Tag Archive: Brazil

Japan’s Q4 23 Contraction Revised Away, Helping Keep Yen Bid

Overview: News that the Japanese economy expanded rather than contracted in Q4 23 has fanned expectations that rates could be as early as next week. This is helping keep the yen supported, though it remains in the pre-weekend range, albeit barely.

Read More »

Read More »

Weak US Durable Goods may Herald Pullback in Capex

Most of the G10 currencies are trading quietly in narrow ranges today. After a slightly firmer than expected national CPI reading, which still moderated, and a pullback in US yields, the Japanese yen is the strongest of the major currencies.

Read More »

Read More »

Dollar Stabilizes After Extending Gains

Overview: The dollar's gains were initially extended before a

consolidative tone emerged. The euro has been sold to $1.0460

and has returned to almost $1.05. Sterling fell to nearly $1.2060 and has

recovered though has stopped short of $1.2100. The dollar edged closed to

JPY150 but stalled near JPY149.95 and has held above JPY149.65. The Australian

dollar near $0.6300 and the greenback rose to CAD1.3725.

Benchmark 10-year yields are firm, though...

Read More »

Read More »

Looming US Government Shutdown Stems the Dollar’s Surge

Overview: The increasingly likely partial US federal

government shutdown has spurred a bout of liquidation of long dollar positions.

The psychologically important JPY150 level was approached, and the euro was

sold through $1.05 yesterday, and the greenback has come back better offered

today. It is lower against all the G10 currencies. It is mixed against the

emerging market currency complex, with central European currencies and South

African rand...

Read More »

Read More »

Higher for Longer Lifts the Dollar, while SNB Surprises Many by Standing Pat–Over to the BOE

Overview: The Federal Reserve's hawkish hold, which

included 50 bp less of cuts next year than it had signaled in June, has lifted

the dollar against most currencies today. The notable exception is the Japanese

yen. The greenback did extend its advance to new highs for the year before the

market turned cautious ahead of the outcome of the Bank of Japan meeting

tomorrow. The Swiss franc is the weakest of the G10 currencies after the Swiss

National...

Read More »

Read More »

Softer UK CPI Weighs on Sterling and Lifts Gilts, while Yen Slumps to New Low for the Year, Ahead of the FOMC

Overview: Softer than expected UK CPI has drawn

attention ahead of the key event of the day, the FOMC meeting. The UK's CPI has

spurred a dramatic rally in Gilts and saw sterling initially extend its recent

losses, falling to new four-month lows before stabilizing. The swaps market

sees less than a 50% chance of a hike by the Bank of England tomorrow. Meanwhile,

even though US Treasury Secretary Yellen suggested conditions in which

intervention by...

Read More »

Read More »

US Dollar Punches Higher

Overview: Disappointing

data in Asia and Europe has sent the greenback broadly higher. The strong gains

posted before the weekend were mostly consolidated yesterday when the US and

Canadian markets were on holiday. The rally resumed today. The Antipodeans and

Scandis have been hit the hardest (-0.7% to -1.25%) but all the G10 currencies

are down. The Swiss franc and yen are off the least (-0.35%-0.45%), and the

euro and sterling have taken out...

Read More »

Read More »

Greenback Remains Firm, with Yen and Aussie Falling to New 2023 Lows

Overview: The dollar and US rates remain firm. The

greenback rose to new highs for the year against the Japanese yen and

Australian dollar before steadying. Outside of the Swedish krona, which is off

nearly 0.5%, the G10 currencies are nursing small losses late in the European

morning, mostly less than 0.1%. Most emerging market currencies are also lower. The Chinese

yuan gapped lower for the second consecutive session and is also approaching

this...

Read More »

Read More »

Markets Remain Unsettled, Bonds and Stocks Retreat, Dollar Gains Ahead of BOE

Overview: The global

capital markets remain unsettled. The combination of the BOJ adjustment of its

monetary policy, Fitch's downgrade of the US to AA+, ahead of a flood of

supply, and new measures by China have injected volatility into the summer

markets. The US dollar has extended it gains today against the G10 currencies

and most emerging market currencies. The yen has recovered a bit after the BOJ

stepped in and bought JGBs for the second time...

Read More »

Read More »

Fitch Roils Markets

Overview: Late yesterday, on the eve of the

quarterly refunding announcement, Fitch cut the US rating to AA+ from AAA,

citing project fiscal deterioration over the next few years and "the

erosion of governance". S&P also has the US as an AA+ credit. Ironically,

many observers who have been critical of the US monetary and fiscal policies,

like former Treasury Secretary Summers and El-Erian, were also critical of Fitch's

decision. The...

Read More »

Read More »

UK Inflation Surprises to the Upside and Weighs on Sterling

Overview: The UK surprised with higher-than-expected consumer

inflation and budget deficit, and the odds of a 50 bp hike tomorrow edged

higher. Sterling has been sold on the news and is the weakest of the G10

currencies, off about 0.5%. The dollar is mixed with the euro, Swedish krona,

Canadian dollar, and Swiss franc posting small gains. Emerging market

currencies are lower, including the Chinese yuan, which is at new lows since

last November. The...

Read More »

Read More »

Hawkish ECB Comments Boost Risk of a 50 bp Hike Next Month

Overview: The 0.5% decline in US March producer

prices pushed on the door opened by the softer-than-expected CPI on Wednesday.

The Fed funds futures market sees the year end rate to a 4.33%, while still

pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled

to new lows for the year against the euro, sterling, and Swiss franc. The

Dollar Index made a new low for the year today, a few hundredths of an index

point below the low...

Read More »

Read More »

US Dollar Slumps and China Surprises with Twice the Expected Trade Surplus

Overview: The market took US short-term rates and

the dollar lower after the CPI data, which was largely in line with

expectations. On the one hand, the odds of a quarter-point hike next month

increased slightly (73.6% vs. 71.6%) to 5.25%, but it reinforced that sense

that it is last hike and that the Fed will unwind this hike and more before the

end of the year. The year-end implied policy rate fell by about six basis points to

4.33%. The dollar...

Read More »

Read More »

Greenback Pares Yesterday’s Gains

Overview: As the long-holiday ends, risk appetites

have returned. Equities and yields are mostly higher. The dollar is seeing

yesterday's gains pared. Yesterday's setback in the yen helped lift Japanese

stocks, with the Nikkei advancing 1%. Several other markets in the region also

gained more than 1%, including Australia and South Korea. China's CSI was an

exception. It slipped fractionally. Europe's Stoxx 600 is up nearly 0.6%

through the European...

Read More »

Read More »

Ueda Day

Overview: Rising rates and falling stocks provided the

backdrop for the foreign exchange market this week. The dollar appreciated

against all the G10 currencies but the Swedish krona, which is still correcting

higher after the hawkish pivot by the central bank. The market looks for a

later and higher peak in the Fed funds rate. This coupled with the risk-off

sentiment helped the dollar extend its recovery after falling since last...

Read More »

Read More »

US Interest Rate Adjustment Post-Jobs is Over as the 2-Year Yield Backs Away from 4.50%

Overview: The capital markets have shrugged off the

more than 1% loss of the Nasdaq and S&P 500 yesterday and have jumped back

into risk assets. The stocks and bonds have been bought and the dollar sold. Chinese

and Hong Kong shares gained more than 1% today. Japan was mixed and Taiwan and

South Korean equites saw minor losses. Europe's Stoxx 600 is up over 1%. Nasdaq

futures are up nearly 1.2% while the S&P 500 is lagging slightly....

Read More »

Read More »

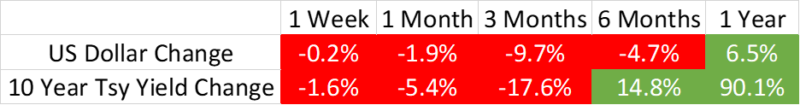

Weekly Market Pulse: A Fatal Conceit

Inflation* in the US is falling rapidly with the CPI rising just 0.9% in the second half of 2022 versus 5.4% in the first six months. Existing home sales are down 14.6% in the last 3 months and 34% over the last year. Housing starts are down 22% and permits are down 30% year-over-year. Orders for durable goods are down 1.2%, exports are down 3.8%, and imports are down 4.3% over the last 3 months.

Read More »

Read More »

Greenback Consolidates Near Recent Lows Ahead of Tomorrow’s US CPI

Overview: Fed Chair Powell did not push against the easing of US financial conditions when he ostensibly had an opportunity yesterday. This coupled with expectations of another decline in the US CPI, which will be reported tomorrow, has kept the greenback mostly consolidating the losses seen last Friday and Monday.

Read More »

Read More »

Consolidative Tone in FX

Overview: After sharp losses yesterday, the US dollar has stabilized today arguably ahead of Fed Chair Powell's speech at the Riksbank symposium. Yesterday's Fed speakers stuck to the hawkish rhetoric, and this seemed to help reverse the equity market gains, though the greenback remained soft.

Read More »

Read More »

Greenback’s Sell-off may Stall Ahead of Powell Tomorrow

Overview: Don't fight the Fed went the manta as the

market took the US two-year yield back up to 4.50% in the aftermath of the FOMC

minutes last week, the highest in over a month. The minutes warned of a

premature easing of financial conditions. And then bam, softer than expected

hourly earnings and a weak service PMI and bonds and stocks rallied, and the

dollar was sold. This is a key part of the backdrop for this week, for which

several Fed...

Read More »

Read More »