Category Archive: 6a) Gold & Monetary Metals

Gold Market Dislocations Spark High Drama in Asia, Europe, and U.S.

Coming up don’t miss another incredible interview with Greg Weldon of Weldon Financial. Greg has some very interesting things to say about the U.S. consumer and what that means about the health of the overall economy and much more. | Do you own precious metals you would rather not sell, but need access to cash? Get Started Here: https://www.moneymetals.com/gold-loan

Read More »

Read More »

Simon Hunt- Trump’s Next Move: Gold Revaluation and the End of U.S. Dominance

It's not just a gold revaluation on our horizon, the world may well be on the verge of a major financial reset. Geoeconomics expert #SimonHunt joins us to break down whether #Trump is fundamentally reshaping U.S. global strategy, how #BRICS could launch a gold-backed currency, and what these major shifts mean for investors.

Learn more about Simon Hunt's work at: https://www.simon-hunt.com/

If you're looking to buy gold or silver coins or bars,...

Read More »

Read More »

Some Records Were Made to Be Broken

Some records were made to be broken.

Last year, gold hit record highs 40 times!

Those weren't the only records relating to gold that fell in 2024. Gold demand also set a record, despite the higher prices. In this episode of the Money Metals' Midweek Memo podcast, host Mike Maharrey breaks down the gold demand data and reveals some interesting trends supporting the gold bull market.

Read More »

Read More »

Is the U.S. About to Revalue Gold? What It Means for You!

Something BIG is happening in the world of #gold!

Could the U.S. Treasury and Federal Reserve be preparing to revalue gold and monetize America’s reserves? If so, what would it mean for the global financial system, the U.S. dollar, and YOUR investments?

In our latest GoldCoreTV episode, Jan Skoyles explores:

What gold monetisation means and why it is being considered

Potential revaluation scenarios, from modest adjustments to major resets

How...

Read More »

Read More »

Metals Soar as Federal Interest Payments Reach Staggering Levels

Coming up don’t miss a wonderful interview with Peter St Onge, economist at the Heritage Foundation and a Fellow at the Mises Institute, for terrific back-and-forth commentary on a range of topics including how the national debt poses a major threat to the economy, with interest payments alone now exceeding what the entire federal budget was under President Clinton. | Do you own precious metals you would rather not sell, but need access to cash?...

Read More »

Read More »

That Was a Weird Question!

Why do I like gold and silver?

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤ https://instagram.com/moneymetals/

LINKEDIN ➤ https://www.linkedin.com/company/money-metals

SOUNDCLOUD ➤ https://soundcloud.com/moneymetals

TUMBLR ➤...

Read More »

Read More »

Is There Any Gold Left To Buy? What The London-New York Trade Means For Your Gold

Gold shortages? Supply squeezes? Record-breaking prices? The headlines are everywhere—but should you really be worried?

In this video, Jan Skoyles breaks down the truth behind the latest gold market frenzy. Here’s what you’ll learn:

- Is there actually a gold shortage? (Spoiler: No—at least not for retail investors)

- Why is gold’s price rising? (Hint: It’s about more than just supply and demand.)

- Is your gold safe? (If you own allocated,...

Read More »

Read More »

Why Do I Want Gold and Silver??

The powers that be may have found a new scapegoat for price inflation -- tariffs.

But while tariffs will raise some prices, they don't cause "inflation" in the true sense of the word. Governments and their central banks do that, but they don't want you to know it.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey explains why tariffs won't cause inflation (as properly defined) and spotlights the true cause of...

Read More »

Read More »

Gold Panic: Why the U.S. is Pulling Every Ounce Home!

#Gold is flooding out of London and into New York at an unprecedented rate—400 metric tonnes since November. While some blame tariffs, the reality is far bigger. A logistical bottleneck, arbitrage trades, and surging demand from central banks are reshaping the gold market. Lease rates are spiking, and #COMEX stockpiles are soaring.

Is this a temporary shift, or does it signal a global move toward gold repatriation and financial realignment?

Watch...

Read More »

Read More »

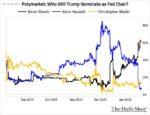

Gold & Silver Markets Heat Up on Trump, Tariffs, and the Fed

This week we have a special interview with Helen Viljoen, founder and CEO of Nebu bullion jewelry. Nebu is the company behind the gold (https://www.moneymetals.com/buy/gold/gold-jewelry) and platinum (https://www.moneymetals.com/buy/platinum/platinum-jewelry) jewelry available at MoneyMetals.com that is actually worth what you pay. | Do you own precious metals you would rather not sell, but need access to cash? Get Started...

Read More »

Read More »

Gold Shortage: The Crisis in London & New York!

#Gold is moving fast, and the financial system is feeling the strain.

A massive 400 metric tonnes of gold has been shipped from London to New York since November’s U.S. election. The Financial Times broke the story, and we’re breaking it down for you. Why is this happening? Who’s behind it? And what does this mean for you as a gold investor?

In this video, we cover:

Why New York dealers are scrambling for physical gold

How a potential #Trump...

Read More »

Read More »

The Sun Shines Bright on Silver

Gold set multiple records last year while silver remained well below its all-time highs. This created the impression that silver underperformed even though it was up over 20 percent. But we're starting to see some bullish sentiment for silver, even in the mainstream.

In fact, some people are projecting 2025 could be silver's year to shine.

In this episode of the Money Metals' Midweek Memo, host Mike Maharrey explains why the supply and demand...

Read More »

Read More »

David Morgan: Mere Paper Promises for Gold & Silver Carry Big Risks

Coming up we’ll hear from our good friend David Morgan of The Morgan Report (https://www.themorganreport.com/) . David has some important advice for investors on the difference between owning physical precious metals as compared to paper derivatives such as silver and gold ETFs.

Read More »

Read More »

This Is Outta Whack

This ratio is out of whack and its telling us something important about silver.

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤ https://twitter.com/MoneyMetals

INSTAGRAM ➤ https://instagram.com/moneymetals/

LINKEDIN ➤ https://www.linkedin.com/company/money-metals

SOUNDCLOUD ➤...

Read More »

Read More »

Why Trump’s Meme Coin Proves Gold Is Still King

In true #Trump fashion, the president and First Lady Melania launched their own meme coin just 48 hours before the inauguration. This bold move is explored in this week’s video, where Jan Skoyles examines the launch of Trump’s meme coin and its implications for the financial system. She highlights the risks of speculative assets like #cryptocurrencies, the growing disregard for counterparty risk, and why physical #gold and silver remain essential...

Read More »

Read More »