Tag Archive: Financial Planning

Money: The 10 Immutable Laws Of Building Wealth

Money - everybody wants it, but few actually have it. As shown in recent financial statistics, the "wealth gap" in America continues to grow between the "haves" and the "have-nots." That gap has led to a bombardment of narratives explaining why younger generations are financially oppressed. As shown, the top 10% of income earners own …

Read More »

Read More »

Retirement Income in Overvalued Markets.

Financial planning industry thought leader Michael Kitces, CFP®, CLU®, ChFC®, RHU, REBC, and professor of retirement income at the American College, Wade D. Pfau, Ph.D., CFA, penned a seminal work for the Journal of Financial Planning titled Reducing Retirement Risk with a Rising Equity Glide Path. Their work and several tips can help with retirement income …

Read More »

Read More »

Retirees with guaranteed income spend more.

David Blanchett and Michael Finke penned a June 2024 research paper for the Retirement Income Institute that shared insight into why retirees with a guaranteed income spend more. They deem guaranteed retirement income a "license to spend."

Read More »

Read More »

Annuities Are Not Your Enemy.

Utter the word ANNUITY and watch facial expressions. They range from fear to disgust to confusion. But hear me out: Annuities are not your enemy. Billionaire money manager and financial pitchman Ken Fisher appears as a haunting senior version of Eddie Munster in television ads. He stares with deep eyes ablaze with intensity. The tight camera …

Read More »

Read More »

The Importance of Emergency Funds in Retirement Planning

When planning for retirement, most people focus on savings, investments, and budgeting for daily living expenses. However, one critical component that often gets overlooked is an emergency fund. Having an emergency fund in retirement is essential for maintaining financial stability and peace of mind. Unexpected expenses, such as medical bills or home repairs, can derail …

Read More »

Read More »

The Comprehensive Approach to Crafting a Future Financial Plan

Securing your financial future begins with a comprehensive plan. This guide explores the fundamentals of financial planning, building a holistic strategy, and effective retirement techniques. Readers will learn how to navigate financial statements, manage tax planning, and engage with a financial advisor for wealth planning. Whether dealing with a single audit or seeking to enhance …

Read More »

Read More »

Use Drone Mentality to Financial Success.

Beware of the mysterious drones hovering over eight cities! They're causing quite a stir. However, what if a drone mentality to financial success truly existed? We probably wouldn't mind. Not long ago, Jeff Bezos, the CEO of Amazon, made big media headlines by suggesting that drones will be used to deliver light packages in the …

Read More »

Read More »

Rosso’s Top 2025 Reads and Holiday Gift Idea.

As most know, books are my passion. For me, it's all about gifting knowledge for the holiday season. There's nothing more exciting to me than to peruse used book outlets and antique stores that sell ancient reads for pennies on the dollar. Also, new book releases excite me. My reading topic interests vary. However, most …

Read More »

Read More »

What a Financial Advisor? Consider these Seven Concepts.

So, you need a financial advisor, but do you truly understand the full extent of the benefits? Consider these Magnificent Seven Concepts:

Concept One: Financial Advisors are NOT Portfolio Managers.

Most consumers believe that financial advisors are primarily investment selectors and asset managers. While these duties are valid, they are not at the top of an advisor’s list or priorities.

Many financial advisors outsource these duties to...

Read More »

Read More »

Retail Sales Data Suggests A Strong Consumer Or Does It

The latest retail sales data suggests a robust consumer, leading economists to become even more optimistic about more robust economic growth this year.

Read More »

Read More »

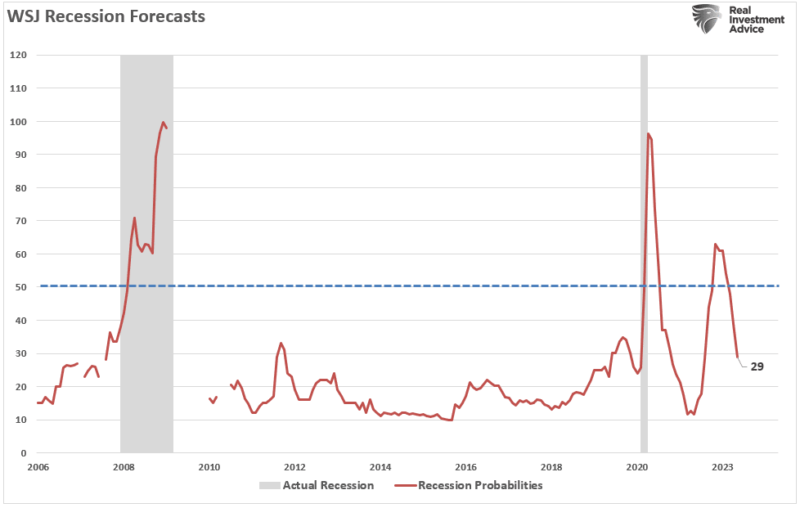

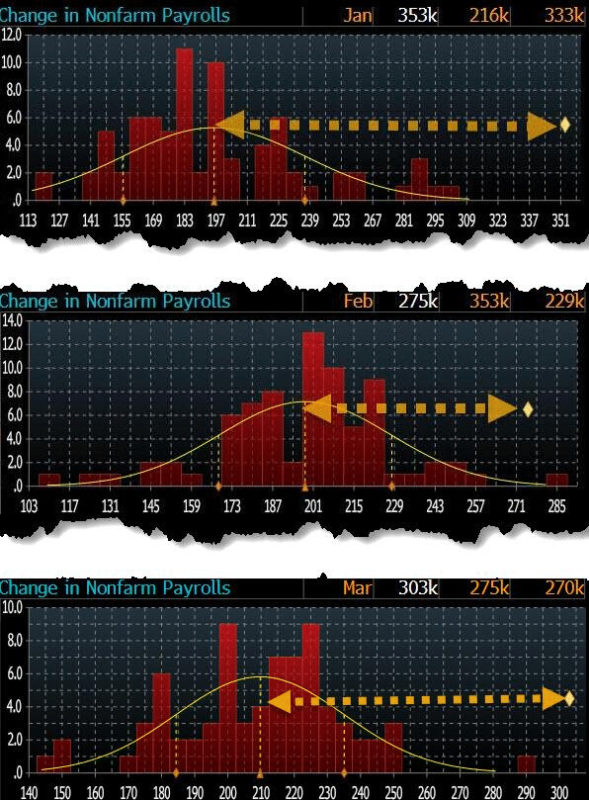

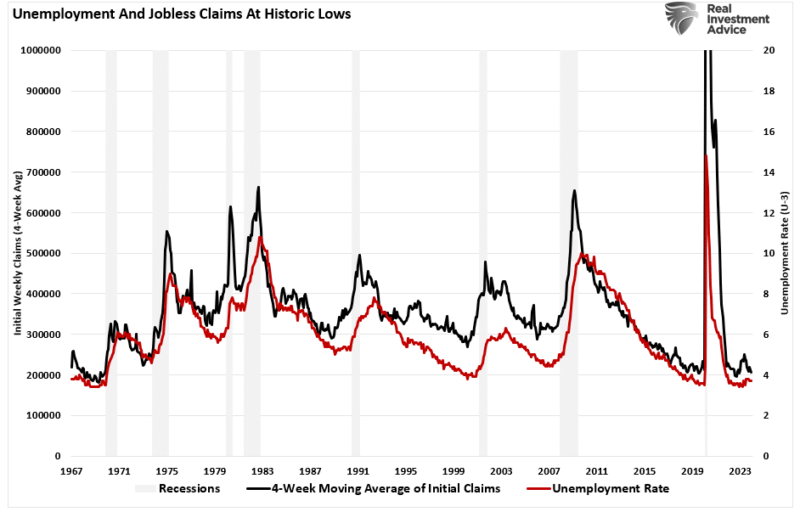

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border.

Read More »

Read More »

Blackout Of Buybacks Threatens Bullish Run

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote.

Read More »

Read More »

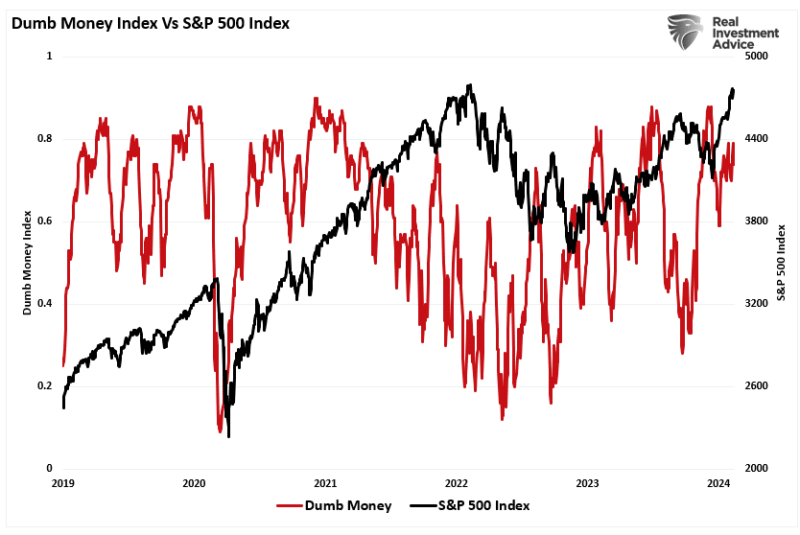

Digital Currency And Gold As Speculative Warnings

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites.

Read More »

Read More »

Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies.

Read More »

Read More »

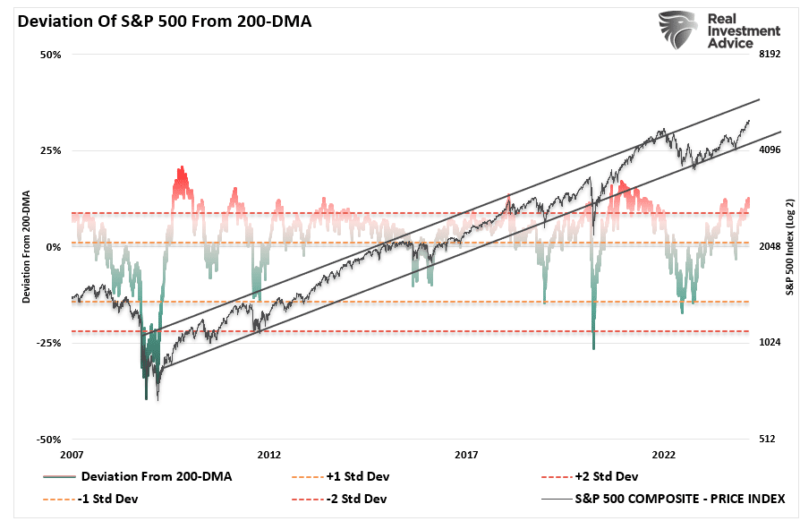

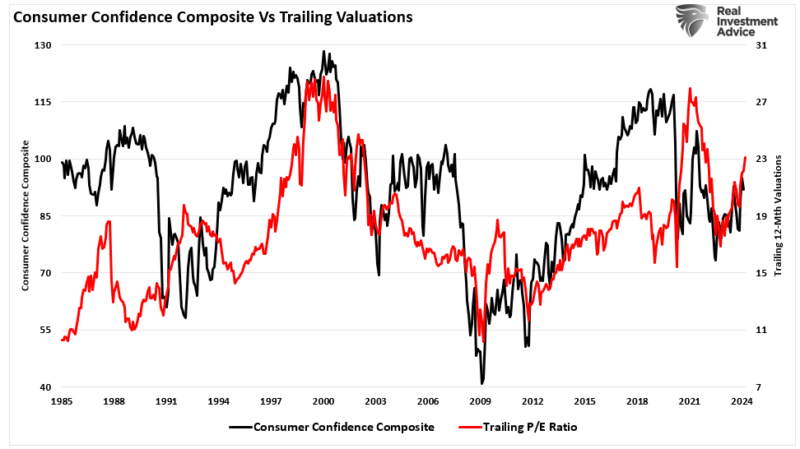

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

Three Ideas to Tackle Financial Ghosts.

Is money distress part of your life? Do the dollars & cents of poor decisions past sneak up on you and rattle around your house like chains? What if I could provide three ideas to tackle 2022’s financial ghosts and put them at rest for good?

Read More »

Read More »

The IRS Will Tax Less of an Estate in 2023

In 2012, the American Taxpayer Relief Act (ATRA) established, for the first time, a permanent estate tax and gift tax exemption. The exemption is the amount an individual can pass on at death without paying estate taxes. The legislation set the exemption at $5 million per person, indexed for inflation.

Read More »

Read More »

2023 Retirement Plan Contribution Limits

Worried about saving enough for retirement? You can put away more next year. The IRS has just announced the new retirement plan contribution limits for 2023. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan increases to $22,500, up from $20,500.

Read More »

Read More »

It’s Time to Tackle the Year-End Financial Checklist

Here we are again in the final quarter of the year when thoughts turn to Thanksgiving and Christmas and… reviewing your financial house. Oh, that’s not on your list? Well, let’s put it there because financial issues cannot be on automatic pilot. Things change and you need to keep current. Here are 16 items you need to review before the end of the year.

Read More »

Read More »