Stock markets can only improve if sales increase more than the costs of the companies. Wage inflation describes the development of the major costs of companies. While retail sales remains sluggish, wages are rising more quickly.

Torsten Sløk of Deutsche Bank on the development of American wages.

——————————————————————————————————————————-

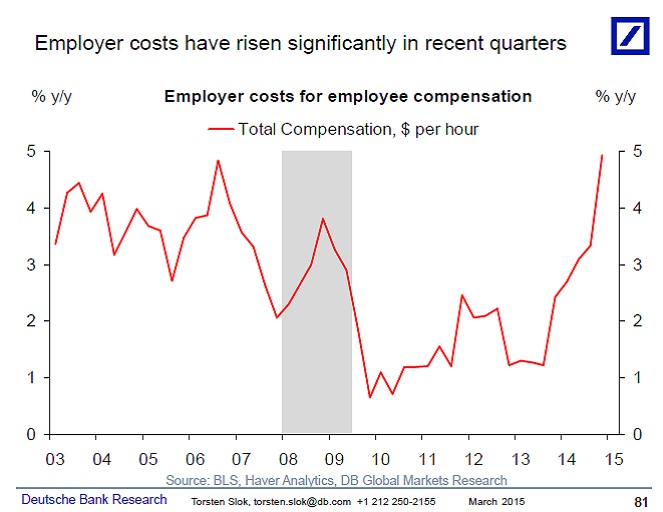

The first chart shows that over the past year employer costs have risen significantly.

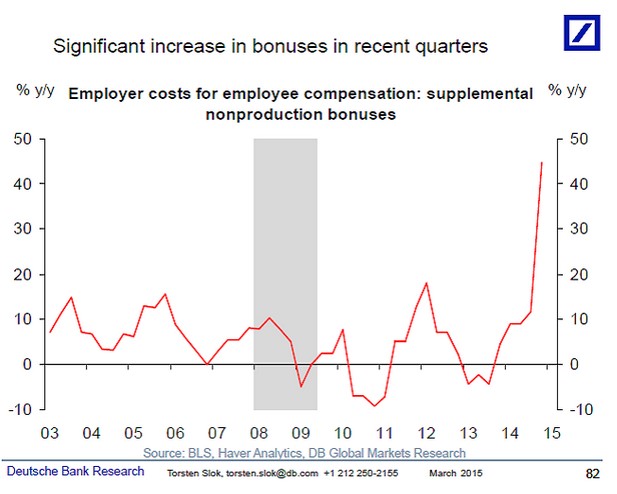

The second chart shows that the rise is driven partly by a significant increase in bonuses.

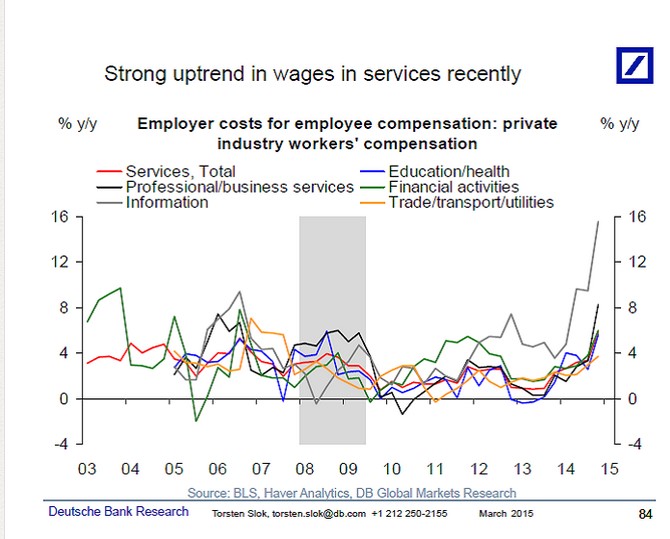

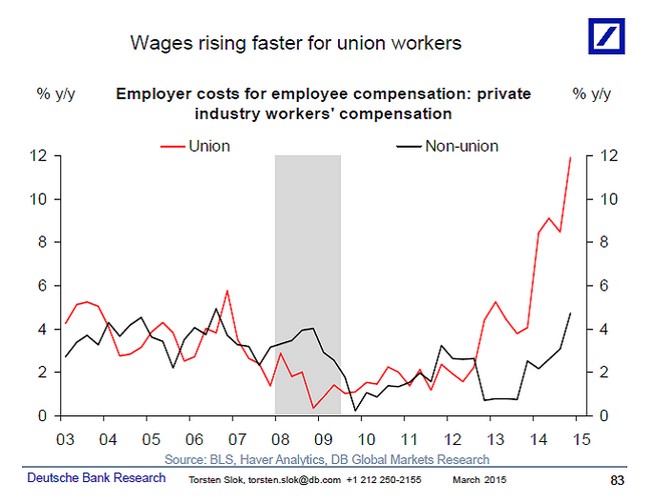

The third chart shows that the uptrend in wages can been seen across all parts of the services sector. And the fourth chart shows that wages are rising faster for unionized workers.

This data, the Employer Costs for Employee Compensation (ECEC), is created using the same raw data that goes into the Employment Cost Index (ECI). The difference between the ECI and the ECEC is that the ECI controls for changes in the industrial-occupational composition of jobs.

This happens to be consistent with the data showing that employment growth has been stronger for high-wage occupations and it is also consistent with the recent strong uptrend seen in private sector R&D spending (see also the charts I have sent out about this). In the 1990s we saw the opposite, with the ECI above the ECEC because more lower paying jobs were created. For more discussion of this and the differences between the ECI and the ECEC see also this BLS article here:

The bottom line remains that there are several ways of measuring wage inflation and although average hourly earnings remains flat, several of the other measures of wages are showing signs of broad-based wage pressure.

See more for