Tag Archive: Finance

Europe’s Agrarian Uprisings: Brussels is reaping what it sowed

Share this article

Across the European landscape, a disquiet rumbles beneath the surface of rolling hills and fertile plains. It emanates from the very backbone of the continent – its farmers. From the tractor rallies of France and Germany to the demonstrations in Poland and the Netherlands, a wave of agrarian protests has erupted, driven by a potent cocktail of frustration, betrayal, and a yearning for stability.

Over the past few years,...

Read More »

Read More »

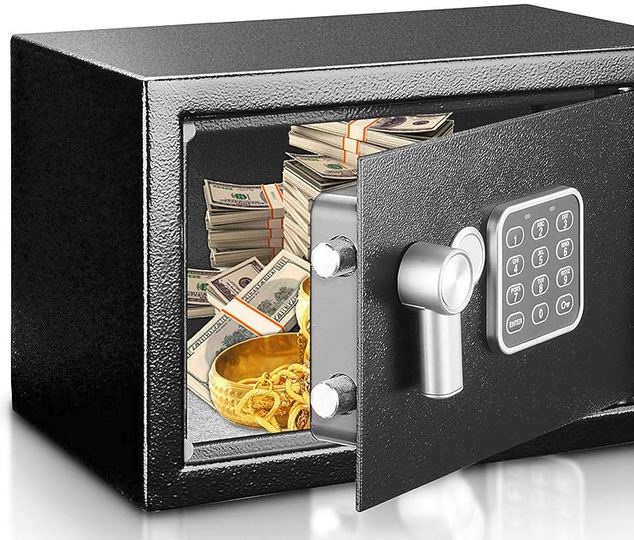

Corrupt Money = Corrupt Society

Share this article

Discussion with Sean from SGT Report about the corruption of our money which has led to the corruption of society.

to watch the video click on this link: https://rumble.com/v44t52f-corrupt-money-corrupt-world-claudio-grass.html

Read More »

Read More »

2024 outlook: Gold Shines Bright in the Gathering Storm

The year 2024 is poised to be a critical period for the global economy and it already appears to be fraught with economic and geopolitical challenges, casting a dark shadow over the global landscape. Signs of a looming economic downturn are becoming increasingly evident and the many challenges we faced over the past year will certainly remain with us for many months to come.

Economic and monetary landscape

Central bankers in most advanced...

Read More »

Read More »

2023: A year in review

After the catastrophic covid crisis of 2020 and 2021, the extremely impactful and consequential Russian invasion of Ukraine in 2022, many hoped that 2023 would break this terrible bad spell and finally present us all with some hope, economically, geopolitically, socially, technologically. Unfortunately, it only offered further reasons for serious concerns on all these fronts.

Economically, even though the official inflation rate followed a...

Read More »

Read More »

The awakening of the working class

Part II of II, by Claudio Grass, Switzerland

One of the maxims I tend to mention quite often in sociopolitical debates or in response to arguments about the flawlessness of the democratic process is “the smallest minority is the individual”. To some, it might sound trite or banal, and perhaps it is; but it does carry a meaning that I believe is an essential human value and a fundamental building block for any civilized, productive and...

Read More »

Read More »

The awakening of the working class

Part I of II, by Claudio Grass, Switzerland

It is a worn-out cliché that many (if not most) political zealots meet their downfall because of their arrogance. “Pride goes before destruction, a haughty spirit before a fall,” the proverb goes, and it does prove true more often than not. The specific kind of pride, or haughty spirit, or plain hubris in this case, has to do with the certainty that some people have (one can’t imagine how and why...

Read More »

Read More »

War is the health of the State

Part II of II by Claudio Grass, Hünenberg See, Switzerland

This is precisely what the State is doing. The idea of war, mayhem and destruction being economic boosters is exactly what has supported the thin facade that politicians like to place over their greed and their personal gain that they derive from the military industrial complex. “It’s good for the country”, is certainly easier to sell than “it’s good for me and my reelection...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

“Sound money must be anchored to and backed by real, tangible assets”

Dani Stüssi interview with Claudio Grass

Over the last few years, the financial woes and daily pressures that have been unleashed upon the average citizen, saver and taxpayer have put the spotlight on money itself. Countless ordinary people who have otherwise never seriously pondered these questions, began to question basic principles like: what makes their paycheck shrink from month to month, what or who actually responsible of it and what,...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

Rethinking “safe” investments

Part I of II by Claudio Grass, Hünenberg See, Switzerland

To most observant citizens and diligent investors it is surely quite obvious that the current monetary, fiscal and banking system is inherently flawed, hopelessly unjust, corrupt, unsustainable and simply destined to collapse sooner or later. With every (predictable) recession and every (foreseeable) crisis, this structure gets weaker; its very own architects increasingly second-guess...

Read More »

Read More »

Gold for the people

At the end of September, a very interesting story made the rounds in the media and caught my attention. Apparently, the US big box giant Costco added one rather surprising product to its range and it proved immensely popular. Next to humongous multipacks of cereal, buckets of peanut butter, mattresses and air fryers, customers were offered the opportunity to throw a gold bar in their carts as well.

Selling like hotcakes

According to a...

Read More »

Read More »

The slow, stealthy but steady spread of absolutism

Part I of II by Claudio Grass, Switzerland

The struggle and rivalry between the “West and the rest” might be grabbing news headlines due to the Ukraine war these days, but in truth, it is anything but newsworthy. This antagonism, this battle for geopolitical, physical dominance, for moral supremacy, and this clash of ideas and fundamental values has been raging for much longer than that, perhaps longer than most of us can recall.

It sowed...

Read More »

Read More »

The Swiss franc’s “phenomenal” bull run

The strength of the Swiss franc (CHF) has been the topic of countless “expert” analyses for over a year and it has received considerable coverage in the mainstream financial press. In fact, the last time the currency garnered this much interest was probably in 2011, when its celebrated “safe haven” status backfired, as investors fled to it in droves and pushed the price to levels that forced the Swiss National Bank (SNB) to intervene and peg it to...

Read More »

Read More »

The Big Shift: The decline of Western politics

Part II of II

The big shift

Of course, this is the Left, but also the Right, of the good old days. The days of gentlemanly conduct and of real sportsmanship during a debate. These were the days when cultivated, curious and humble people argued passionately, but honourably. These were the days of decency, of common courtesy and civility.

But also these were the days of ideological integrity and consistency. For example, the arguments and...

Read More »

Read More »

The Big Shift: The decline of Western politics

Part I of II

Those of us who have read and studied political history, who have closely observed its evolution and especially those who have taken note of all the tactics and ploys used over the last couple of decades, will surely not be surprised by any of the findings and ideas I’ll outline in the following analysis. I would still encourage the reader to read on, though. Because for the majority of citizens, taxpayers, savers and investors,...

Read More »

Read More »

Freedom of speech and “de-banking”

Threats to freedom of speech and efforts to suppress dissenting views and voices have been on the rise over the past decades. They were exponentially intensified since the ascent of social media and as the political polarisation in the West truly took hold of our societies, the powers that be have been using any and all toolsat their disposal to “defend” the interests of the establishment against those who might try to publicly question its...

Read More »

Read More »

The real failure of “trickle down economics”

Part II of II

If this kind of theoretical reasoning seems too abstract, let us think about it more practically: Any public servant, any member of government, and even the leader of a nation, has very different motivations than any private sector decision-maker. Their financial compensation is a given and their time preference is dictated by their job description.

The company owner on the other hand has no such guarantees regarding their...

Read More »

Read More »