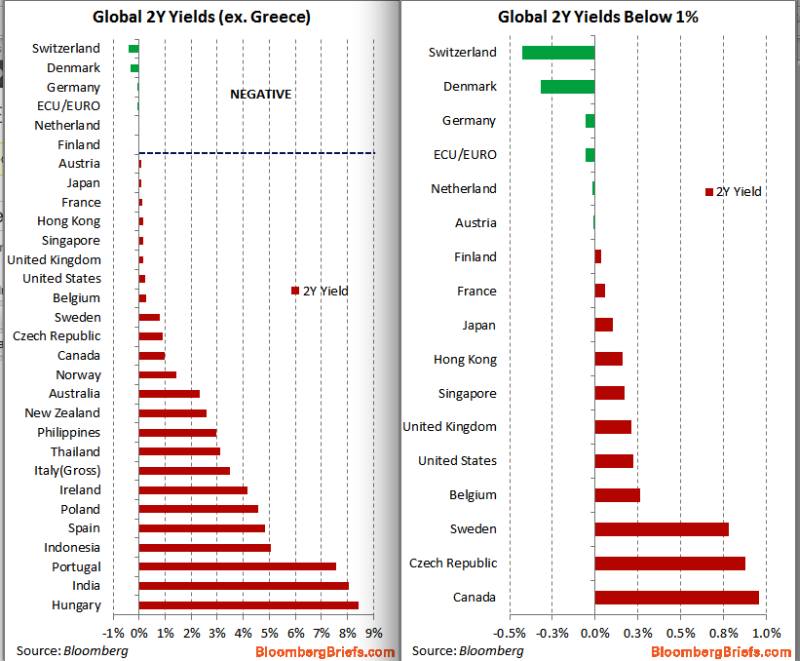

The Safe-haven government bond bubble did not pop, but Italy or Spain have become low yielders as well

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century?

Read More »

Category Archive: 7b) Instruments

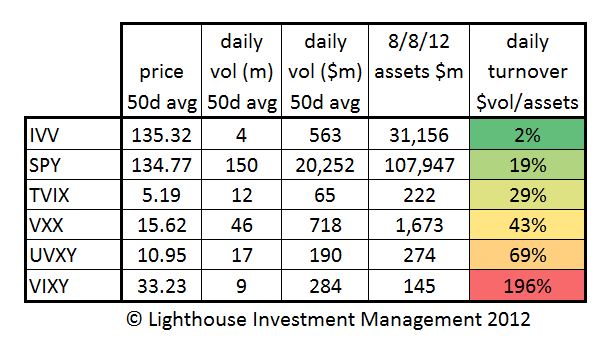

Volatility ETFs’ crazy churn

Two volatility ETFs (VXX and UVXY) are having almost half of the trading volume in the world’s largest ETF (SPY). How come? First, the facts: SPY is heavily traded (19% of assets daily turnover) compared to IVV (also referring to the S&P 500). But then come the volatility ETFs. Tiny VIXY (assets $145m) … Continue reading...

Read More »

Read More »