Category Archive: 4.) Forex Live

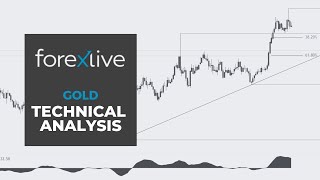

Gold Technical Analysis – WATCH OUT for the data this week

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:36 Technical Analysis with Optimal Entries.

2:06 Upcoming Economic Data....

Read More »

Read More »

USDJPY Technical Analysis – Waiting for a breakout

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:43 Technical Analysis with Optimal Entries.

3:08 Upcoming Economic Data....

Read More »

Read More »

AUDUSD rebounds higher after dump lower runs out of steam and snaps back higher.

The price of AUDUSD fell below trend line support and ran lower but the NY session is seeing a snapback rally.

Read More »

Read More »

USDCHF tests a cluster of support as buyers take profit. Can support area hold?

The USDCHF is testing iss100 hour MA, swing level and 38.2% on the daily chart above and below 0.9020 area.

Read More »

Read More »

EURUSD Technical Analysis – Watch what happens at this key support zone

#eurusd #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the EURUSD pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

------------------------------------------------------------------------------------

Website: https://www.forexlive.com/

Twitter: https://twitter.com/ForexLive

Facebook: https://www.facebook.com/forexlive/...

Read More »

Read More »

AUDUSD sellers pushed below trend line support but failed in what is an up and down day

The price action in the AUDUSD has been up and down today, with the lows trying to break below a lower upward sloping trend line. Those breaks have failed keeping the buyers in play.

Read More »

Read More »

USDCAD backs off from ceiling area again

The ceiling going back to November/December 2023 and over the last 5 weeks at 1.36049 to 1.35269 Staying below, keeps the sellers in play (and in short term control too).

Read More »

Read More »

USDCHF continues its run to the upside as the buyers keep the momentum going

The USDCHF runs away from its 38.2% retracement of the move down from the 2022 high at 0.90254.

Read More »

Read More »

WTI Crude Oil Technical Analysis – Dip buying opportunities ahead of the key resistance

#crudeoil #futures #technicalanalysis

In this video you will learn about the latest fundamental developments for WTI Crude Oil. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:39 Technical Analysis with Optimal Entries.

2:17 Upcoming Economic Data....

Read More »

Read More »

USDJPY Technical Analysis – The calm before the storm?

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:42 Technical Analysis with Optimal Entries.

3:19 Upcoming Economic Data....

Read More »

Read More »

Gold Technical Analysis – We are approaching a key support zone

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:39 Technical Analysis with Optimal Entries.

2:24 Upcoming Economic Data....

Read More »

Read More »

Breakout or Reversal? USDJPY Tests Three-Year Highs and Triggers Sellers

Has USDJPY formed a triple top at recent highs? What could boost sellers' confidence moving forward?

Read More »

Read More »