Tag Archive: Blockchain

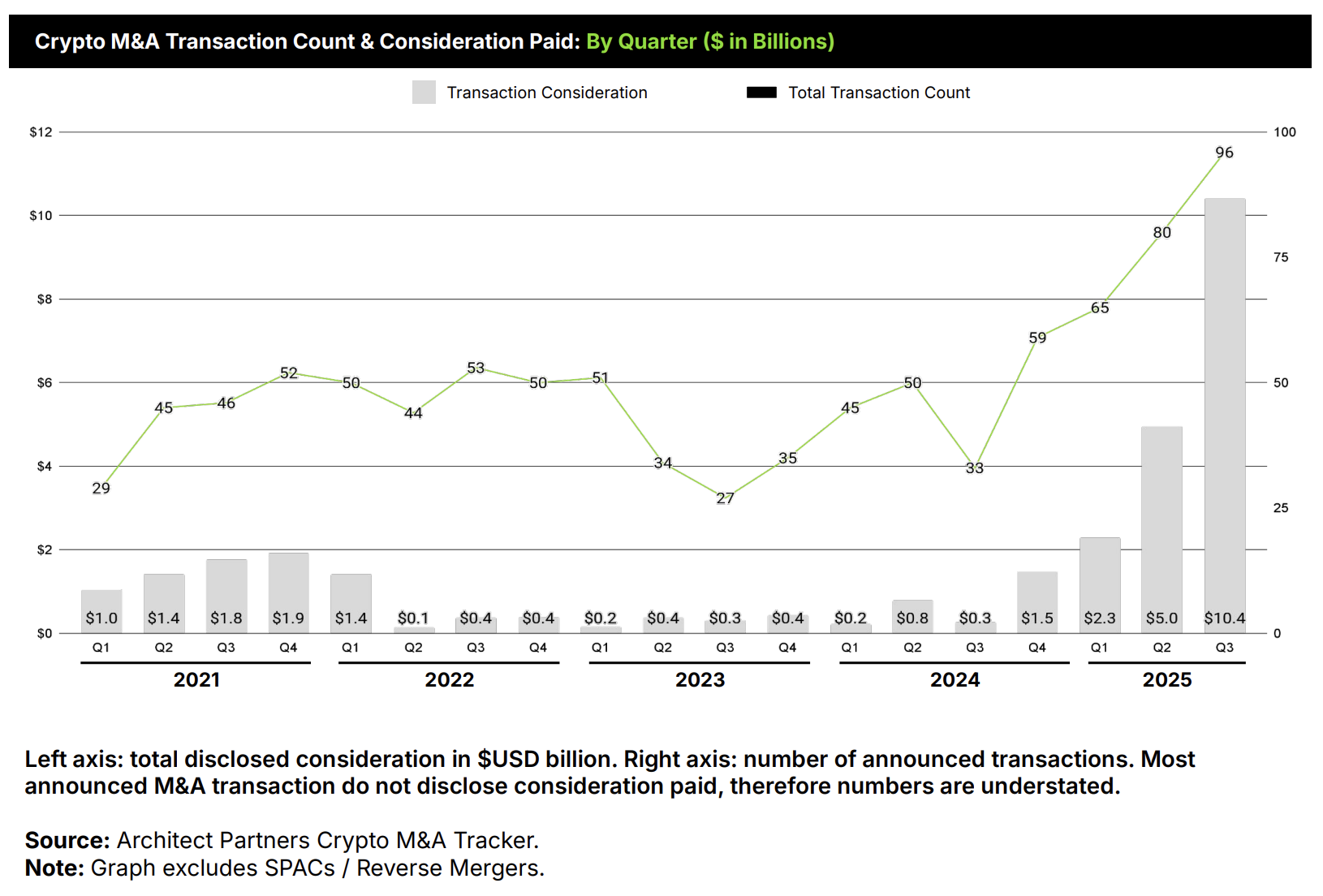

FalconX to Acquire 21Shares in Major Digital Asset Industry Deal

FalconX, an institutional digital asset prime brokerage, has agreed to acquire 21Shares, the provider of the world’s largest range of cryptocurrency exchange-traded funds and products (ETFs/ETPs).

