Tag Archive: fiscal policy

Dollar Slips but Dip may Offer New Opportunity

Overview: The US dollar is offered today. It is

trading softer against all the G10 currencies, with the yen the notable

exception, and it is flat. The Antipodean are leading the way, taking out last

week's highs, as has the euro. That said, the intraday momentum indicators are

stretched as NY dealers return from the long holiday weekend. The Scandis are

also trading above last week's highs. The yen, sterling, Canadian dollar, and

Swiss franc are...

Read More »

Read More »

Calmer Capital Markets…for the Moment

Overview: The capital markets are quiet today. Equity markets and bond yields have a slight upside bias, while the dollar is little changed. Despite reports that the lockdown in Chengdu is easing, Chinese equities underperformed in the Asia Pacific region.

Read More »

Read More »

Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large.

Read More »

Read More »

FX Daily, February 16: Greenback Remains Heavy

The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today, the Dow Jones Stoxx 600 is consolidating.

Read More »

Read More »

FX Daily, February 9: Players are Not Buying Everything Today

The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today's regional advance led by a 2% rally in China's main indices.

Read More »

Read More »

FX Daily, February 8: Limited Follow-Through Dollar Selling to Start the Week

Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the holidays may also be encouraging risk-taking to extend the global equity rally.

Read More »

Read More »

“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence.

Read More »

Read More »

“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives.

Read More »

Read More »

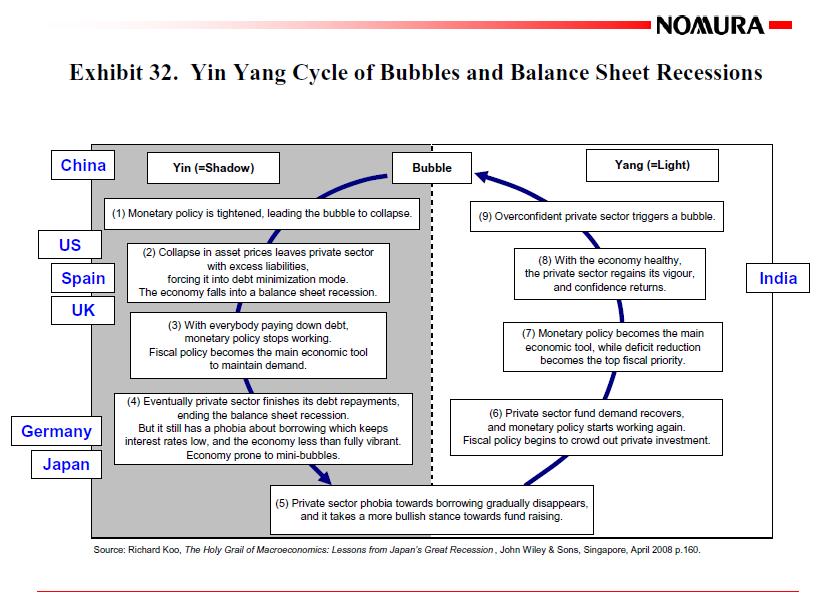

The Central Banks Pull Back: Now It’s Up to Fiscal Policy to “Save the World”

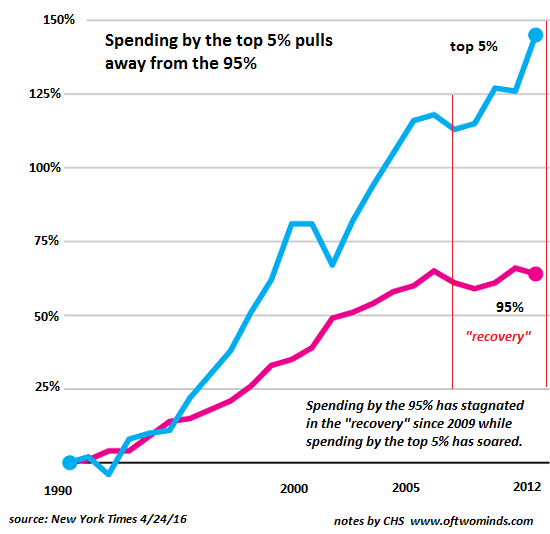

Another problem is the rise of social discord, for reasons that extend beyond the reach of tax reductions and increased infrastructure spending. Have you noticed that the breathless anticipation of the next central bank "save" has diminished? Remember when the financial media was in a tizzy of excitement, speculating on what new central bank expansion would send the global markets higher in paroxysms of risk-on joy?

Read More »

Read More »

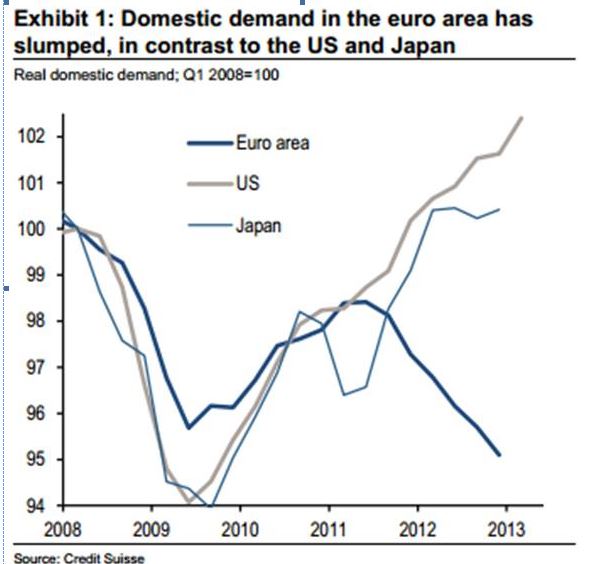

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »