Tag Archive: China

Position Squaring Ahead of US Data Helps the Dollar Recoup Some Recent Losses

Overview: Position-squaring ahead of today's US

personal consumption data and perhaps tomorrow's jobs report is giving the

dollar a firmer profile against most G10 and emerging market currencies. The

Scandis have been the hit hardest and are off 0.75%-0.85%. The euro and

sterling about 0.35%-0.45% lower. The yen is the only G10 currency that is

slightly firmer. The dollar-bloc is nursing small losses (0.10%-0.15%). Despite

the firmer than expected...

Read More »

Read More »

Market Awaits US Data and Leadership

Overview: The dollar staged a major technical

reversal yesterday, in a dramatic reaction to a considerably weaker JOLTs

report than expected, spurring a large drop in US interest rates. And this is

despite press reports that the participation rate in the survey is half of what

was three years ago. We suspect the price action said as much about market

positioning as it did about the data. The path to the US jobs data on Friday

goes through...

Read More »

Read More »

Still No Follow-Through Dollar Buying After Last Week’s Surge

Overview: The dollar was threatening to break higher

at the end of last week, and the euro and sterling closed below key supports. However,

so far this week, the greenback is consolidating and has not seen

follow-through buying. The key data this week, US consumption and jobs, and the

eurozone's CPI still lay ahead. The Antipodeans and Norwegian krone enjoy a

firmer today. A 0.8% contraction in Sweden's Q2 GDP was not as deep as had been

feared,...

Read More »

Read More »

Dollar Consolidates as Market Considers Breakout and Rebuffs Beijing’s Latest Efforts

Overview: Many market participants sense an

inflection point is near. The dollar settled last week beyond key levels

against several major currencies, bolstered by higher short-term US rates. The

market is aware that the Bank of Japan could intervene in the foreign exchange

market with the trading near its best levels of the year, and the 10-year JGB

yield grinding higher. Beijing cut the tax on equity transactions, will

restrict IPOs, and urged...

Read More »

Read More »

Dollar Bid and Rates Firm Ahead of Powell

Overview: The euro and sterling took

out important chart levels near $1.08 and $1.26, respectively. They have

steadied in the European morning but remain fragile ahead of Fed Chair Powell's

speech at Jackson Hole. A couple of ECB officials sounded a bit hawkish and a

less hawkish comment by ECB President Lagarde could renew the pressure on the

euro. The market appears to be going into Powell's speech with a hawkish bias

and the odds of a hike next...

Read More »

Read More »

Dollar Eases, Stocks and Bonds Advance

Overview: For the first time in more than a week,

North American dealers will take to their posts with the dollar softer against

all the G10 and most of the emerging market currencies. Despite stepped up

efforts by Chinese officials and a firmer yen, the yuan remains on the

defensive and is one of the handful of emerging market currencies softer on the

day. Stocks and bonds are mostly higher too. The yuan might not be benefitting

from a softer...

Read More »

Read More »

China Surprises While the Dollar Begins Week Softer

Overview: The new week, which features the BRICS

meeting and the Jackson Hold symposium is off to a quiet start. The failure of

Chinese banks to pass through last week's 15 bp cut fully into the lending

prime rates was a major disappointment and it is not yet clear the logic. While

the yuan and yen are softer, as are more local Asian currencies, while most of

the G10 currencies are posting small gains against the greenback. Gold is

trading little...

Read More »

Read More »

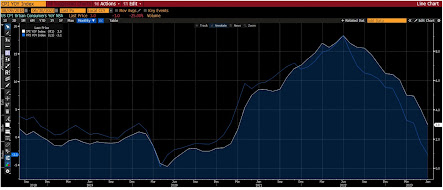

Dollar Bulls Still in Control

Overview: What may have been hoped to be a quiet

August has turned into a feeding frenzy for dollar bulls as the contrasting

economic performance has spurred persistent buying of the greenback. Even

shallow dips have been bought. Today, it is mostly trading inside yesterday's ranges

against the G10 currencies. The PBOC set the dollar's reference rate at what

appears to be a record gap below the Bloomberg average survey, and the dollar

was scooped...

Read More »

Read More »

Dollar’s Rally Pauses Near Key Levels

Overview: The US dollar is trading with a slightly

heavier tone in the European morning. It has stalled in front of JPY145.90,

where the BOJ intervened last September and ahead of CNY7.30, which some

observers think Chinese officials are defending. We are less convinced that

either central bank has drawn a line at a particular level and suspect it is

too early to be confident that the greenback has peaked against either. On the

back of yesterday's...

Read More »

Read More »

Surprise-Packed Tuesday: China Cut Rates, Japan’s Q2 GDP Rises Twice as Fast as Expected, and UK Wages Accelerate

Overview: Today's highlights include a surprise rate

cut from China after another series of disappointing data and much stronger

than expected Japanese Q2 GDP (6% annualized pace). The UK reported an

unexpected sharp jump in average weekly earnings, which were sufficient to get

renew speculation of a 50 bp hike by the Bank of England next month. The US

dollar is mixed. The Swedish krona and dollar-bloc currencies are struggling,

while the Swiss...

