Category Archive: 6a) Gold & Monetary Metals

Feindbild Russland und Ukraine Krieg mit Prof Dr Max Otte und Enes Witwit

Ein spannendes Gespräch mit Prof. Dr. @Max Otte. Wir sprechen über den Krieg in der Ukraine und mehr. Dies ist der zweite Teil des Gesprächs.

Viel Spaß damit,

euer Enes.

// Erste Teil des Gesprächs:

++ Wenn euch das Video gefallen hat, würde es mir als Content Crestor sehr helfen, wenn ihr dem Video einen Daumen hoch gebt und den Kanal abonniert. Danke! ++

// Mehr zu Enes Witwit //

Instagram: http://instagram.com/eneswitwit

// Mehr zu Prof....

Read More »

Read More »

Diesen Sparplan solltest du jetzt befolgen (Max Otte)

Diesen Sparplan solltest du jetzt befolgen (Max Otte)

BLEIBEN WIR IN KONTAKT!

📒Wlads Buch "Das Geheimnis der erfolgreichen Alltagskommunikation": https://amzn.to/3RhDfpC

📙Wlads Buch "Redest du noch, oder überzeugst du schon?": https://amzn.to/3LZUo3G

Wlads Buch "Manipuliere dich glücklich": https://amzn.to/3AWGjC6

📘 Wlad's Buch "Dunkle Rhetorik": https://amzn.to/36tYvl6

📙 Wlad's Buch "Weiße...

Read More »

Read More »

Max Otte im Interview mit Krissy Rieger

Max Otte Schlimmer als im Korea Krieg Katastrophal und verheerend für die deutsche Wirtschaft !

Read More »

Read More »

Ketchup-Zeiten – Im Gespräch mit Max Otte (Teaser)

Jetzt ansehen (NuoFlix Abo) https://nuoflix.de/ketchup-zeiten--im-gespraech-mit-max-otte

Wer kennt das nicht? Man schüttelt die Ketchup-Flasche und nichts passiert, bis plötzlich alles auf einmal auf dem Teller landet.

Und genauso könnte man diese so verwirrende Zeit sehen, wenn nach mehreren heftigen Schlägen hintereinander auf einmal alles auseinander zu brechen scheint. Jahrzehntelanger Wohlstand und politische Sicherheit lösen sich in...

Read More »

Read More »

New Banking Crisis Looms, Dangerous Enablers Rewarded

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As new inflation data pushes the Fed toward continuing with rate hikes, precious metals markets are struggling to make headway. The so-called core CPI, which excludes food and energy, increased 6.6% from a year ago. That’s the highest core inflation reading since 1982.

Read the full Transcript Here:...

Read More »

Read More »

Food Shortage 2022. Global Food Crisis and Supply Shortages Have Been Planned – Alasdair Macleod

Food Shortage 2022. Global Food Crisis and Supply Shortages Have Been Planned - Alasdair Macleod

Alasdair has been a renowned stockbroker and Fellow of the London Stock Exchange for over forty years. His experience spans the stock and bond markets, fund management, corporate finance and investment strategy.

Special Thanks To:

Alasdair Macleod

https://goldmoney.com

Palisades Gold Radio

https://www.youtube.com/c/PalisadeRadio

You can reach the...

Read More »

Read More »

Be Ready: Markets To Takeover GOLD Pricing SOON! – Alasdair Macleod | Gold Price Prediction

Be Ready: Markets To Takeover GOLD Pricing SOON! - Alasdair Macleod | Gold Price Prediction⬇ Inspired By: ⬇

#goldprice #goldpriceprediction

--------

👇 Checkout These Similar Videos👇:

-------

🔑 Don't Forget To Subscribe For More: shorturl.at/twPQ2

Read More »

Read More »

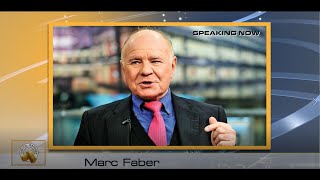

Marc Faber: ‘A Lot Of People Will Lose All Their Money’ – Huge Market Losses Lie Ahead

WORRIED ABOUT THE MARKETS? SCHEDULE YOUR FREE PORTFOLIO REVIEW with Wealthion's endorsed financial advisors at https://www.wealthion.com

Fan-favorite forecaster Marc Faber returns for Part 2 of our interview with him to focus on which assets he thinks investors should consider to protect their wealth through the turmoil he sees ahead.

Diversification is key in Marc's eyes, though he does think that having large cash reserves right now is...

