Tag Archive: global trade

Tariffs ‘threaten global medicine supply’: Swiss pharma agency

United States tariffs on medicines have threatened global drug supply chains, says an association representing Swiss pharmaceutical companies. +Get the most important news from Switzerland in your inbox Customs barriers disrupt production and supply chains and hinder research and development, Interpharma told AWP.

Read More »

Read More »

Switzerland enters digital trade deal with Singapore

Switzerland is among the EFTA states ( also Iceland, Liechtenstein and Norway) that have signed an agreement on digital trade with Singapore. +Get the most important news from Switzerland in your inbox Swiss Economics Minister Guy Parmelin and representatives of the other EFTA states signed the deal with Singapore's Minister for Trade Relations, Grace Fu, …

Read More »

Read More »

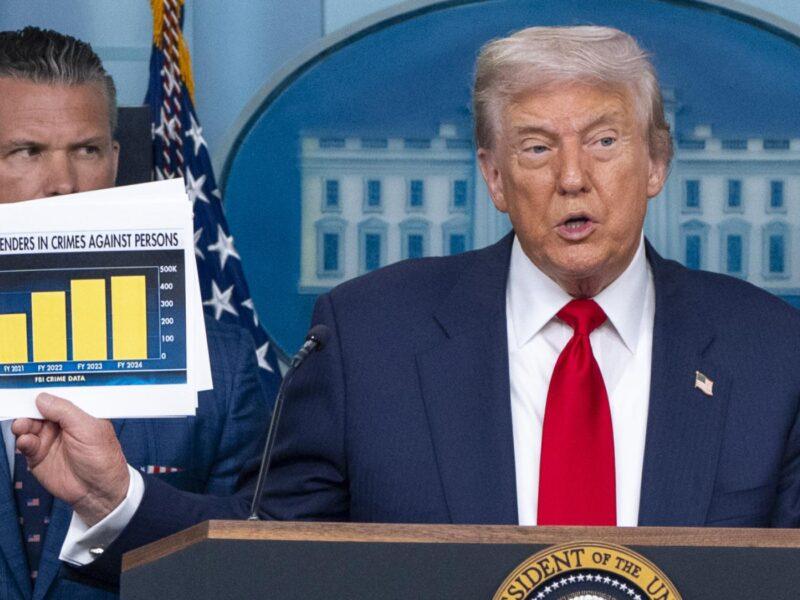

Switzerland braces for 100% US medicine tariff

United States President Donald Trump has announced new tariffs on medicines, lorries and furniture produced outside the US. +Get the most important news from Switzerland in your inbox From October 1, "we will apply a 100% tax on all branded and patented pharmaceutical products, unless a company BUILDS its pharmaceutical plant in America", Trump wrote …

Read More »

Read More »

US tariffs force Switzerland to rethink trade ties

United States trade policy is rattling countries worldwide and prompting them to redirect trade flows at record speed. This is also how Switzerland is responding. US tariffs have put many countries in a tight spot. Persistent uncertainty is only making matters worse: will the US president suddenly slap on further tariffs, despite all concessions, as …

Read More »

Read More »

Switzerland launches trade alliance with 13 small and medium-sized economies

Switzerland wants to diversify and strengthen trade relations together with 13 other countries. With this in mind, the small and medium-sized economies involved have launched the 'Future of Investment and Trade Partnership'. The new initiative brings together small and medium-sized economies with an interest in open and rules-based global trade. According to the economics ministry, …

Read More »

Read More »

US Secretary of Commerce confident of Swiss tariff deal

United States Secretary of Commerce Howard Lutnick is confident about striking a customs deal with Switzerland, which is facing 39% tariffs for good exported to the US. +Get the most important news from Switzerland in your inbox "We will probably get a deal with Switzerland," he said in an interview with the US broadcaster CNBC …

Read More »

Read More »

Swiss SME sentiment remains stable despite steep US tariffs

Despite the high US tariffs, the mood among Swiss SMEs has hardly deteriorated. However, two-thirds of export-oriented companies have now adjusted their export strategy, with one in ten even questioning it as a whole. The mood among small and medium-sized enterprises (SMEs) in Switzerland is stable despite the high US tariffs, according to the study …

Read More »

Read More »