The transaction marks a significant step in FalconX’s strategy to bridge listed markets and digital assets, expanding its presence across the US, Europe, and Asia-Pacific.

The acquisition combines 21Shares’ expertise in asset management product...

Read More »

Read More »

Relai Secures MiCA License from France’s AMF to Expand Across EU

Relai, a Swiss Bitcoin startup, has marked a significant milestone by obtaining authorisation as a Crypto-Asset Service Provider (CASP) under the EU’s Markets in Crypto-Assets (MiCA) Regulation.

The license, granted by France’s Financial Markets Authority (AMF), positions Relai among the first Bitcoin-focused firms to receive such approval in Europe.

The company, which raised a Series A funding round last year and has surpassed 500,000 app...

Read More »

Read More »

Revolut Secures MiCA License in Cyprus for EU Crypto Operations

Revolut has secured a Markets in Crypto-Assets (MiCA) license from the Cyprus Securities and Exchange Commission (CySEC), enabling it to offer regulated cryptocurrency services across all 30 countries in the European Economic Area (EEA).

Revolut, which serves more than 65 million customers worldwide, said the authorisation reaffirms its compliance-first approach to digital assets, CoinDesk reported.

The company plans to launch “Crypto 2.0,” an...

Read More »

Read More »

Swiss National Bank: SCION is an Ideal Infrastructure for DLT Cross-Border Payments

Distributed ledger technology (DLT) has the potential to improve today’s slow, expensive, and opaque cross-border payment systems by enabling instant, transparent, and resilient settlements.

However, because DLT systems rely on the public Internet, they remain exposed to infrastructure-based attacks.

According to the Swiss National Bank (SNB), these vulnerabilities can be addressed through SCION (Scalability, Control, and Isolation on...

Read More »

Read More »

Luxembourg’s Sovereign Wealth Fund Allocates 1% to Bitcoin ETFs

Luxembourg’s sovereign wealth fund has allocated 1% of its portfolio to Bitcoin exchange-traded funds (ETFs), becoming one of the first European state-backed investment entities to do so.

According to Cointelegraph, Luxembourg’s Director of the Treasury and Secretary General, Bob Kieffer, confirmed the investment in a LinkedIn post on 8 October.

He said Finance Minister Gilles Roth announced the decision during his presentation of the 2026 Budget...

Read More »

Read More »

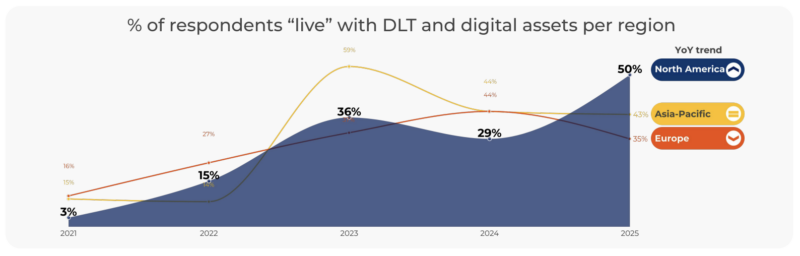

DLT Adoption Accelerates in Capital Markets, With Growing Focus on Digital Assets, Public Blockchains

This year, distributed ledger technology (DLT) continues to gain traction in capital markets, with institutions emphasizing asset mobility, digital tokens, and public blockchains to unlock new revenue streams and drive innovation, a new study by the International Securities Services Association (ISSA) found.

The study, conducted in collaboration with the ValueExchange, Broadridge, Accenture and Taurus, surveyed more than 420 respondents globally to...

