Category Archive: 9d) Fund and Hedge Funds

Tag 49 #motivation

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

Free Homes: Unternehmen auf der Shit-Liste & 4 wichtige Tipping Points! #shorts

Diese 4 Kipppunkte entscheiden über Erfolg oder Misserfolg! Erfahre, welche Unternehmen auf der 'Shit-Liste' stehen und warum diese entscheidenden Wendepunkte Gold wert sind. Verpasse nicht die Gründe! #tippingpoints #kipppunkte #inflektionspunkte #scheidewege #unternehmenserfolg

Read More »

Read More »

Tech-Giganten: Massiver Jobverlust? Ein Blick auf historische Crashes! #shorts

Tech-Alarm! Der Jobmarkt erlebt ein Déjà-vu des Grauens. Steht ein Crash bevor? Der Diffusionsindex erreicht gefährliche Höhen – wie 2000 & 2008! „Wir sind genau wieder an diesem Punkt angelangt…“ #TechCrash #Jobmark #Wirtschaftskrise #Rezession #Finanzen

Read More »

Read More »

SAP-Entlassungen: Warum jetzt? Aktienkurse & Dividenden im Visier! #shorts

Entlassungswelle rollt! Erst 3000, dann 8000 – und jetzt Deutschland? Aktionäre fordern mehr Dividende, während Arbeitsplätze abgebaut werden. Ist das der Preis des Erfolgs? "Weil sie's können..." #Entlassungswelle #Dividende #Arbeitsplatzverlust #Deutschland #Wirtschaftskrise

Read More »

Read More »

KI: Jobs weg! Was Firmen euch nicht erzählen! #shorts

KI verändert alles! 20 Vorstände enthüllen: „Wir stellen nicht ein!“ Erfahren Sie, warum Unternehmen skeptisch sind und wie sich der Arbeitsmarkt wandelt. Neueinstellungen im IT-Bereich sinken drastisch. #KünstlicheIntelligenz #Arbeitsmarkt #KIRevolution #ZukunftDerArbeit #Wirtschaft #Technologie

Read More »

Read More »

KI-Kritik? Musk & MIT enthüllen Schockierendes! #shorts

KI vs. kritisches Denken? Eine neue MIT-Studie enthüllt überraschende Ergebnisse! Was Elon Musk und ChatGPT wirklich denken – jetzt die ganze Wahrheit erfahren! #KI #ChatGPT #ElonMusk #MITStudie #KritischesDenken

Read More »

Read More »

Wegzug-Studie: KI-Fehler korrigiert & Freehomes-Anzeige! #shorts

Eine massive Wegzugstudie enthüllt: Welches Land passt zu wem? KI produzierte tonnenweise Fehler, aber mit Expertise und stringenter Verfahrensweise konnte das Analystenteam diese perfekt nutzen. Ohne dieses Wissen hätten wir Fehlinformationen verbreitet! #Wegzugstudie #Auswandern #KI #Datenanalyse #Reiseplanung #Deutschland

Read More »

Read More »

KI-Krieg? Sam Altman vs. Elon Musk: Wer wird gewinnen? #shorts

Sam Altman und Elon Musk im KI-Kampf? Die Meinungen sind gespalten! Werden sie die Kontrolle über OpenAI und Grok behalten? „Ein polarisierendes Thema“! #KIDebatte #OpenAI #ElonMusk #GrokKI #TechTitanen

Read More »

Read More »

Nvidia stellt ein: Fokus auf Forschung und Entwicklung!? #shorts

80% in Forschung & Entwicklung? Fachkräfte sind gefragt! Die Tendenz im Vertrieb bleibt "absolut flat". Was bedeutet das für den Arbeitsmarkt? Jetzt mehr erfahren! #forschungundentwicklung #fachkräfte #arbeitsmarkt #karriere #wirtschaft

Read More »

Read More »

Ray Dalio Explains Money Vs Credit

In an advanced economy, credit does more good than bad. But it’s important to remember that borrowing creates cycles — and if the cycle goes up, it eventually needs to come down.

