A Huge Leak

The “Panama Papers” tax haven leak is big …

After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak.

But Why Is It Mainly Focusing On Enemies of the West?

But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Assad’s Syria and others disfavored by the West.

Former British Ambassador Craig Murray notes:

Whoever leaked the Mossack Fonseca papers appears motivated by a genuine desire to expose the system that enables the ultra wealthy to hide their massive stashes, often corruptly obtained and all involved in tax avoidance. These Panamanian lawyers hide the wealth of a significant proportion of the 1%, and the massive leak of their documents ought to be a wonderful thing.

Unfortunately the leaker has made the dreadful mistake of turning to the western corporate media to publicise the results. In consequence the first major story, published today by the Guardian, is all about Vladimir Putin and a cellist on the fiddle. As it happens I believe the story and have no doubt Putin is bent.

But why focus on Russia? Russian wealth is only a tiny minority of the money hidden away with the aid of Mossack Fonseca. In fact, it soon becomes obvious that the selective reporting is going to stink.

The Suddeutsche Zeitung, which received the leak, gives a detailed explanation of the methodology the corporate media used to search the files. The main search they have done is for names associated with breaking UN sanctions regimes. The Guardian reports this too and helpfully lists those countries as Zimbabwe, North Korea, Russia and Syria. The filtering of this Mossack Fonseca information by the corporate media follows a direct western governmental agenda. There is no mention at all of use of Mossack Fonseca by massive western corporations or western billionaires – the main customers. And the Guardian is quick to reassure that “much of the leaked material will remain private.”

What do you expect? The leak is being managed by the grandly but laughably named “International Consortium of Investigative Journalists”, which is funded and organised entirely by the USA’s Center for Public Integrity. Their funders include

Ford Foundation

Carnegie Endowment

Rockefeller Family Fund

W K Kellogg Foundation

Open Society Foundation (Soros)among many others. Do not expect a genuine expose of western capitalism. The dirty secrets of western corporations will remain unpublished.

Expect hits at Russia, Iran and Syria and some tiny “balancing” western country like Iceland. A superannuated UK peer or two will be sacrificed – someone already with dementia.

The corporate media – the Guardian and BBC in the UK – have exclusive access to the database which you and I cannot see.

They are protecting themselves from even seeing western corporations’ sensitive information by only looking at those documents which are brought up by specific searches such as UN sanctions busters. Never forget the Guardian smashed its copies of the Snowden files on the instruction of MI6.

What if they did Mossack Fonseca database searches on the owners of all the corporate media and their companies, and all the editors and senior corporate media journalists? What if they did Mossack Fonseca searches on all the most senior people at the BBC? What if they did Mossack Fonseca searches on every donor to the Center for Public Integrity and their companies?

What if they did Mossack Fonseca searches on every listed company in the western stock exchanges, and on every western millionaire they could trace?

That would be much more interesting. I know Russia and China are corrupt, you don’t have to tell me that. What if you look at things that we might, here in the west, be able to rise up and do something about?

And what if you corporate lapdogs let the people see the actual data?

Indeed, Wikileaks comments:

Washington DC based Ford, Soros funded soft-power tax-dodge “ICIJ” has a WikiLeaks problem #PanamaPapers https://twitter.com/ChMadar/status/717395684207550467 …

And:

Putin attack was produced by OCCRP which targets Russia & former USSR and was funded by USAID & Soros.

U.S. Companies Use Foreign Tax Evasion

American companies are big users of foreign tax havens. For example, we pointed out in 2014:

American multinationals pay much less in taxes than they should because they use a widespread variety of tax-avoidance scams and schemes, including … Pretending they are headquartered in tax havens like Bermuda, the Cayman Islands or Panama, so that they can enjoy all of the benefits of actually being based in America (including the use of American law and the court system, listing on the Dow, etc.), with the tax benefits associated with having a principal address in a sunny tax haven.

***

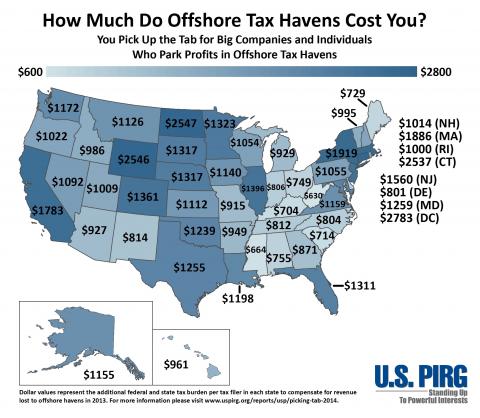

U.S. Public Interest Research Group notes:

Tax haven abusers benefit from America’s markets, public infrastructure, educated workforce, security and rule of law – all supported in one way or another by tax dollars – but they avoid paying for these benefits. Instead, ordinary taxpayers end up picking up the tab, either in the form of higher taxes, cuts to public spending priorities, or increases to the federal debt.

