Category Archive: 6b) Austrian Economics

Entrepreneurship in the Time of COVID-19

Per Bylund, author of The Seen, the Unseen, and the Unrealized: How Regulations Affect Our Everyday Lives has commented extensively here at mises.org, and in a variety of entrepreneurship-focused publications, about the economics of entrepreneursip. Editor Ryan McMaken recently asked Professor Bylund to comment on what challenges entrepreneurs face right now in a rapidly changing legal and economic landscape.

Read More »

Read More »

BRUTAL: El Hachazo Fiscal Que Prepara Sánchez

Lectura adicional: La mentira de los impuestos a los “ricos” https://www.elespanol.com/opinion/columnas/20190504/hachazo-fiscal-sanchez-pagara-clase-media/395840415_13.html _______________________________________________________________________ Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales: ☑ Twitter – https://twitter.com/dlacalle ☑ Instagram – https://www.instagram.com/lacalledanie ☑ Facebook –...

Read More »

Read More »

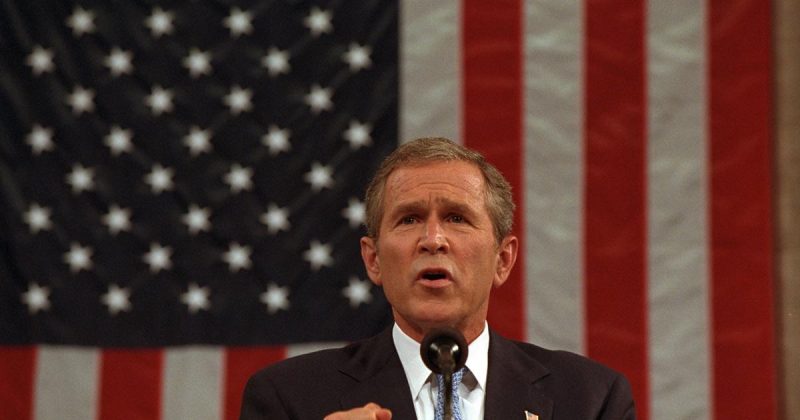

The Media Has Conveniently Forgotten George W. Bush’s Many Atrocities

Former president George W. Bush has returned to the spotlight to give moral guidance to America in these troubled times. In a statement released on Tuesday, Bush announced that he was “anguished” by the “brutal suffocation” of George Floyd and declared that “lasting peace in our communities requires truly equal justice. The rule of law ultimately depends on the fairness and legitimacy of the legal system. And achieving justice for all is the duty...

Read More »

Read More »

Das größte Konjunkturprogramm der Geschichte – doch was bringts?

Jede Woche werden weitere Milliarden Notfall – und Konjunkturpakete geschnürt und verabschiedet. Mit aller Wucht oder wie Olaf Scholz sagt mit Wumms möchte man gegen die Rezession und die Pandemie ankämpfen. Wie nachhaltig ist das? Was bringt es uns Bürgern? Und wer zahlt die ganze Schose? Einen Überblick der Billionen Liste sowie Antworten erhalten Sie heute in einer neuen Folge finanzielle Intelligenz mit Marc Friedrich.

Finanzen und mehr:

●...

Read More »

Read More »

Das größte Konjunkturprogramm der Geschichte – doch was bringts?

Jede Woche werden weitere Milliarden Notfall – und Konjunkturpakete geschnürt und verabschiedet. Mit aller Wucht oder wie Olaf Scholz sagt mit Wumms möchte man gegen die Rezession und die Pandemie ankämpfen. Wie nachhaltig ist das? Was bringt es uns Bürgern? Und wer zahlt die ganze Schose? Einen Überblick der Billionen Liste sowie Antworten erhalten Sie …

Read More »

Read More »

Dr Yu on Hadron Anomalies, Fusion Progress, Ryan McMaken Takes on News – A Neighbor’s Choice

A Neighbor’s Choice with David Gornoski airs live weekdays 4-6pm EST. Call in at 727-587-1040. Email A Neighbor’s Choice with a guest suggestion, story tip or question at [email protected]

Read More »

Read More »

Carolina González Rodríguez expone “La acción humana” de Ludwig von Mises

En esta obra Mises expone los principios y fundamentos esenciales de la ciencia económica, encuadrada en una teoría general de la acción humana o praxeología. Sobre esta base, y siguiendo una metodología apriorístico-deductiva en la línea de la concepción subjetivista típica de la Escuela Austriaca, se analizan también las principales cuestiones de la Economía y …

Read More »

Read More »

#26 Gold und Aktien sind eine gute Kombination – Golden Times

Der beschwerliche Weg aus der Lockdownkrise: wie kommen wir da wieder heraus? Thorsten Polleit, Chefvolkswirt von Degussa sieht drei Szenarien: das optimistische Szenario mit schneller Erholung und steiler V-förmiger Erholung, das Worst-Case-Szenario mit lang anhaltender Belastung und Stagnation und ein mittleres Szenario: flacher Erholungsverlauf, flaches V. “Das mittlere Szenario halte ich für das wahrscheinliche.” Die …...

Read More »

Read More »

The German Court’s Unexpected Blow to the ECB

A high German court recently ruled that the European Central Bank has overstepped the bounds of its power. The angry response from high-ranking European bureaucrats tells us a lot about what they want for the EU.

This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros.

Original Article: "The German Court's Unexpected Blow to the ECB"

Read More »

Read More »

Kommt der Bürgerkrieg? (USA zerbricht)

Der tragische Tod von George Floyd hat zu massiven Protesten gegen Polizeigewalt und Rassismus geführt. Leider wird nicht nur friedlich demonstriert sondern es kommt auch zu Plünderungen und massiven, gewalttätigen Ausschreitungen. In vielen Städten herrscht Anarchie und Chaos. Was sind die wahren Auslöser, Hintergründe und wie geht es weiter? Was muss man jetzt machen um sich vorzubereiten.

Vergessenes Video: https://bit.ly/2Unn3rN

Finanzen und...

Read More »

Read More »

Kommt der Bürgerkrieg? (USA zerbricht)

Der tragische Tod von George Floyd hat zu massiven Protesten gegen Polizeigewalt und Rassismus geführt. Leider wird nicht nur friedlich demonstriert sondern es kommt auch zu Plünderungen und massiven, gewalttätigen Ausschreitungen. In vielen Städten herrscht Anarchie und Chaos. Was sind die wahren Auslöser, Hintergründe und wie geht es weiter? Was muss man jetzt machen um …

Read More »

Read More »

Minimally Invasive Key Hole Bunion Surgery David Gordon

Minimally Invasive Key Hole Bunion Surgery David Gordon Visit http://www.davidgordonortho.co.uk/ for more information

Read More »

Read More »

Cashkurs präsentiert: Eine unerwartete Reise: THE UNCERTAINTY HAS SETTLED- Ein Film von Marijn Poels

Seit dem Erscheinen des Kinofilms „Paradogma“ 2018, in welchem auch Dirk Müller zu Wort kommt, haben wir Sie hier auf Cashkurs immer wieder über die Projekte des Filmemachers Marijn Poels auf dem Laufenden gehalten. Heute freuen wir uns sehr darüber, mitteilen zu können, dass jetzt der Startschuss für die frei zugängliche Veröffentlichung der gesamten Trilogie …

Read More »

Read More »

Words of wisdom from Ludwig von Mises

Explain : Ludwig von Mises ‘s Wisdom Quotes [Ludwig von Mises was an Austrian School economist, historian, and sociologist. Mises wrote and lectured extensively on the societal contributions of classical liberalism. He is best known for his work on praxeology, a study of human choice and action.]

Read More »

Read More »

Daniel Lacalle: El Fondo de Recuperación Europeo Ni Es Gratis Ni Evita La Crisis

No, no nos va a llover dinero gratis y sin condiciones. Suscríbete a mi canal y deja tus comentarios. Más información en www.dlacalle.com Twitter: @dlacalle

Read More »

Read More »

Why The European Union Recovery Plan Will Likely Fail

The EU stimulus plans have very poor track-record. This is not free money but a massive malinvestment exercise. More: https://www.theepochtimes.com/why-the-european-recovery-plan-will-likely-fail_3371204.html Please subscribe to my channel and leave your comments below. Website: www.dlacalle.com/en Twitter: @dlacalle_IA

Read More »

Read More »

There’s No End in Sight to the Zombie Economy

The United States was waiting for the zombie apocalypse. The country was given a coronapocalypse instead. But could the two events merge and provide the nation with a dangerous economic trend? Corporate America’s worst-kept secret had been the swelling number of zombies kept on life support and hidden away during the boom phase of the business cycle.

Read More »

Read More »

Michael Flynn, Lori Loughlin, and the Permanent Culture of Prosecutorial Abuse

When US attorney general William Barr recently announced that the Department of Justice was reversing course and dropping all charges against former Trump adviser Michael Flynn, the response from Democrats, the mainstream news media, and Never-Trump Republicans such as David French was thermonuclear, to put it mildly.

Read More »

Read More »