Tag Archive: Bonds

Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac.

Read More »

Read More »

Two Seemingly Opposite Ends Of The Inflation Debate Come Together

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else.

Read More »

Read More »

Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag.

Read More »

Read More »

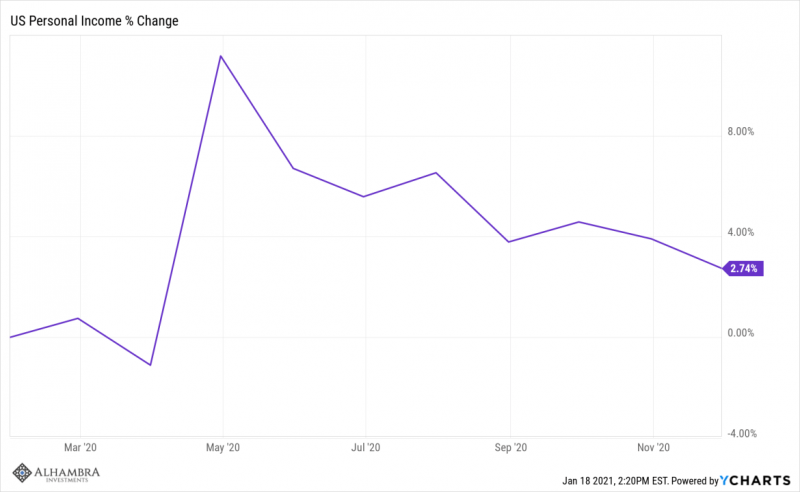

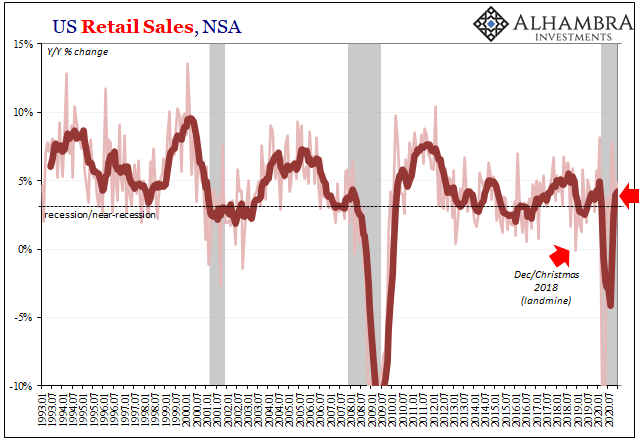

Consumers, Producers, and the Unsettled End of 2020

The months of November and December aren’t always easily comparable year to year when it comes to American shopping habits. For a retailer, these are the big ones. The Christmas shopping season and the amount of spending which takes place during it makes or breaks the typical year (though last year, there was that whole thing in March and April which has had a say in each’s final annual condition).

Read More »

Read More »

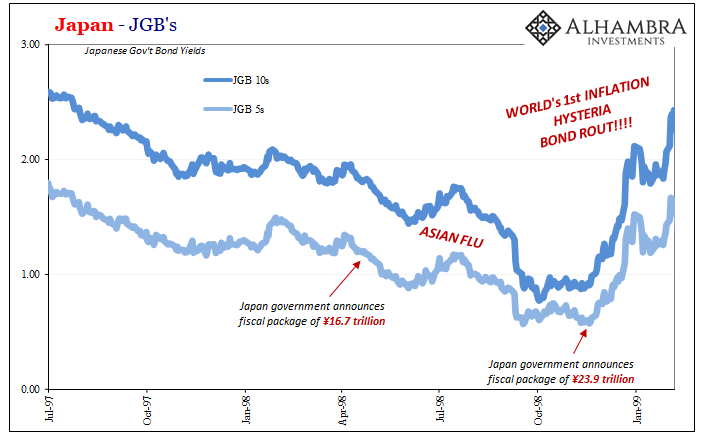

They’ve Gone Too Far (or have they?)

