Older paper from JP Morgan

14 May 2010 •

- The inexorable decline in EUR/CHF is fostering market discussion of alternative policy measures to address CHF strength •

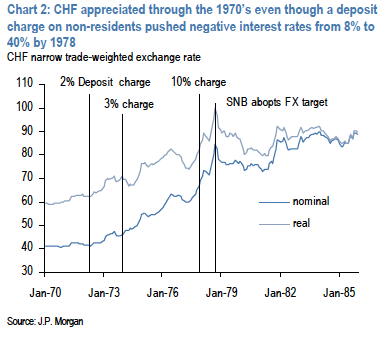

- Negative interest rates naturally attract attention given Switzerland’s use of these between 1972-1978. A surcharge on non-resident deposits was sufficient to push net interest rates to -40% in 1978. •

- The history of negative interest rates was not compelling – CHF still managed to appreciate by 75% through this period. Only once the SNB explicitly abandoned monetary stability in favor of FX stability did the currency reverse course. •

- Negative rates do not overcome the fundamental ‘one tool, one target’ constraint on central bank policy. Unless the SNB is once again willing to formally abandon price stability in favor of an exchange rate target, which we do not believe it will, the most it can hope to achieve is to slow the pace of appreciation in the Swiss franc. •

- Our strategy remains to be short EUR/CHF. We have also revised down our forecasts to a trough of 1.34 to reflect the perceived erosion in euro area monetary stability and enhanced risks to the euro.

The last thing that the SNB needed over the past week was for the ECB to compromise its monetary principles and to embark upon the monetization of the sovereign debt of the least creditworthy Euro area governments in the interests of preventing a broader run on its sovereign debt markets and potential contagion from this to the banks. This entirely unexpected initiative has delivered the coup de grace to EUR/CHF, which in any case was on a firmly established fundamental downtrend. While we believe that EUR/CHF would fall to the mid-low 1.30s over the coming six months if left to its own devices, discussion in the market increasingly is turning towards the possibility of the SNB adopting alternative means of stemming the upward pressure on CHF, in particular the possibility of the central bank re-imposing the de facto negative interest rates on capital inflows last seen in the 1970s. The underlying problem for the SNB remains the inexorable narrowing in the interest rate differential between CHF and other industrialized countries (chart 1) as the market increasingly comes to expect Swiss-style lowfor- longer monetary policy in most other major economies as the counterpart to fiscal consolidation from overindebted governments (the irony of course is that Switzerland has one of the strongest fiscal positions of any major economy).

If the SNB can no longer rely on the prospect of higher foreign interest rates at any point in the foreseeable future to deter capital inflow to Switzerland, can it overcome the zero bound on nominal CHF interest rates and encourage capital outflow by imposing negative interest rates? Leaving aside the abstruse issue of whether the nominal interest rate can ever go negative, the de-facto yield to foreign investors can of course be set below zero should the authorities impose a sufficient capital surcharge on deposits held by non-residents (this can be viewed as an extension of a withholding tax, except that in this case the tax is levied on the principal rather than the interest). Switzerland has a long history of wrestling with an inconveniently strong exchange rate. This indeed defines much of the period since the break up of the Breton Woods system of fixed exchange rates in the 1970s. Switzerland’s first taste of negative interest rates came in June 1972, when a penalty charge of 2% per quarter was levied on the increase in CHF deposits from non-residents (this measure followed the failure of 100% reserve requirements on nonresident deposits and then the prohibition of interest payments to non-residents to curb capital inflows). The defacto negative interest rate regime lasted until October 1973. The negative interest rate was re-introduced in November 1973 at 3% per quarter and then increased to 10% per quarter in February 1978. All though this period capital inflows were being sustained by the global monetary turmoil/inflation that characterized the first years of floating exchange rates, not to mention the SNB’s singular focus on promoting monetary and price stability through money supply targeting. Ultimately the SNB abandoned these purely technical attempts to curb capital inflows and embraced a much more effective policy of currency debasement, namely it abandoned money supply targeting in favor of an explicit exchange rate target that required huge amounts of unsterilized intervention, money supply expansion and ultimately inflation. (Suffice to say this policy lasted only until 1982, when the Swiss realized that inflation was too high a price to pay for a weak currency).

| Chart 2: CHF appreciated through the 1970’s even though a deposit charge on non-residents pushed negative interest rates from 8% to 40% by 1978 |

What are the lessons from this experience?

Primarily that negative rates, while practically feasible, do not necessarily prevent a fundamentally strong currency from appreciating CHF rose by 8% in nominal and real terms during the first phase of negative rates between 1972-1973.

Appreciation during the period Nov 73-Feb 1978 amounted to 62% in nominal terms and 29% in real terms. This experience should not come as a surprise.

After all, certain currencies offer de facto negative interest rates at present yet continue to attract substantial capital inflows, the most notable of which is CNY – despite a domestic yield of -3% in the 3m NDF, long CNY remains one of the most heavily populated FX positions in the world. Negative interest rates will only deter capital inflows if they are sufficiently large to offset the capital gain an investor expects to make through exchange rate appreciation. This is not the case with CNY. In the 1970s the Swiss used negative interest rates together with a range of capital controls as the policy of first resort to control currency appreciation. This failed because such technical measures were inconsistent with the thrust of tight domestic monetary policy, which was the ultimate source of the capital inflows into the country. The Swiss only managed to get a grip of the currency when the overriding goal of monetary policy – price stability – was subordinated to the goal of preventing currency appreciation.

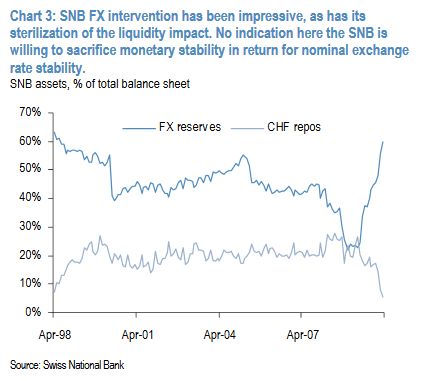

A country can pursue price stability or a weaker exchange rate but very rarely both. It is the old ‘one-tool, one target’ constraint that binds all central banks. Capital controls or negative interest rates do not necessarily overcome this constraint. The lessons for the current situation could not be clearer. The SNB might temporarily succeed in generating a spike in EUR/CHF by adopting some form of deposit surcharge/withholding tax but ultimately it is only a fundamental shift in monetary policy that can bring about a durable weakening in the currency. In short, is the SNB willing to engage in massive unsterilized intervention, not the largely sterilized version it has practiced over the past year, in order to weaken the currency? Or in other words, is the SNB willing to compromise monetary stability to weaken the currency, mirroring the way in which the ECB has now subordinated its primary monetary objective of price stability to secure instead a financial market objective (i.e. stabilization of sovereign debt markets)? That really is the judgment one needs to make here, not whether or not negative rates are a possibility. If the Swiss economy were not pulling out of recession the way it is, and if domestic and monetary aggregates were not already causing some concern for the SNB, we might be tempted to conclude that the SNB might just take a risk. As it is, we see no pressing economic danger from further, controlled CHF appreciation for the SNB to justify risking a repeat of the 1978-1981 episode of inflationary exchange rate management. The bottom-line from a strategy perspective is clear: stay short EUR/CHF.

Chart 3: SNB FX intervention has been impressive, as has its sterilization of the liquidity impact. No indication here the SNB is willing to sacrifice monetary stability in return for nominal exchange rate stability. SNB assets, % of total balance sheet

www.morganmarkets.com J.P. Morgan Securities Ltd. The certifying analyst is indicated by an AC. See page 3 for analyst certification and important legal and regulatory disclosures. Global FX Strategy Paul Meggyesi (44-20) 7859-6714 [email protected]

The full PDF is here.

See more for