Tag Archive: Demographics

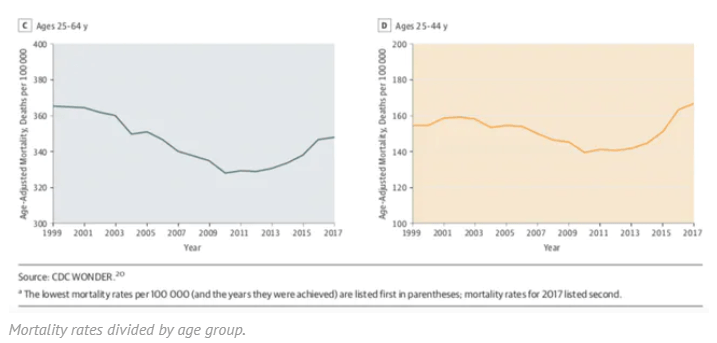

Inflation, But Only At The Morgue

Why is everyone so angry? How can socialism possibly be on such a rise, particularly among younger people around the world? Why are Americans suddenly dying off? According to one study, two-thirds of millennials are convinced they are doing worse when compared to their parents’ generation. Sixty-two percent say they are living paycheck to paycheck, with no savings and no way to get any (though they also tend to “overspend” when compared to other...

Read More »

Read More »

If American Federalism Were Like Swiss Federalism, There Would Be 1,300 States

In a recent interview with Mises Weekends, Claudio Grass examined some of the advantages of the Swiss political system, and how highly decentralized politics can bring with it great economic prosperity, more political stability, and a greater respect for property rights. Since the Swiss political system of federalism is itself partially inspired by 19th-century American federalism, the average American can usually imagine in broad terms what the...

Read More »

Read More »

When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Last year, I posted an article titled "If Sweden and Germany Became US States, They Would be Among the Poorest States" which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly reached the point of dogma with many leftists that European countries enjoy higher standards of living thanks to more government regulation and...

Read More »

Read More »

Yellen and Fischer Still Singing from the Same Song Book

Many see Yellen and Fischer at odds over benefits of high pressure economy. However, this fails to put the comments in the proper context--same message different styles. They are arguing against the doves who don't want to hike this year.

Read More »

Read More »

Financial Repression Is Now “In Play”

A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for...

Read More »

Read More »

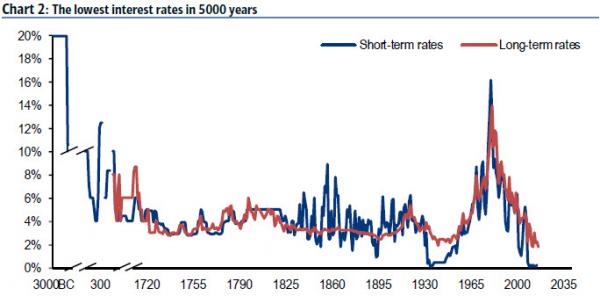

Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financi...

Read More »

Read More »

Why The Powerball Jackpot Is Nothing But Another Tax On America’s Poor

Now that the Powerball Jackpot has just hit a record $1.4 billion, people, mostly those in the lower and middle classes, are coming out in droves and buying lottery tickets with hopes of striking it rich.

After all, with $1.4 billion one can ...

Read More »

Read More »