Tag Archive: COVID

Weekly Market Pulse: A Fatal Conceit

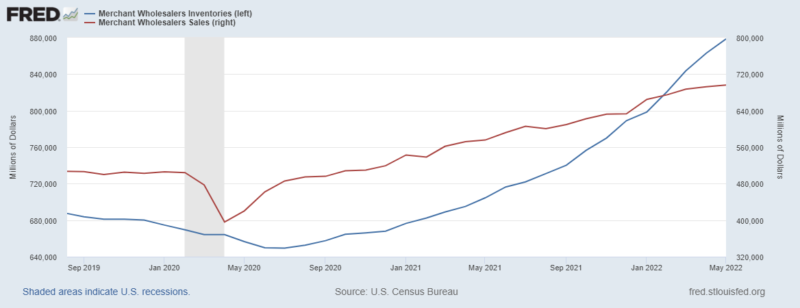

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

European Rates Continue to Surge, Sending Stocks Spiraling Lower

Overview: Seven of the G10 central banks pumped the brakes between last week and this week as they purposely seek to push demand back into line with supply. And there are more signs that they are succeeding in weakening growth impulses. The dramatic surge in European bond yields continues today with 10-year rates mostly rising another 13-15 bp.

Read More »

Read More »

What Can the Fed tell the Market it Does Not Already Know?

Overview: The softer than expected US CPI drove the

dollar and interest rates lower, while igniting strong advances in equities,

risk assets, commodities, and gold. Calmer market conditions are

prevailing today, and we suspect that in the run-up to the FOMC meeting, a broadly

consolidative tone will emerge. The dollar is mostly softer, but within yesterday’s

ranges. Only the New Zealand and Canadian dollars among the G10 currencies are softer....

Read More »

Read More »

US CPI ahead of FOMC Outcome Tomorrow

Overview: The dollar

softer against the G10 currencies ahead of today’s CPI report and the FOMC meeting

the concludes tomorrow. Emerging market currencies are most mixed. The

Hungarian forint leads the complex with around a 1% gain on news of a

preliminary deal struck with the EU. The South African rand is the worst

performer, off around 0.8%, as impeachment proceedings against Ramaphosa

proceed. Global equities are mostly higher today after the...

Read More »

Read More »

Chinese Yuan Jumps While the Dollar recovers After Losses were Extended Against the Euro and Sterling

Overview: The markets remain hopeful about a re-opening in

China and continue to pour into Chinese stocks on the mainland and in Hong Kong. The

index of Chinese companies that trade in the US rose nearly 22.4% last week. Large

bourses in the Asia Pacific region were mixed, but China and Hong Kong stand out.

Europe’s Stoxx 600 is nursing a small loss for the second consecutive session. US

equity futures have a slightly heavier bias. European 10-year...

Read More »

Read More »

China Steps away from the Abyss and Animal Spirits are Rekindled

Overview: Chinese officials using the carrot and the stick have succeeded in dampening the protests and easing some anxiety and rekindled the animal spirits. Hong Kong’s Hang Seng rallied 5.25% and its index of mainland shares surged 6.20%.

Read More »

Read More »

China Shakes Markets, Euro Shakes it Off

Overview: The surging Covid cases in China and the protests in

several cities seemed to set the tone for today’s session. Equities are lower. China,

Hong Kong, Taiwan, and South Korea were marked down the most. Of the large

bourses, only India escaped unscathed. Europe’s Stoxx 600 is off more than 0.8%

and US futures are poised to gap lower. Bond markets are quieter. The 10-year

US Treasury yield is off a little more than one basis point to around...

Read More »

Read More »

US Jobs and Eurozone CPI Highlight the Week Ahead

Two high-frequency economic

reports stand out in the week ahead: The US November employment report

and the preliminary eurozone CPI. The Federal Reserve has deftly distanced itself from any one

employment report. As a result, it would take a significant miss of the median forecast

(Bloomberg survey) to alter market expectations for a 50 bp hike when the FOMC

meeting concludes on December 14.Economists are looking for

around a 200k increase in US...

Read More »

Read More »

Consolidative Session, even if Not Turn Around Tuesday

Overview: The US dollar is trading with a somewhat heavier bias after bouncing

higher yesterday. All the G10 currencies are higher, led by the New Zealand

dollar, where the central bank is expected to hike first thing tomorrow. Most emerging

market currencies are also firmer. Those that are not, like the South Korean

won and Mexican peso, are nursing minor losses. The surge in Covid cases

weighed on Chinese shares that trade in Hong Kong, while the...

Read More »

Read More »

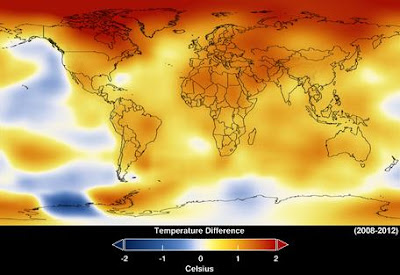

High Anxiety: China’s Covid and US Inflation

Overview: Anxiety is running high. Rather than ease its Covid restrictions, a surge in cases is seeing more areas in China come under restrictions. The US reports CPI and of the ten reports this year, seven of them have been stronger than expected.

Read More »

Read More »

The Week Ahead: How Sticky is US Inflation and How Soft is China’s?

There are three potential inflection points. The first is a

pause from the Fed; if nothing else, Powell signaled it was too early to think

about it. The second is for the Bank of Japan to change monetary policy.

Governor Kuroda has signaled that it is not time. Conventional wisdom is there

will not be a change until Kuroda's term ends next April. However, we note that

the surveys suggest economists and BOJ inflation forecasts for next year have...

Read More »

Read More »

It is not So Much about the Fed’s hike Today but the Forward Guidance

Overview: A consolidative tone has emerged ahead of the outcome

of the FOMC meeting later today. The focus is not so much on the 75 bp rate

hike, but on its forward guidance. Many expect the Fed to signal it will return

to a 50 bp move next month, but we are not convinced that it will go beyond indicating

that 50 bp or 75 bp will be debated in December, depending on the data. The market

has a 5% terminal rate discounted. The Fed does not need to...

Read More »

Read More »

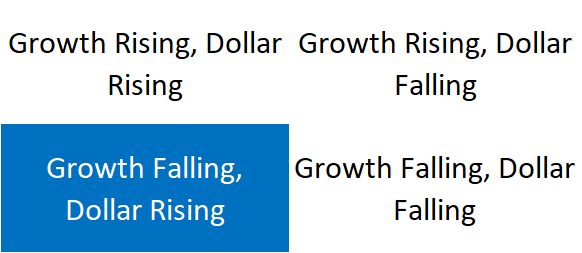

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

No Relief for the Euro or Sterling

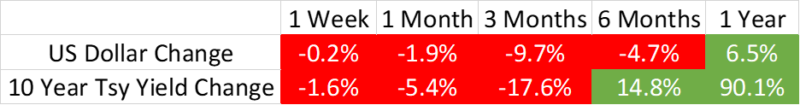

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors.

Read More »

Read More »

Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong.

Read More »

Read More »

Greenback Softens, but Think Twice about Chasing It

Overview: Aside from political economic risks, three

other challenges are emerging. First, the new sub-variant of Covid is spreading

rapidly. BA5 reportedly is accounting for around 80% of the new cases. It is

better able to evade antibodies from vaccines and earlier infections. Hospitalization

rates are also climbing. Dining, retail, and travel may be impacted. Second,

the World Health Organization declared monkeypox a global emergency. The US...

Read More »

Read More »

The Dollar Remains Bid, while Sterling Shrugs Off Johnson’s Political Woes

Overview: The dollar jumped yesterday making new highs against most of the major currencies, including the euro, sterling, the dollar-bloc and the Scandis. The yen and Swiss franc held in better, but the greenback still closed firmly against the yen despite a six-basis point decline in the 10-year yield.

Read More »

Read More »

China and Hong Kong Stocks Plummet, Yields Soar

Overview: While the World Health Organization debates about downgrading Covid from a pandemic, the rise China and Hong Kong cases is striking. A lockdown in Shenzhen and restrictions in Shanghai, coupled with a record fine by PBOC officials on Tencent drove local stocks sharply lower. China's CSI 300 fell 3% and a measure of Chinese stocks that trade in HK plunged more than 7%.

Read More »

Read More »

Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs.

Read More »

Read More »

Pessimistic Omicron Assessment Squashes Risk Appetites

Overview: A pessimistic assessment offered by the CEO of Moderna shattered the fragile calm seen yesterday after the pre-weekend turmoil. Risk appetites shriveled, sending equity markets lower and the bond markets higher. Funding currencies rallied, with the euro and yen moving above last week's highs. The uncertainty weighs on sentiment and makes investors question what they previously were certain of. The MSCI Asia Pacific Index fell over 1%...

Read More »

Read More »