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

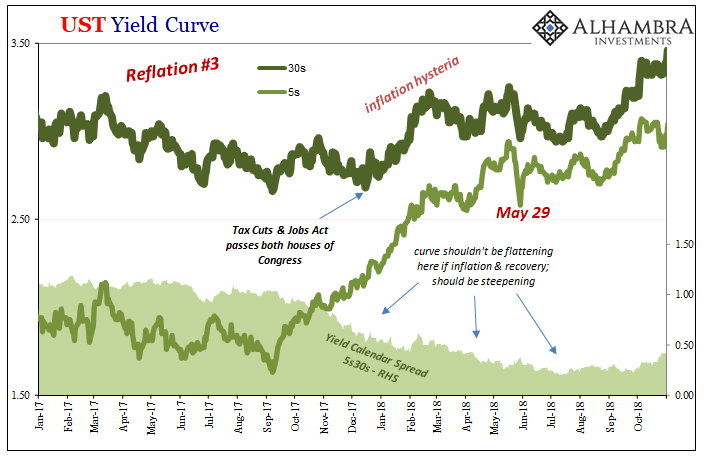

Inflation Hysteria #2 (Nominal UST)

What had given Inflation Hysteria #1 its real punch had been the benchmark 10-year Treasury note. Throughout 2017, despite the unemployment rate in the US, globally synchronized growth being declared around the world (and being declared as some momentously significant development), and whatever other tiny factors acceding to the narrative, longer-term Treasury rates just weren’t buying it.

Read More »

Read More »

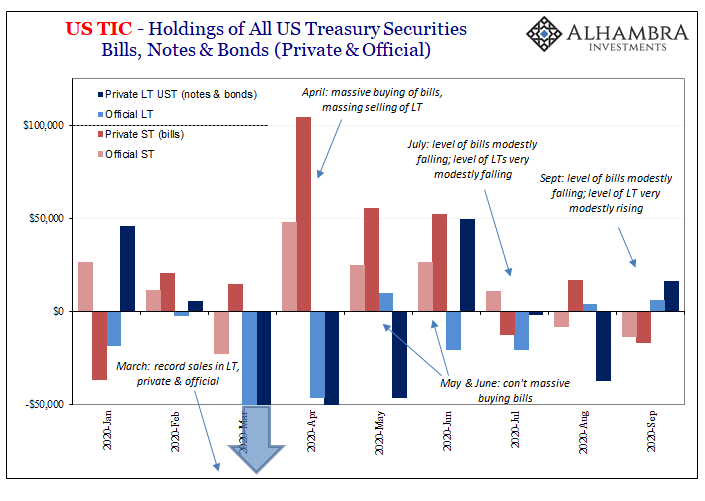

Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »

Extending the Summer Slowdown

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer

Read More »

Read More »

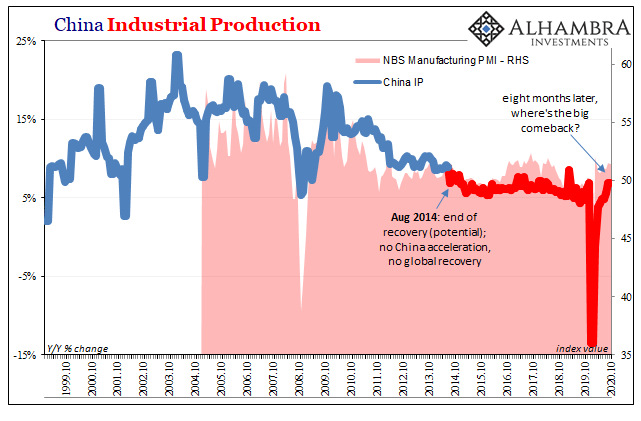

Six Point Nine Times Two Equals What It Had In Twenty Fourteen

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.”

Read More »

Read More »

Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too.

Read More »

Read More »

Meanwhile, Outside Today’s DC

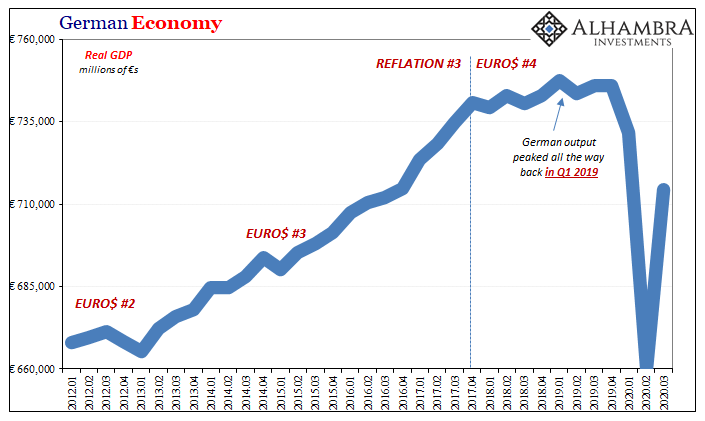

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

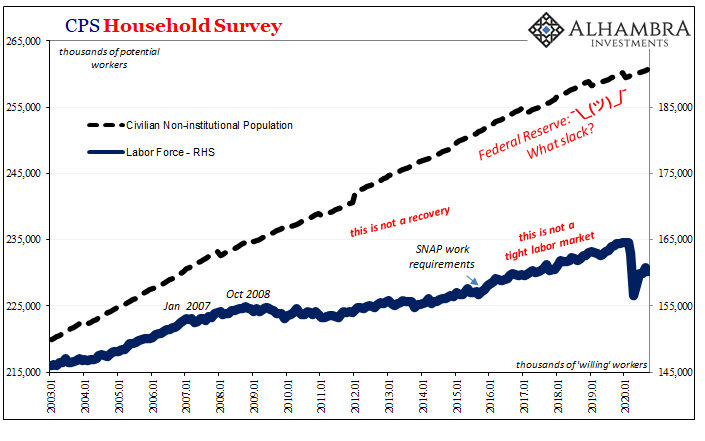

Who’s Negative? The Marginal American Worker

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments.

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »

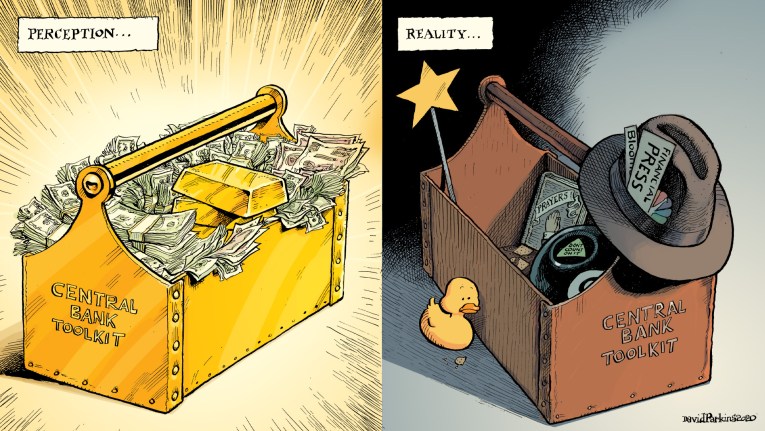

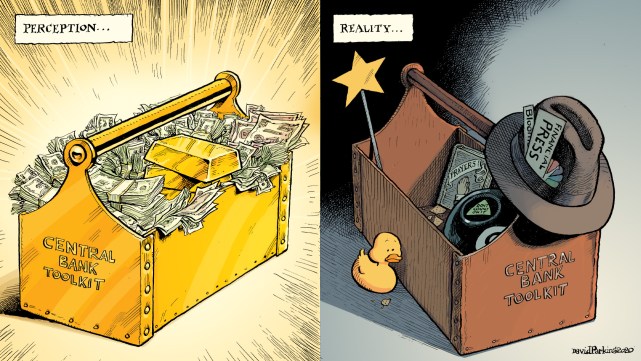

Why Aren’t Bond Yields Flyin’ Upward? Bidin’ Bond Time Trumps Jay

It’s always something. There’s forever some mystery factor standing in the way. On the topic of inflation, for years it was one “transitory” issue after another. The media, on behalf of the central bankers it holds up as a technocratic ideal, would report these at face value. The more obvious explanation, the argument with all the evidence, just couldn’t be true otherwise it’d collapse the technocracy right down to the ground.And so it was also in...

Read More »

Read More »

Monthly Macro Monitor – September 2020

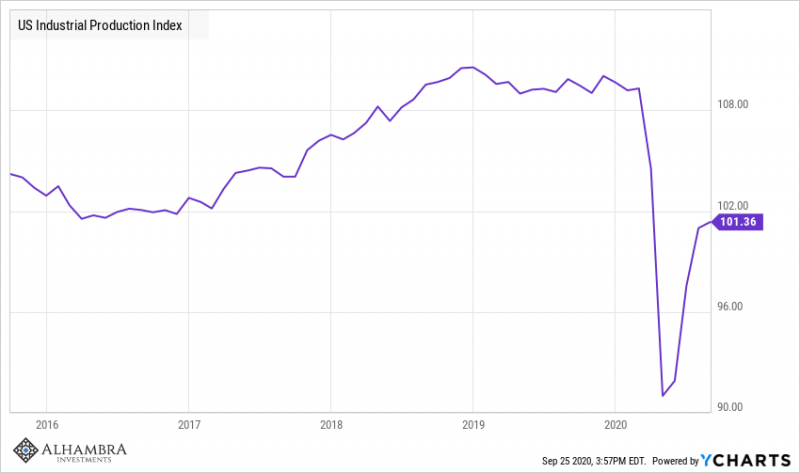

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

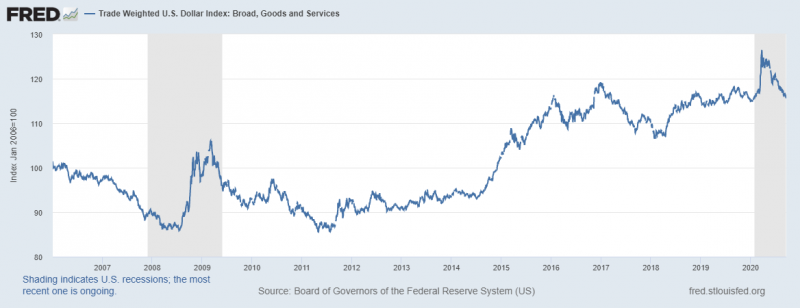

Uh Oh, The Dollar Has Caught A Bid

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008.

Read More »

Read More »

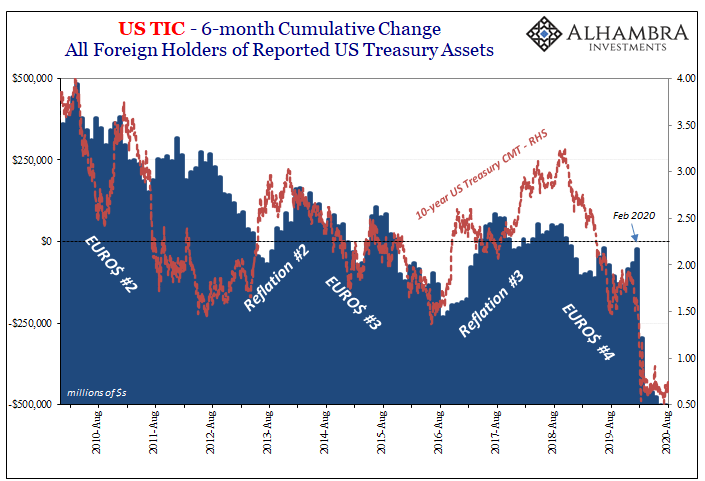

If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »