Tag Archive: Finance

Corporate Debt Time Bomb

While I have reportedly highlighted the many risks of the current monetary policy direction and the multiple distortions that it has created in the markets, in the economy, and even in society, one of the most pressing dangers of the unnaturally low rates and cheap money is the staggering accumulation of debt. Nowhere is this more obvious than in the ballooning corporate debt, especially in the US.

Read More »

Read More »

The destruction of civilization – implications of extreme monetary interventions

When I was asked to write an article about the impact of negative interest rates and negative yielding bonds, I thought this is a chance to look at the topic from a broader perspective. There have been lots of articles speculating about the possible implications and focusing on their impact in the short run, but it’s not very often that an analysis looks a bit further into the future, trying to connect money and its effect on society itself.

Read More »

Read More »

The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies.

Read More »

Read More »

The Evolution Of The Bank Run

There are numerous and wide-ranging reasons why someone may choose to invest in physical precious metals. A deep understanding of monetary history provides plenty of solid arguments, and so do the mounting geopolitical risks, the spiking probability of a recession and the long-term goal of many conservative investors to safeguard their financial self-determination.

Read More »

Read More »

“We don’t have to behead the king if we can just ignore him” – Claudio Grass

“Negative interest rates are unsustainable and once investors decide to stop paying for the privilege of holding government debt, a banking crisis could result, says James Grant.” Returning SBTV guest, Claudio Grass, speaks with us about the unsustainable pensions, crumbling fiat currencies and a looming financial crisis in a world of insane central bank monetary policies.

Read More »

Read More »

QE by any other name

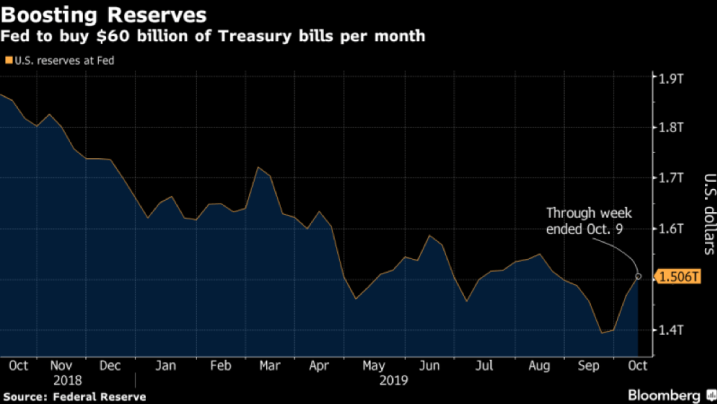

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since.

Read More »

Read More »

The Growing Opposition Against the ECB

Few investors and market observers were really surprised when Mario Draghi announced the ECB’s next massive easing package in mid-September. Cutting rates further into negative territory and the revival of QE were largely expected sooner or later, as the “whatever it takes” outgoing ECB President is now faced with a wide economic slowdown in the Eurozone.

Read More »

Read More »

A buying opportunity in precious metals

After a remarkable run over the past few months, gold and silver now appear to have entered a period of consolidation. Many speculators and short-term focused investors have sold their positions fearing a correction, while mainstream market commentators fuel these fears, with analyses that proclaim “the end of the road” for gold and silver.

Read More »

Read More »

A turning point in the bond market?

We’ve recently seen a lot of coverage and even more “expert analyses” on the state of the bond market, to the extent that the average investor, or the average citizen for that matter, is likely to be overwhelmed and very confused about what it all means. Experts from the institutional side and defenders of the current monetary direction argue that it is all the result of policy choices, that’s it’s all under control and that we really shouldn’t...

Read More »

Read More »

“The Eurozone faces the worst combination of economic and systemic risk”

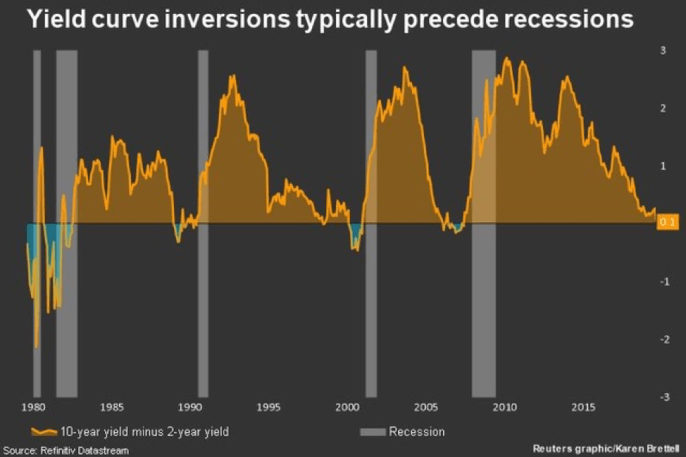

The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally.

Read More »

Read More »

THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep stock markets afloat and the economic expansion alive.

Read More »

Read More »

“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos. It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in.

Read More »

Read More »

THE PENALTY FOR SAVING

In previous articles, we have outlined in great detail the many faults of the current monetary policy direction of major central banks and the large-scale economic impact of keeping interest rates artificially low. Among the worst offenders is the ECB, that is unapologetically persistent on continuing this exercise in absurdity that are negative interest rates.

Read More »

Read More »

THE CURRENT MONETARY ORDER IS NEARING ITS END

Interview with Dimitri Speck. Given the massive intervention and monetary manipulation experiment by central banks over the last decade, the amount of distortions created in the market, as well as the record debt accumulation at all levels of the economy, have given rise to considerable risks for investors. For a more detailed understanding of these issues and for his outlook, I turned to Dimitri Speck, a renowned expert in the development of...

Read More »

Read More »

Sound money: A Biblical perspective – Part I

In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of Enlightenment roughly 200 years ago. In the words of Immanuel Kant:

Read More »

Read More »

Merger mania: Consolidation in the gold mining sector

Late last year, Barrick Gold, the world’s largest gold miner in terms of reserves, made headlines when it announced its acquisition of Randgold Resources, in an $18bn mega-merger that marked a key moment for the mining industry. In January, United States gold giant Newmont and principal rival of Barrick, made public its own plans to buy Canada’s Goldcorp, the world’s third-largest bullion producer by market value, for $10 billion.

Read More »

Read More »

ECB: running out of runway – Part II

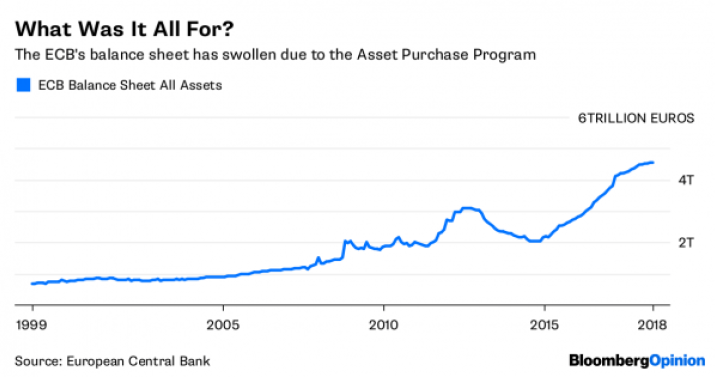

Overall, under Mr. Draghi’s watch, the ECB’s balance sheet has ballooned to a previously unimaginable scale and aggressive policies like the extensive QE program and negative rates have encouraged the accumulation of debt and heavily distorted market mechanisms.

Read More »

Read More »

ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change.

Read More »

Read More »

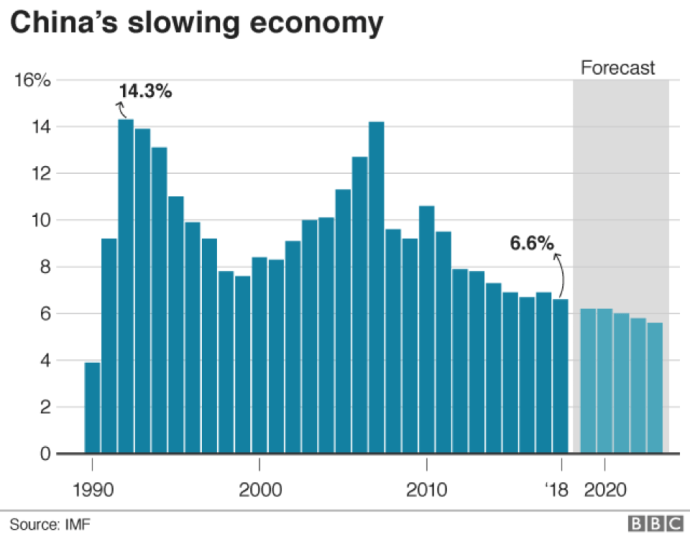

China: Harbinger of Global Economic Decline

The latest numbers released by China’s statistics bureau fueled widespread concerns about the outlook of the global economy, as the Asian superpower reported its slowest growth rate since 1990. The figures showed a 6.6% growth for 2018, confirming the view that the growth engine of the world economy is running out of steam.

Read More »

Read More »