Read More »

Read More »

Greenback Remains Firm, with Yen and Aussie Falling to New 2023 Lows

Overview: The dollar and US rates remain firm. The

greenback rose to new highs for the year against the Japanese yen and

Australian dollar before steadying. Outside of the Swedish krona, which is off

nearly 0.5%, the G10 currencies are nursing small losses late in the European

morning, mostly less than 0.1%. Most emerging market currencies are also lower. The Chinese

yuan gapped lower for the second consecutive session and is also approaching

this...

Read More »

Read More »

Dollar Proves Resilient and Even Strong UK GDP Figures Hardly Dents It

Overview: The dollar's resilience after initially

selling off in response to the as-expected CPI was impressive. A quieter tone

is dominating today and most of the G10 currencies are +/- 0.15%. While the

dollar is consolidating, the underlying tone is still firm. For the week, it

has risen against all the major currencies and the Dollar Index is up nearly

0.6% this week, its fourth consecutive weekly gain. The greenback is rising

today against most...

Read More »

Read More »

The Greenback is Softer Ahead of CPI but Key Chart Points Remain Intact

Overview: The deluge of Treasury supply is nearly

over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year

bonds to finish the quarterly refunding. The sales will come after the July CPI

print that is expected to see the first year-over-year increase since last June.

The market is going into the report with about a 15% chance of a Fed hike next

month discounted. Meanwhile, September crude oil extended its recover from $80

seen...

Read More »

Read More »

After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well

received, with the three-year note being scooped up by investors, driving the

yield below it was trading in the when-issued market. Today, the Treasury sells

$38 bln 10-year notes, whose auctions have been less than stellar recently. The

US 10-year yield reached 4.20% last week and is now straddling 4%. Italian

bonds are also firm as the Italian government clarifies the

new tax on banks' windfall...

Read More »

Read More »

Dollar Comes Back Bid

Overview: The US dollar is recovering today

after it was sold following the jobs report before the weekend. It is enjoying

a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring

best, while the Scandis are off close to 0.5%. Most emerging market currencies

are also softer, with only a few Asian currencies edging higher today,

including the South Korean won, Indian rupee, and Taiwanese dollar. With a

stronger dollar and...

Read More »

Read More »

US Jobs Report and OPEC Statement Featured Ahead of the Weekend

Overview: The

capital markets are calmer today but the US (and Canadian) jobs data stand in

the way of the weekend. While equity markets are firmer, the rise in yields

continues with new highs for the week being recorded today. European benchmark

yields are 2-3 bp higher and the US 10-year Treasury yield is approaching 4.20%.

Most of the large market in the Asia Pacific region advanced, but South Korea

and Taiwan where the superconductor...

Read More »

Read More »

Markets Remain Unsettled, Bonds and Stocks Retreat, Dollar Gains Ahead of BOE

Overview: The global

capital markets remain unsettled. The combination of the BOJ adjustment of its

monetary policy, Fitch's downgrade of the US to AA+, ahead of a flood of

supply, and new measures by China have injected volatility into the summer

markets. The US dollar has extended it gains today against the G10 currencies

and most emerging market currencies. The yen has recovered a bit after the BOJ

stepped in and bought JGBs for the second time...

Read More »

Read More »

BOJ Moves to Slow JGB Sell-Off, while Month-End is Making for Subdued Price Action in FX outside the Yen

Overview: The Bank of Japan took the market by

surprise with its adjustment of the cap on the 10-year yield before the

weekend, and then stepped in to buy the government bond as yields rose in

reaction today. The move helped lift the dollar to JPY142.50. from where it had

settled on Friday (~JPY141.15). The dollar is mostly softer, however, with only

the yen and Swiss franc weaker. The Australian dollar is leading the other

currencies higher ahead...

Read More »

Read More »

Euro Edges Higher

Overview: The US dollar has mostly steadied at

the start of the week after last week's sharp losses. The yen, euro, and Swiss

franc are enjoying a firmer tone, but only the euro has thus far extended

last week's gains, and then, only marginally. Uninspiring data from China

pressed the yuan lower, while the firm euro is helping the central European

currencies. A typhoon shut Hong Kong markets and Japan's markets were closed

for a national holiday....

Read More »

Read More »

After Dramatic Week, Capital Markets are Stabilizing

Overview: After tumbling headlong this week, the

dollar appears to be broadly consolidating ahead of the weekend Among the G10

currencies, the Canadian dollar's 1.2% gain is the least and it made new

10-month highs earlier today The beleaguered Scandis soared The Norwegian

krone's 6.6% advance followed by the Swedish krona's 5.8% surge led the major

currencies The Dollar Index is off about 2.4% this week ahead of the North

American session It is...

Read More »

Read More »