Tag Archive: Bear Market

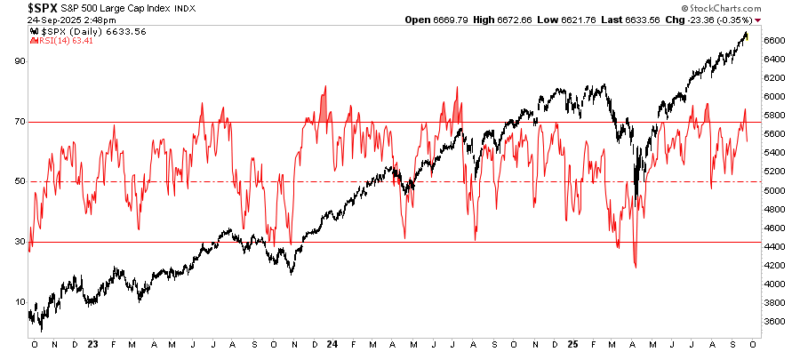

RSI (Relative Strength Index): Timing The Next Correction

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

Read More »

Read More »

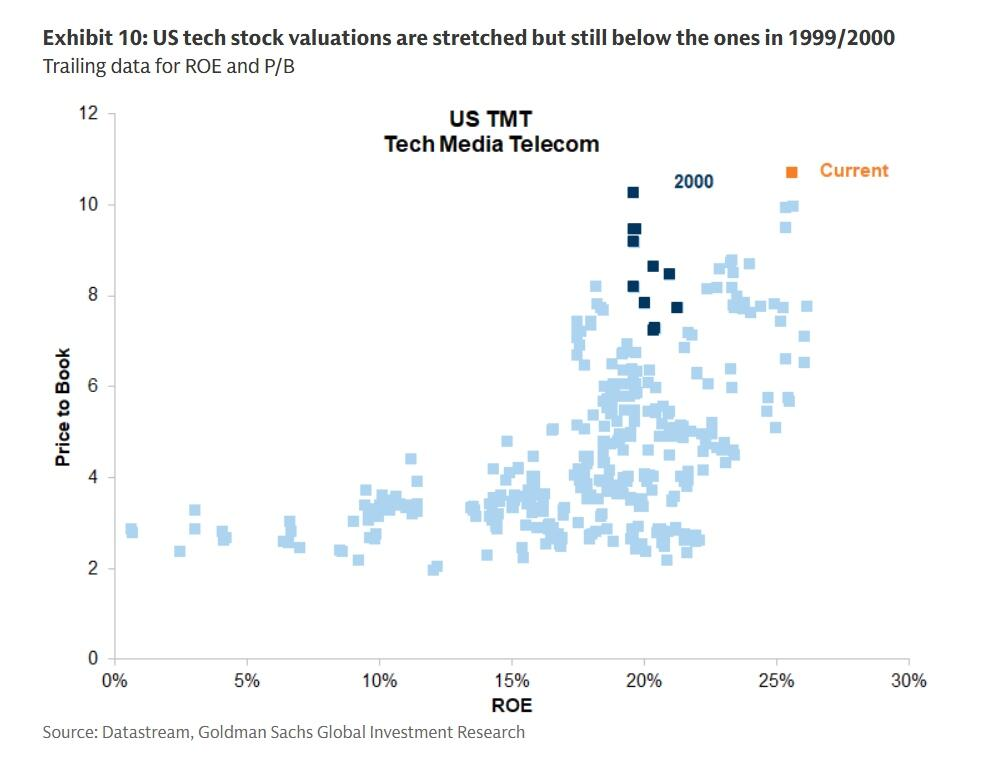

Markets: Bullish Vs Bearish Case

Just recently, Scott Rubner of Citadel Securities wrote an excellent piece discussing the bull versus the bear case for the markets. You look at the markets today and see a tension between expectation and reality. On one hand, equities—especially tech and growth—are pushing to fresh highs. Optimism about rate cuts, AI and productivity gains, global …

Read More »

Read More »

Why Diversification Is Failing In The Age Of Passive Investing

Diversification has been the backbone of "buy and hold" strategies for the last few decades. It was a boon to financial advisors who couldn't actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: "Buy a basket of assets, dollar cost …