Read More »

Read More »

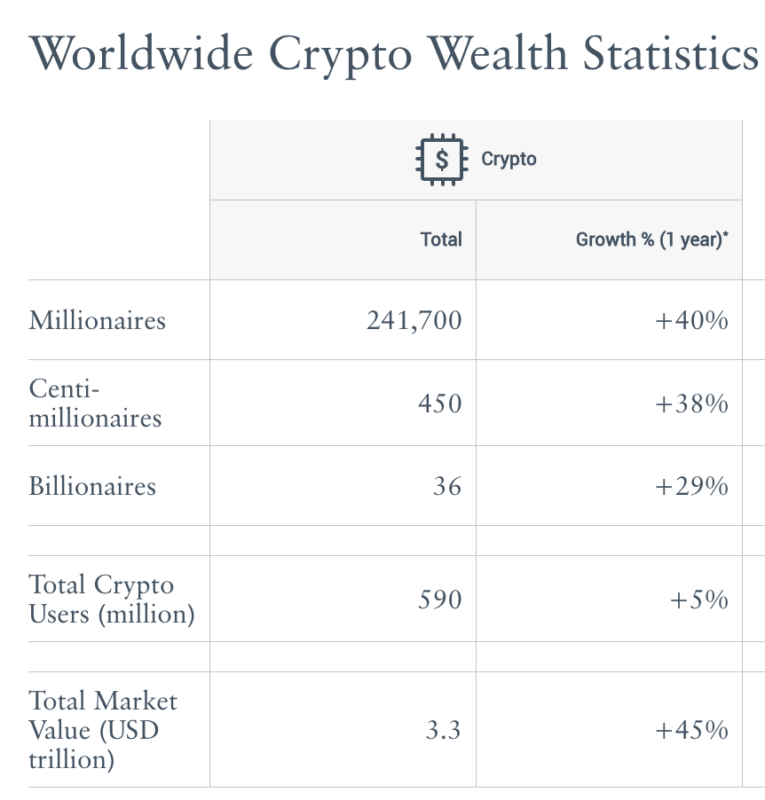

Global Crypto Wealth Surges, Driving 40% Increase in Millionaire Count

Soaring cryptocurrency prices over the past year have pushed the number of crypto millionaires to a record of 241,000 individuals worldwide as of July 2025, marking a remarkable 40% year-over-year (YoY) increase, according to a new report by British investment migration consultancy Henley & Partners.

Read More »

Read More »

SIX to Bring SDX Digital Asset Platform In-House

SIX, the operator of the Swiss Stock Exchange, is set to bring its digital asset division, SDX, in-house as it moves closer to becoming a blockchain-based marketplace.

In May, it was announced that digital bonds issued on SDX would be traded exclusively on the SIX Swiss Exchange.

Regarding equities, SDX supports both private securities and public assets.

“Everyone acknowledges that securities and other assets will eventually become digital....

Read More »

Read More »

US SEC and FINRA Probe 200+ Firms Over Crypto-Treasury Deals

Nearly 200 publicly traded companies are under scrutiny by the US Securities and Exchange Commission (SEC) over their crypto-focused treasury strategies, which have coincided with significant spikes in their stock prices.

According to CCN, the Financial Industry Regulatory Authority (FINRA) and the SEC have launched inquiries into more than 200 firms that announced “crypto-treasury” plans in 2025.

These strategies typically involve raising capital...

Read More »

Read More »

Deutsche Bank Conducts First Euro Cross-Border Payment via Partior Blockchain

Deutsche Bank has conducted its first euro-denominated cross-border payment using Partior’s blockchain platform.

The transaction was carried out in collaboration with DBS, Southeast Asia’s largest bank by assets, with Deutsche Bank acting as the settlement bank and DBS as the beneficiary bank.

Deutsche Bank invested in Partior in 2024 and finalised a platform agreement in May 2025 to provide real-time, secure, and scalable settlement.

This live...

Read More »

Read More »

Swiss Banks Complete First Deposit Token Trial on Public Blockchain

The Swiss Bankers Association (SBA), PostFinance, Sygnum and UBS have completed a feasibility study enabling legally compliant payments with digitised bank deposits on a public blockchain.

The findings mark a first for the Swiss financial centre.

While today’s payment systems are fast and efficient, they face limitations with emerging digital business models. The deposit token concept seeks to address this by bringing bank deposits onto the...

