Tag Archive: ECB

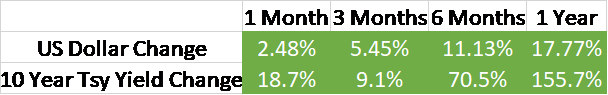

Currency and Bond Markets Challenge the Bank of Japan

Asia Pacific equities were mixed as the China, Hong Kong, Taiwan, and South Korean markets, among the large markets were unable to gain in the wake of a solid performance in the US. Europe is also struggling to maintain the upside momentum that has lifted the Stoxx 600 for the past four sessions.

Read More »

Read More »

Wake Me Up When September Ends

Benchmark 10-year yields are off 6-8 basis points in Europe and the United States. The panic seen at the start of the week in the UK has subsided considerably, as sterling recovered to almost where it was a week ago, while BOE’s hand has help steady the Gilt market. Equities in Asia Pacific suffered after the losses in the US yesterday. Hong Kong and India were notable exceptions.

Read More »

Read More »

Weekly Market Pulse: No News Is…

Nothing happened last week. Stocks and bonds and commodities continued to trade and move around in price but there was no news to which those movements could be attributed. The economic news was a trifle and what there was told us exactly nothing new about the economy.

Read More »

Read More »

Sharp Dollar Setback may offer Bulls a Bargain

The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is

surprising, and likely speaks to the extreme positioning.

Read More »

Read More »

ECB: Coping with Conflict, Covid, and Climate

Overview: Heightened warnings from Japanese officials has helped the dollar steady against the yen, while the euro hugs parity ahead of the outcome of the ECB meeting, where a 75 bp hike is anticipated. Most Asian equity markets rallied in the wake of yesterday’s gains in the US.

Read More »

Read More »

RBA, BOC, and ECB Meetings and more in the Week Ahead

All

three major central banks that meet in the coming days will hike rates. The question is by how much. The Reserve Bank of Australia makes its

announcement early Tuesday, September 6. One of the challenges for policymakers and investors is

that Australia reports inflation quarterly. The Q2 estimate was released on July

27. It showed prices accelerating to 6.1% year-over-year from 5.1% in Q1. The

trimmed mean rose to 4.9% from 3.7%, and the...

Read More »

Read More »

“War on cash” update: A brighter outlook

For years, I’ve been following very closely all the relevant updates on the State’s war on cash. I’ve read and written a lot about all the direct and indirect efforts to restrict the citizens’ choices and make sure they shift all their transactions and savings to the digital realm, where they can be better monitored, controlled and if need be, confiscated, by central authorities.

Read More »

Read More »

Stocks and Bonds Sell Off, while the Dollar Rallies

Overview: The reverberations from last week continue to roil the capital markets today. Equities and bonds have been sold and the greenback bought. Most of the large markets in Asia Pacific fell by more 2%, including Japan’s Nikkei, Taiwan’s Taiex, and South Korea’s Kospi.

Read More »

Read More »

The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk.

Read More »

Read More »

Jackson Hole and More

Overview: Ahead of the much-anticipated speech by

Federal Reserve Chair Powell, the Fed funds futures are pricing in about a 70%

chance of a 75 bp hike next month. The

US 10-year yield is up nearly five basis points today to 3.07% and the two-year

yield is firm at 3.38%. Asia Pacific equities

were mostly higher, with China the main exception among the large markets, after

US equities rallied yesterday. Europe’s

Stoxx 600 is off about 0.3% to...

Read More »

Read More »

Market Takes China’s Response in Stride, Risk Appetites Recover

Overview: The market is

judging China's response to Speaker Pelosi's visit in a mild way and risk

appetites returned. Equity markets are higher, even though Chinese shares

weakened. Europe's Stoxx 600 is edging higher after two days of small loses,

and US futures enjoy a firmer bias. The surge in US rates yesterday has calmed.

The US 10-year yield is firm near 2.76% and the 2-year yield is up a

couple of basis points near 3.07%. European yields are...

Read More »

Read More »

The Fed and GDP: Week Ahead

The outcome of the Federal

Reserve Open Market Committee meeting on July 27 is the most important event in

the last week of July. After a brief flirtation with a 100 bp hike after the June

CPI accelerated, the market has settled back to a 75 bp move. The Fed

funds futures are pricing about a 10% chance of a 100 bp

hike. The market anticipates that after the second 75 bp hike, the Fed will most likely return to a 50 bp hike in September. Fed...

Read More »

Read More »

Dismal EMU Flash PMI on Heels of First ECB Rate Hike since 2011

Overview: The euro is over a cent lower from yesterday’s peak, pressured by

the drop in the flash PMI composite below 50 for the first time since early

last year. More generally, the flash PMIs have shown the global economic

momentum is waning, and the bond markets have responded accordingly. The US

10-year yield is flirting with 2.80%, its lowest level in more than two weeks. European

yields are 15-20 bp lower and the spread between Italian and...

Read More »

Read More »

Italian Politics Complicate the ECB’s Task

The appetite for risk seen earlier this week is fading. Yesterday’s US equity gains helped lift most of the large markets in the Asia Pacific region, but China’s CSI 300 fell 1.1%, giving back most of this week’s gains as credit issues from the property sector haunt sentiment.

Read More »

Read More »

The Dollar is on its Back Foot

The dollar’s downside correction continues today, helped by hawkish signals from the Reserve Bank of Australia and unnamed sources who have played up the chances of a 50 bp hike by the European Central Bank on Thursday.

Read More »

Read More »

Parity hysterics: What it means and what it doesn’t

There’s been a flurry of articles, news stories and headlines lately over the developments in the FOREX market, specifically over the moves of the EUR/USD currency pair. As headwinds on all levels, economic, geopolitical and social, got a lot worse in recent months for the Eurozone, the news-breaking, headline-dominating “parity” event finally came about, with the euro even breaking below parity on July 13, and it seems to have captivated global...

Read More »

Read More »

Monday Blues

Overview: The US dollar is bid against most currencies today, encouraged not just by good news in the US and poor news out of China, where Covid is flaring up and new social restrictions are fared, while Macau has been lockdown for a week.

Read More »

Read More »

What Happened Today in a Few Bullet Points

1. The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures.

Read More »

Read More »

No Turn Around Tuesday

Overview: The global capital markets are calm today. Most of the large bourses in the Asia Pacific extended yesterday’s gain. Europe’s Stoxx 600 is advancing for the third consecutive session and is near two-and-a-half week highs.

Read More »

Read More »

Consolidation in FX Featured

Overview: The strong equity market rally seen at the end of last week is carrying into today’s activity. Most of the large markets in Asia Pacific rose by at least 1%.

Read More »

Read More »