I explain why this is particularly important today in my new book, How Countries Go Broke.

But if you’d like more context on how all of these pieces come together, I recommend you watch my 30-minute explainer “How the Economic Machine Works” here: &t=1444s...

Read More »

Read More »

Tag 48

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

KI & Jobs: Finanz, Logistik, Wirtschaftsprüfer. Wahrheit tut weh! #shorts

Neue Jobs? Dieser Wirtschaftsprüfer deckt die Wahrheit auf!📉 Die Realität hinter PwC, Ernst & Young, Deloitte & KPMG: Mitarbeiterabbau trotz steigendem Auftragsvolumen. „Es ist Zeit, realistisch zu werden.“ Die Lösungen folgen! #Wirtschaftsprüfung #Jobverlust #Finanzkrise #Karriere #ZukunftDerArbeit

Read More »

Read More »

KI-Mind Control: Wird unsere Gesellschaft versklavt? #shorts

KI-Kontrolle: Wer die Technologie beherrscht, manipuliert das Denken! 🔥 Enthüllung der erschreckenden Nebenwirkungen und Folgen für unsere Gesellschaft. Ist KI Chance oder Untergang? Die Wahrheit über Mind Control! #KünstlicheIntelligenz #MindControl #KI #Technologie #Zukunft

Read More »

Read More »

Tag 47

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

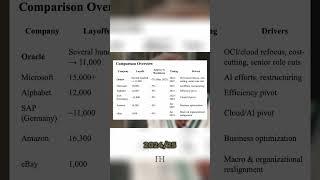

Tech-Branche 2024/25: Massenentlassungen! Was passiert wirklich? #shorts

Tech-GAU 2024/25? 🔥 Die Tabelle enthüllt das Ausmaß des Jobabbaus bei Tech-Giganten! "Was ist los?" Erfahre, welche Unternehmen am stärksten betroffen sind. Die Zahlen schockieren! #TechJobs #Jobverluste #TechKrise #Entlassungen #TechNews

Read More »

Read More »

Tag 46 – Geheime Informationen

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

The Big Cycle: How Great Powers Rise

When great powers rise throughout history, they generally do so for the same reasons. These successful new orders are typically started by powerful revolutionary leaders doing four things:

1) Winning power by gaining more support than their opposition

2) Consolidating power by converting, weakening, or eliminating that opposition

3) Establishing systems and institutions that make the country work well

4) Creating systems that pick successors well...

Read More »

Read More »

KI-Mind Control: Studie deckt unglaubliche Wahrheit auf! (Schockierend) #shorts

KI-Mind Control enthüllt! Eine beunruhigende Anekdote aus der Forschung zeigt, wie KI Fehlinformationen verbreitet. Was geschah, als hunderte Quellen in die Analyse einflossen? Es wurde gedreht! #KIMindControl #Fehlinformation #KIRevolution #Myokarditis #PandemieAufklärung

Read More »

Read More »

Tag 45 – Unkonventionell #karriere

@MarkusElsaesser1 👈

Um immer up-to-date zu sein, tragen Sie sich jetzt in den Mailverteiler ein

👉 https://www.elsaessermarkus.de/newsletteranmeldung

Read More »

Read More »

Trump scheitert? Israel greift an! Heftige Schlagzeilen!

Wir analysieren Trumps potenzielles Scheitern und die Auswirkungen der israelischen Angriffe. Erfahren Sie mehr über die Angriffe der israelischen Verteidigungskräfte auf Syrien und deren geopolitische Bedeutung. Bleiben Sie informiert! #Trump #Israel #NahostKonflikt #Syrien #Politik #Nachrichten #Geopolitik #IDF #Angriffe #Weltgeschehen

Read More »

Read More »