Tag Archive: Economics

Martin Armstrong: Empires always fail

Part of the upcoming “World War III” documentary

Martin Armstrong has long been known for his very influential work on global capital flow analysis and cyclical economic trends. The forecasting models he designed have anticipated sovereign debt crises and times of geopolitical instability, with his most widely recognized forecasting framework being the Economic Confidence Model (ECM). He has successfully predicted a number of major events,...

Read More »

Read More »

The Reflation Narrative

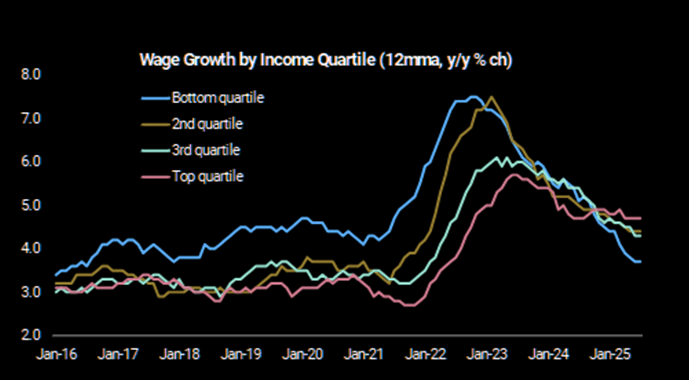

The market got off to a strong start in 2026, with investors chasing industrials, materials, and commodity-related stocks as the reflation narrative gained traction. The "reflation narrative" is the belief that a range of policies will boost the rate of economic growth in the U.S. without triggering inflation. As I discussed at our recent 2026 …

Read More »

Read More »

General Kujat: War, Diplomacy, and the Risks of Escalation

Part of the upcoming “World War III” documentary

Few voices in the European debate on the war in Ukraine can claim to combine actual military experience with sound arguments for diplomatic pragmatism and persistent calls for an end to the conflict. General Harald Kujat stands out even among those precious few. He is a retired four-star general of the German Air Force, he served as Inspector General of the Bundeswehr from 2000 to 2002, the...

Read More »

Read More »

Mainstream Expectations: Hope Vs. Potential Risk

Mainstream expectations, those from Wall Street, economists, and corporate strategists, have congealed around a bullish economic outlook for 2026. Most forecasts project stronger economic growth, with contained inflation, and continued investment in technology and capital expenditure. As such, many institutional investors interpret this as a year of opportunity for markets and corporate earnings.That was a …

Read More »

Read More »

Ron Paul: War Is Bipartisan

First Interview in the “World War III” Series Is Now Live

When it comes to opposing war and to raising objections even when it is extremely unpopular and even when one is the only sole voice speaking out against collective madness, there are very few individuals alive today that have repeatedly demonstrated the courage to do so. Even among these select few, arguable no-one has been as consistent, as tireless and as consistently sidelined and...

Read More »

Read More »

World War III: A film that challenges everything we have been told

Over the past decades, and especially in the last few years, war has been radically reframed in the public mind. It’s not raw and brutal bloodshed, senseless destruction and atrocious human pain and suffering. War is no longer seen as an abomination, as the absolute worst case scenario that we must all do our best to avoid. The mainstream media and political leadership of the western world is enthusiastically calling for war, with ominous...

Read More »

Read More »

AI Productivity, Employment and UBI

A funny thing about bull markets is that investors develop a very short memory about the previous bear market. Such is why cycles repeat throughout history as lessons must be learned and relearned. The post AI Productivity, Employment and UBI appeared first on RIA.

Read More »

Read More »

Inflation as a moral hazard

As I have argued many times in the past, the corruption of money itself and its purposeful devaluation is by far the most important problem facing not just investors and savers, but virtually every single citizen on the face of the planet. Taxation, especially the extremely predatory and aggressive kind that most governments enforce today, might indeed be theft, but inflation is even worse. This is because taxation might be robbery, but at least it...

Read More »

Read More »

What Inflation Alarmists Missed In Their Warnings

Over the last couple of years, inflation alarmists such as Paul Tudor Jones, James Grant, and Jeff Gundlach have all said that inflation is returning with force. In different ways, they each stated that they would not own Treasury bonds due to the expectation that inflation would rise as the dollar declined due to the … Continue...

Read More »

Read More »

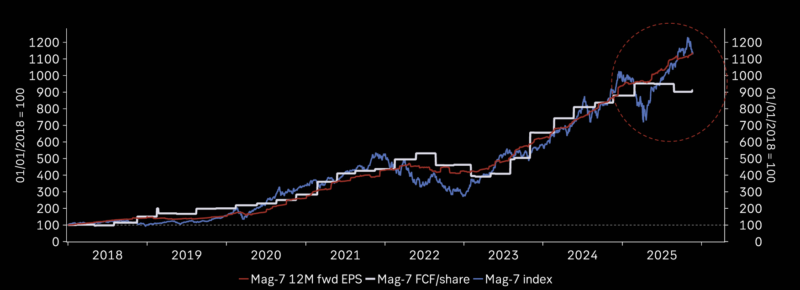

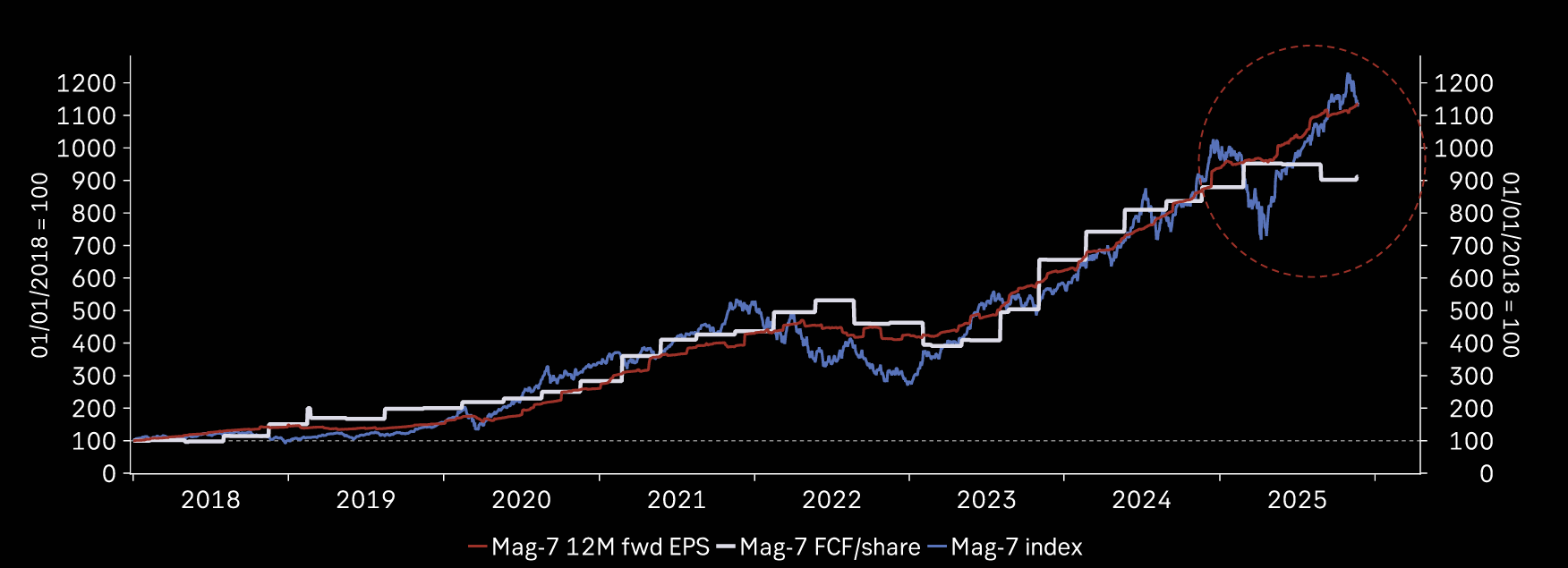

Does AI Capex Spending Lead To Positive Outcomes?

As someone who views corporate finance through a pragmatic lens, I’ve been closely watching the current surge in capital expenditures (capex) tied to artificial intelligence (AI). The question I’m addressing here is this: when a company spends massive amounts of free cash flow and takes on increasing debt, in this case for AI CapEx, does …

Read More »

Read More »

Korruption & Machtmissbrauch – Die dunkle Seite der Politik!

In dieser Folge im Modelhof begrüßen wir Claudio Grass – Unternehmer, Edelmetall-Experte und überzeugter Verfechter individueller Freiheit und Selbstverantwortung. Seit Jahrzehnten beschäftigt er sich mit dem Geldsystem, der Geschichte des Goldes und den globalen Machtverhältnissen hinter der Finanzwelt.

Im Gespräch analysieren wir, wie korrumpiertes Geld ganze Gesellschaften verändert, warum Zentralbanken mehr Einfluss haben als viele...

Read More »

Read More »

Jobs Data From Alternative Sources May Drive Fed’s Next Move

With the federal government shutdown delaying critical economic reports, the official jobs data remains incomplete. Last week, the Bureau of Labor Statistics (BLS) released the September jobs report. However, the October report, originally expected earlier this month, remains in limbo, potentially permanently. The reason is due to the shutdown, as the BLS was unable to …

Read More »

Read More »

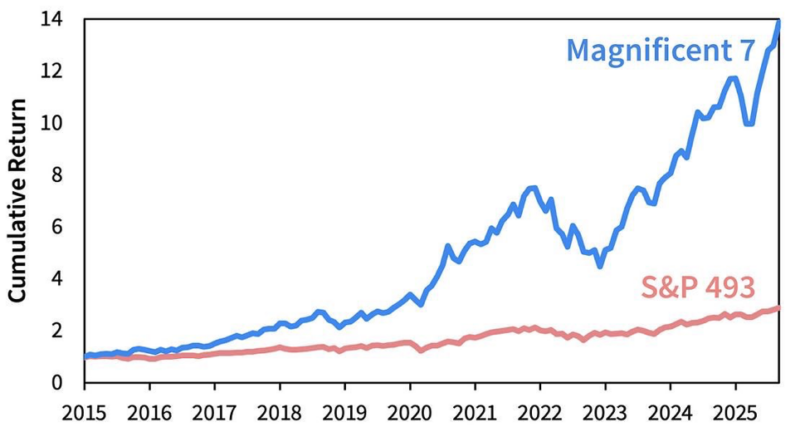

“Sometimes, the only winning move is not to play”

This was the conclusion of the assessment of legendary investor Michael Burry regarding the current market conditions. To be precise, his take as recently posted on X, in full, was “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” The insight behind these words is something that a lot of investors could use at this time. The unrestrained, unjustifiable and unrealistic...

Read More »

Read More »

Capex Spending On AI Is Masking Economic Weakness

The U.S. economy’s recent growth has a distinctive engine: large‑scale capital expenditures (capex) tied to artificial intelligence (AI). Firms such as Microsoft, Alphabet (Google), Meta Platforms, and Amazon have announced massive investments in data centers, servers, networking equipment, and AI infrastructure. As noted by Investing.com: "Artificial intelligence is consuming capital faster than investors can recalibrate. …

Read More »

Read More »

Economic Reacceleration: A Contrarian View

Over the past two weeks, we’ve addressed a persistent question: if the data signals weakness, why hasn’t the recession arrived? In "Slowdown Signals: Are Leading Indicators Flashing Red?" we examined the cracks forming beneath the economy's surface. From deteriorating leading indicators to credit stress and cooling employment metrics, the evidence supported a cautious stance. In …

Read More »

Read More »

