If the four structural trends highlighted below don’t reverse, the middle class is heading for extinction.

Everyone knows the middle class is fading fast. I’ve covered this issue in depth for years, for example: Honey, I Shrunk the Middle Class: Perhaps 1/3 of Households Qualify (December 28, 2015) and What Does It Take To Be Middle Class? (December 5, 2013)

This raises an obvious question: what killed the middle class? While many commentators try to identify one killer cause (for example, the U.S. going off the gold standard in 1971), the die-off of the middle class is more akin to the die-off in honey bees, which is the result of the interaction of multiple causes (factors that increase the toxic load dumped on bees and other pollinators by modern agriculture).

Longtime collaborator Gordon T. Long and I discuss the decline of the middle class and other key topics in a new 29-minute video How did that work out for you?

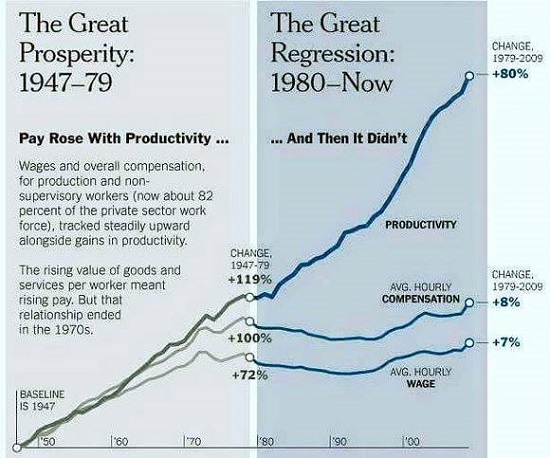

| So where do we begin this detective story? With the engine of all real prosperity, productivity. This chart reveals that wages stopped rising with productivity around 1980. |

The Great Prosperity and Regression |

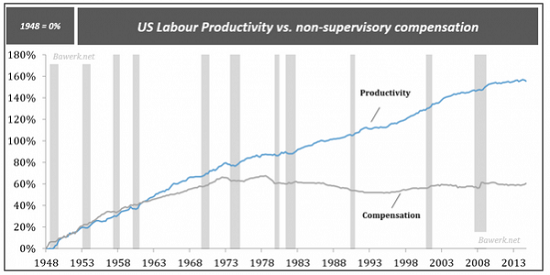

| Here’s another look at the same phenomenon: |

U.S. Labour Productivity vs non-supervisory compensation |

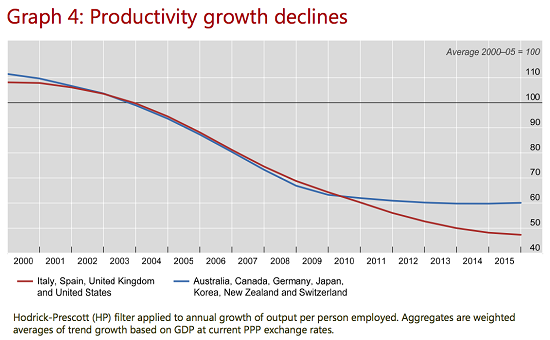

| Productivity has been slipping since around 2003: Alan Greenspan:”Productivity is Dead” |

Productivity growth declines |

| Cause #1: declining productivity, which means the pie of real wealth is no longer expanding.

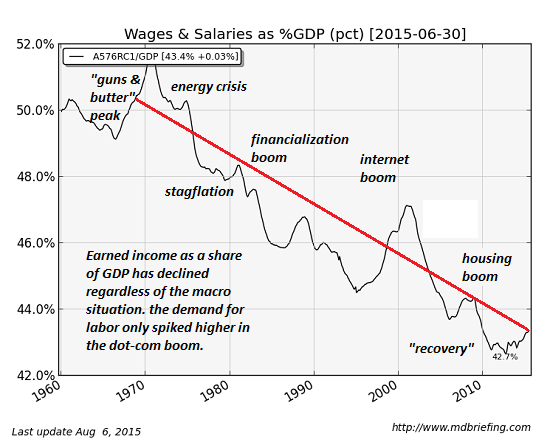

Exhibit #2: middle class wage earners have not received any of the gains. Wages as a percentage of GDP have been falling for decades, with occasional blips up in tech/housing bubbles: |

Wages and Salaries as %GDP |

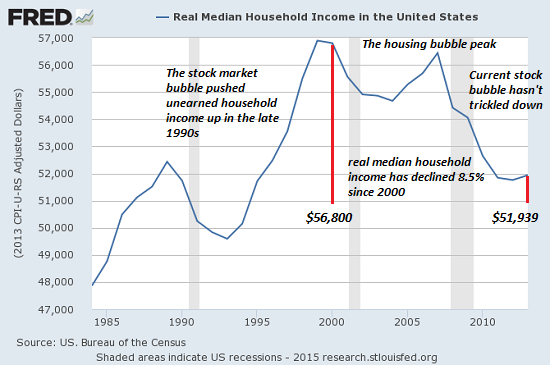

| Inflation-adjusted household income has dropped back to levels first reached in the 1980s: |

U.S. Household Income |

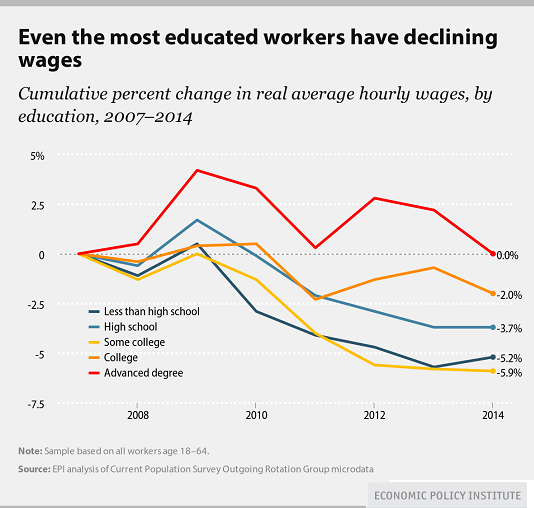

| More recently, wages have actually declined, regardless of educational attainment: |

Even the most educated workers have declining wages |

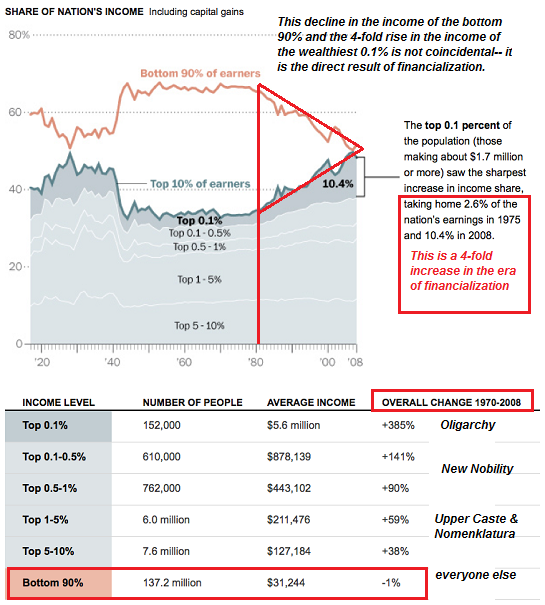

| Income gains have all flowed to the top 10%, with most of the gains being concentrated in the top 5% and top 1%: |

Share of nation's income |

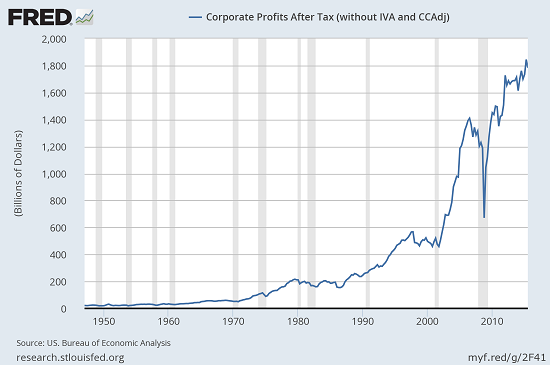

| If the middle class didn’t receive any of the gains, who did? Corporate profits have soared to unprecedented levels:

Cause #2: all the gains in the economy have flowed to corporations and the top 10% of financiers, managers and technocrats. |

Corporate Profits After Tax |

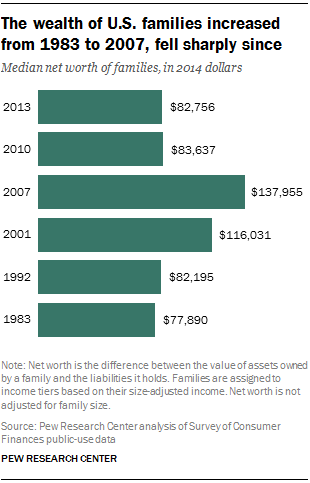

| But wait a minute–hasn’t the rising stock market enriched the middle class? Short answer: no. Middle class household wealth has absolutely cratered since the top of the housing bubble in 2007, and hasn’t recovered. |

The wealth of U.S. |

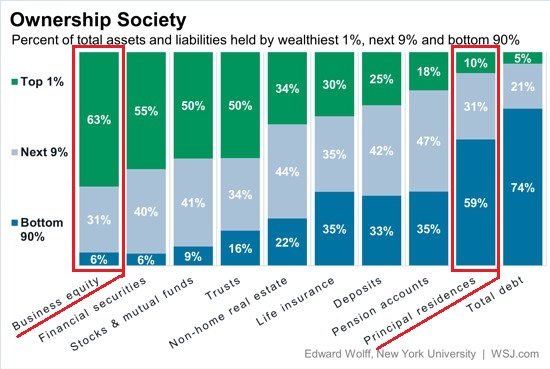

| Why? Middle class wealth is based not in stocks but in the family home. The middle class does not own enough financial assets to have participated in the latest stock market bubble, while the majority did not recover the wealth lost in the housing bubble bust. This is the cost of allowing the financial sector to financialize housing and mortgages in the 2000s.

Cause #3: the middle class doesn’t own the “right” assets to benefit from systemic financialization and financial speculation. |

Ownership Society |

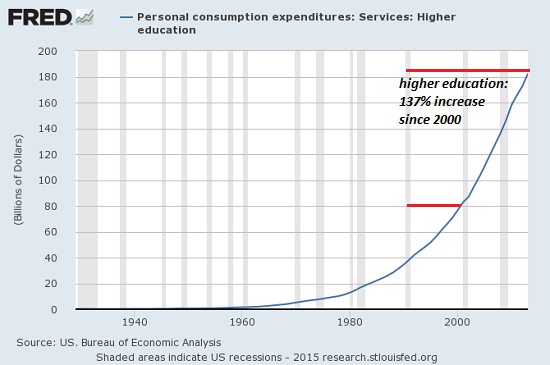

| How about rising costs? The federal agencies tasked with measuring inflation assure us inflation is near-zero. But these measures underweight big-ticket costs like healthcare and higher education, where costs have exploded higher, greatly increasing the burden on the middle class:

Cause #4: soaring costs of big-ticket expenses such as higher education and healthcare. Saving $10 on cheap jeans imported from Asia does not make up for 135% jumps in tuition and college fees, and $100 decline in the cost of a laptop computer does not make up for healthcare insurance and out-of-pocket expenses in the tens of thousands of dollars per household. |

Personal Consumption expenditures |

| Correspondent Kevin K. submitted this article and accompanying note: Colleges with the biggest tuition hikes (my ala mater University of Hawaii-Manoa clocked in with an increase of 137% since 2004.)

“It looks like the article linked above didn’t do much research since: There is no way middle class households with declining real incomes can pay soaring costs imposed by state-enforced cartels and gain ground financially. If the four structural trends highlighted above don’t reverse, the middle class is heading for extinction, the victim of financialization, the glorification of financial speculation via central bank-central state policies, the decline of productivity and rising costs imposed by state-enforced cartels. Gordon T. Long and I discuss the decline of the middle class and other key topics:

|

See more for