USPIRG continues:

The United States loses approximately $184 billion in federal and state revenue each year due to corporations and individuals using tax havens to dodge taxes. On average, every filer who fills out a 1040 individual income tax form would need to pay an additional $1,259 in taxes to make up for the revenue lost.

- Pfizer, the world’s largest drug maker, paid no U.S. income taxes between 2010 and 2012 despite earning $43 billion worldwide. In fact, the corporation received more than $2 billion in federal tax refunds. In 2013, Pfizer operated 128 subsidiaries in tax haven countries and had $69 billion offshore and out of the reach of the Internal Revenue Service (IRS).

- Microsoft maintains five tax haven subsidiaries and stashed $76.4 billion overseas in 2013. If Microsoft had not booked these profits offshore, they would have owed an additional $24.4 billion in taxes.

- Citigroup, bailed out by taxpayers in the wake of the financial crisis of 2008, maintained 21 subsidiaries in tax haven countries in 2013, and kept $43.8 billion in offshore jurisdictions. If that money had not been booked offshore, Citigroup would have owed an additional $11.7 billion in taxes.

Al Jazeera reports:

Rich individuals and their families have as much as $32 trillion of hidden financial assets in offshore tax havens, representing up to $280bn in lost income tax revenues, according to research published on Sunday.

***

“We’re talking about very big, well-known brands – HSBC, Citigroup, Bank of America, UBS, Credit Suisse – some of the world’s biggest banks are involved… and they do it knowing fully well that their clients, more often than not, are evading and avoiding taxes.”

Much of this activity, Christensen added, was illegal.

So the Panama Papers stories haven’t focused on it, but U.S. corporations are hiding huge sums of money in foreign tax havens.

Obama and Clinton Enabled Panamanian Tax Evasion Havens

Of course, Obama and Hillary Clinton enabled and supported Panama’s ability to act as a tax evasion haven.

So it’s a little disingenuous for them now to say we should “crack down” on tax havens.

US and UK – Not Panama – Biggest Tax Havens for Money Laundering Criminals and Tax Cheats

But the bigger story is that America is the world’s largest tax haven … with the UK in a close second-place position.

The Guardian noted last year:

The US has overtaken Singapore, Luxembourg and the Cayman Islands as an attractive haven for super-rich individuals and businesses looking to shelter assets behind a veil of secrecy, according to a study by the Tax Justice Network (TJN).

Bloomberg headlined in January, The World’s Favorite New Tax Haven Is the United States:

After years of lambasting other countries for helping rich Americans hide their money offshore, the U.S. is emerging as a leading tax and secrecy haven for rich foreigners. By resisting new global disclosure standards, the U.S. is creating a hot new market, becoming the go-to place to stash foreign wealth. Everyone from London lawyers to Swiss trust companies is getting in on the act, helping the world’s rich move accounts from places like the Bahamas and the British Virgin Islands to Nevada, Wyoming, and South Dakota.

“How ironic—no, how perverse—that the USA, which has been so sanctimonious in its condemnation of Swiss banks, has become the banking secrecy jurisdiction du jour,” wrote Peter A. Cotorceanu, a lawyer at Anaford AG, a Zurich law firm, in a recent legal journal. “That ‘giant sucking sound’ you hear? It is the sound of money rushing to the USA.”

Rothschild, the centuries-old European financial institution, has opened a trust company in Reno, Nev., a few blocks from the Harrah’s and Eldorado casinos. It is now moving the fortunes of wealthy foreign clients out of offshore havens such as Bermuda, subject to the new international disclosure requirements, and into Rothschild-run trusts in Nevada, which are exempt.

The U.S. “is effectively the biggest tax haven in the world” —Andrew Penney, Rothschild & Co.

***

Others are also jumping in: Geneva-based Cisa Trust Co. SA, which advises wealthy Latin Americans, is applying to open in Pierre, S.D., to “serve the needs of our foreign clients,” said John J. Ryan Jr., Cisa’s president.

Trident Trust Co., one of the world’s biggest providers of offshore trusts, moved dozens of accounts out of Switzerland, Grand Cayman, and other locales and into Sioux Falls, S.D., in December, ahead of a Jan. 1 disclosure deadline.

