Tag Archive: banks

Strategic Ambiguity Leaves Intervention Question Unanswered, but US Dollar has Steadied

Overview: Dramatic yen price action around the JOLTS

report yesterday after the dollar pierced the JPY150 level spurred speculation

of BOJ intervention. Although there has been no confirmation, the strategic

ambiguity is helping steady the yen and the dollar more broadly today, even

though US yields remain firm. Final PMI readings were a better than the flash

estimates and this may also be facilitating the consolidative tone. Most

promising, from a...

Read More »

Read More »

After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well

received, with the three-year note being scooped up by investors, driving the

yield below it was trading in the when-issued market. Today, the Treasury sells

$38 bln 10-year notes, whose auctions have been less than stellar recently. The

US 10-year yield reached 4.20% last week and is now straddling 4%. Italian

bonds are also firm as the Italian government clarifies the

new tax on banks' windfall...

Read More »

Read More »

Sobering PMI Readings Sap Risk Appetites

Overview: As US markets prepare to re-open from yesterday's holiday, the dollar

is trading mostly higher, though the euro and yen are steady to slightly firmer.

Narrow ranges are prevailing. The Canadian and Australian dollars are

exceptions and are off about 0.3%. Emerging market currencies are mostly lower,

including Russia, China, South Africa, and Turkey. Final service and composite

PMIs were mostly revised lower in Japan, Australia, and the...

Read More »

Read More »

Dollar Comes Back Bid, as First Republic Taken Over (Mostly) by JP Morgan

Overview: Most markets are closed for the May Day

holiday. News that JP Morgan will acquire most of First Republic assets will be

a relief for the markets. US equity futures are slightly firmer, and the

10-year Treasury yield is around three basis points higher, slightly above

3.45%. Recall that before the weekend, it has fallen from almost 3.55% to 3.42%.

The market has more than a 90% chance of a quarter-point hike discounted for

Wednesday. The...

Read More »

Read More »

Markets Becalmed Ahead of Key Data and BOJ Meeting Outcome

Overview: Some regional bank earnings were weighing

on investor sentiment but reports that the FDIC is running out of patience with

First Republic Bank to strike a private deal and could decide to downgrade its

assessment. This could lead to limits on its ability to use the Fed's emergency

facilities. Other reports said that the bank's advisers are securing

commitments to buy a new stock as part of a broader restructuring. Still, while

the KBW bank...

Read More »

Read More »

Banking Stress Eases

Overview: The banking crisis is ebbing. The Bank of

England and European Central Bank assured investors that the AT1 bonds are

senior to equity claims, and Switzerland is a unique case. Bank share indices

in the Europe and the US rose yesterday, even though the shares of First

Republic Bank fell by 47% yesterday. The $123-stock at the end of last month

reached almost $11 yesterday. It is trading around $14.75 pre-market. Global equities are...

Read More »

Read More »

Terms of UBS Acquisition Wipes out Additional Tier 1 Capital and Spurs Fresh Concerns

Overview: UBS takeover of Credit Suisse, the sale of

Signature bank assets, and the daily dollar swaps could have helped stabilize

the budding banking crisis. However, the wipeout of the additional tier 1

capital cushion (16 bln Swiss francs) at Credit Suisse has raised concern about

the vulnerability of other such assets, which post-GFC is a $275 bln market in

Europe. Asia Pacific equities was a sea of red, led by a 2.65% drop in the Hang

Seng...

Read More »

Read More »

Fragile Calm to End the Volatile Week even with the Quadruple Expirations

Overview: The support for First Republic Bank shown

by a consortium of US banks by shifting $30 bln of deposits is helping break

the financial anxiety that has gripped the market for more than a week. The

liquidity provisions for Credit Suisse by the Swiss National Bank also are

contributing to improved sentiment. The Fed's balance sheet expanded sharply

last week as the bridge banks were extended credit to help the unwind of SVB

and Signature...

Read More »

Read More »

Concerns Over US Banks Rival Today’s Jobs Report

Overview: The unexpectedly large rise in US weekly

jobless claims, the largest since the end of last September and concerns about

the impact of the sharp rise in interest rates on the liquidity and value of

assets (bonds) owned by small and medium-sized banks saw the market unwind the

effect of Fed Chair Powell's comments. The yield on the US two-year note

slumped almost 20 bp to 4.87% yesterday and fell to 4.75% today before

stabilizing (~4.82%)....

Read More »

Read More »

Weekly Market Pulse: A Very Contrarian View

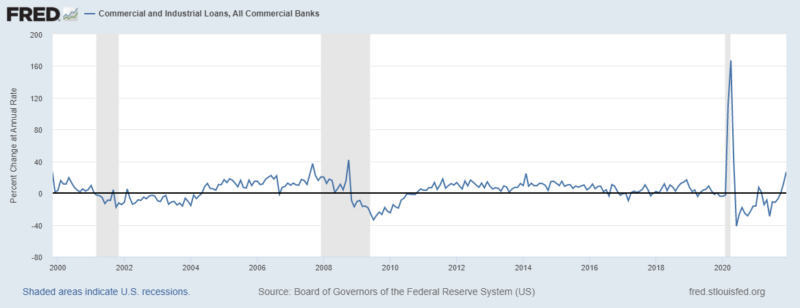

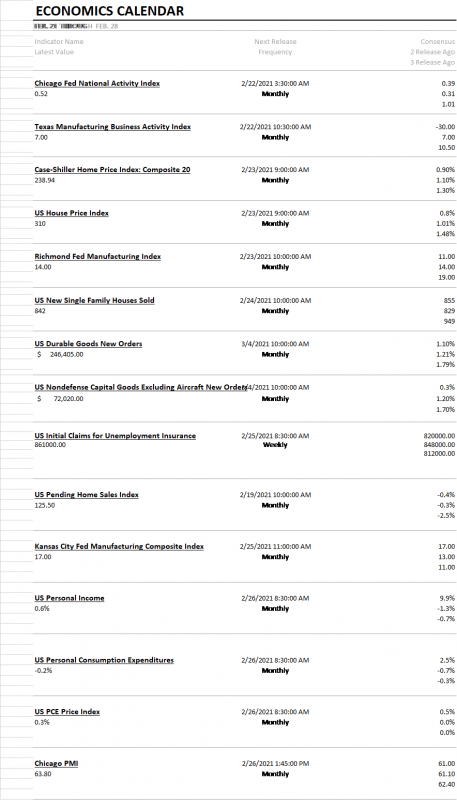

What is the consensus about the economy today? Will 2022 growth be better or worse than 2021? Actually, that probably isn’t the right question because the economy slowed significantly in the second half of 2021. The real question is whether growth will improve from that reduced pace.

Read More »

Read More »

