Tag Archive: Financial Planning

Medicare Part B Premiums Will Go Down in 2023

In a world where the price of everything is going up, Medicare recipients get a price cut beginning January 1, 2023. The Centers for Medicare and Medicaid Services (CMS) just announced that the monthly premium for Medicare Part B, which covers doctor visits, diagnostic tests, and other outpatient services, is decreasing $5.20 per month to $164.90.

Read More »

Read More »

Be Sure to Read the Medicare Fine Print

Medicare. The government defines it as “The federal health insurance program for people 65 and older.” That seems simple enough. But there’s more to it than meets the eye because Medicare, like so many other things, has fine print that could end up costing you a lot of money if you don’t know about it.

Read More »

Read More »

How Working Longer Affects Your Social Security Benefits

Since 1935, Social Security has been synonymous with retirement. It was always intended to supplement retirement income, never be a person’s total retirement income. Unfortunately, according to the Center on Budget and Policy Priorities, about half of older Americans rely on Social Security for at least 50% of their income, and 25% of retirees rely on it for 90% of their income. That’s why more Americans are choosing to work longer.

Read More »

Read More »

Tips for Buying a Medicare Supplement Policy

The clock is ticking and it gets louder the closer you get to the magic age of 65. That’s when you sign up for Medicare. But there’s more than one way to receive Medicare coverage. There are Medicare Advantage plans, sometimes referred to as all-in-one plans, because they provide medical coverage and can also provide benefits for vision, dental, hearing, and prescriptions.

Read More »

Read More »

Another Historic Social Security Cost of Living Increase is on the Way

It’s almost time for the Social Security Administration to break out pencil and calculator to find out how much more it costs to live this year than it did last, and then decide how much of a raise Social Security beneficiaries will get in 2023. For 2022, the Social Security Cost of Living Adjustment (COLA) was 5.9%, the largest increase since 1982.

Read More »

Read More »

4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Read More »

Read More »

Wasting Money on Medicare

How would you like to waste a lot of the money you spend on Medicare coverage and miss a bunch of the benefits Medicare provides? Crazy question. But that’s exactly what’s happening to millions of Medicare beneficiaries. In October 2021, the insurance website MedicareAdvantage.com published the results of its most recent survey of Medicare beneficiaries.

Read More »

Read More »

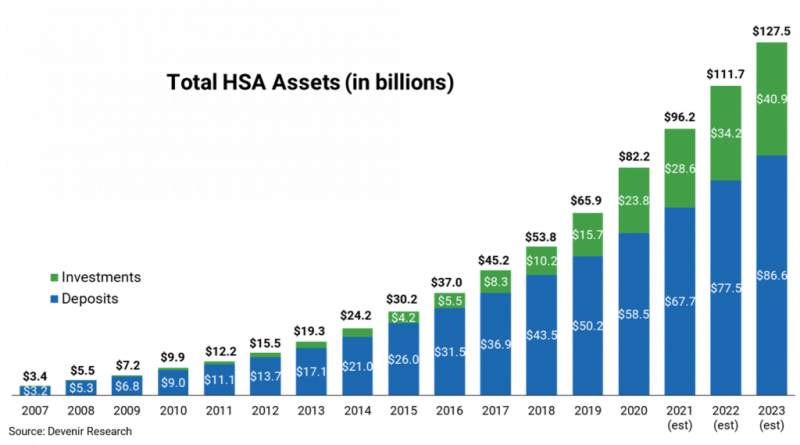

Letting Retirees Save for Healthcare Tax-Free

Health Savings Accounts (HSA) for retired folks. Isn’t that a novel idea? But it’s being considered in Congress—The Health Savings for Seniors Act, H.R. 3796.

Read More »

Read More »

Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger.

Read More »

Read More »

Baby Boomer Retirement at Risk

The seven deadliest words in the English language—We’ve never done it this way before. And that certainly applies to Baby Boomers whose prospects for retirement are different than any preceding generation.

Read More »

Read More »

How the IRS Taxes Your Retirement Income

Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.”

Read More »

Read More »

Medicare Eats Up Most of the 2022 Social Security Raise

There was dancing in the streets when Social Security announced that 2022 checks will go up by 5.9%, the biggest Cost of Living Adjustment (COLA) in 40 years. But now, the streets are empty and the cheering is gone. Most of that Social Security COLA will be eaten up by increases in Medicare.

Read More »

Read More »

10 Smart Money Moves to Make Right Now.

2021 isn’t over yet. So here are 10 smart money moves to make right now.

Saving money should be a year-round endeavor, but life gets in the way just like anything else. So with 2021 coming to a swift, thankful end, take advantage of the fourth quarter to accelerate your financial acumen, bolster your balance sheet and successfully springboard into the new year.

Tip One: Max Out HSA Contributions for 2021.

A Health Savings...

Read More »

Read More »

Ask Bob – What Do I Do If I Choose The Wrong Medicare Plan?

Alhambra’s Bob Williams answers the question, “What do I do if I choose the wrong Medicare Plan?”.

Read More »

Read More »

Don’t Be the Victim of These 20 IRA Mistakes

Hey! It’s just an IRA. What is there to know? You put money in and it’s a tax deduction, you get to take it out after 59 ½ without paying a penalty, and at 72 the IRS makes you take some out. What else could there be?

In reality, there’s a lot more.

Read More »

Read More »

4 Social Security Planning Steps BEFORE You’re Ready to Retire

Social Security is an important part of almost every retirement plan, whether you’ve saved enough or not. That’s why it’s important to know as much about your Social Security situation as possible. And you don’t want to wait until you’re about to retire to gather the facts and take appropriate steps. Social Security planning needs to start 5 years before your target retirement date.

Read More »

Read More »

The Insatiable Appetite to Tax Social Security Benefits

First, it was 10%, then 20%, and today more than 50% of U.S. retirees pay taxes on their Social Security benefits, and the number is expected to go even higher. The cause seems to be that one government hand doesn’t know, or care, what the other government hand is doing.

Read More »

Read More »

Take Advantage of These COVID Estate Planning Opportunities by the End of 2020

May you live in interesting times. Although that sounds like an ancient blessing, it’s believed to be a Chinese curse casting instability and uncertainty on the person who hears it. Blessing or curse, it’s a great description of the year we’ve just come through, and in spite of all the turmoil, there are some things you can do before the end of 2020 to take advantage of all the madness.

Read More »

Read More »

How Much Taxes Will Retirees Owe on Their Retirement Income

Planning for retirement. We spend most of our working career preparing for it, saving for it, covering every contingency. When you finally wave goodbye to the company, you’re ready for all that planning to take over. But does your planning take into account the taxes you’ll have to pay on your retirement income? It’s one of the biggest retirement planning mistakes people make.

Read More »

Read More »