Tag Archive: Bank of international Settlements

The Great Taking!

Interview with James Patrick, TheGreatTakingReport.com

As many of my clients, friends and regular readers know well, I’ve spent the better part of the last decade criticizing all the great evils and trespasses of the State and its crony capitalist accomplices. I’ve written extensive analyses and gave many speeches warning fellow citizens about the dangers that lie in government power grabs and authoritarian transgressions. The most important of...

Read More »

Read More »

Davos Man Will Fail, World Will Move Toward Decentralization

I truly enjoyed the conversation with Hrvoje Morić. I hope you will enjoy it 2.

Happy Weekend!

In liberty,

Claudio

Claudio Grass, Hünenberg See, Switzerland

This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »

Read More »

BOJ Doesn’t Surprise, but EMU does with October CPI and Q3 Growth

Bonds and stocks are being sold ahead of the weekend. Poor corporate earnings and higher inflation in Japan and Europe are weighing on sentiment. The dollar is mostly higher. Hong Kong and mainland China led large Asia Pacific markets lower. India and Singapore were notable exceptions.

Read More »

Read More »

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

Consolidation in FX Featured

Overview: The strong equity market rally seen at the end of last week is carrying into today’s activity. Most of the large markets in Asia Pacific rose by at least 1%.

Read More »

Read More »

De-dollarization By Default Is Not What You Might Think

Last month, a group of central bank governors from across the South Pacific region gathered in Australia to move forward the idea of a KYC utility. If you haven’t heard of KYC, or know your customer, it is a growing legal requirement that is being, and has been, imposed on banks all over the world. Spurred by anti-money laundering efforts undertaken first by the European Union, more and more governments are forcing global banks to take part.

Read More »

Read More »

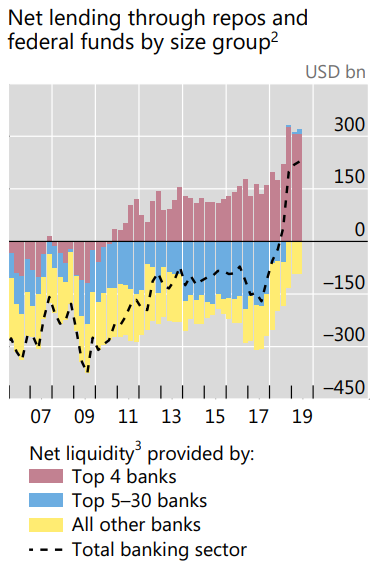

The BIS Misses An Opportunity To Get Consistent With The Facts

Much has been made about the repo market since mid-September. Much continues to be made about it. The question is why. It is now near the middle of December and repo looks dicey despite repo operations and a not-QE small-scale asset purchase intended to increase the level of bank reserves. Always the focus on “funds” which may be available. It was John Adams who took on the task of defending several British soldiers on trial for the Boston...

Read More »

Read More »

Seriously, Good Luck Dethroning the (euro)Dollar

Scarcely a week will go by without some grand prediction of the dollar being dethroned. Set aside how if anything is to be deposed it would have to be the eurodollar, these stories typically follow the same formulaic approach: Country X is moving away from dollar reserves, “diversifying” its holdings because of the geopolitics of Y.

Read More »

Read More »

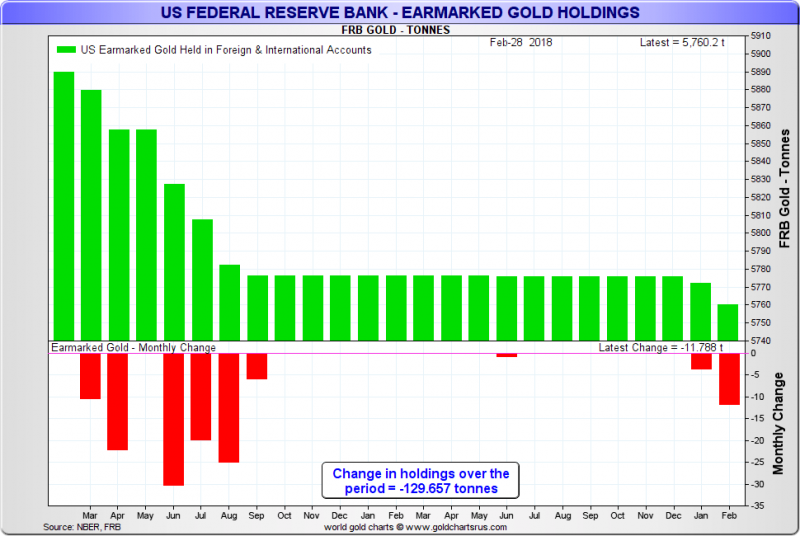

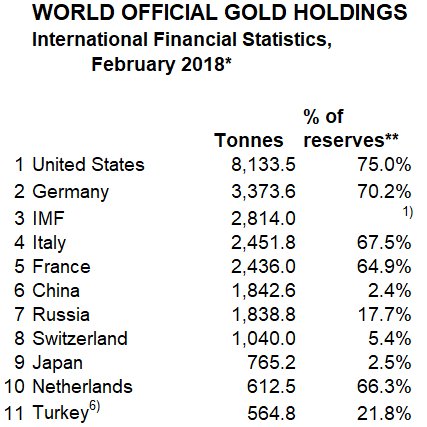

Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey.

Read More »

Read More »

Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here on the BullionStar website.

Read More »

Read More »

The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Read More »

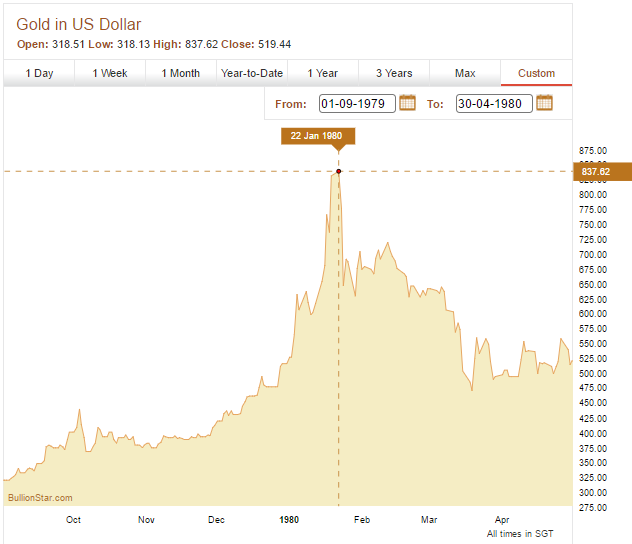

New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland.

Read More »

Read More »

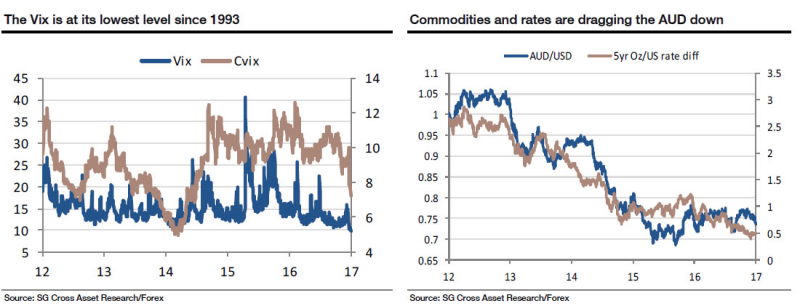

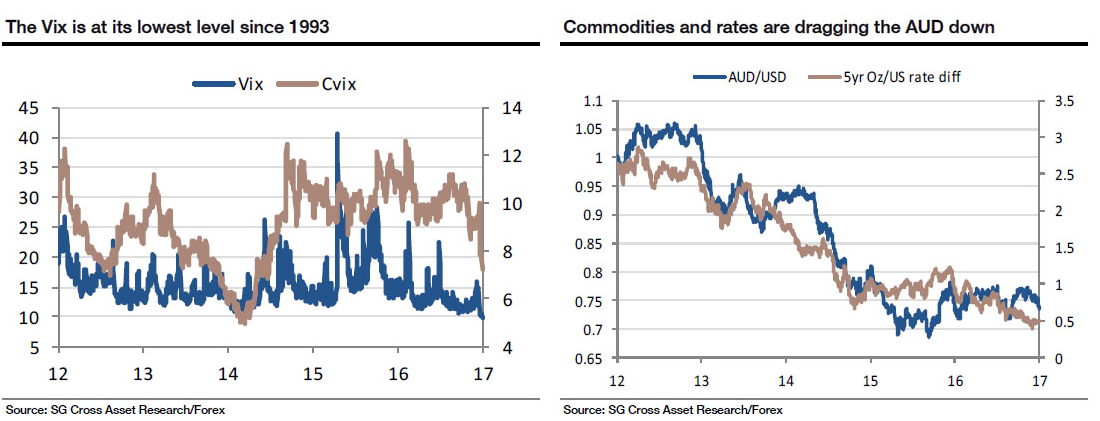

SocGen: Beware The Ghost Of 1993

With Monday's financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen's Kit Juckes with his overnight note, "The ghost of 1993"

Read More »

Read More »

The Wrong People Have An Innate Tendency To Stand Out

I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of that kind could be transposed...

Read More »

Read More »

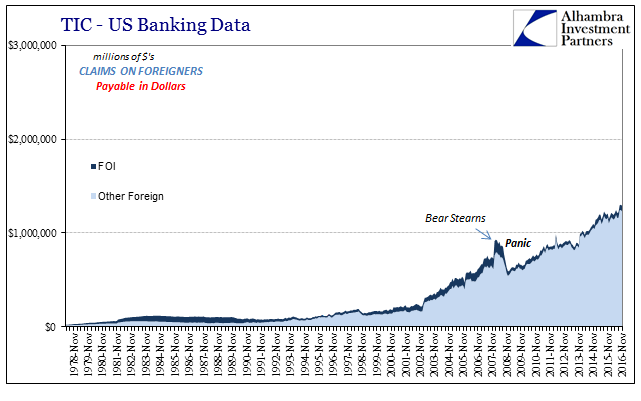

Do Record Eurodollar Balances Matter? Not Even Slightly

The BIS in its quarterly review published yesterday included a reference to the eurodollar market (thanks to M. Daya for pointing it out). The central bank to central banks, as the outfit is often called, is one of the few official institutions that have taken a more objective position with regard to the global money system. Of the very few who can identify eurodollars, or have even heard of them, the BIS while not fully on board is at least open...

Read More »

Read More »

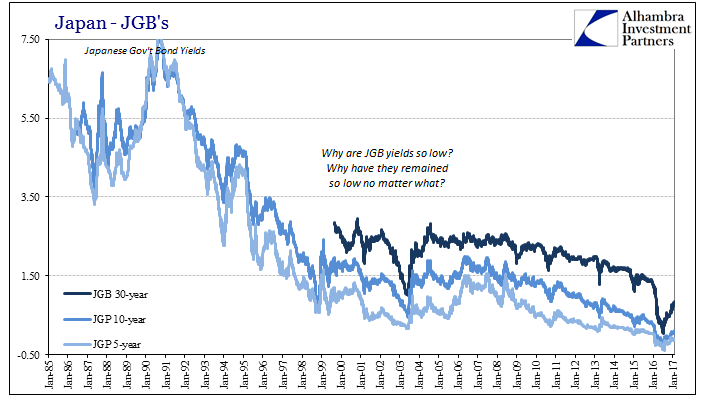

BIS: A Paradigm Shift on Bond Yields?

Review of recent BIS report. US election spurred a substantial change in sentiment. Equity and bond market reactions are roughly similar to when Reagan was elected, with the dollar, at least initially, stronger than then.

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »