Category Archive: 4.) Forex Live

The Nasdaq & S&P indices are having a solid day. What are the technicals telling traders?

The S&P is solidly bullish after bouncing near the 100 day MA. The Nasdaq is below the 100 day MA but found support buyers near a swing area at the lows yesterday

Read More »

Read More »

GBPUSD Technicals: GBPUSD tests key retracement ceiling after two-leg decline

The 1.3550 level becomes the short-term battleground as sellers defend control and buyers attempt a rebound

Read More »

Read More »

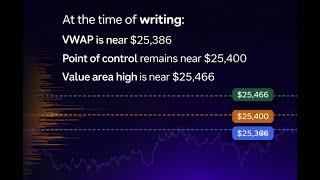

Bitcoin compresses below key resistance. Looking for a move away from consolidation soon

Sellers hold control as “Three’s a Crowd” signals a potential trend move ahead. Be aware

Read More »

Read More »

USDJPY Technicals: The buyers are looking to take more control in the short term

The USDJPY buyers need to get and stay above the 153.73 level to break out of the 4 day trading range. Sellers had their shot below the recent trend line earlier today.

Read More »

Read More »

EURUSD Technicals: EURUSD sellers defend key retracement levels

Failure at the 50% midpoint keeps price below the 100- and 200-hour MAs, shifting focus toward the 1.1765–1.1778 support zone

Read More »

Read More »

JP Morgan rebound scenario | trade of the week | 10.02.2026

JP Morgan stock could be setting up for a continuation move higher as sector rotation and strong investment banking dynamics come back into focus.

In this week’s Trade of the Week, we briefly review last week’s crude oil idea before turning attention to JPMorgan. The stock has bounced from key support, crossed the 20-day moving average, and is moving toward the upper boundary of its price formation, with a potential target around the $350 level....

Read More »

Read More »

Bitcoin Technical Analysis After Last Friday’s Big Rebound

Bitcoin price prediction and technical analysis after a sharp rebound.

Key support zones, downside risk levels, and the upside magnet traders are watching next.

This breaks down where buyers may defend and what would invalidate the rebound.

Educational market analysis only. Not financial advice.

Follow real-time trade ideas and updates:

https://t.me/investingLiveStocks

Read More »

Read More »

Trading oil’s bounce | trade of the week | 14.01.2026

Crude oil could continue to retest recent highs and possibly break through, depending on developing fundamentals.

Explore Exness's trading conditions on our website: https://bit.ly/Exness-homepage-mo

Trading oil so far this year has been dominated by higher volatility and an ongoing overall bounce. OPEC+ has recently held supply and seems likely to continue doing so amid relatively low demand, but ongoing talks between Iran and the USA could...

Read More »

Read More »

Why Beginner Traders Start With Forex Trading

Forex trading is often described in complicated terms, but at its core, it’s simply the global market where currencies are exchanged.

In this video, we explain:

• What forex trading is

• How the 24-hour market works

• Why beginners are often drawn to the forex market

👉 Read the full beginner’s guide here:

https://investinglive.com/Education/what-is-forex-trading-a-beginners-guide-20251217/

This video is part of our trading education series,...

Read More »

Read More »

Has the bull market in gold ended? History suggests yes

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Overview

1:35 Technical Analysis with Optimal Entries

2:45 Upcoming Catalysts...

Read More »

Read More »

Nasdaq Technical Analysis for Today and This Week

Crypto is still bearish. Nasdaq declines in Asian session and partially rebounding in the European session. What's next?

Video walkthrough: Key Nasdaq futures levels and why they matter

In today’s video update, Itai Levitan walks through the Nasdaq futures structure using higher-timeframe reference points to explain why short-term rebounds still need to be treated with caution.

The analysis starts with a major pivot low from late December, which...

Read More »

Read More »

Have we reached a short-term top in gold after the sharp swing lower?

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Overview

1:51 Technical Analysis with Optimal Entries

3:11 Upcoming Catalysts...

Read More »

Read More »

USDJPY consolidates below a key resistance as intervention fears wane. What’s next?

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Overview

1:57 Technical Analysis with Optimal Entries

3:01 Upcoming Catalysts...

Read More »

Read More »

Will Nasdaq break through the range? | trade of the week | 28.01.2026

Nasdaq could push higher if risk appetite and liquidity narratives persist.

Nasdaq is testing the upper boundary of a consolidation range near the top of the Bollinger Bands on the daily chart, signalling a potential momentum breakout. After a period of underperformance driven by valuation concerns and geopolitical rhetoric, sentiment toward tech stocks has started to stabilise. Market breadth is improving and fear levels remain neutral, which...

Read More »

Read More »

S&P 500 Technical Analysis, Big Picture View

InvestingLive is a real-time market news and analysis platform, built on the legacy of ForexLive. Covering forex, stocks, commodities, and global markets, it delivers fast, reliable updates to support informed trading and investment decisions. With a global team of expert analysts, investingLive combines speed and clarity to keep professionals ahead of market moves, 24/7.

Read More »

Read More »

Dubai Trading Festival February 10-12. Greg Michalowski to give Masterclass for traders

Greg Michalowski from InvestingLive.com will be in Dubai at the 1st Trading Festival on February 10-12. He will be giving two sessions, - one for beginning traders and one for advanced traders. The Masterclass will take traders through his Trader Pyramid which takes traders on a step-by-step process toward success as a trader.

Join Greg and others at the Dubai Trading Festival.

Read More »

Read More »

What’s next for USDJPY as the bearish momentum from intervention risk wanes?

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Overview

2:19 Technical Analysis with Optimal Entries

3:49 Upcoming Catalysts...

Read More »

Read More »