Read More »

Read More »

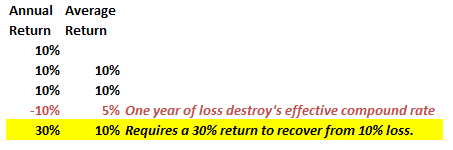

Portfolio Risk Management: Accepting The Hard Truth

Alfonoso Peccatiello recently wrote an interesting piece on portfolio risk management, starting with a quote from Steve Cohen: ‘’I compile statistics on my traders. My best trader makes money only 63 percent of the time. Most traders make money only in the 50 to 55 percent range. That means you’re going to be wrong a …

Read More »

Read More »

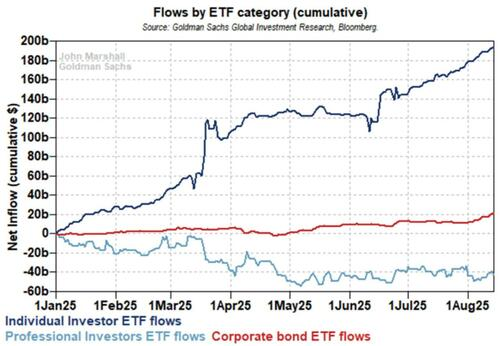

“Buy Every Dip” Remains The Winning Strategy…For Now

"Buy Every Dip" has lately been the "Siren's Song" for this market. Such is seen in the flows into ETFs over the course of this year. Retail investors treat pullbacks as temporary noise, and their behavior borders on mechanical. Every sell-off is seen as an opportunity, not a warning. Meanwhile, institutional managers sit it out. …

Read More »

Read More »

Excess Bullishness & 10-Rules To Navigate It

There is little doubt that excess bullishness has invaded the general market psyche. Just a couple of months following the market decline in March and April, where sentiment turned exceedingly bearish, the S&P 500 hovers near its highs. Furthermore, analysts are rushing to raise price targets to 7,000 or more.

Read More »

Read More »

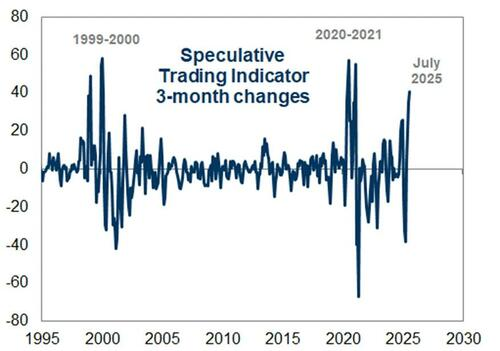

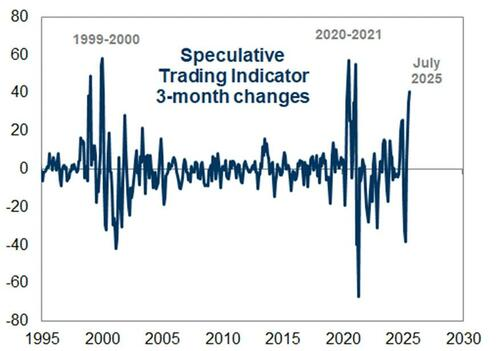

Meme Stock Trading & Livermore’s Approach To Speculation

Meme stock trading has returned in force. As discussed last week, the fear of missing out (FOMO) continues to dominate investor sentiment. The meme stock movement is again dominated by speculative retail trading driven by online forums, social media hype, and short-term momentum. Unlike GameStop and AMC in 2021, the current cycle revolves around names …

Read More »

Read More »

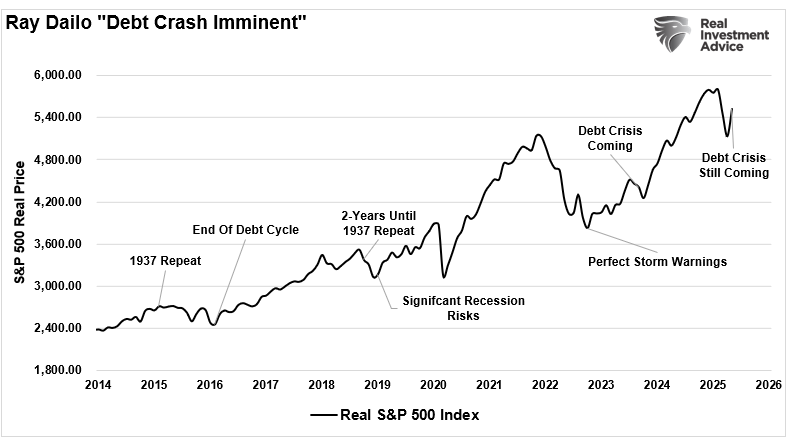

The Debt And Deficit Problem Isn’t What You Think

In recent months, much debate has been about rising debt and increasing deficit levels in the U.S. For example, here is a recent headline from CNBC: The article's author suggests that U.S. federal deficits are ballooning, with spending surging due to the combined impact of tax cuts, expansive stimulus, and entitlement expenditures. Of course, with …

Read More »

Read More »

Bull Streak Ends As August Begins

As the turn of the calendar occurred on Friday, the bull streak for the market since the April lows ended. Such was not unexpected, and the correction has been a topic of discussion in our #DailyMarketCommentary over the last two weeks. To wit: "While the overall backdrop remains bullish, including stable economic growth and earnings, …

Read More »

Read More »

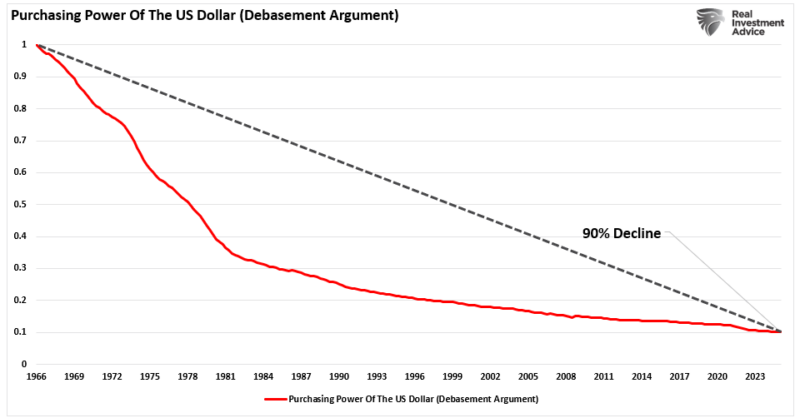

Debasement: What It Is And Isn’t.

Over the past year, financial headlines continue to flood investors with doomsday predictions about the U.S. dollar. Whether it's social media influencers waving "dollar collapse" charts or YouTube personalities warning about debasement, the noise has become deafening. The narrative is seductive: inflation is out of control, the government is printing money, and the dollar is on its last legs.

Read More »

Read More »

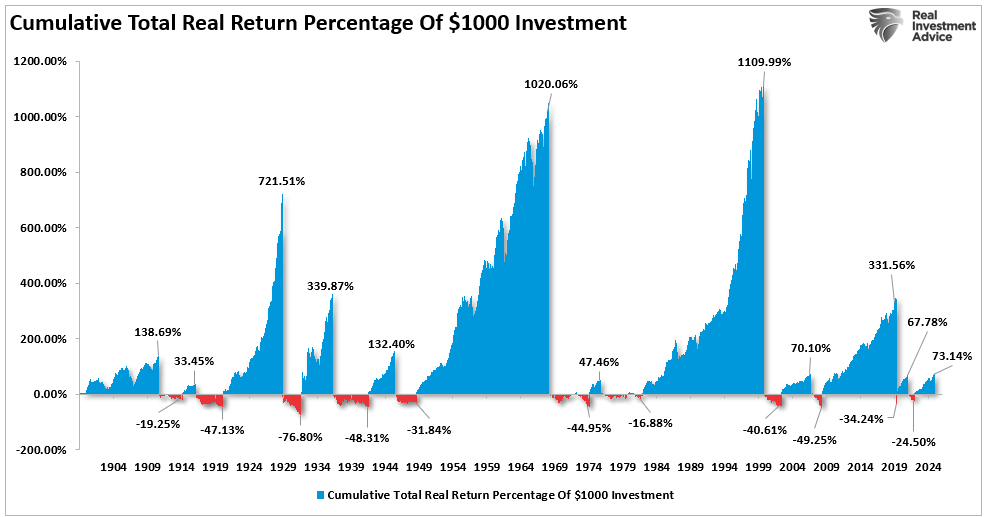

Portfolio Benchmarking: 5-Reasons Underperformance Occurs

When markets decline—especially after long periods of sustained growth—the familiar advice resurfaces: "Be patient. Stay invested. Ride it out." The rationale? The market always goes up over time. But there's a critical flaw in this narrative. Your portfolio and a portfolio benchmark are entirely different things. And portfolio benchmarking, or the constant comparison of your …

Read More »

Read More »

Is Private Equity A Wolf In Sheep’s Clothing?

In July 2007, just before the financial crisis erupted, Citigroup CEO Chuck Prince summed up Wall Street's dangerous exuberance: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing.” Eighteen years later, Wall Street is …

Read More »

Read More »

Retail Speculation Is Back With A Vengeance

Retail speculation is once again gripping the markets. A recent Wall Street Journal article highlighted how the latest retail gambling vehicle—zero-days-to-expiration (0DTE) options—has exploded in popularity. According to CBOE, trading volumes in these contracts have surged nearly sixfold over the past five years, with retail traders now accounting for more than half of all transactions. …

Read More »

Read More »

China’s Economic Demise And Its Impact On The U.S.

Few are as candid and historically accurate as hedge fund manager Kyle Bass when identifying structural breaks in the global economy. In a recent interview, Bass painted a grim but telling picture of China's economic condition, warning: “We are witnessing the largest macroeconomic imbalances the world has ever seen, and they are all coming to …

Read More »

Read More »

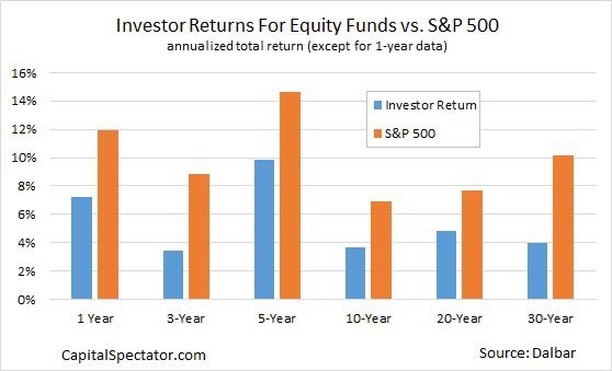

Relative Returns Or Absolute. What’s More Important?

A couple of years ago, I wrote about absolute versus relative returns. Given the latest market run, I am getting a lot of questions about chasing returns, and individuals comparing themselves to the S&P 500 index. Historically, trying to beat a benchmark index leads to poor outcomes. However, understanding absolute and relative returns can help …

Read More »

Read More »

Q2-2025 Earnings Season Preview

Next week, the Q2-2025 earnings season will begin in earnest as a barrage of S&P 500 companies report, starting with the Wall Street money center banks on Tuesday and Wednesday. Since earnings drive the market by supporting investor expectations, what […] The post Q2-2025 Earnings Season Preview appeared first on RIA.

Read More »

Read More »

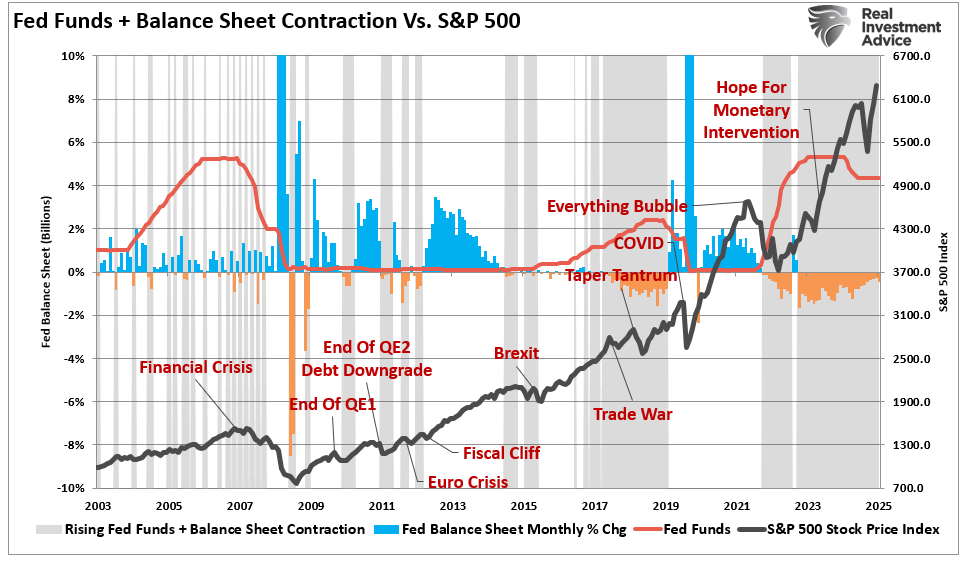

The Bull Market Is Alive And Well

The bull market is alive and well, even amid widespread talk of the “death of U.S. exceptionalism.” Early 2025 saw a sharp shift in investor sentiment. Concerns over erratic trade policy, soaring debt, and weakening dollar pressure challenged America’s long-standing market dominance. Markets fell sharply in April and May, feeding a narrative of declining "US …

Read More »

Read More »

SLR: Could It End The Bond Bear Market

On June 25th, the Federal Reserve quietly announced a significant change to the Supplementary Leverage Ratio (SLR). While the headlines were muted, the implications for the U.S. Treasury market were anything but. For sophisticated investors, this technical shift marks a subtle but powerful pivot in monetary mechanics. It could create demand for Treasuries, improve market …

Read More »

Read More »

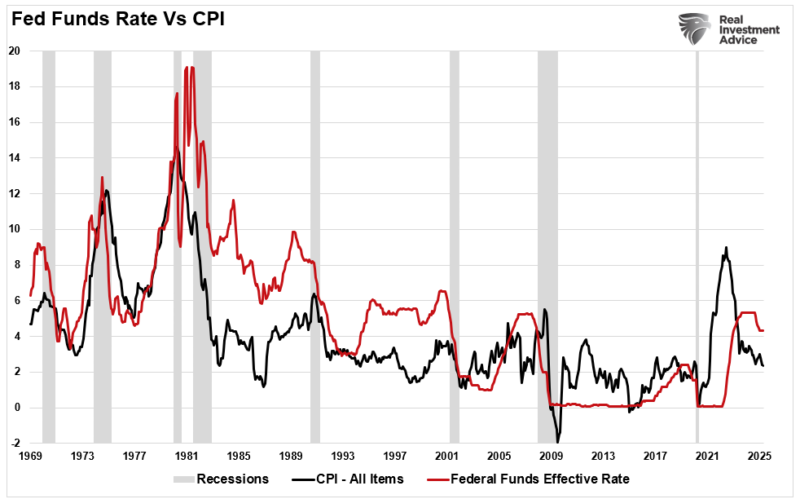

The Fed’s “Transitory” Mistake Is Affecting Its Outlook

In 2023 and 2024, the Fed was under intense public and media scrutiny for calling the post-pandemic surge in inflation “transitory.” Critics argued that the Fed's failure to anticipate the persistence and severity of rising prices undermined its credibility. Yet, with the benefit of hindsight and historical context, the Fed's position wasn't entirely misguided. Inflation …

Read More »

Read More »

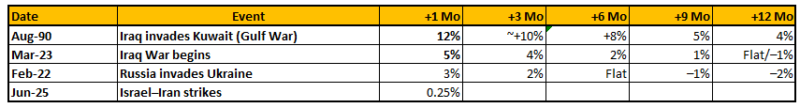

Iran Stuck By U.S.: Markets, Risk, and Rational Investing

Over the weekend, the U.S. launched strikes against Iran's nuclear facilities. Currently, I only have the details reported by major mainstream outlets. However, given that stock market futures are trading sharply lower on Sunday, I wanted to get something in print before the market opens relating to navigating this event over the next few days.

Read More »

Read More »