Tag Archive: Crisis

A conversation with Catherine Austin Fitts

I recently had the great pleasure of (virtually) sitting down with Catherine Austin Fitts, investment banker, President of Solari, and former US Assistant Secretary of Housing and Urban Development for Housing, and having an extremely interesting conversation about the outlook for gold and silver. It was a fascinating discussion, especially given our current economic, monetary and geopolitical context: there so many risks and challenges ahead, that...

Read More »

Read More »

Geopolitical theater and implications for investors (or lack thereof)

The last month has been truly remarkable for modern human history – at least if one was paying attention to mainstream news headlines and TV anchors. Apparently, we came extremely close to World War III and we very likely had a very tight escape from an all-out nuclear holocaust that could have forever changed the our species’ trajectory and annihilated millions.

It all started with Israel’s surprise bombardment of Iran (which wasn’t really a...

Read More »

Read More »

A Politically Incorrect “Where Are We Now?”

A few days ago, I had the great pleasure to sit down again with my good friend James Patrick in person, in Monte Brè. It was a truly spontaneous and unfiltered conversation about the current state of the world, the bizarre geopolitical situation and the tragicomical moment in history that we find ourselves in. We talked about the extreme, and likely unprecedented, risks we face in the global economic and financial system and I’m very glad we...

Read More »

Read More »

Speculator Or Investor? 10-Rules From Legendary Investors

Are you a "speculator" or an "investor"? This is an essential question that every individual deploying capital into the financial markets must answer. The reason is that how you answer that question determines how you should behave during market cycles.

Read More »

Read More »

Silver: A rare buying opportunity

The gold price recently surged to unprecedented levels, surpassing the $3,000 per ounce milestone. This remarkable surge has been attributed to escalating geopolitical tensions, the revival of the trade wars, mounting inflation concerns, and of course, a very uncertain and very worrying outlook for the global economy and for the markets. As they always do, investors have once again flocked to the safe haven that gold unmistakably provides, pushing...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

Share this article

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war...

Read More »

Read More »

Year in review: A tectonic shift has only just begun

As we’re approaching the final hours of 2024, it is a good time to take a step back and remember what this year taught us. History might not repeat itself, but it does rhyme, as the saying goes, and the past is always the best teacher to prepare us for the future.

For many of our fellow humans, 2024 was yet another turbulent year, filled with terrible strife, war, death, pain and indescribable suffering. The two ongoing war fronts and the images...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Share this article

Part II of II

Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before.

And it’s not only because the central bankers have overused these “weapons” and have by now...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Part II of II

Business as usual” will simply not cut it anymore. The “print and spend” policies of the past, the QE lifelines, the liquidity injections, the zero and negative interest rates, the blatant debasement of the currency, the market manipulation and all the direct and indirect bailouts will not work as they did before.

And it’s not only because the central bankers have overused these “weapons” and have by now exhausted all their...

Read More »

Read More »

Gold climbing from record high to record high: why buy now?

Share this article

Part I of II

There is no question that gold owners have been finally and spectacularly vindicated over the last months: the “barbarous relic”, the “worthless shiny rock”, as many have called the yellow metal, once again proved its value as a true safe haven. In the face of inflation, intense geopolitical turmoil and widespread uncertainty, investors fled to safety “en masse”, as they consistently, repeatedly and predictably...

Read More »

Read More »

Saving in gold is the only reliable way to save

Share this article

For the longest time, according to conventional and widely embraced wisdom, all responsible and prudent members of society had to have a savings account. All those hardworking taxpayers and all those forward-thinking and sensible individuals that understand the importance of planning ahead, of being prepared for whatever the future holds and of securing a better life for their children, have traditionally been expected to put...

Read More »

Read More »

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

US Banking Crisis Swamps Other Considerations

Overview: The US banking crisis has overwhelmed other

market drivers. The strong measures announced as Asia Pacific trading got under

way was embraced by the market even though moral hazard issues and gaps in the

Dodd-Frank regulatory framework were exposed. The dollar is trading heavily. The

prospect of a 50 bp Fed hike next week has evaporated and some are doubting

that a 25 bp increase will be delivered. Rate hike expectations for the ECB

this...

Read More »

Read More »

“Keynes is the winner of the day, not Milton Friedman”

To many of us, no matter how well versed in history, in political affairs or in socioeconomic issues, the present conditions in the West, and especially in Europe, can sometimes seem like the plot of a bad movie. It is often said that history doesn’t repeat itself, but it does rhyme, and what we’re seeing today is a great example of that.

Read More »

Read More »

Claudio Grass – The Movement Is Spreading World Wide, The Great Awakening, The [DS] Has Failed

Claudio begins his discussion with the pandemic, the people are waking up and they are now seeing that the criminals lied to them. The war is a show and as the economy implodes on itself the people understand that its not Putin fault, it is the criminal politicians that are causing the problem. Claudio says that more and more people are waking up.

Read More »

Read More »

“Whatever it takes” – Part II of II

The Fascist Boogeyman awakes again

The threat of a far-right takeover has been around for at least three decades in Europe and Italy has been one of the best “candidates” for the “beginning of the end” since the last European crisis ten years ago. Back then it was the Lega, led by Salvini, that fueled the scaremongering campaigns of the mainstream press, labeling every conservative policy point as basically pure fascism. Of course, none of those...

Read More »

Read More »

Parity hysterics: What it means and what it doesn’t – Part II

Part II of II, by Claudio Grass, Hünenberg See, Switzerland

“Reverse currency wars”?

Although the parity event may have captured the attention of the mainstream financial press and most western citizens, there’s a much bigger shift that has been going on in the background, which received much less coverage.

Read More »

Read More »

Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss.

Read More »

Read More »

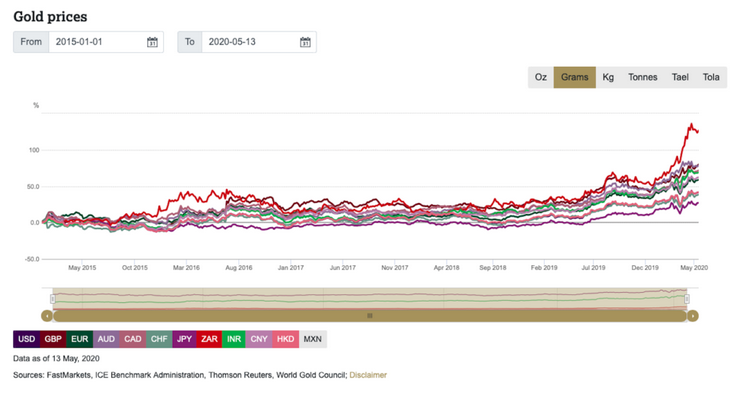

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »