Faking It

|

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. - Click to enlarge |

| BALTIMORE – That old rascal! Before joining the feds, former Fed chief Alan “Bubbles” Greenspan was a strong proponent of gold and the gold standard. He wrote clearly and forcefully about how it was necessary to restrain the Deep State and protect individual freedom.

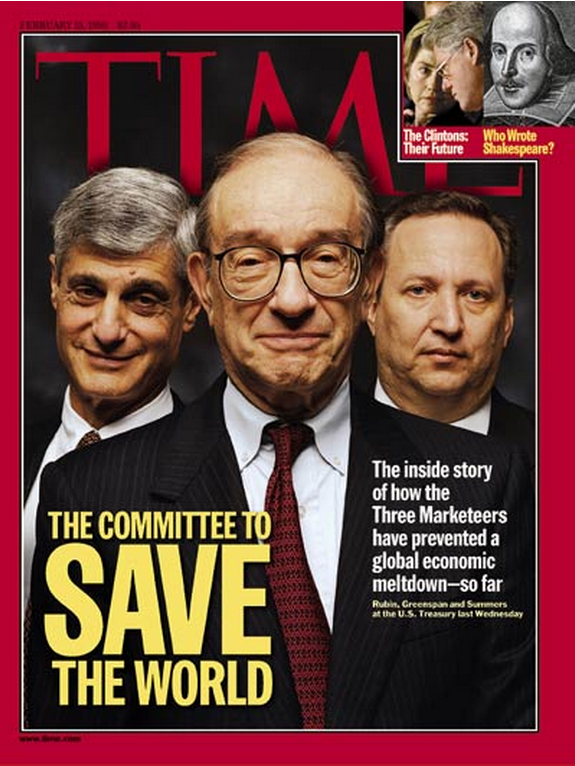

Then he went to Washington and faced a fork in the tongue. In one direction, lay honesty and integrity. In the other, lay power and glory. Under the Bretton Woods monetary system, the U.S. promised foreign central banks that it would convert their dollars to gold at a fixed price of $35 an ounce. This constrained the amount of dollars the U.S. could print to the amount of gold it had in its reserves. A smart man, Greenspan quickly realized he could not advocate for this old, tried-and-true gold standard and run the Deep State’s new credit money system. In 1987, he made his choice. He took over the top job at the Fed and faked it for the next 19 years. Since 1978, we have had four different Fed chiefs. Some were smart. Some were honest. Only Paul Volcker was smart and honest. Bernanke was honest… we believe. As near as we can tell, so is Janet Yellen. Both may mean well, but both are careful not to think out of the Deep State box. Alan Greenspan was smart. But he is a scalawag. He knew all along that the system was corrupt and self-serving. He had explained it in essays he’d written prior to joining the Fed. But he also knew he would never get his picture on the cover of TIME magazine if he told the truth. In 1999, Greenspan eventually got his mug on the cover. The magazine pictured him alongside then Treasury secretary Robert Rubin and his deputy, Larry Summers, under the headline “The Committee to Save the World” for their handling of the Asian financial crisis. It was power Greenspan wanted; he knew he would have to play the Deep State’s game to get it. |

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. - Click to enlarge |

Golden PeriodNow, Mr. Greenspan is 90 years old. Either he feels the cold downdraft of the beckoning grave… or he is simply forgetting to mumble. In an interview in the wake of Britain’s decision to end its membership of the European Union, he had this to say:

|

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. - Click to enlarge |

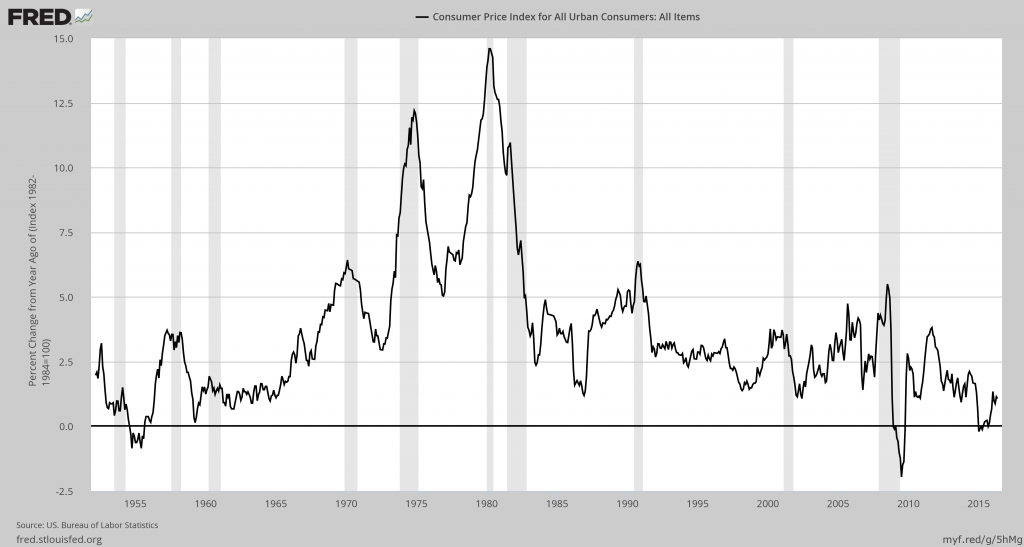

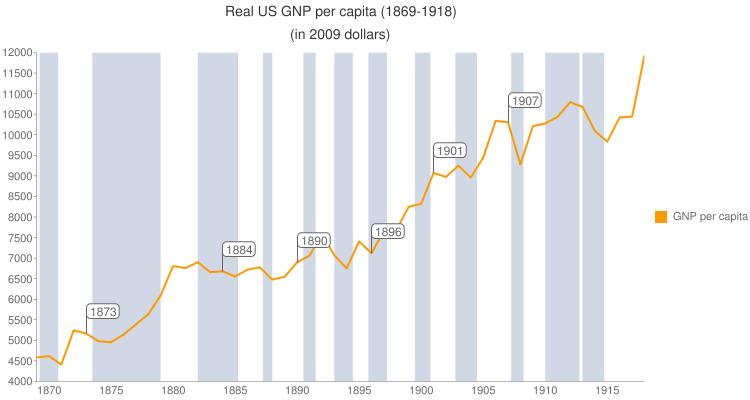

Most GNP Improvements Happened During Gold StandardThe former Fed chairman says he believes another debt crisis is inevitable. He believes it will lead to high levels of inflation. His solution? Gold:

The Fed’s minutes from its last meeting reveal no intention to return to the gold standard. Instead, the Fed’s central planners want their photos on TIME, too. They can’t give up their control of the nation’s money or risk a correction. It would be “prudent to wait for additional data” before raising rates, they say. Mr. Greenspan might have said so, too – perhaps with a hidden, sly smile on his face. |

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. - Click to enlarge |

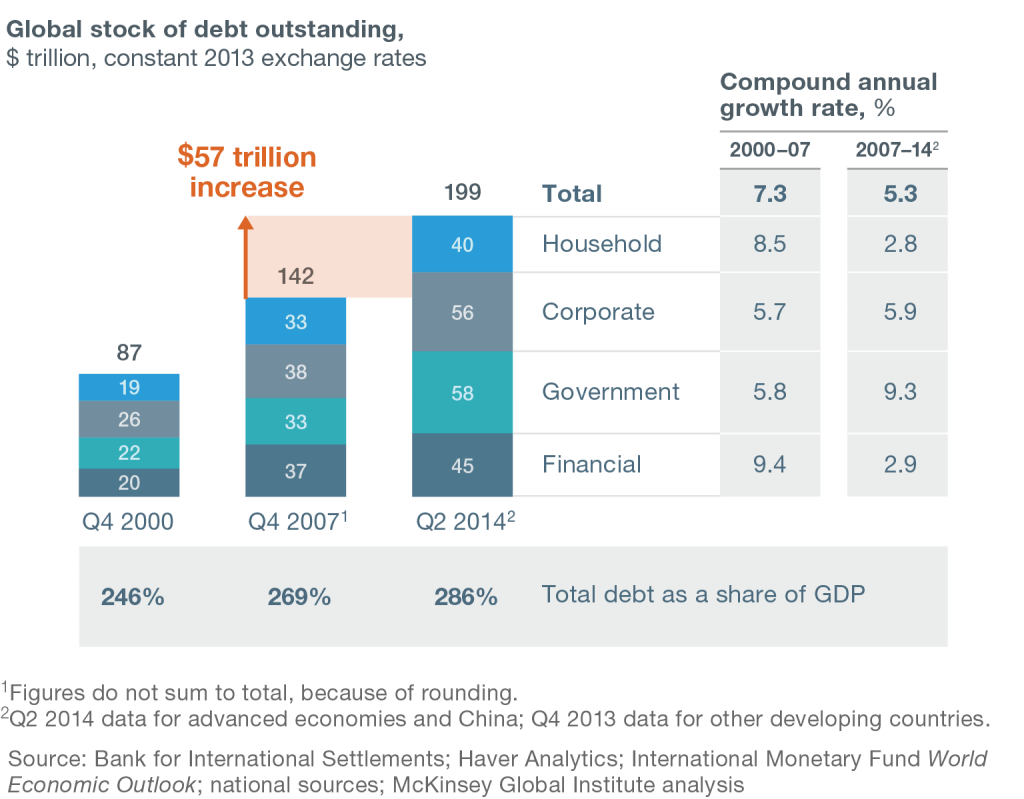

Misbegotten BubbleWe have been connecting dots; we want new readers to see what we see, so we can all look at some more dots together. Like everything else in economics and the markets, credit is cyclical. At the beginning of an expansion, people borrow more and more. Then, when they have borrowed too much, they cut back, they default, they trim their expenses… and they trim their debt. The expansion phase – like the bull market on Wall Street that usually accompanies it – is a happy time. People feel richer and smarter; they feel their hair grow and their private parts swell. Then comes a less happy time, full of blame and regret… “You should never have bought that boat,” says the nervous wife. “I told you we didn’t need that extra warehouse,” says the worried business partner. “I thought a degree would increase my income,” says the college graduate, as he takes your order. The EZ money is supposed to beget an asset boom, which is supposed to beget an economic boom, which is supposed to beget the wealth that will pay off the extravagant borrowing that the credit expansion begat. “Higher stock prices will boost consumer wealth and help increase confidence, which will also spur spending,” said an earnest, but perhaps dim, Ben Bernanke in 2010. “Increased spending will lead to higher incomes and profits that… will further support economic expansion.” Six years later, all we see is a misbegotten credit bubble and $60 trillion more, worldwide, of debt. To be continued… |

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. - Click to enlarge |

Charts by: St. Louis Federal Reserve Research, Wikipedia, McKinsey

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.