Read More »

Read More »

CFTC Considers Allowing MiCA-Licensed Platforms to Operate in US

The US Commodity Futures Trading Commission (CFTC) may permit trading platforms licensed under Europe’s new MiCA framework to operate in American markets, Acting Chairman Caroline D. Pham told UK lawmakers.

Speaking before the All-Party Parliamentary Group on Blockchain Technologies in London, Pham said the CFTC is examining whether MiCA-authorised venues could qualify under its long-standing cross-border recognition rules.

According to Finance...

Read More »

Read More »

US Fed Has Limited Impact on Stablecoin Lending Rates

New research has indicated that the US Federal Reserve’s monetary policy has only a limited effect on stablecoin lending rates, according to a conference at Warwick Business School.

Presenting at Warwick Business School’s Gillmore Centre for Financial Technology Academic Conference on DeFi and Digital Currencies, Andrea Barbon of the University of St. Gallen analysed 2.5 million transactions of US dollar-backed stablecoins on the DeFi platform...

Read More »

Read More »

Bitwise Lists 5 Crypto ETPs on SIX Swiss Exchange

Pure-play digital asset manager Bitwise has listed five of its flagship crypto ETPs on the SIX Swiss Exchange this week.

The listings provide investors with additional options to gain exposure to the cryptocurrency market, including staking and index ETPs.

Bitwise’s range of crypto ETPs consists of financial instruments designed to integrate with traditional portfolios, offering exposure to digital assets as an asset class.

In August 2025, Bitwise...

Read More »

Read More »

Boerse Stuttgart Group Launches Pan-European Blockchain Settlement Platform

Boerse Stuttgart Group is developing the infrastructure for the future of the digital capital market with Seturion, a pan-European, blockchain-based platform designed to enable faster and more cost-efficient settlement of tokenised assets across national borders.

Seturion is accessible to all market participants in Europe, including banks, brokers, trading venues, both traditional and digital, and tokenisation platforms.

Its open architecture and...

Read More »

Read More »

Amina Bank Expands Circle Partnership and Launches Stablecoin Rewards

Switzerland-based Amina Bank announced on X on August 29 that it had expanded its partnership with Circle through the Circle Alliance Programme, reinforcing its position in the stablecoin market.

Regulated by the Swiss Financial Market Supervisory Authority (FINMA), the bank highlighted the scale of its involvement, stating:

“Over the years, Amina has transacted billions in USDC and EURC through our FINMA-regulated banking system.”

As reported by...

Read More »

Read More »

Gemini Opens ETH and SOL Staking to UK Users

Gemini, the global digital asset platform, has made staking for Ethereum (ETH) and Solana (SOL) available to users in the UK.

This development allows UK users to participate in the crypto ecosystem and earn passive income through the Gemini platform, reinforcing the company’s commitment to expanding its presence in the region following the opening of its first permanent UK office in London.

Staking is an integral component of the Proof-of-Stake...

Read More »

Read More »

Bitpanda Launches in the UK with Access to 600+ Digital Assets

Bitpanda has officially launched in the UK, offering British investors access to more than 600 digital assets, the most comprehensive selection on the UK market.

Bitpanda has over 7 million users across Europe and holds multiple regulatory licenses outside the UK.

Its offering includes a wide range of digital assets, from well-known cryptocurrencies such as Bitcoin and Ethereum to emerging tokens and stablecoins.

Users also have access to selected...

Read More »

Read More »

SPAR Switzerland Launches Crypto Payments with Binance Pay and DFX.swiss

Swiss shoppers can now pay for groceries using stablecoins and other cryptocurrencies following a partnership between SPAR, Binance Pay, and Swiss fintech firm DFX.swiss.

Through the collaboration with Binance Pay, a crypto payment service from Binance, and DFX.swiss, customers are able to make payments with cryptocurrency at more than 100 SPAR stores across Switzerland.

The rollout marks the first nationwide introduction of a crypto payment system...

Read More »

Read More »