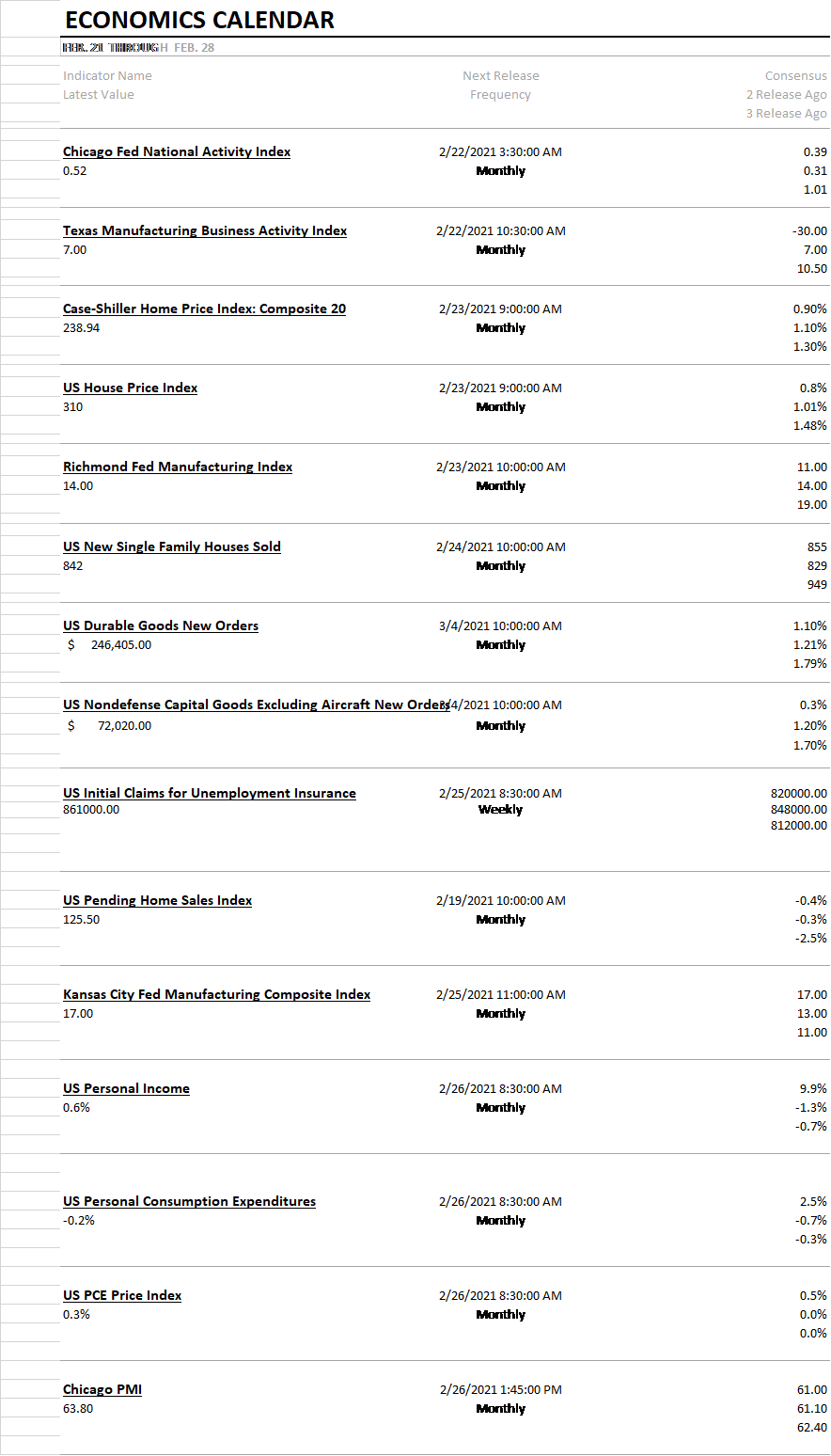

Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Can Switzerland Survive Today’s Assault On Cash And Sound Money?

“Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world than in Switzerland.”

Read More »

Read More »

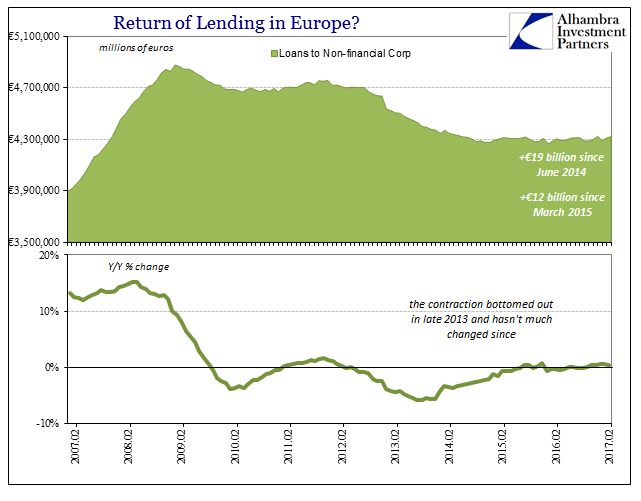

Ultra-Loose Terminology, Not Policy

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction.

Read More »

Read More »

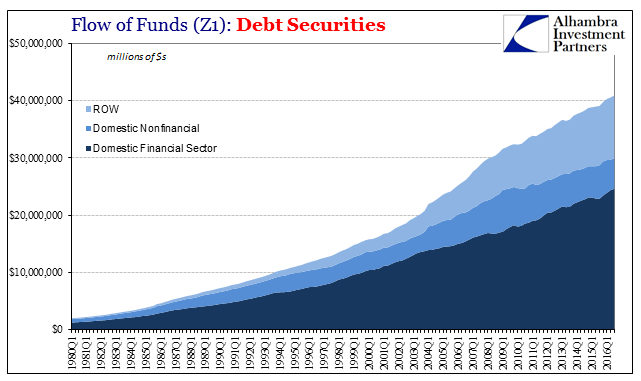

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

Central Banks…Why Bother?

2022-05-21

by Stephen Flood

2022-05-21

Read More »