The US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765.

Read More »

Tag Archive: Canada Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, April 20: The Greenback is Alive

The US dollar is set to finish the week on a firm note. It reflects rising US yields, where the 10-year is above 2.90% for the first time since February and the widening two-year different between the US and Germany, which is holding just below 300 bp. It is the fourth consecutive advancing session for the Dollar Index, which is near a two-week high.

Read More »

Read More »

FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

The euro has depreciated by 0.13 to 1.1043 CHF. ECB President Draghi did not argue forcefully enough at yesterday's press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year's high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near.

Read More »

Read More »

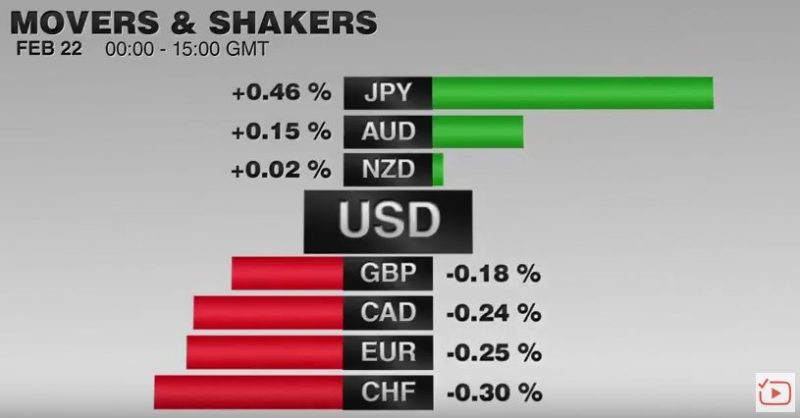

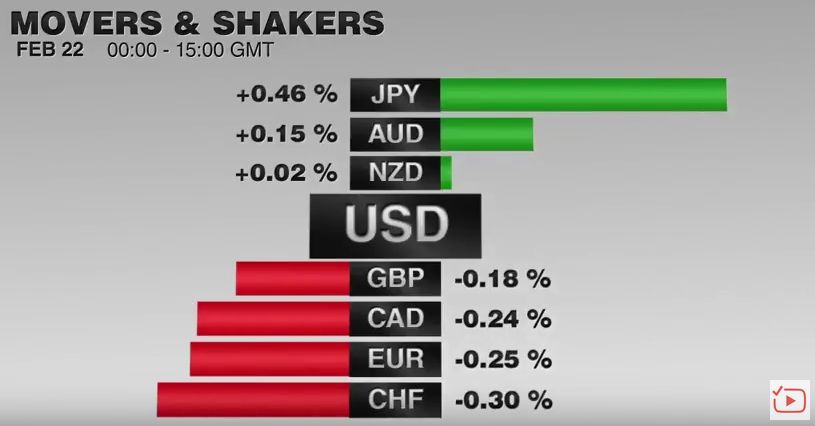

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »