Tag Archive: Energy

US Employment Data to Determine Whether the Greenback’s Rally since mid-July is Over…Maybe

Overview: One key issue for market participants is

if the dollar's pullback is the beginning of something important or is largely

position adjusting ahead of today's US jobs report. We suspect that the

dollar's rally that began in mid-July is over, though a strong employment

report that boosts the chances of a Fed hike before year-end could quickly

demonstrate the folly of making claims ahead of what is still one of the most

important reports in...

Read More »

Read More »

The Greenback Firms to Start the New Week, Stocks Slide

Overview: The busy week is off to a slow

start as Japan is on holiday and the UK and Canadian markets are closed to

honor Queen (Australia will commemorate with a holiday on Thursday). Nevertheless,

the sell-off in equities continues and the US dollar is firm. Most of the large

markets in Asia fell. India is a notable exception. Its benchmark rose for the

first time in four sessions, helped by bank shares and Infosys. Europe’s Stoxx

600 is off for...

Read More »

Read More »

Calmer Capital Markets…for the Moment

Overview: The capital markets are quiet today. Equity markets and bond yields have a slight upside bias, while the dollar is little changed. Despite reports that the lockdown in Chengdu is easing, Chinese equities underperformed in the Asia Pacific region.

Read More »

Read More »

Markets Remain on Edge

Overview: The firmer than expected US CPI set off a major reversal of the recent price action. It is a two-prong issue. The first is about inflation and the squeeze on the cost-of-living.

Read More »

Read More »

Will the Dollar Recover After CPI?

Overview: The US dollar remains offered ahead of today’s CPI report. Most European currencies are outperforming the dollar bloc, and the greenback is holding inside yesterday’s range against the yen. Most emerging market currencies are firmer, as well.

Read More »

Read More »

Sharp Dollar Setback may offer Bulls a Bargain

The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is

surprising, and likely speaks to the extreme positioning.

Read More »

Read More »

Can the US Employment Report be Anti-Climactic Ahead of Long North American Weekend?

Overview: Nothing is decisive, but the recent

string of data pushes the needle a little more to a soft landing for the US

economy and gave the US dollar another leg up. The risk is that some of the buying

drained some of the interest that may materialize after today's US jobs report. The

greenback is softer against the major currencies except the Japanese yen. The

dollar is extending its rally against the yen for the sixth consecutive session

and...

Read More »

Read More »

EMU August CPI at 9.1%, while the Core Rate Jumps to 4.3%

Overview: The rise in global interest rates continues. The US 10-year yield is a few basis points near 3.15% and European benchmarks are mostly 5-6 bp higher. Of note, the sharp sell-off in UK Gilts has being extended. Yesterday’s 10 bp rise has been followed by another 14 bp surge today. Italian bonds are also getting hit. The 10-year yield is up a little more than 10 bp.

Read More »

Read More »

Turn Around Tuesday Began Yesterday, Likely Ends before Wednesday

Corrective pressures were evident yesterday and they extended today in Asia and Europe but seem to be running their course now. Market participants should view these developments as countertrend and be wary of waning risk appetites in North America today.

Read More »

Read More »

Stocks and Bonds Sell Off, while the Dollar Rallies

Overview: The reverberations from last week continue to roil the capital markets today. Equities and bonds have been sold and the greenback bought. Most of the large markets in Asia Pacific fell by more 2%, including Japan’s Nikkei, Taiwan’s Taiex, and South Korea’s Kospi.

Read More »

Read More »

Monday Blues

Overview: The US dollar is bid against most currencies today, encouraged not just by good news in the US and poor news out of China, where Covid is flaring up and new social restrictions are fared, while Macau has been lockdown for a week.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

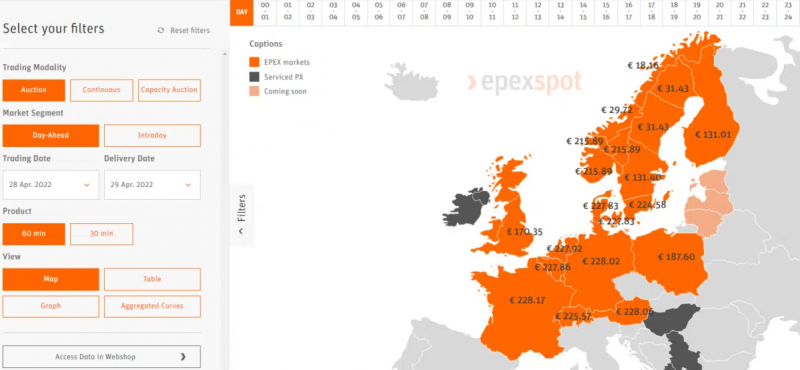

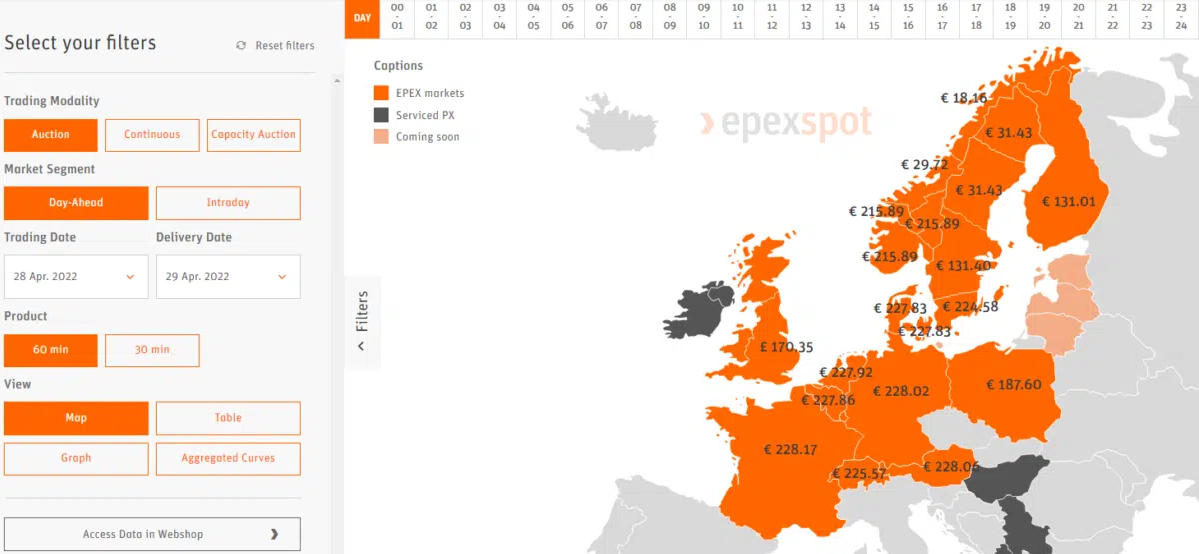

The EU energy price crisis – is the market design to blame?

The electricity prices reflect the supply and demand conditions in Europe and interfering with the price formation mechanism would have dangerous consequences.

Read More »

Read More »

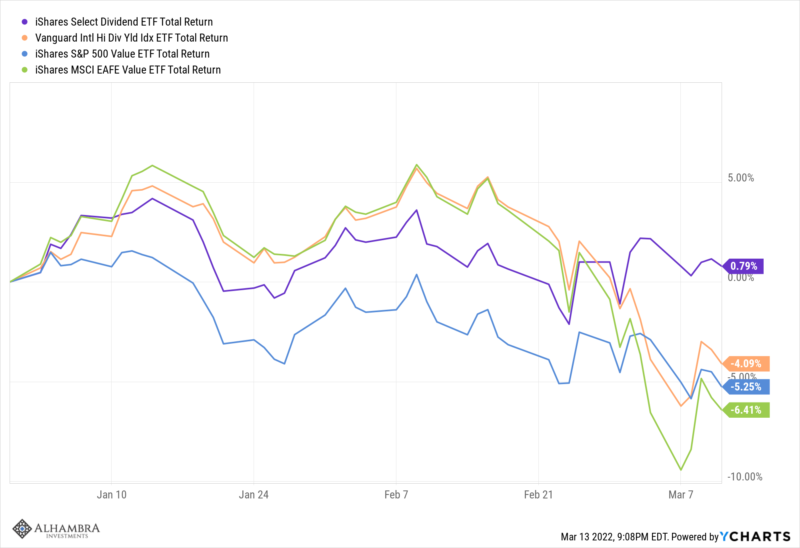

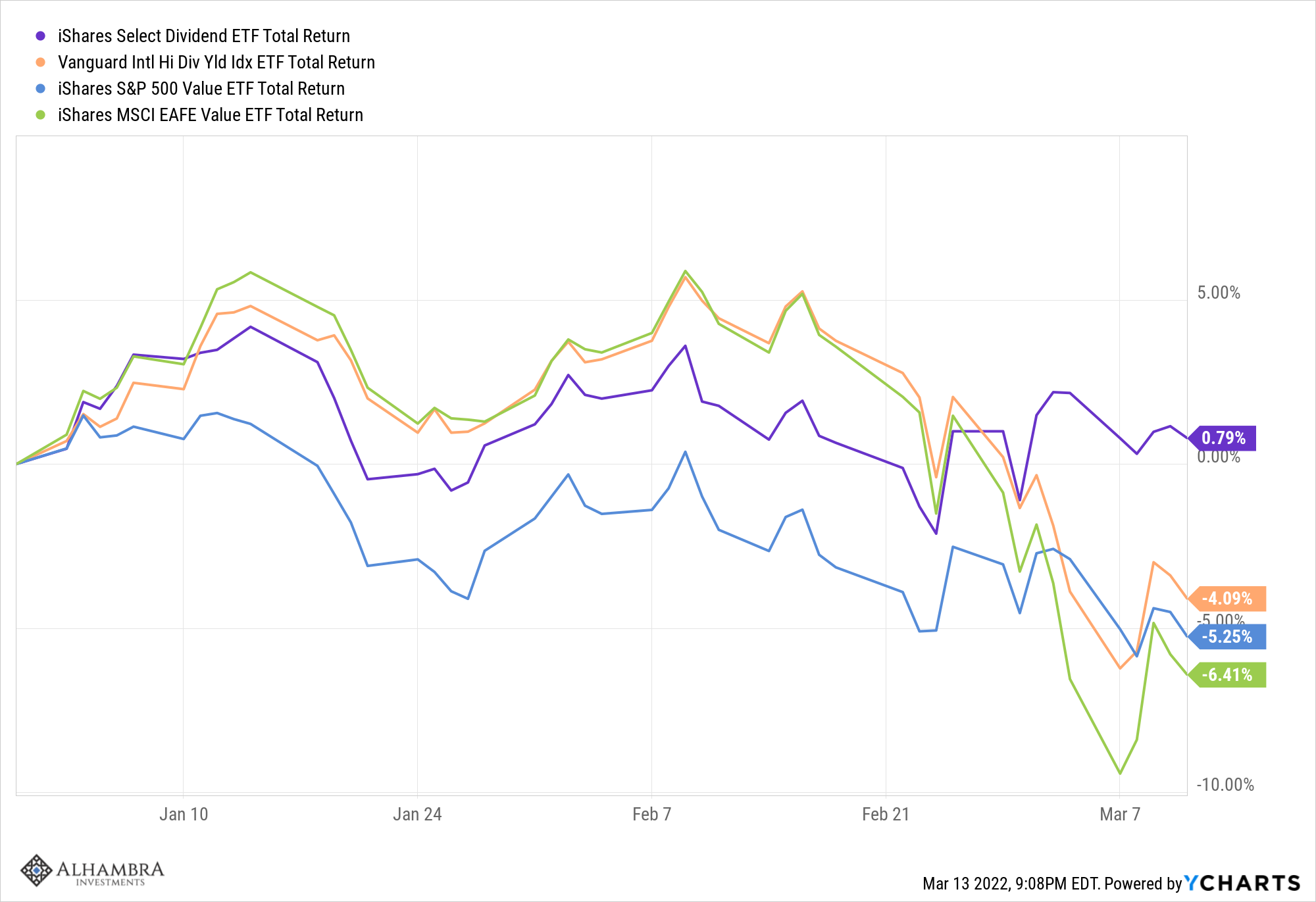

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

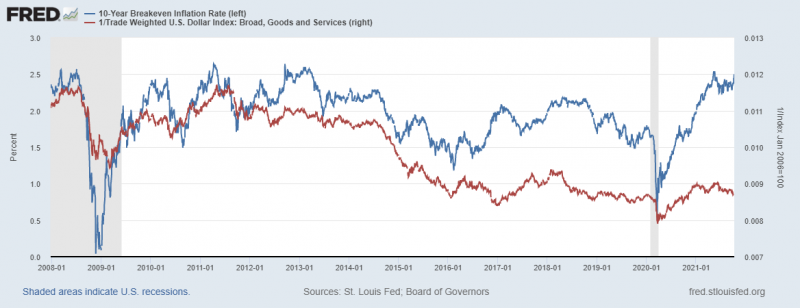

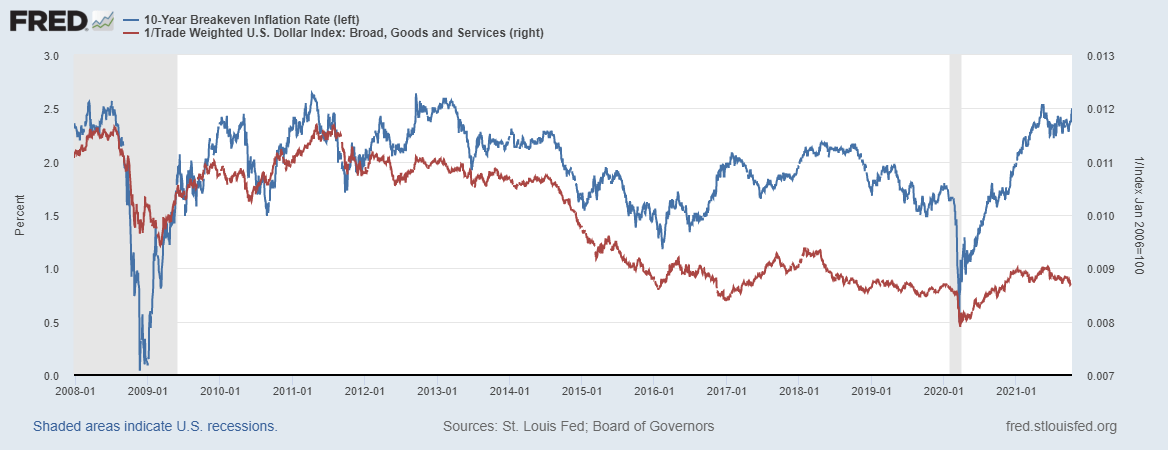

Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it.

Read More »

Read More »

Hope Springs Eternal, or at least enough to Lift Risk Taking Today

Overview: The animal spirits have been reanimated today. Encouraged by the dramatic reversal in oil and gas prices, a deal in the US that pushes off the debt ceiling for a few weeks and talk of a new bond-buying facility in the euro area spurred further risk-taking today, ahead of tomorrow's US employment report.

Read More »

Read More »

Ever Grand

Overview: Coming into yesterday's session, the S&P 500 had fallen in eight of the past ten sessions. It closed on its lows before the weekend and gapped. Nearly the stories in the press blamed China and the likely failure of one of its largest property developers, Evergrande.

Read More »

Read More »

Oil market outlook: Land in sight but rough seas ahead

In November, new vaccines showed great promise in fighting Covid-19, and the exhilaration was clear in markets around the world. However, the enthusiasm was not sustained. Many experts and political leaders rushed to warn that while a vaccine could mean the end of the health crisis, the economy – and oil markets in particular – are still in for a rough ride.

Read More »

Read More »

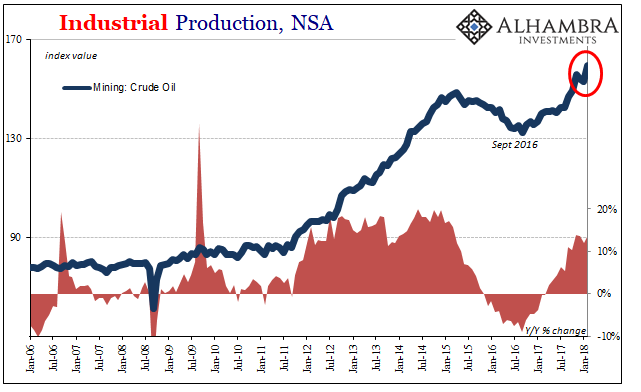

US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

Read More »

Read More »

More energy blows are dealt to Europe, causing a cold chill to be even colder

2022-08-13

by Stephen Flood

2022-08-13

Read More »