Tag Archive: Bank of Canada

US Dollar is Better Bid Ahead of Powell, while Aussie Sells Off on Dovish Hike by the RBA

Overview: The US dollar is trading with a firmer bias against

nearly all the G10 currencies ahead of Federal Reserve Chairman Powell's

semi-annual testimony before Congress. Speaking for the Federal Reserve, the

Chair is likely to stay on message which is higher rates are necessary to cool

the overheating economy. This comes on the heels of the Reserve Bank of

Australia's 25 bp hike and indication that it is not pre-committing to an April

hike. The...

Read More »

Read More »

Yields Pull Back to Start the New Week

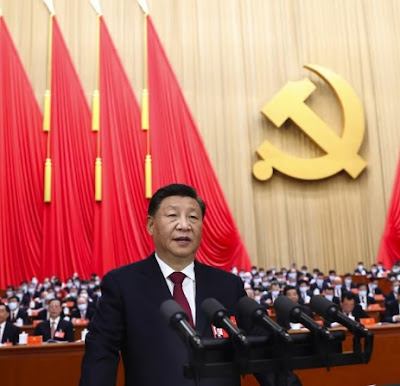

Overview: The modest economic goals announced as

China's National People's Congress starts was seen as a cautionary sign after

growth disappointed last year. It seemed to weigh on Chinese stocks, though

others large bourses in the region advanced, led by Japan's Nikkei and South

Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after

rising for the past two sessions. US index futures are slightly softer. Strong

gains were seen...

Read More »

Read More »

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

Bank of Canada may say Pause, but the Market Hears Finished

Overview: Amid sharp losses in the US equity futures, the US dollar is mostly firmer against the G10 currencies. The notable exception is the Australian dollar, where high-than-expected inflation boosts the risk of a more aggressive central bank.

Read More »

Read More »

No Follow-Through Euro Buying while S&P Holds Yesterday’s Breakout

Overview: A quiet consolidative session has been recorded

so far today as North American leadership is awaited. The preliminary PMI

readings are mixed. Japan and the eurozone look somewhat better, but Australia

and the UK disappointed. The dollar is trading with a mostly firmer bias,

but largely confined to yesterday's ranges. The markets seem to be looked

ahead toward next week's Fed, ECB, and BOE meetings, and the return of China

from this...

Read More »

Read More »

Greenback’s Sell-off may Stall Ahead of Powell Tomorrow

Overview: Don't fight the Fed went the manta as the

market took the US two-year yield back up to 4.50% in the aftermath of the FOMC

minutes last week, the highest in over a month. The minutes warned of a

premature easing of financial conditions. And then bam, softer than expected

hourly earnings and a weak service PMI and bonds and stocks rallied, and the

dollar was sold. This is a key part of the backdrop for this week, for which

several Fed...

Read More »

Read More »

Week Ahead: RBA and BOC Meetings Featured and China’s Inflation and Trade

The week ahead

is more than an interlude before five G10 central banks meet on December

14-15. The data highlights

include the US ISM services and producer prices, Chinese trade and inflation

measures, Japanese wages, household consumption, and the current account.

Also, the Reserve Bank of Australia and the Bank of Canada hold policy

meetings. Central banks from India, Poland, Brazil, Peru, and Chile also meet.The dollar appreciated in Q1 and Q2...

Read More »

Read More »

Dollar Slumps, Yuan Rallies by Most this Year amid Intervention Talk

Overview: The US dollar is having one of toughest days of the year. It has been sold across the board and taken out key levels like parity in the euro, $1.15 in sterling, and CAD1.36. The Chinese yuan surged over 1%. Chinese officials promised healthy bond and stock markets.

Read More »

Read More »

Macro and Prices: The Week Ahead

There are five macro highlights in the week ahead. After providing a thumbnail sketch of them, we will look more closely at the price action of the leading dollar-pairs. We suspect that the dollar is in the process of carving out a top amid ideas that a 5.0% terminal Fed funds rate is discounted.

Read More »

Read More »

Greenback Holds Above JPY150, while BOJ goes MIA

Overview: The continued surge in US rates and inability of the equity market to sustain gains saw the post-Truss sterling rally unwind amid a broader recovery of the dollar. Sterling has been sold to new lows for the week.

Read More »

Read More »

Currency and Bond Markets Challenge the Bank of Japan

Asia Pacific equities were mixed as the China, Hong Kong, Taiwan, and South Korean markets, among the large markets were unable to gain in the wake of a solid performance in the US. Europe is also struggling to maintain the upside momentum that has lifted the Stoxx 600 for the past four sessions.

Read More »

Read More »

Turn Around Tuesday Aside, is the Dollar Topping?

Global equities moved higher in the wake of the strong gains in the US yesterday. US futures point to the possibility of a gap higher opening today. Most of the large Asia Pacific bourses rallied 1%-2%, with China’s CSI a notable exception, slipping fractionally.

Read More »

Read More »

Sterling and UK Debt Market Respond Favorably to the Return of Orthodoxy

Overview: The markets have returned from the weekend with a greater appetite for risk. Equities and bonds are rallying, and the dollar is better offered. China, Hong Kong, South Korea, and Indian bourses advanced. Mainland shares edged higher even though Zhengzhou, a city of one million people, near an iPhone manufacturing hub was locked down due to Covid. Europe’s Stoxx 600 is up nearly 0.5% to extend its recovery into a third session.

Read More »

Read More »

The Yen and Yuan Continue to Weaken

While the US dollar appears to be consolidating its recent gains, the Japanese yen and Chinese yuan remain under pressure. Officials seem more concerned about the pace of the move than the level it has reached. New and large fiscal initiatives that the new UK government has floated has failed to change sentiment toward sterling, which is the second weakest major currency today after the Japanese yen.

Read More »

Read More »

RBA, BOC, and ECB Meetings and more in the Week Ahead

All

three major central banks that meet in the coming days will hike rates. The question is by how much. The Reserve Bank of Australia makes its

announcement early Tuesday, September 6. One of the challenges for policymakers and investors is

that Australia reports inflation quarterly. The Q2 estimate was released on July

27. It showed prices accelerating to 6.1% year-over-year from 5.1% in Q1. The

trimmed mean rose to 4.9% from 3.7%, and the...

Read More »

Read More »

Market Prices in More Aggressive Fed AND is more Confident of Rate Cuts by the End 2023

Overview: The higher-than-expected US CPI and the strong expectation of a 100 bp hike by the Fed in two weeks is propelling the dollar higher.

Read More »

Read More »

Euro Parity Holds ahead of US CPI

Overview: The US dollar is consolidating with a slight downside bias ahead of the June CPI report. The euro held above $1.00 but is still pinned in the trough. The rate hike by the Reserve Bank of New Zealand failed to have much impact.

Read More »

Read More »

Dollar Gains Pared

Asia Pacific equities were mostly lower. China and India bucked the trend. Europe’s Stoxx 600 is steady with no follow through selling after yesterday reversal. US index futures are posting modest gains and are trying to snap a two-day drop.

Read More »

Read More »

Bank of Canada’s Turn

Overview: The recent equity rally is stalling. Asia Pacific equities were mixed, with Japan, South Korea, and Australia, among the major bourses posting gains. Europe’s Dow Jones Stoxx 500 is slipping lower for the second consecutive session, ending a four-day bounce. US equity futures are little changed.

Read More »

Read More »

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

2022-09-10

by Stephen Flood

2022-09-10

Read More »