“Cayman was slammed in December, closing things that people were withdrawing,” said Alice Rokahr, the president of Trident in South Dakota, one of several states promoting low taxes and confidentiality in their trust laws. “I was surprised at how many were coming across that were formerly Swiss bank accounts, but they want out of Switzerland.”

***

One wealthy Turkish family is using Rothschild’s trust company to move assets from the Bahamas into the U.S., he said. Another Rothschild client, a family from Asia, is moving assets from Bermuda into Nevada. He said customers are often international families with offspring in the U.S.

Forbes points out that the U.S. is not practicing what it is preaching:

A report by the Tax Justice Network says that the U.S. doesn’t even practice what it preaches. Indeed, the report ranks America as one of the worst. How bad? Worse than the Cayman Islands. The report claims that America has refused to participate in the OECD’s global automatic information exchange for bank data. The OECD has been designing and implementing the system to target tax evasion. Given the IRS fixation on that topic, you might think that the U.S. would join in.

However, it turns out that the United States jealously guards its information. The Tax Justice Network says the IRS is stingy with data. Of course, with FATCA, America has more data than anyone else. FATCA, the Foreign Account Tax Compliance Act is up and running. The IRS says it is now swapping taxpayer data reciprocally with other countries. The IRS says it will only engage in reciprocal exchanges with foreign jurisdictions meeting the IRS’s stringent safeguard, privacy, and technical standards.

The Tax Justice Network report blasts the U.S. for being a one-way street:

The United States, which has for decades hosted vast stocks of financial and other wealth under conditions of considerable secrecy, has moved up from sixth to third place in our index. It is more of a cause for concern than any other individual country – because of both the size of its offshore sector, and also its rather recalcitrant attitude to international co-operation and reform. Though the U.S. has been a pioneer in defending itself from foreign secrecy jurisdictions, aggressively taking on the Swiss banking establishment and setting up its technically quite strong Foreign Account Tax Compliance Act (FATCA) – it provides little information in return to other countries, making it a formidable, harmful and irresponsible secrecy jurisdiction at both the Federal and state levels. (Click here for a short explainer; See our special report on the USA for more).”

The Washington Post writes:

One of the least recognized facts about the global offshore industry is that much of it, in fact, is not offshore. Indeed, some critics of the offshore industry say the U.S. is now becoming one of the world’s largest “offshore” financial destinations.

***

A 2012 study in which researchers sent more than 7,400 email solicitations to more than 3,700 corporate service providers — the kind of companies that typically register shell companies, such as the Corporation Trust Company at 1209 North Orange St. — found that the U.S. had the laxest regulations for setting up a shell company anywhere in the world outside of Kenya. The researchers impersonated both low- and high-risk customers, including potential money launderers, terrorist financiers and corrupt officials.

Contrary to popular belief, notorious tax havens such as the Cayman Islands, Jersey and the Bahamas were far less permissive in offering the researchers shell companies than states such as Nevada, Delaware, Montana, South Dakota, Wyoming and New York, the researchers found.

***

“In some places [in the U.S.], it’s easier to incorporate a company than it is to get a library card,” Joseph Spanjers of Global Financial Integrity, a research and advocacy organization that wants to curtail illicit financial flows, said in an interview earlier this year.

***

Too often, however, shell companies are used as a vehicle for criminal activity — disguising wealth from tax authorities, financing terrorism, concealing fraudulent schemes, or laundering funds from corruption or the trafficking in drugs, people and arms.

***

The Organization for Economic Co-operation and Development, a group of 34 advanced countries, drew up its own tough tax disclosure requirements, called Common Reporting Standards, and asked roughly 100 countries and jurisdictions around the world to approve them. Only a handful of countries have refused, including Bahrain, Vanuatu and the United States.

Bloomberg reports:

Advisers around the world are increasingly using the U.S. resistance to the OECD’s standards as a marketing tool — attracting overseas money to U.S. state-level tax and secrecy havens like Nevada and South Dakota, potentially keeping it hidden from their home governments.

Salon notes:

Several states – Delaware, Nevada, South Dakota, Wyoming – specialize in incorporating anonymous shell corporations. Delaware earns between one-quarter and one-third of their budget from incorporation fees, according to Clark Gascoigne of the FACT Coalition. The appeal of this revenue has emboldened small states, and now Wyoming bank accounts are the new Swiss bank accounts. America has become a lure, not only for foreign elites looking to seal money away from their own governments, but to launder their money through the purchase of U.S. real estate.

And the UK is a giant swamp of tax evasion and laundering as well …

The Independent reported last year:

The City of London is the money-laundering centre of the world’s drug trade, according to an internationally acclaimed crime expert.

***

His warning follows a National Crime Agency (NCA) threat assessment which stated: “We assess that hundreds of billions of US dollars of criminal money almost certainly continue to be laundered through UK banks, including their subsidiaries, each year.”

Last month, the NCA warned that despite the UK’s role in developing international standards to tackle money laundering, the continued extent of it amounts to a “strategic threat to the UK’s economy and reputation”. It added that the same money-laundering networks used by organised crime were being used by terrorists as well.

***

Interviewed by The Independent on Sunday, Mr Saviano said of the international drugs trade that “Mexico is its heart and London is its head”. He said the cheapness and the ease of laundering dirty money through UK-based banks gave London a key role in drugs trade. “Antonio Maria Costa of the UN Office on Drugs and Crime found that drug trafficking organisations were blatantly recycling dirty money through European and American banks, but no one takes any notice,” he said. “He found that banks were welcoming dirty money because they need cash, liquidity during the financial crisis. The figures are too big to be rejected …. Yet there was no reaction.”

(Background.)

In a separate article, the Independent wrote:

Billions of pounds of corruptly gained money has been laundered by criminals and foreign officials buying upmarket London properties through anonymous offshore front companies – making the city arguably the world capital of money laundering.

The flow of corrupt cash has driven up average prices with a “widespread ripple effect down the property price chain and beyond London”, according to property experts cited in the most comprehensive study ever carried out into the long-suspected money laundering route through central London real estate, by the respected anti-corruption organisation Transparency International.

***

Any anonymous company in a secret location, such as the British Virgin Islands, can buy and sell houses in the UK with no disclosure of who the actual purchaser is. Meanwhile, TI said, estate agents only have to carry out anti-money-laundering checks on the person selling the property, leaving the buyers bringing their money into the country facing little, if any scrutiny.

***

Detective Chief Inspector Jon Benton, director of operations at the Proceeds of Corruption Unit, said: “Properties that are purchased with illicit money, which is often stolen from some of the poorest people in the world, are nearly always layered through offshore structures.

***

Companies set up in the Crown Dependencies and British Overseas Territories such as Jersey, British Virgin Islands and Gibraltar are the preferred option for concealment of corrupt property purchases.

More than a third of company-owned London houses are held by effectively anonymous firms ….

TruePublica notes:

The consequence of its operations is that money laundering is now at such levels and so widespread that the authorities have recently admitted defeat in its battle of attrition by stating openly it has been completely overwhelmed and lost control. Keith Bristow Director-General of the UK’s National Crime Agency said just six months ago that the sheer scale of crime and its subsequent money laundering operations was “a strategic threat” to the country’s economy and reputation and that “high-end money laundering is a major risk”.

TJN [the Tax Justice Network] says the UK would be ranked as the worst offender in the world if considered along with the three Crown Dependencies (Jersey, Guernsey and the Isle of Man) and the 14 Overseas Territories (including notorious tax havens such as Bermuda, the Cayman and Virgin islands).

In their 2015 Index, TJN state: “Overall, the City of London and these offshore satellites constitute by far the most important part of the global offshore world of secrecy jurisdictions.”

For background on the Isle of Jersey, see this Newsweek article.

Agence France-Press points out:

See more for“London is the epicentre of so much of the sleaze that happens in the world,” Nicholas Shaxson, author of the book “Treasure Islands”, which examines the role of offshore banks and tax havens, told AFP.

***

“Tax evasion and stuff like that will be done in the external parts of the network. Usually there will be links to the City of London, UK law firms, UK accountancy firms and to UK banks,” he said, calling London the centre of a “spider’s web”.

“They’re all agents of the City of London — that is where the whole exercise is controlled from,” Richard Murphy, professor at London’s City University, said of the offshore havens.

***

“When the British empire collapsed, London swapped being the governor of the imperial engine to being an offshore island and allowing money to come with no questions asked,” he added.

With public pressure mounting, Murphy said Britain had the power to legislate directly on its overseas territories, but the lobbying power of the financial sector and worries about upsetting the jewel in Britain’s economic crown were holding back efforts.

“The City of London seems to believe that without these conduits, then it would not have the competitive edge that it needs,” he said.

“The financial institutions have become like wild animals,” added Shaxson.