Tag Archive: Germany

DZ BANK Granted MiCAR Authorisation for “meinKrypto” Crypto Platform

At the end of December 2025, DZ BANK received MiCAR authorisation from the German Federal Financial Supervisory Authority (BaFin) to operate its cryptocurrency platform, “meinKrypto”.

The platform allows primary institutions of the cooperative financial network to offer retail customers access to crypto trading.

Each Volksbank and Raiffeisenbank must now submit their own MiCAR notification for “meinKrypto” to BaFin.

Once approved and implemented,...

Read More »

Read More »

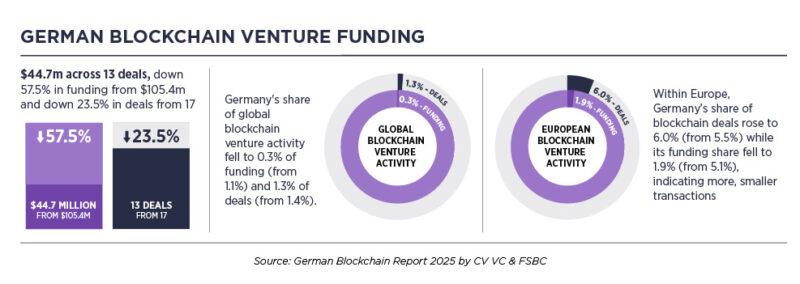

German Blockchain Funding Falls to Four-Year Low Despite $9.3B Venture Growth

CV VC, together with the Frankfurt School Blockchain Center, has released the German Blockchain Report 2025, analysing venture capital activity in Germany’s blockchain sector from Q3 2024 to Q2 2025.

While overall German venture funding rose, blockchain-specific investment declined, representing the lowest share of national venture activity in four years.

Globally, venture funding reached US$411.9 billion across 21,872 deals, up 19.5% year-on-year,...

Read More »

Read More »

Boerse Stuttgart Group Launches Pan-European Blockchain Settlement Platform

Boerse Stuttgart Group is developing the infrastructure for the future of the digital capital market with Seturion, a pan-European, blockchain-based platform designed to enable faster and more cost-efficient settlement of tokenised assets across national borders.

Seturion is accessible to all market participants in Europe, including banks, brokers, trading venues, both traditional and digital, and tokenisation platforms.

Its open architecture and...

Read More »

Read More »

Fall of French Government Does Not Roil the Markets and a BOJ Dove did not Rule out Rate Hike this Month

Overview: The US dollar is mostly softer today. The only G10 currency that has not gained on it today is the Swedish krona, which is nursing minor losses. Still, the tone is one of consolidation and this may persist through the North American session, ahead of tomorrow US employment report. The median forecast in Bloomberg's survey has crept up to 215k. Most emerging market currencies have also gained on greenback, but the South Korean won. The...

Read More »

Read More »

French Government on Precipice, Presses Euro Lower

Overview: The US dollar is beginning the new week and month on a firm note. It is rising against all the G10 currencies and nearly all the emerging market currencies. US-President-elect Trump's threat to BRICS if they abandon the dollar is symbolic than substantive, as we have argued, despite the occasional claim to the contrary, a BRICS currency is not realistic, and the China has little interest in fostering another competitor to the yuan. Still,...

Read More »

Read More »

Trump’s Tariff Talks Wobble Forex Market, Close Neighbors Suffer Most

Overview: As some market pundits were debating about a possible grand deal between the US and China. In exchange for a lighter tariff regime, Beijing would accept yuan appreciation. As far-fetched as such scenario may be, it was predicated on ideas that people like the Bessent, the Treasury Secretary-nominee, was pragmatic. Trump's comments hit in early Asia Pacific turnover specifically cited a 25% tariff on all product from Canada and Mexico and...

Read More »

Read More »

The Dollar’s Surge Continues

Overview: The dollar's surge continues. Most G10 currencies are off 0.45%-0.65%. The US dollar is trading above CAD1.40 for the first time since the pandemic, but the Canadian dollar is faring the best of the G10 today (~-0.15%). Since US election, it is the only major currency not to have fallen by at least 2%. All the emerging market currencies are lower today, as well. The greenback is being underpinned by the continued rise in US rates and...

Read More »

Read More »

Searching for Direction

Overview: The capital markets have been choppy as pre-existing positioning meets new thoughts on the implications of a second Trump administration. The dollar has found better footing today after giving back a chunk of Wednesday's gains yesterday. The yen is an exception, but it is not exception that the dollar trades heavier against the yen as the US 10-year yield drifts lower. On the week, the most G10 currencies are holding on to gains against...

Read More »

Read More »

Serenity Now

Overview: The markets are calmer after yesterday's post-US election drama. A consolidative tone has emerged in the foreign exchange market, and the dollar is softer against all the G10 currencies, led the 1% gain in the Norwegian krone, after the central bank left rates on hold. Sweden's Riksbank delivered the expected half-point cut and the krona is up 0.5%. Japanese officials warned against excessive moves, and the PBOC set the dollar's...

Read More »

Read More »

Greenback Consolidates

Overview: US interest rates remain firm and the dollar is mostly consolidating against the G10 currencies, in a muted "Turn Around Tuesday." The greenback is straddling the JPY151 area, its best level since the end of July. Despite bearish price action yesterday, the euro, sterling, and Australian dollar have seen limited follow-through selling and modest …

Read More »

Read More »

Risk of 50 bp cut by the Fed Tomorrow Keeps the Greenback on the Defensive

With heightened expectations of a 50 bp cut by the Federal Reserve tomorrow, the dollar has not gotten a reprieve and is softer against nearly all the currencies. Japan's long holiday weekend ended, and the greenback has held above JPY140 today.

Read More »

Read More »

Siemens Launches €300 Million Digital Bond on Blockchain

Siemens has again issued a digital bond in accordance with Germany’s Electronic Securities Act (Gesetz über elektronische Wertpapiere, eWpG).

This follows the successful issuance of its first digital bond last year. In issuing the bond, the company is supporting the trials by the Eurosystem and the Bundesbank in particular, that are aimed at testing blockchain technology for the digital financial market.

Ralf P. Thomas

“Since the successful...

Read More »

Read More »

The Market Discounts around a 40% Chance of not One but Two 50 bp Cuts in last Three FOMC Meetings of the Year Ahead of Jobs Report

Overview: The US jobs report is front and center. The market is going into the report with about a 40% chance of a 50 bp Fed rate cut later this month. The Dollar Index is trading lower for the third consecutive session. Helped by the fifth consecutive decline in US 10-year yields, the yen approached last month's high but without the turmoil seen in July and August. Still, equity markets are under pressure. Most large markets in the Asia Pacific...

Read More »

Read More »

US Benchmark Payroll Revisions Over-Hyped? Dollar may Benefit from Buying on Fact after Being Sold on Rumors

Overview: The preliminary annual revision to US jobs growth is front and center today. It has gotten more play that usual, amid speculation of a historically large revision. Yet, the direct impact on policy may be minimal. Federal Reserve officials, including Chair Powell, acknowledged that the payroll growth may have been overstated. Moreover, the Fed's judgment of the labor market is not based on one element of the multidimensional labor market....

Read More »

Read More »

BOJ Offers Verbal Support, Extends the Yen’s Pullback

Overview: The calls earlier this week for an emergency rate cut seemed to be a call for the Fed put, which, we argue is misunderstood. It is not about the stock market per se but financial stability, which did not seem threatened in the US. Japan is a different story, and the Bank of Japan offered a verbal put today, with an indication that it wants to maintain low (accommodative) rates. The markets reacted accordingly. The yen was sold (and...

Read More »

Read More »

Greenback Catches a Bid

Overview: The dollar has caught a bid ahead of the US retail sales and industrial production figures. It is higher against all the G10 currencies but the Swiss franc. The SNB meets Thursday. It surprised many by cutting rates in March and the same logic (low inflation, move ahead of the ECB, stronger franc) may apply now. A hawkish hold by the Reserve Bank of Australia has not done much for the Australian dollar, which is little changed on the day....

Read More »

Read More »

Double Whammy: US CPI and Federal Reserve

Overview: Position adjustments ahead of today's US CPI and FOMC

meeting are giving the dollar a modestly heavier tone today. Each of these

events are typically a source of volatility in their own right and together

they promise an eventful North American session. The yen is the only exception

among the G10 currencies, but even there, the dollar is holding below

yesterday's highs. Even sterling's relative resilience this week was unmarred

by the...

Read More »

Read More »

Powell, PPI, and US Tariff Announcement on China Featured

Overview: The tone in the foreign exchange market

today is mostly consolidative. The two notable exceptions are the yen and yuan.

Despite higher JGBs yields amid speculation that the BOJ will scale back bond

purchases, as it did yesterday, to support the yen, the greenback is at its

best level since the suspected intervention. The next important technical area

is near JPY157.00. The US is set to announce a new set of tariffs on a wide

range of...

Read More »

Read More »

Will the Market Push the Dollar Above JPY152 as Japanese Prime Minister Heads to the US?

Overview: The jump in US rates after the employment

report failed to ignite a sustained rally in the dollar and this shaken the

market's near-term confidence. The dollar has been mostly confined to narrow

ranges and the low yielding Swiss franc and Japanese yen are softest with the

G10 complex today. The dollar is knocking on JPY152. The Scandis and Antipodeans lead the advancers. The euro has

made little headway despite a much stronger than...

Read More »

Read More »

Sterling Buoyed by Labor Market Report Ahead of US CPI

Overview: The US dollar is enjoying a mostly firmer bias ahead

of today's CPI report. Sterling is the strongest among the G10 currencies after

a more resilient than expected labor market report. The dollar extended its

gains against the Japanese yen to a new high since last November, but the

market seems cautious as it approaches JPY150, where large options expire today.

On the other hand, emerging market currencies are mostly faring better. The...

Read More »

Read More »