Tag Archive: federal-reserve

The Week Ahead: US CPI and PPI Set to Soften

The Fed's 50 bp rate hike is behind us. Another 50 bp hike is expected next month. The April

employment report will do little to calm the anxiety about the "too tight" labor market.

Read More »

Read More »

Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India.

Read More »

Read More »

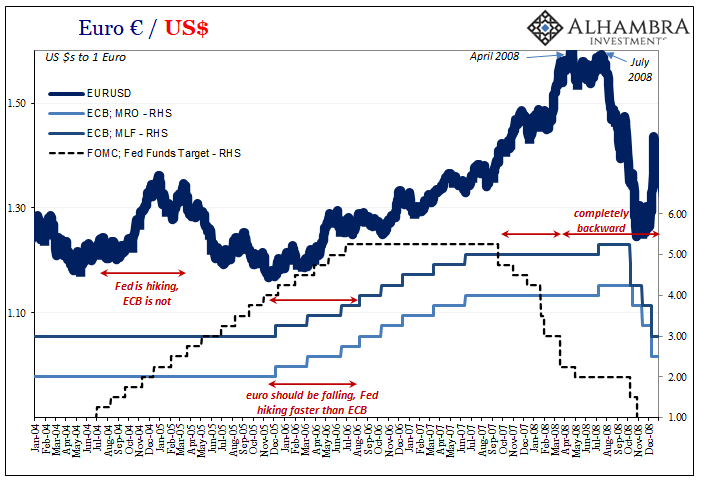

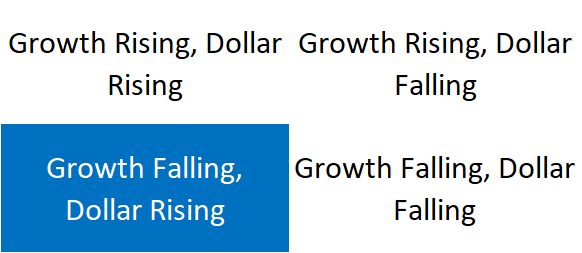

What Really ‘Raises’ The Rising ‘Dollar’

It’s one of those things which everyone just accepts because everyone says it must be true. If the US$ is rising, what else other than the Federal Reserve. In particular, the Fed has to be raising rates in relation to other central banks; interest rate differentials.

Read More »

Read More »

China’s Covid Sends Commodities Lower and helps the Dollar Extend Gains

Overview: Fears that the Chinese lockdowns to fight Covid, which have extended for four weeks in Shanghai, are not working, and may be extended to Beijing has whacked equity markets, arrested the increase in bond yields, and lifted the dollar.

Read More »

Read More »

The Yen Bounces after 13-Day Slide and BOJ Defends Yield Cap

Overview: The record-long yen slide has stalled just shy of JPY129.50, even though the Bank of Japan defended its Yield-Curve Control cap on the 10-year bond and will continue to do so for the next four sessions. The greenback fell to almost JPY128 before steadying. China again defied expectations for lower rates (loan prime rate), the yuan's sell-off accelerated and slide to its lowest level since last October.

Read More »

Read More »

Equities Finding a Bid in Europe After Sliding in Asia Pacific

Overview: The capital markets are calmer today. The market is digesting the FOMC minutes, where officials tipped an aggressive path to shrink the balance sheet and confirmed an "expeditious" campaign to lift the Fed funds rate to neutrality. Benchmark 10-year yields are softer, with the US off a couple basis points to 2.58%. European yields are 1-3 bp lower.

Read More »

Read More »

Cautious Markets after China Disappoints

Overview: Ukraine's Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan's markets managed to post small gains. Tokyo was closed for the spring equinox.

Read More »

Read More »