Swiss Senate votes to extend short-time working to counter tariffs

The Swiss Senate has approved the extension of short-time working compensation from 18 to 24 months in the face of United States tariffs. +Get the most important news from Switzerland in your inbox Businesses have demanded the measure since since tariffs were raised. It has now cleared the first parliamentary hurdle. According to the parliamentary …

Read More »

Read More »

Swiss central bank invests in controversial companies

The Swiss National Bank (SNB) is investing money in nine companies that are facing sharp international criticism for their military cooperation with Israel. At the same time, the SNB emphasises ethical principles. How does this fit together? +Get the most important news from Switzerland in your inbox Caterpillar is one of the nine companies. The …

Read More »

Read More »

Swiss await US Supreme Court ruling on tariffs

The United States Supreme Court is set to rule on the legality of President Donald Trump's tariff policy, which also impact Swiss imports duties. +Get the most important news from Switzerland in your inbox A hearing will take place in November, according to a Supreme Court document. Last week, Trump's government applied to the Supreme …

Read More »

Read More »

Switzerland held “constructive” tariff meeting in Washington

Swiss economics minister Guy Parmelin says a meeting in Washington to discuss tariffs with United States officials was "constructive". +Get the most important news from Switzerland in your inbox Switzerland sees good opportunities for both countries and wants to strengthen the partnership, he wrote on the social media platform X on Saturday night. Parmelin met …

Read More »

Read More »

Switzerland seeks improved tariff deal with US

Swiss Economics Minister Guy Parmelin has flown to the United States with a new offer to resolve the customs dispute between the two countries. +Get the most important news from Switzerland in your inbox The purpose of Parmelin's short notice mission was confirmed by Foreign Minister Ignazio Cassis. "We have drawn up an optimised offer …

Read More »

Read More »

Swiss government calls for counter-proposal to the Responsible Business Initiative

The federal government wants to counter the new Responsible Business Initiative with an indirect counter-proposal. The future regulations should be based on new provisions currently being discussed in the European Union. The national government does not want to go any further. +Get the most important news from Switzerland in your inbox On Wednesday, it set …

Read More »

Read More »

Vitol: the secretive trading giant minting fortunes for its employees

The commodity house is among world’s most profitable companies and has returned $20 billion to senior staff over past three years. Across two floors of an unremarkable office block tucked between Buckingham Palace and London’s gritty Victoria coach station sits one of the most profitable but least known companies in the world. Commodity trader Vitol …

Read More »

Read More »

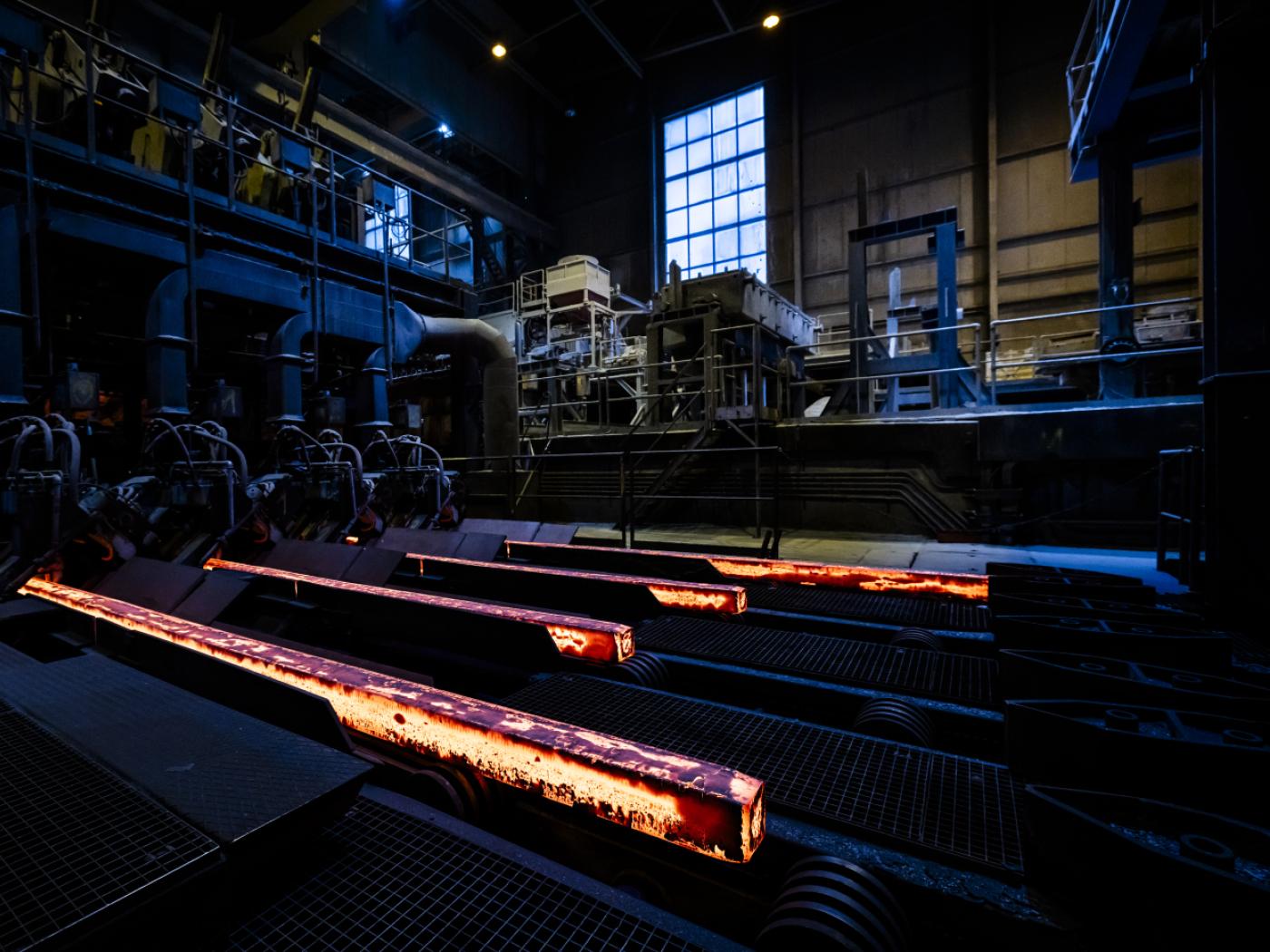

Swiss machinery sector continues to suffer from shrinking demand

The Swiss machine and engineering industry remains caught in a downward spiral. In the current year, the number of orders have continued to fall, as has turnover. The industry association Swissmem assumes that the order situation will deteriorate even further. The main reason for this is the US tariff hike at the beginning of August. …

Read More »

Read More »

Trump made direct financial demands during call with Swiss president

During the telephone call between Karin Keller-Sutter and Donald Trump on July 31, Trump demanded direct payments from Switzerland, according to an investigation by SonntagsBlick. Contrary to initial assumptions, the conversation was not initiated by Keller-Sutter, but by the US Trade Representative.

Read More »

Read More »

US tariffs putting 100,000 jobs at risk in Switzerland

United States tariffs of 39% on Swiss imports will directly affect 100,000 jobs in Switzerland, mainly in the watchmaking, machinery, metals, and food industries, warned the business umbrella organisation economiesuisse on Friday. +Get the most important news from Switzerland in your inbox For the Swiss business federation, "the consequences could be even heavier, as suppliers and service providers also suffer indirectly".

Read More »

Read More »

Lufthansa mulls importing its future Boeing aircraft via Switzerland

Lufthansa is considering buying new Boeing aircraft from the United States via Switzerland. This measure could reduce the US trade deficit with Switzerland and thus help the country to avoid punitive customs duties, according to a report in the Tages-Anzeiger. +Get the most important news from Switzerland in your inbox The order from German airline …

Read More »

Read More »

Gold will not be subject to tariffs, says Trump

'Gold will not be subject to tariffs,' American President Donald Trump wrote on the social network Truth Social on Monday. Last week, it was unclear whether the new tariffs would also be imposed on gold bars from Switzerland. Trump himself weighed in on the issue of gold tariffs after confusion and panic triggered by the … Continue reading »

Read More »

Read More »

Swiss government working with firms to overcome high US tariffs

The Swiss delegation that travelled to Washington has returned from talks on tariffs in the United States. The negotiations are now being conducted under the aegis of the government and the federal administration. "The federal administration has very close and regular contacts with the Swiss economy at all levels. Such cooperation has always been a …

Read More »

Read More »