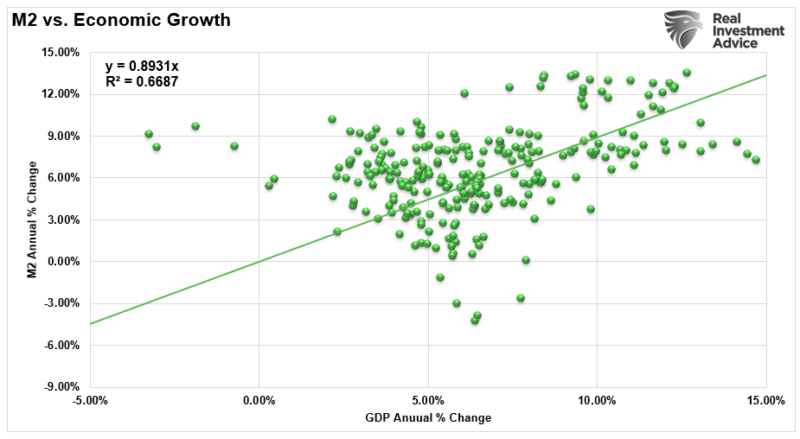

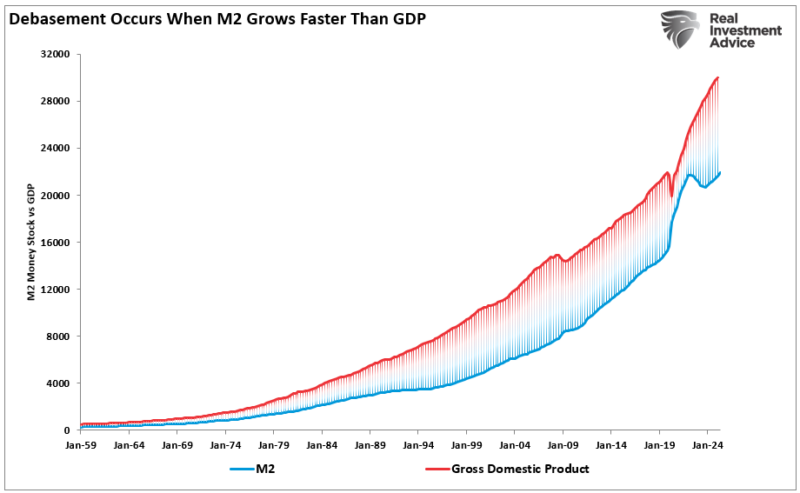

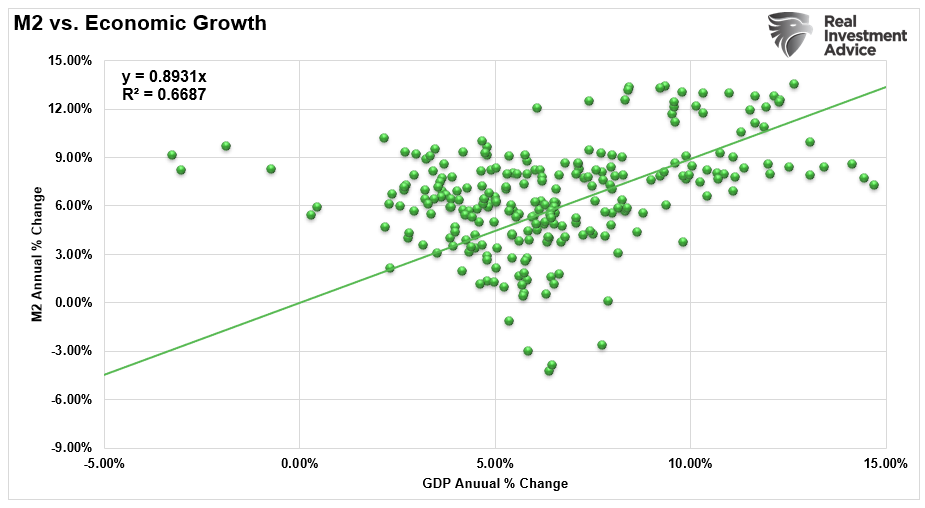

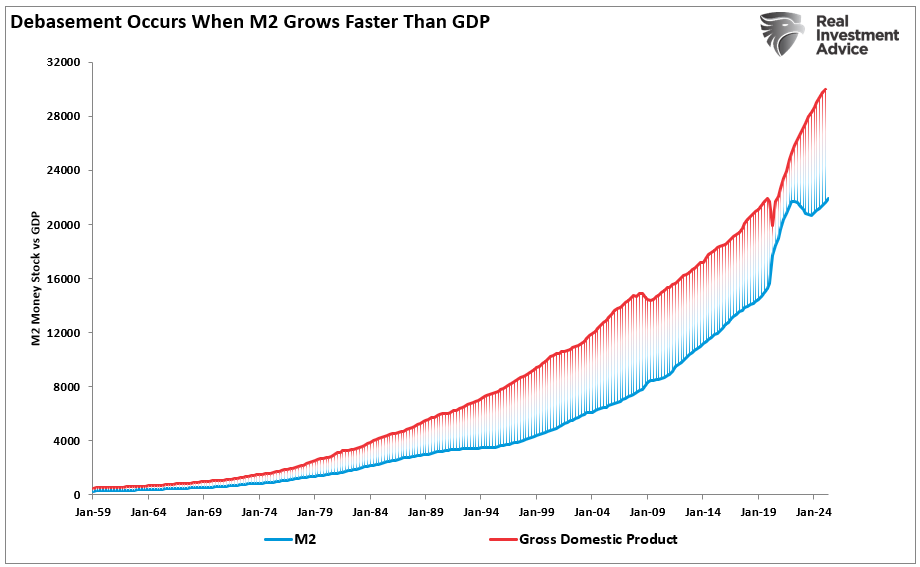

“Money Printing” By The Fed: Fact Or Fiction?

I recently penned an article on "Money Supply Growth," which elicited a very thoughtful response from Garrett Baldwin via Substack. He argued that labeling Federal Reserve operations as "money printing" is not rhetoric, but rather a reality. He points to Ben Bernanke’s 2010 interview, where Bernanke described how the Fed marks up digital accounts. But …

Read More »

Read More »

Gold’s flashing warning: The end is nigh for fiat

Gold’s spectacular performance has drawn a lot of attention and invited endless analyses and commentaries. There are many theories out there as to why the yellow metal is surging like never before in modern memory, however most of them are shortsighted, or tend to miss the forest for the trees. The metal’s meteoric rise is not merely sending message about inflation expectations or rate policy. It’s flashing a clear warning sign about the...

Read More »

Read More »

Money Supply Growth: A Thesis With A Fatal Flaw

Recently, MarketWatch ran a provocative headline: “When the world’s largest asset manager and the Bond King both agree: Run to gold, silver, and bitcoin.” The article highlighted how Larry Fink’s BlackRock and Jeffrey Gundlach, often dubbed the “Bond King,” see deficits and “money printing” as reasons for investors to escape fiat currencies and pile into …

Read More »

Read More »

Bastiat’s enduring legacy

Frédéric Bastiat, the 19th-century French economist and philosopher, is best known for his defense of individual liberty, free markets, and limited government, and his ideas, especially at the time he conceived them were as profound as they were simple and elegant. He recognized the absolute need to protect the smallest minority in the world, the individual, and he clearly saw the numerous dangers of state overreach, of aggressive interventionism...

Read More »

Read More »

A conversation with Catherine Austin Fitts

I recently had the great pleasure of (virtually) sitting down with Catherine Austin Fitts, investment banker, President of Solari, and former US Assistant Secretary of Housing and Urban Development for Housing, and having an extremely interesting conversation about the outlook for gold and silver. It was a fascinating discussion, especially given our current economic, monetary and geopolitical context: there so many risks and challenges ahead, that...

Read More »

Read More »