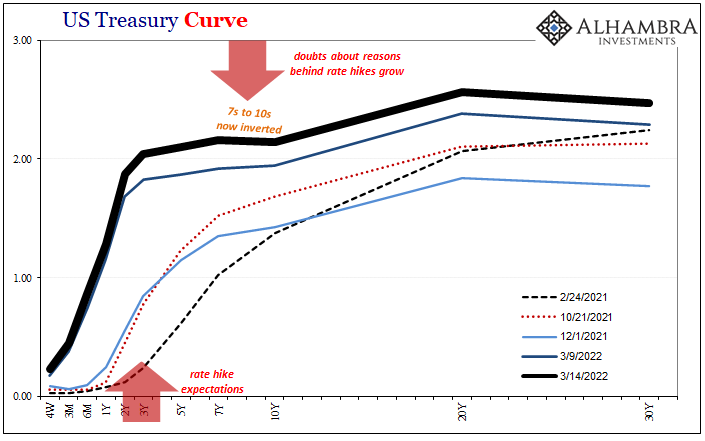

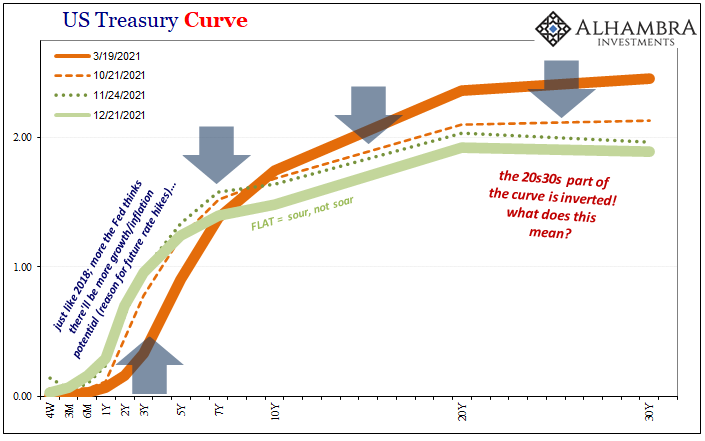

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place.

Read More »

Read More »

Fed Delivers Hawkish Hike

The Federal Reserve hiked the Fed funds target rate by 25 bp as widely anticipated. It clearly signaled it was beginning an ongoing hiking cycle. The FOMC statement also indicated the balance sheet roll-off would begin at a coming meeting. The uncertainty posed by Russia's invasion of Ukraine was acknowledged, but the FOMC recognized that in the first instance it boosts price pressures while also weakening growth.

Read More »

Read More »

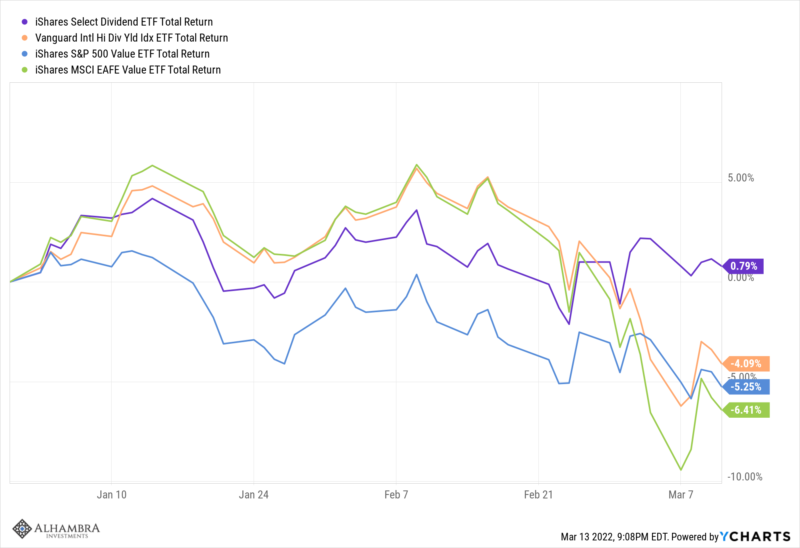

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

Capital and Commodity Markets Strain

Overview: The capital and commodity markets are becoming less orderly. The scramble for dollars is pressuring the cross-currency basis swaps. Volatility is racing higher in bond and stock markets. The industrial metals and other supplies, and foodstuffs that Russia and Ukraine are important providers have skyrocketed. Large Asia Pacific equity markets, including Japan, Hong Kong, China, and Taiwan fell by 1%-2%, while South Korea, Australia,...

Read More »

Read More »

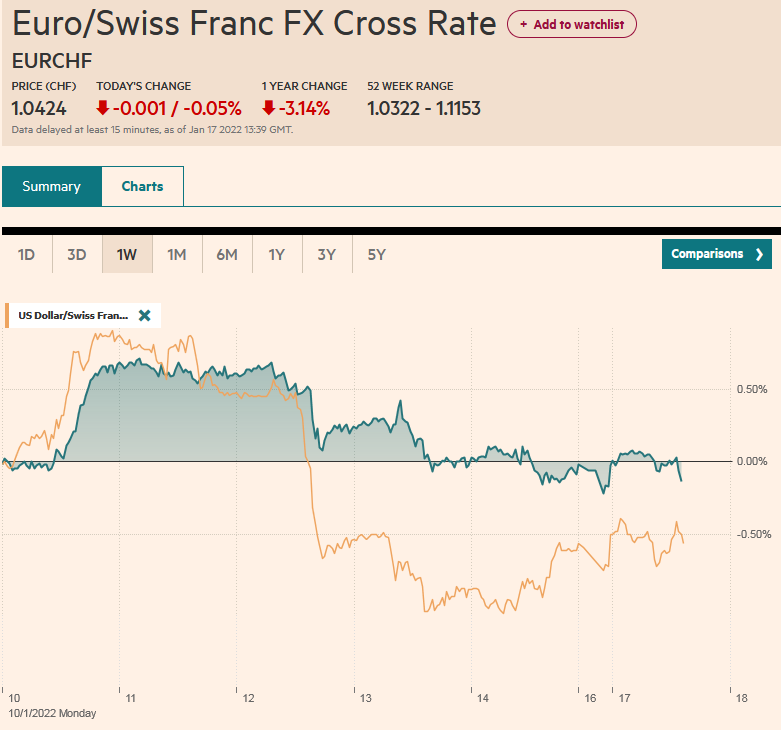

FX Daily, January 17: PBOC Eases, but the Yuan Firms

Overview: Russia is thought to be behind the cyber-attack on Ukraine at the end of last week, but a military attack over the weekend may be underpinning risk appetites today. The dollar's pre-weekend gains are being pared slightly. Led by the Canadian dollar and Norwegian krone, the greenback is lower against most major currencies, with the yen being the notable exception, which is off about 0.2%.

Read More »

Read More »

How the Market Responds to US CPI may set the Near-Term Course

Overview: US stocks built on the recovery started on Monday and Powell's suggestion of letting the balance sheet shrink later this year eased some speculation of a fourth hike this year, which seemed to allow the Treasury market to stabilize.

Read More »

Read More »

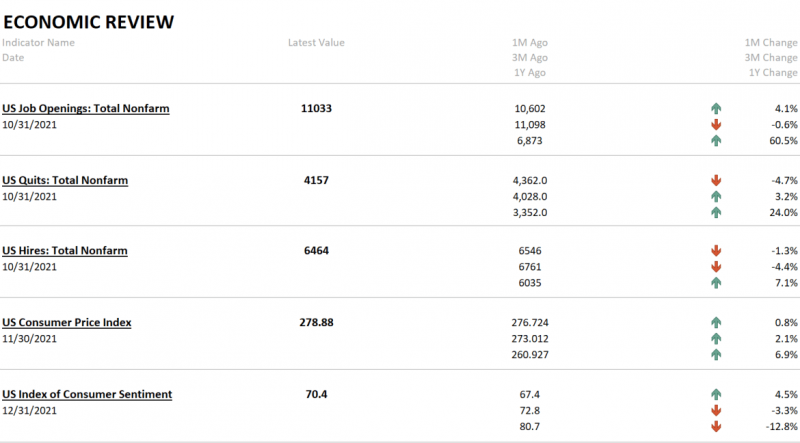

Inflation and Geopolitics in the Week Ahead

The Omicron variant may be less fatal than the earlier versions, but it is disrupting economies. The surge in the Delta variant well into Q4 in the US and Europe was already slowing the recoveries. Investors will likely take the high-frequency real sector data with the proverbial pinch of salt until January data available beginning later this month.

Read More »

Read More »

Start Long With The (long ago) End of Inflation

With the eurodollar futures curve slightly inverted, the implications of it are somewhat specific to the features of that particular market. And there’s more than enough reason to reasonably suspect this development is more specifically deflationary money than more general economic concerns.

Read More »

Read More »

The Chagrin of Beijing and the Problem of Time

The central bank meeting cycle is over. Most of the important high-frequency data has been released until early January. The US debt ceiling has been lifted, avoiding an improbable default. A year ago, there was a sense of optimism, with a couple of vaccines being announced and monetary and fiscal stimulus boosting risk-appetites. Populism, which had been in the ascendancy after the Great Financial Crisis, seemed to be retreating in Europe and the...

Read More »

Read More »

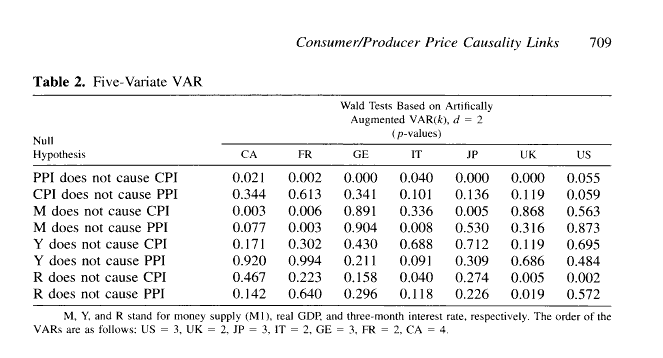

Testing The Supply Chain Inflation Hypothesis The Real Money Way

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs.

Read More »

Read More »

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

2022-01-09

by Stephen Flood

2022-01-09

Read More »