Read More »

Read More »

Prof. Dr. Max Otte eröffnet den Privatinvestor-Tag 2022 in Köln

Beim Privatinvestor-Tag kamen am 01.10.2022 über 200 Privatinvestoren zusammen. Hier finden Sie den Eröffnungsvortrag von Prof. Dr. Max Otte. Er erklärt darin seinen Ausblick auf die kommende Börsensaison sowie die makroökonomischen und politischen Rahmenbedingungen.

Sechs weitere Gastreferenten und Experten hielten am Privatinvestor-Tag spannende Vorträge zu Investmentthemen. Die Aufzeichnungen werden exklusiv für die Teilnehmer der...

Read More »

Read More »

Alasdair Macleod: This Is About To Happen To Gold & Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3VkewU4

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Join the official 1000x Telegram channel! Join us on the road to 1000x: https://t.me/official1000x

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment...

Read More »

Read More »

This Has Never Happened Before

Alasdair Macleod: This Has Never Happened Before Gold & Silver | Silver Forecast

#alasdairmacleod #Silver

Read More »

Read More »

Buy Gold & Silver, Market Is Mispriced?

Gold & Silver Is Undervalued? | Alasdair Macleod Silver & Gold Price Prediction & Andrew Maguire Gold & Silver Price Prediction

Read More »

Read More »

Marc Faber packt gnadenlos aus! Wir werden zum Ziel!

ABONNIERE UNSEREN KANAL KOSTENLOS UND TEILE UNSER VIDEO:

https://bit.ly/3OYzW5L

___________________

Videobeschreibung:

🔥Marc Faber packt gnadenlos aus! Wir werden zum Ziel!🔥

© 2022 Finance Experience

___________________

Videoinhalte:

Marc Faber, Dr. Doom, Gloom Boom & Doom Reports, Zentralbanken, FED, EZB, Weltwirtschaft, Rezession, Inflation, Staatspleite, Steigende Zinsen, Weltwirtschaft, Geldanlage

___________________

Wichtige...

Read More »

Read More »

Max Otte: “Schlimmer als im Korea Krieg” | Katastrophal und verheerend für die deutsche W.

🔥 Investieren wie ein Profi? Ganz einfach mit diesem Weiterbildungsangebot:

►► https://www.rieger-consulting.com/shop

Aber wo kann ich investieren? Hier kostenlos anmelden:

📈 Aktiendepot (Captrader) ►► https://bit.ly/3BQTxzk *

📈 Aktiendepot (Smartbroker ) ►► https://bit.ly/3mMxnEO *

💻 Bitcoin kaufen 15€ for free (Bison) ►► https://bit.ly/3Bs4Kb1 *

💻 Krypto & Aktiendepot (Etoro) ►► https://bit.ly/3qvhYeK *

📊 ETF Sparpläne (Consorsbank) ►►...

Read More »

Read More »

Silver Alert ️: This Is About To Happen To Gold & Silver

Silver Alert 🛎️: This Is About To Happen To Gold & Silver - Alasdair Macleod | Silver Forecast

In this video Alasdair Macleod talks about the coming Gold & Silver reversal.

Read More »

Read More »

EXKLUSIV Marc Faber: “Der Euro ist wie Konfetti!” | Capital-Manager Finanz-Stammtisch.

Der 1. offizielle Finanz-Stammtisch vom Capital-Manager war ein großer Erfolg! Zu Gast war unter anderem Dr. Marc Faber, der auch Zuschauerfragen beantwortet hat.

Unsere heutige Expertenrunde:

- Dr. Marc Faber (Finanzmarkt-Profi bekannt aus BBC, Bloomberg und Herausgeber vom www.gloomboomdoom.com Report)

- Rainer Hahn (Chefredakteur vom www.swissmonday.de)

- Bastian Stein (Herausgeber vom www.capital-manager.com)

- Bernd Malitzki (Strom- und...

Read More »

Read More »

Max Otte vs. Andrij Melnyk. Viktor Orban in Berlin. OSZE Zahlen vor dem 24.02. Milosz Matuschek.

Max Otte vs. Andrij Melnyk- Kulturkreise prallen aufeinander. Viktor Orban in Berlin. Waffenstillstandsverletzungen- OSZE Zahlen vor dem 24.02. Milosz Matuschek gelesen von Robert Stein.

Die kleine Audiodatei für den 13.Oktober 2022- RADIO MARABU.

www.radio-marabu.de

Read More »

Read More »

Physical Gold & Why I Hold it – Bubba Horwitz

Founder and CEO Todd Bubba Horwitz joins GoldCore TV’s Dave Russell to discuss the Great Reset, physical gold investment forthcoming stagflation . This is Bubba’s first appearance on GoldCore TV , and we’re delighted to welcome him.

Read More »

Read More »

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

2022-10-16

by Stephen Flood

2022-10-16

Read More »