Tag Archive: Brazil

Euro$ #5 in Goods

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one?

Read More »

Read More »

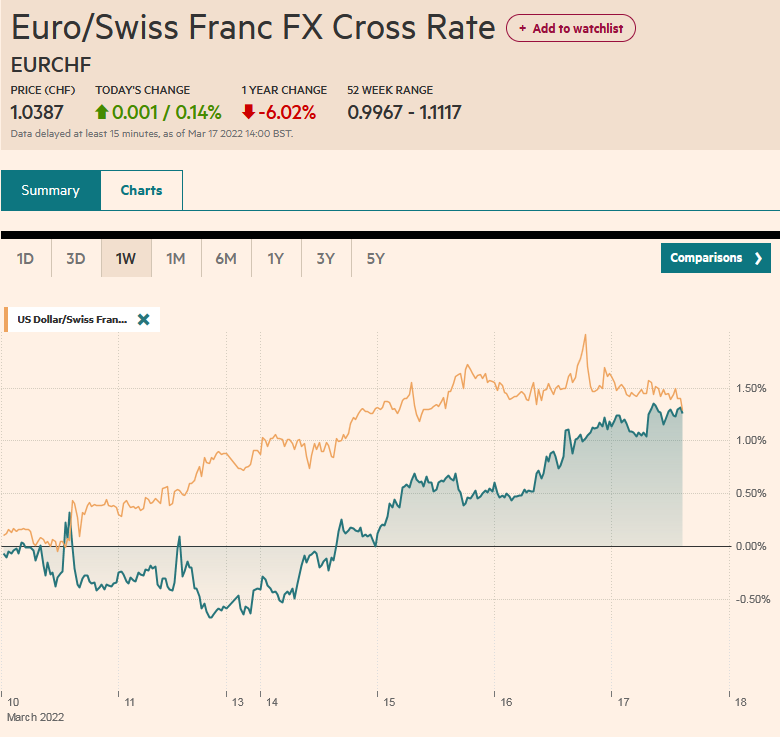

FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

Overview: The markets continue to digest the implications of yesterday's Fed move and Beijing's signals of more economic supportive efforts as the Bank of England's move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the dilemma (behind the inflation curve) to the other horn (recession fears). Asia Pacific equities extended yesterday's surge. The Hang Seng led the...

Read More »

Read More »

Risk Assets Given a Reprieve

Overview: US equities failed to sustain early gains yesterday, but risk appetites have returned today. Asia Pacific equities had a poor start, with Chinese and Japanese indices losing ground, but the equity benchmarks in Taiwan, Australia, India, and most of the smaller markets traded higher. Taiwan's 1.1% gain is notable as foreign investors continued to be heavy sellers.

Read More »

Read More »

Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week.

Read More »

Read More »

Yuan Rises Despite China’s Move and the Fed’s Course is Set Regardless of Today’s CPI

Overview: After US equity indices posted their first loss of the week, Asia Pacific and European equities fell. While the MSCI Asia Pacific Index fell for the first time since Monday, Europe's Stoxx 600 is posting its third consecutive decline. US futures are trading slightly firmer. The US 10-year Treasury yield is up about 1.5 bp to 1.51%, which is about eight basis points higher than it settled last week when the sharp drop in equities saw...

Read More »

Read More »

Markets Turn Cautious Ahead of Tomorrow’s US CPI

Overview: The euro has come back offered after its seemingly inexplicable advance yesterday. The dollar is firmer against most major currencies today, with the yen an exception after JPY114.00 held on yesterday's advance. Most emerging market currencies are also softer, with a handful of smaller Asian currencies proving a bit resilient. Most large bourses advance in the Asia Pacific region, except Japan and Australia. Europe's Stoxx 600 is...

Read More »

Read More »

The Greenback Slips to Start the New Week

Overview: While the Belarus-Poland border remains an intense standoff, there have been a couple other diplomatic developments that may be exciting risk appetites today. First, Biden and Xi will talk by phone later today. Second, reports suggest the UK has toned down its rhetoric making progress on talks on the implementation of the Northern Ireland Protocol.

Read More »

Read More »

Eyes Turn to the ECB and the First Look at Q3 US GDP

Overview: The market awaits the ECB meeting and the first look at the US Q3 GDP. The pullback in US shares yesterday was a drag on the Asia Pacific equities. It is the first back-to-back loss of the MSCI Asia Pacific in a few weeks. Europe's Stoxx 600 is recovering from early weakness and US future indices are firm. The US 10-year yield is flat, around 1.55%, after falling around 15 bp over the past four sessions. European bonds are paring...

Read More »

Read More »

Today’s Big Events Still Lie Ahead

Overview: The day’s big events lie ahead: the UK’s budget, the Bank of Canada, and the central bank of Brazil meetings. The US data on tap, especially trade and inventories, will allow economists to fine-tune their forecasts for tomorrow’s first estimate of Q3 GDP. The mixed tech earnings helped spur a bout of profit-taking in Asia Pacific equities, where most of the large markets fell. Europe’s Stoxx 600 is posting a slight loss for the first...

Read More »

Read More »

Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached...

Read More »

Read More »

What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%.

Read More »

Read More »

Consolidative Mood Grips Markets

Overview: The dollar is consolidating yesterday's advance and is confined to fairly narrow ranges in quiet turnover. Most of the major currencies are within 0.1% of yesterday's close near midday in Europe. The $1.1700-level held in the euro.

Read More »

Read More »

Rising Rates Underpin the Greenback

Overview: The US dollar remains firm ahead of the July CPI release, and even though Chicago Fed Evans demurred from the hawkish talk, the market is getting more comfortable with the idea of a rate hike next year.

Read More »

Read More »

US Employment Data is Important but for the Millionth Time, Don’t Exaggerate It

Overview: Record high closes yesterday for the S&P 500 and NASDAQ have done little to help global equities today. Most of the Asia Pacific region markets, but Japan and Australia slipped ahead of the weekend while still holding on to gains for the week.

Read More »

Read More »

Yesterday’s Dollar Recovery Stalls

Overview: US interest rates and the dollar turned higher following comments by the Fed's Vice Chairman Clarida, who appeared to throw his lot with the more hawkish members. The dollar recovered from weakness that had seen it fall to almost JPY108.70, its lowest level since late May, and lifted the euro to $1.19.

Read More »

Read More »

Greenback Softens amid Stronger Risk Appetites to Start August

Overview: Risk appetites snap back after easing in the waning hours last month. The MSCI Asia Pacific equities jumped back after dropping 1.8% last week for the second week in a row. Japan's Topix and China's CSI 300 rose by more than 2%, and Hong Kong, Taiwan, and Australia gained more than 1%.

Read More »

Read More »

FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

The dollar has steadied after surging yesterday and has so far retained the lion's share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming.

Read More »

Read More »

FX Daily, July 01: The Greenback is Bid to Start the Second Half

Soft Asian manufacturing PMIs weighed on local shares after the S&P 500 set new record highs yesterday. European shares are recouping yesterday's month-end losses, while US futures indices are bid. The US 10-year yield is around 1.47%, and European yields are 1-2 bp higher.

Read More »

Read More »

FX Daily, June 17: Fed Rocks the World

A more hawkish than expected Federal Reserve sent the US dollar and interest rates higher and spurred an equity sell-off. The knock-on effect sent ripples through the capital markets today. Most equity markets in the Asia Pacific region fell. China, Hong Kong, and Taiwan were notable exceptions.

Read More »

Read More »

FX Daily, June 16: Will the Fed Talk the Talk?

With the outcome of the FOMC meeting awaited, the dollar is narrowly mixed in quiet turnover. The Scandis are the weakest (~-0.3%) among the majors, while the Antipodeans are the strongest (~+0.25%). JP Morgan's Emerging Market Currency Index is snapping a three-day decline

Read More »

Read More »