries. There are many theories out there as to why the yellow metal is surging like never before in modern memory, however most of them are shortsighted, or tend to miss the forest for the trees. The metal’s meteoric rise is not merely sending message about inflation expectations or rate policy. It’s flashing a clear warning sign about the...

Read More »

Read More »

A conversation with Catherine Austin Fitts

I recently had the great pleasure of (virtually) sitting down with Catherine Austin Fitts, investment banker, President of Solari, and former US Assistant Secretary of Housing and Urban Development for Housing, and having an extremely interesting conversation about the outlook for gold and silver. It was a fascinating discussion, especially given our current economic, monetary and geopolitical context: there so many risks and challenges ahead, that...

Read More »

Read More »

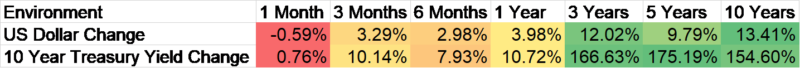

Investing in times of policy volatility

At the end of last month, a shock announcement came from the US Customs and Border Protection (CBP), declaring that one-kilogram and 100-ounce gold bars imported from Switzerland would be subject to a hefty 39% tariff, under the country’s “reciprocal tariffs” policy, which had already applied broadly to Swiss goods. This CBP decision came in response to a Swiss refiner’s request for clarity and guidance on whether gold would be part of the wider US...

Read More »

Read More »

Storing gold in the right place and in the right way

By now, I’m pretty sure that all of my clients and regular readers fully understand why allocating a part of their wealth to physical precious metals is not just the smart move, but an increasingly essential one. Owing real, tangible gold and silver is the only way to protect yourself from both monetary and fiscal excesses and from government overreach. However, it is equally important to know what to do with it once you bought it. Preparing for...

Read More »

Read More »

Geopolitical theater and implications for investors (or lack thereof)

The last month has been truly remarkable for modern human history – at least if one was paying attention to mainstream news headlines and TV anchors. Apparently, we came extremely close to World War III and we very likely had a very tight escape from an all-out nuclear holocaust that could have forever changed the our species’ trajectory and annihilated millions.

It all started with Israel’s surprise bombardment of Iran (which wasn’t really a...

Read More »

Read More »

A Politically Incorrect “Where Are We Now?”

A few days ago, I had the great pleasure to sit down again with my good friend James Patrick in person, in Monte Brè. It was a truly spontaneous and unfiltered conversation about the current state of the world, the bizarre geopolitical situation and the tragicomical moment in history that we find ourselves in. We talked about the extreme, and likely unprecedented, risks we face in the global economic and financial system and I’m very glad we...

Read More »

Read More »

Silver: A rare buying opportunity

The gold price recently surged to unprecedented levels, surpassing the $3,000 per ounce milestone. This remarkable surge has been attributed to escalating geopolitical tensions, the revival of the trade wars, mounting inflation concerns, and of course, a very uncertain and very worrying outlook for the global economy and for the markets. As they always do, investors have once again flocked to the safe haven that gold unmistakably provides, pushing...

Read More »

Read More »

“Does The West Have Any Hope? What Can We All Do?”

Share this article

Interview with Godfrey Bloom

I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years.

It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and...

Read More »

Read More »

“Does The West Have Any Hope? What Can We All Do?”

Interview with Godfrey Bloom

I recently had the great pleasure of being interviewed by my good friend Godfrey Bloom, whose point of view and sharp assessment skills of economic and political events I have consistently found illuminating throughout the years.

It’s always extremely refreshing talking to Godfrey, because his questions cut through the noise and concentrate on what is actually important. I find his views and arguments are also...

Read More »

Read More »

Weekly Market Pulse: Tune Out The Noise

Okay, I confess. It was my fault. I decided to take a couple of days off. I took my eye off the ball and the stock market fell a quick 2% while I was relaxing, eating too much, and seeing some great art in the Holy City, Charleston, SC. I promise it won’t happen again, at least until my wife tells me where we’re going next.

It is a running joke within Alhambra that every time I go away for a few days the market takes a hit. Of course, that isn’t...

Read More »

Read More »

Predictions vs. Convictions

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can accurately predict market...

Read More »

Read More »

Predictions vs. Convictions

Share this article

Separating the signal from the noise

Most regular readers and friends will undoubtedly already know what my position is in regards to projections and forecasts. For many years, I have consistently maintained that any and all attempts to “time the market” are as useless as they are unrealistic and I have always urged all responsible and rational investors to be extremely wary and suspicious of anyone that claims they can...

Read More »

Read More »

Weekly Market Pulse: Is The Honeymoon Over Already?

President Trump’s first week on the job was a good one for markets. The S&P 500 was up 1.75%, with tech stocks taking the lead as the President welcomed a group of leading technology CEOs to D.C. to announce big investments in AI.

Read More »

Read More »

Swissgrams: the natural progression of the Krugerrand in the digital age

Having worked in the precious metals industry for decades, I have had countless opportunities to have very honest and very enlightening conversations with numerous investors and partners alike. For many years, I’ve been discussing the challenges, the hurdles and the problems they’ve encountered. The details of each story I’ve heard might be as unique as the person who shared it with me, however, most of these accounts have a common denominator....

Read More »

Read More »

Swissgrams: the natural progression of the Krugerrand in the digital age

Share this article

Having worked in the precious metals industry for decades, I have had countless opportunities to have very honest and very enlightening conversations with numerous investors and partners alike. For many years, I’ve been discussing the challenges, the hurdles and the problems they’ve encountered. The details of each story I’ve heard might be as unique as the person who shared it with me, however, most of these accounts have a...

Read More »

Read More »

“THE BIG BULL MARKET IN GOLD AND SILVER HAS ONLY JUST BEGUN”

DR. THORSTEN POLLEIT (WWW.BOOMBUSTREPORT.COM) INTERVIEWS CLAUDIO GRASS

Thorsten Polleit (TP): On November 5, 2024, Donald J. Trump was elected the new U.S. president with a landslide victory. His declared goal is to take on the “Deep State” and its bureaucracy. His advisor, Elon Musk, is urging the reduction of national debt, and even the inflationary Federal Reserve (Fed) has become a target, described as an evil that must be healed. Is all...

Read More »

Read More »